Evaluating Vistra Against Peers In Independent Power and Renewable Electricity Producers Industry

In the fast-paced and highly competitive business world of today, conducting thorough company analysis is essential for investors and industry observers. In this article, we will conduct an extensive industry comparison, evaluating Vistra VST in relation to its major competitors in the Independent Power and Renewable Electricity Producers industry. Through a detailed examination of key financial metrics, market standing, and growth prospects, our objective is to provide valuable insights and illuminate company’s performance in the industry.

Vistra Background

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Vistra Corp | 87.88 | 13.17 | 3.07 | 10.2% | $1.29 | $1.62 | 20.57% |

| The AES Corp | 10.22 | 3.18 | 0.85 | 15.73% | $1.01 | $0.72 | -4.22% |

| Central Puerto SA | 10.16 | 1.09 | 4.70 | 0.43% | $70.68 | $59.33 | 9.64% |

| Average | 10.19 | 2.14 | 2.77 | 8.08% | $35.85 | $30.02 | 2.71% |

When conducting a detailed analysis of Vistra, the following trends become clear:

-

At 87.88, the stock’s Price to Earnings ratio significantly exceeds the industry average by 8.62x, suggesting a premium valuation relative to industry peers.

-

It could be trading at a premium in relation to its book value, as indicated by its Price to Book ratio of 13.17 which exceeds the industry average by 6.15x.

-

The Price to Sales ratio of 3.07, which is 1.11x the industry average, suggests the stock could potentially be overvalued in relation to its sales performance compared to its peers.

-

With a Return on Equity (ROE) of 10.2% that is 2.12% above the industry average, it appears that the company exhibits efficient use of equity to generate profits.

-

The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $1.29 Billion is 0.04x below the industry average, suggesting potential lower profitability or financial challenges.

-

The gross profit of $1.62 Billion is 0.05x below that of its industry, suggesting potential lower revenue after accounting for production costs.

-

With a revenue growth of 20.57%, which surpasses the industry average of 2.71%, the company is demonstrating robust sales expansion and gaining market share.

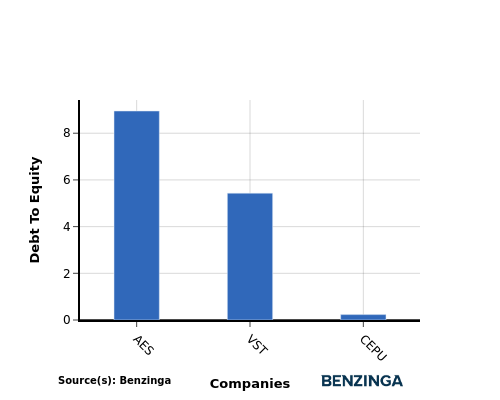

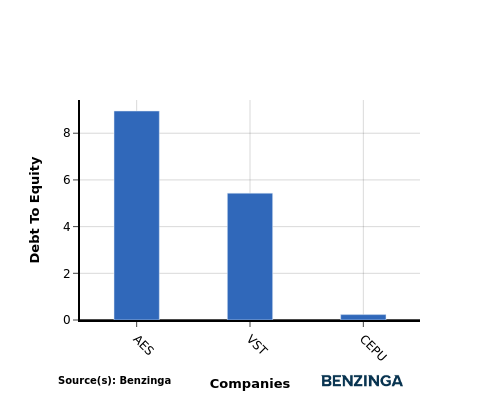

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a financial metric that helps determine the level of financial risk associated with a company’s capital structure.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

By analyzing Vistra in relation to its top 4 peers based on the Debt-to-Equity ratio, the following insights can be derived:

-

Among its top 4 peers, Vistra is placed in the middle with a moderate debt-to-equity ratio of 5.43.

-

This implies a balanced financial structure, with a reasonable proportion of debt and equity.

Key Takeaways

For Vistra, the PE, PB, and PS ratios are all high compared to its peers in the Independent Power and Renewable Electricity Producers industry, indicating potentially overvalued stock. On the other hand, Vistra’s high ROE and revenue growth suggest strong performance relative to its competitors. However, the low EBITDA and gross profit levels may raise concerns about the company’s operational efficiency and profitability compared to industry peers.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply