United Rentals Unusual Options Activity For November 04

Investors with a lot of money to spend have taken a bearish stance on United Rentals URI.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with URI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for United Rentals.

This isn’t normal.

The overall sentiment of these big-money traders is split between 22% bullish and 44%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $555,100, and 3 are calls, for a total amount of $150,585.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $770.0 to $850.0 for United Rentals over the last 3 months.

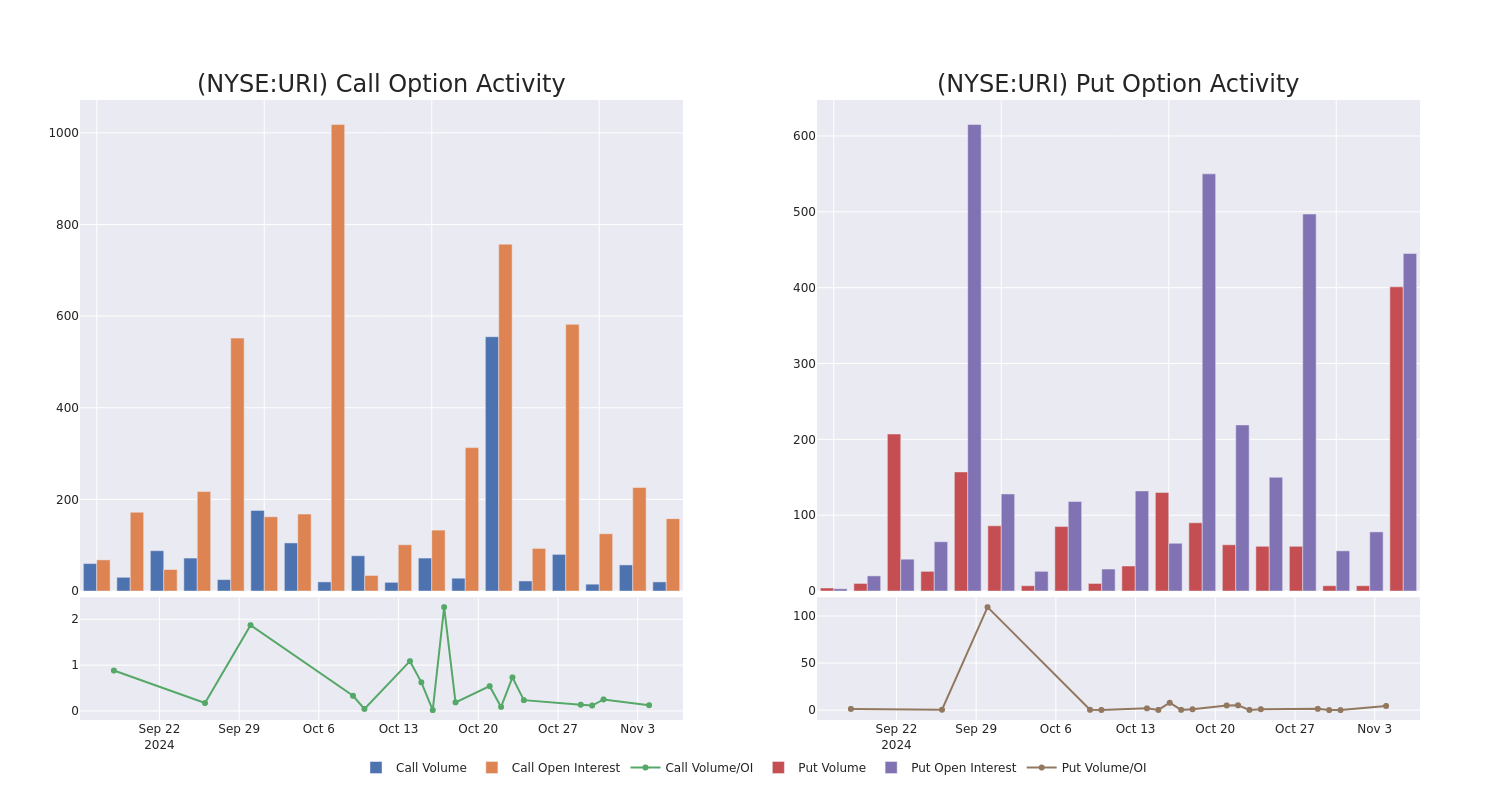

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for United Rentals’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across United Rentals’s significant trades, within a strike price range of $770.0 to $850.0, over the past month.

United Rentals Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| URI | PUT | SWEEP | BULLISH | 12/20/24 | $31.8 | $29.2 | $29.39 | $770.00 | $138.5K | 440 | 152 |

| URI | PUT | TRADE | BEARISH | 03/21/25 | $64.0 | $63.1 | $64.0 | $790.00 | $115.2K | 5 | 18 |

| URI | PUT | SWEEP | BULLISH | 12/20/24 | $29.7 | $29.3 | $29.37 | $770.00 | $105.6K | 440 | 102 |

| URI | PUT | SWEEP | NEUTRAL | 12/20/24 | $30.0 | $29.3 | $29.57 | $770.00 | $77.1K | 440 | 66 |

| URI | PUT | SWEEP | NEUTRAL | 12/20/24 | $30.1 | $29.0 | $29.6 | $770.00 | $68.1K | 440 | 23 |

About United Rentals

United Rentals is the world’s largest equipment rental company. It principally operates in the United States and Canada, where it commands approximately 15% share in a highly fragmented market. It serves three end markets: general industrial, commercial construction, and residential construction. Like its peers, United Rentals historically has provided its customers with equipment that was intermittently used, such as aerial equipment and portable generators. As the company has grown organically and through hundreds of acquisitions since it went public in 1997, its catalog (fleet size of $22 billion) now includes a range of specialty equipment and other items that can be rented for indefinite periods.

Following our analysis of the options activities associated with United Rentals, we pivot to a closer look at the company’s own performance.

Where Is United Rentals Standing Right Now?

- Currently trading with a volume of 403,771, the URI’s price is down by -1.32%, now at $782.96.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 79 days.

Professional Analyst Ratings for United Rentals

5 market experts have recently issued ratings for this stock, with a consensus target price of $862.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on United Rentals with a target price of $930.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for United Rentals, targeting a price of $954.

* An analyst from B of A Securities persists with their Buy rating on United Rentals, maintaining a target price of $910.

* An analyst from Truist Securities has decided to maintain their Buy rating on United Rentals, which currently sits at a price target of $955.

* Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for United Rentals, targeting a price of $565.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest United Rentals options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply