This Is What Whales Are Betting On Regeneron Pharmaceuticals

Investors with a lot of money to spend have taken a bearish stance on Regeneron Pharmaceuticals REGN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with REGN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 20 uncommon options trades for Regeneron Pharmaceuticals.

This isn’t normal.

The overall sentiment of these big-money traders is split between 35% bullish and 60%, bearish.

Out of all of the special options we uncovered, 16 are puts, for a total amount of $5,066,701, and 4 are calls, for a total amount of $205,030.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $420.0 to $1120.0 for Regeneron Pharmaceuticals over the recent three months.

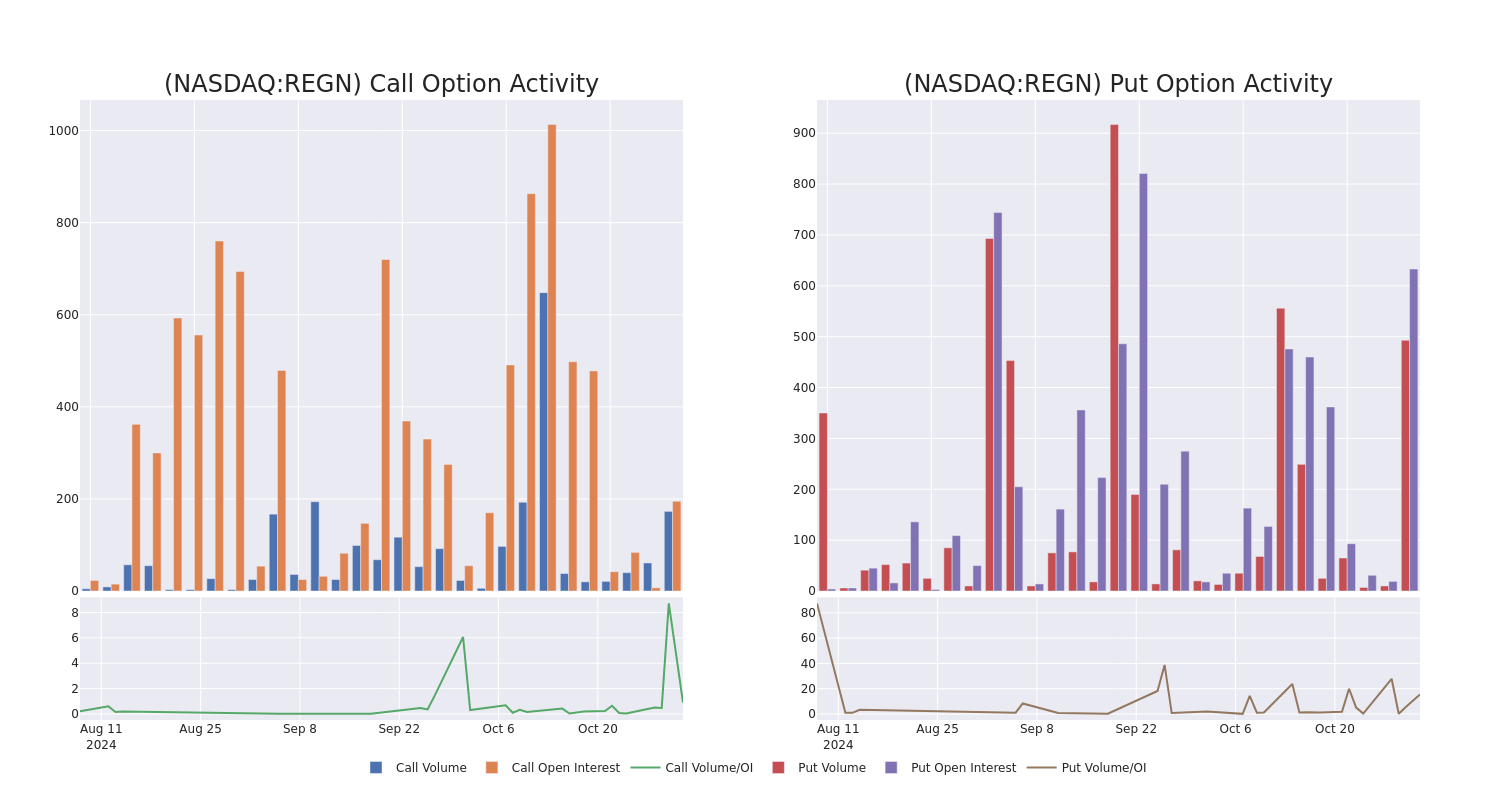

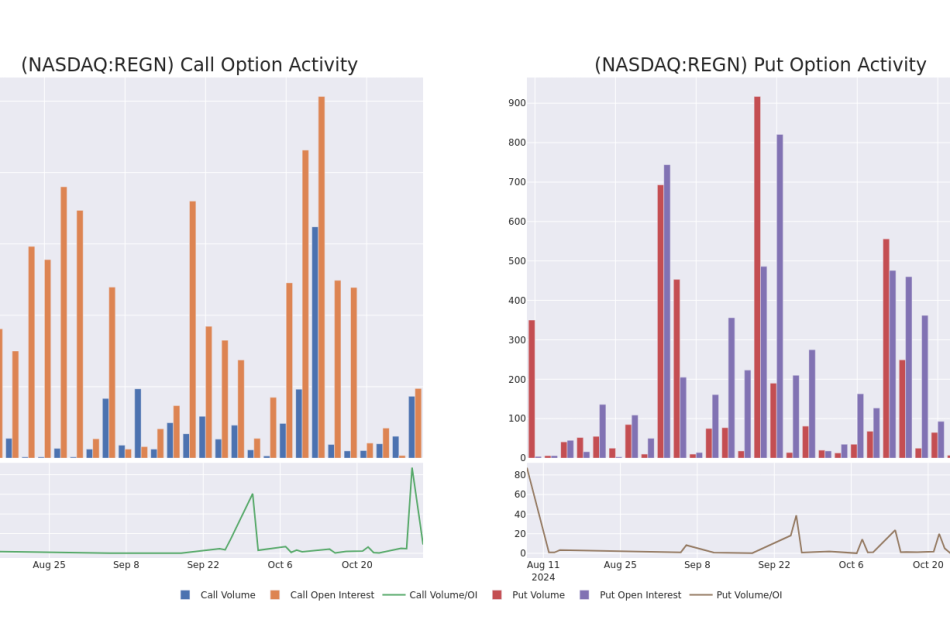

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Regeneron Pharmaceuticals’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Regeneron Pharmaceuticals’s substantial trades, within a strike price spectrum from $420.0 to $1120.0 over the preceding 30 days.

Regeneron Pharmaceuticals Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| REGN | PUT | SWEEP | BEARISH | 09/19/25 | $233.0 | $224.0 | $232.48 | $1060.00 | $2.0M | 95 | 91 |

| REGN | PUT | SWEEP | BEARISH | 06/20/25 | $210.0 | $203.9 | $209.06 | $1040.00 | $837.4K | 98 | 40 |

| REGN | PUT | SWEEP | BEARISH | 11/15/24 | $99.0 | $90.8 | $97.52 | $930.00 | $485.0K | 99 | 50 |

| REGN | PUT | SWEEP | BEARISH | 01/17/25 | $190.0 | $181.4 | $189.9 | $1020.00 | $379.9K | 126 | 20 |

| REGN | PUT | SWEEP | BULLISH | 02/21/25 | $69.7 | $64.0 | $67.8 | $880.00 | $271.2K | 49 | 40 |

About Regeneron Pharmaceuticals

Regeneron Pharmaceuticals discovers, develops, and commercializes products that fight eye disease, cardiovascular disease, cancer, and inflammation. The company has several marketed products, including low-dose Eylea and Eylea HD, approved for wet age-related macular degeneration and other eye diseases; Dupixent in immunology; Praluent for LDL cholesterol lowering; Libtayo in oncology; and Kevzara in rheumatoid arthritis. Regeneron is also developing monoclonal and bispecific antibodies with Sanofi, other collaborators, and independently, and has earlier-stage partnerships that bring new technology to the pipeline, including RNAi (Alnylam) and Crispr-based gene editing (Intellia).

Having examined the options trading patterns of Regeneron Pharmaceuticals, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Regeneron Pharmaceuticals’s Current Market Status

- Trading volume stands at 391,366, with REGN’s price down by -1.56%, positioned at $830.46.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 88 days.

What The Experts Say On Regeneron Pharmaceuticals

5 market experts have recently issued ratings for this stock, with a consensus target price of $1138.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Regeneron Pharmaceuticals, targeting a price of $1150.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Regeneron Pharmaceuticals with a target price of $1080.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Regeneron Pharmaceuticals, targeting a price of $1215.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Regeneron Pharmaceuticals with a target price of $1065.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Regeneron Pharmaceuticals, targeting a price of $1184.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Regeneron Pharmaceuticals, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply