Iovance Biotherapeutics Options Trading: A Deep Dive into Market Sentiment

Financial giants have made a conspicuous bullish move on Iovance Biotherapeutics. Our analysis of options history for Iovance Biotherapeutics IOVA revealed 11 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $234,150, and 5 were calls, valued at $414,807.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.5 to $15.0 for Iovance Biotherapeutics during the past quarter.

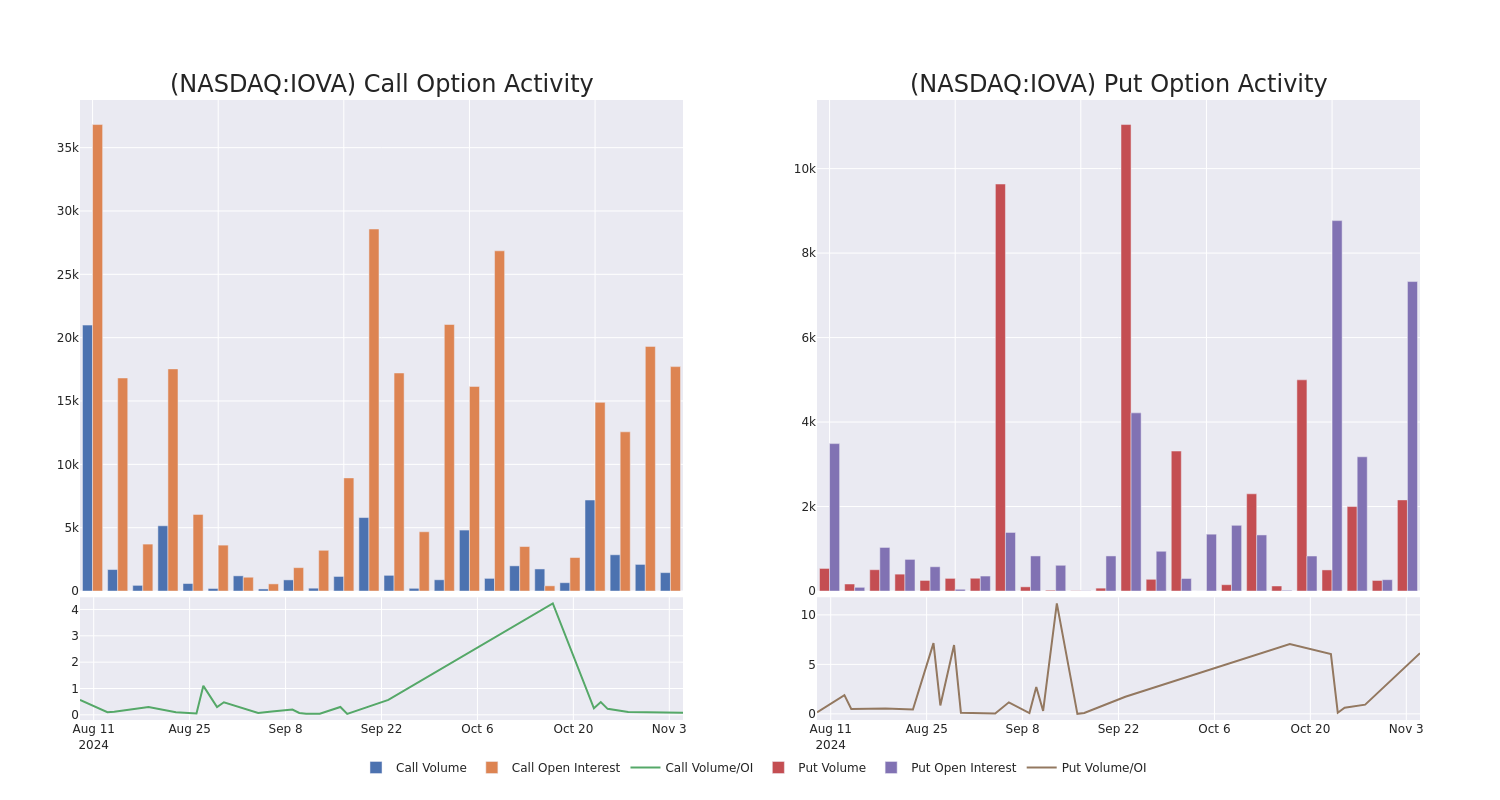

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Iovance Biotherapeutics’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Iovance Biotherapeutics’s whale activity within a strike price range from $7.5 to $15.0 in the last 30 days.

Iovance Biotherapeutics Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IOVA | CALL | SWEEP | BULLISH | 03/21/25 | $3.3 | $3.1 | $3.3 | $10.00 | $141.9K | 2.4K | 433 |

| IOVA | CALL | SWEEP | BEARISH | 12/20/24 | $3.2 | $3.0 | $3.0 | $9.00 | $135.0K | 6.1K | 200 |

| IOVA | CALL | SWEEP | BULLISH | 03/21/25 | $1.5 | $1.2 | $1.49 | $15.00 | $64.8K | 891 | 440 |

| IOVA | PUT | TRADE | NEUTRAL | 01/16/26 | $4.0 | $3.8 | $3.9 | $12.00 | $46.8K | 109 | 362 |

| IOVA | PUT | SWEEP | BULLISH | 01/16/26 | $4.0 | $3.8 | $3.8 | $12.00 | $45.6K | 109 | 242 |

About Iovance Biotherapeutics

Iovance Biotherapeutics Inc is a clinical-stage biopharmaceutical company, pioneering a transformational approach to treating cancer by harnessing the human immune system’s ability to recognize and destroy diverse cancer cells using therapies personalized for each patient. The company is preparing for potential U.S. regulatory approvals and commercialization of the first autologous T-cell therapy to address a solid tumor cancer. its objective is to be the leader in innovating, developing, and delivering tumor-infiltrating lymphocyte, or TIL, therapies for patients with solid tumor cancers.

Following our analysis of the options activities associated with Iovance Biotherapeutics, we pivot to a closer look at the company’s own performance.

Iovance Biotherapeutics’s Current Market Status

- With a volume of 1,428,846, the price of IOVA is down -1.97% at $11.21.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 2 days.

What The Experts Say On Iovance Biotherapeutics

In the last month, 1 experts released ratings on this stock with an average target price of $17.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from UBS lowers its rating to Buy with a new price target of $17.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Iovance Biotherapeutics options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply