Understanding Adobe's Position In Software Industry Compared To Competitors

In the ever-evolving and intensely competitive business landscape, conducting a thorough company analysis is of utmost importance for investors and industry followers. In this article, we will carry out an in-depth industry comparison, assessing Adobe ADBE alongside its primary competitors in the Software industry. By meticulously examining key financial metrics, market positioning, and growth prospects, we aim to offer valuable insights to investors and shed light on company’s performance within the industry.

Adobe Background

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing, and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Adobe Inc | 40.88 | 14.61 | 10.46 | 11.46% | $2.31 | $4.85 | 10.59% |

| Salesforce Inc | 51.34 | 4.89 | 7.92 | 2.44% | $2.79 | $7.17 | 8.39% |

| SAP SE | 92.53 | 6.08 | 7.56 | 3.53% | $2.71 | $6.21 | 9.38% |

| Intuit Inc | 59.61 | 9.45 | 10.84 | -0.11% | $0.13 | $2.4 | 17.4% |

| Palantir Technologies Inc | 246.59 | 23.18 | 40.17 | 3.43% | $0.11 | $0.55 | 27.15% |

| Synopsys Inc | 53.45 | 10.33 | 12.45 | 5.49% | $0.46 | $1.24 | 12.65% |

| Cadence Design Systems Inc | 74.23 | 16.95 | 17.71 | 5.4% | $0.41 | $1.05 | 18.81% |

| Workday Inc | 41.23 | 7.59 | 8.16 | 1.6% | $0.28 | $1.57 | 16.68% |

| Autodesk Inc | 58.72 | 24.96 | 10.69 | 12.17% | $0.39 | $1.36 | 11.9% |

| Roper Technologies Inc | 39.86 | 3.13 | 8.62 | 2.01% | $0.69 | $1.19 | 2.78% |

| AppLovin Corp | 69.88 | 67.08 | 14.48 | 39.35% | $0.51 | $0.8 | 43.98% |

| Datadog Inc | 262.26 | 17.26 | 18.96 | 1.9% | $0.06 | $0.52 | 26.66% |

| Ansys Inc | 57.20 | 5.06 | 12.20 | 2.37% | $0.2 | $0.52 | 19.64% |

| Tyler Technologies Inc | 110.19 | 7.88 | 12.56 | 2.37% | $0.12 | $0.24 | 9.84% |

| Zoom Video Communications Inc | 27 | 2.73 | 5.16 | 2.6% | $0.23 | $0.88 | 2.09% |

| PTC Inc | 75.52 | 7.37 | 10.05 | 2.32% | $0.13 | $0.41 | -4.37% |

| Manhattan Associates Inc | 75.31 | 58.09 | 16.09 | 24.6% | $0.08 | $0.15 | 11.84% |

| Dynatrace Inc | 103.98 | 7.79 | 10.85 | 1.89% | $0.06 | $0.32 | 19.93% |

| Average | 88.17 | 16.46 | 13.2 | 6.67% | $0.55 | $1.56 | 14.99% |

After thoroughly examining Adobe, the following trends can be inferred:

-

The Price to Earnings ratio of 40.88 is 0.46x lower than the industry average, indicating potential undervaluation for the stock.

-

With a Price to Book ratio of 14.61, significantly falling below the industry average by 0.89x, it suggests undervaluation and the possibility of untapped growth prospects.

-

The Price to Sales ratio is 10.46, which is 0.79x the industry average. This suggests a possible undervaluation based on sales performance.

-

The Return on Equity (ROE) of 11.46% is 4.79% above the industry average, highlighting efficient use of equity to generate profits.

-

The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $2.31 Billion is 4.2x above the industry average, highlighting stronger profitability and robust cash flow generation.

-

The gross profit of $4.85 Billion is 3.11x above that of its industry, highlighting stronger profitability and higher earnings from its core operations.

-

The company’s revenue growth of 10.59% is significantly lower compared to the industry average of 14.99%. This indicates a potential fall in the company’s sales performance.

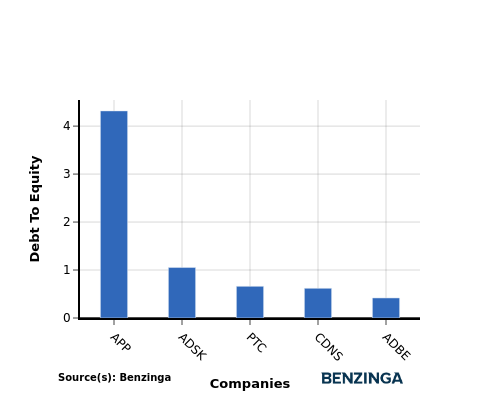

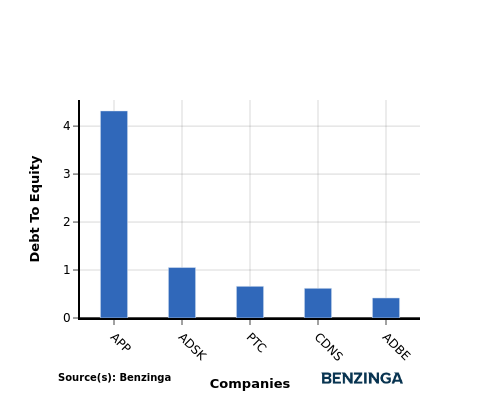

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a key indicator of a company’s financial health and its reliance on debt financing.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

In terms of the Debt-to-Equity ratio, Adobe stands in comparison with its top 4 peers, leading to the following comparisons:

-

Adobe has a stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.42.

-

This suggests that the company has a more favorable balance between debt and equity, which can be perceived as a positive indicator by investors.

Key Takeaways

For Adobe in the Software industry, the PE, PB, and PS ratios are all low compared to peers, indicating potential undervaluation. On the other hand, Adobe’s high ROE, EBITDA, and gross profit suggest strong profitability and operational efficiency. However, the low revenue growth rate may raise concerns about future performance compared to industry peers.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply