Barrick Gold Options Trading: A Deep Dive into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on Barrick Gold.

Looking at options history for Barrick Gold GOLD we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 66% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $60,075 and 7, calls, for a total amount of $401,005.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $20.0 for Barrick Gold during the past quarter.

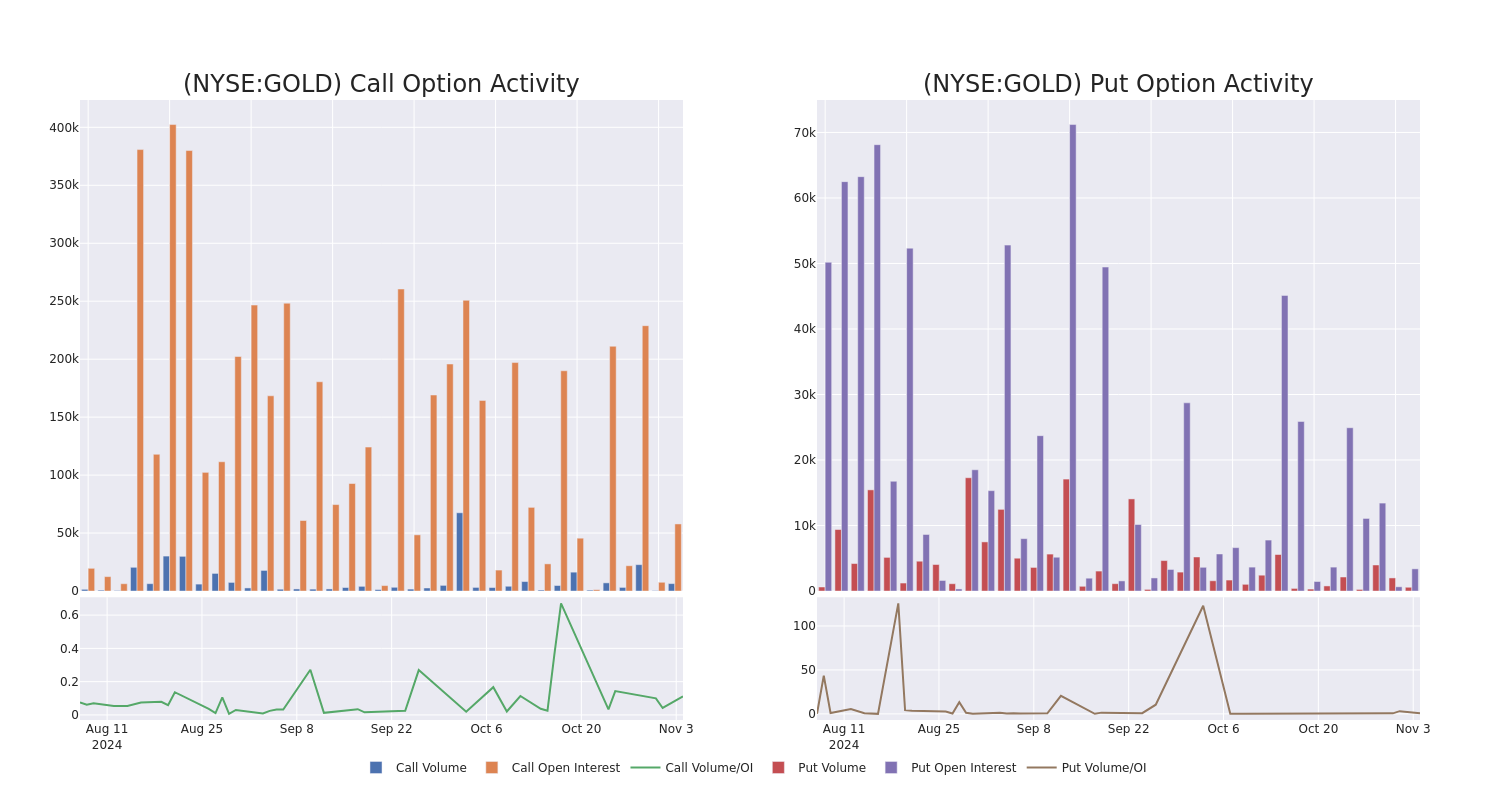

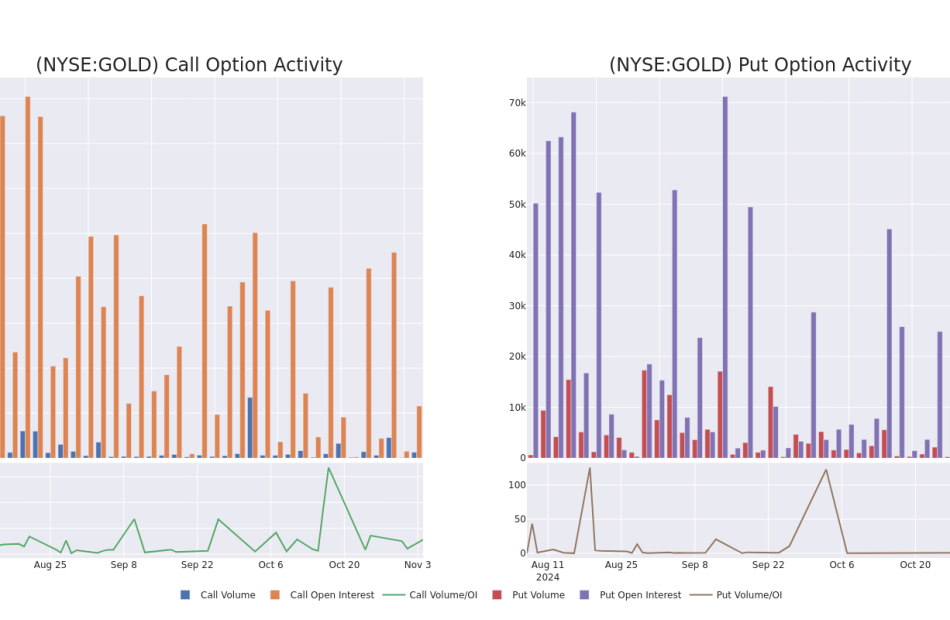

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Barrick Gold options trades today is 10210.17 with a total volume of 6,992.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Barrick Gold’s big money trades within a strike price range of $15.0 to $20.0 over the last 30 days.

Barrick Gold Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOLD | CALL | SWEEP | BULLISH | 12/20/24 | $0.58 | $0.56 | $0.58 | $20.00 | $115.4K | 11.5K | 2.2K |

| GOLD | CALL | SWEEP | BEARISH | 01/16/26 | $5.15 | $5.05 | $5.05 | $15.00 | $63.1K | 14.2K | 184 |

| GOLD | CALL | SWEEP | BULLISH | 01/16/26 | $4.05 | $3.95 | $4.05 | $17.00 | $58.7K | 7.5K | 271 |

| GOLD | CALL | TRADE | BULLISH | 11/15/24 | $0.22 | $0.21 | $0.22 | $20.00 | $54.9K | 24.5K | 3.0K |

| GOLD | CALL | SWEEP | BULLISH | 01/16/26 | $4.05 | $3.95 | $4.05 | $17.00 | $44.9K | 7.5K | 112 |

About Barrick Gold

Based in Toronto, Barrick Gold is one of the world’s largest gold miners. In 2023, the firm produced nearly 4.1 million attributable ounces of gold and about 420 million pounds of copper. At year-end 2023, Barrick had about two decades of gold reserves along with significant copper reserves. After buying Randgold in 2019 and combining its Nevada mines in a joint venture with competitor Newmont later that year, it operates mines in 19 countries in the Americas, Africa, the Middle East, and Asia. The company also has growing copper exposure. Its potential Reko Diq project in Pakistan, if developed, could double copper production by the end of the decade.

In light of the recent options history for Barrick Gold, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Barrick Gold Standing Right Now?

- Trading volume stands at 12,506,357, with GOLD’s price down by -1.08%, positioned at $18.84.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 3 days.

What Analysts Are Saying About Barrick Gold

In the last month, 2 experts released ratings on this stock with an average target price of $22.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from UBS downgraded its rating to Neutral, setting a price target of $22.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Barrick Gold, targeting a price of $23.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Barrick Gold with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply