This Is What Whales Are Betting On Sirius XM Holdings

Deep-pocketed investors have adopted a bearish approach towards Sirius XM Holdings SIRI, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SIRI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for Sirius XM Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 44% bearish. Among these notable options, 2 are puts, totaling $73,900, and 7 are calls, amounting to $1,172,700.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $23.0 and $28.0 for Sirius XM Holdings, spanning the last three months.

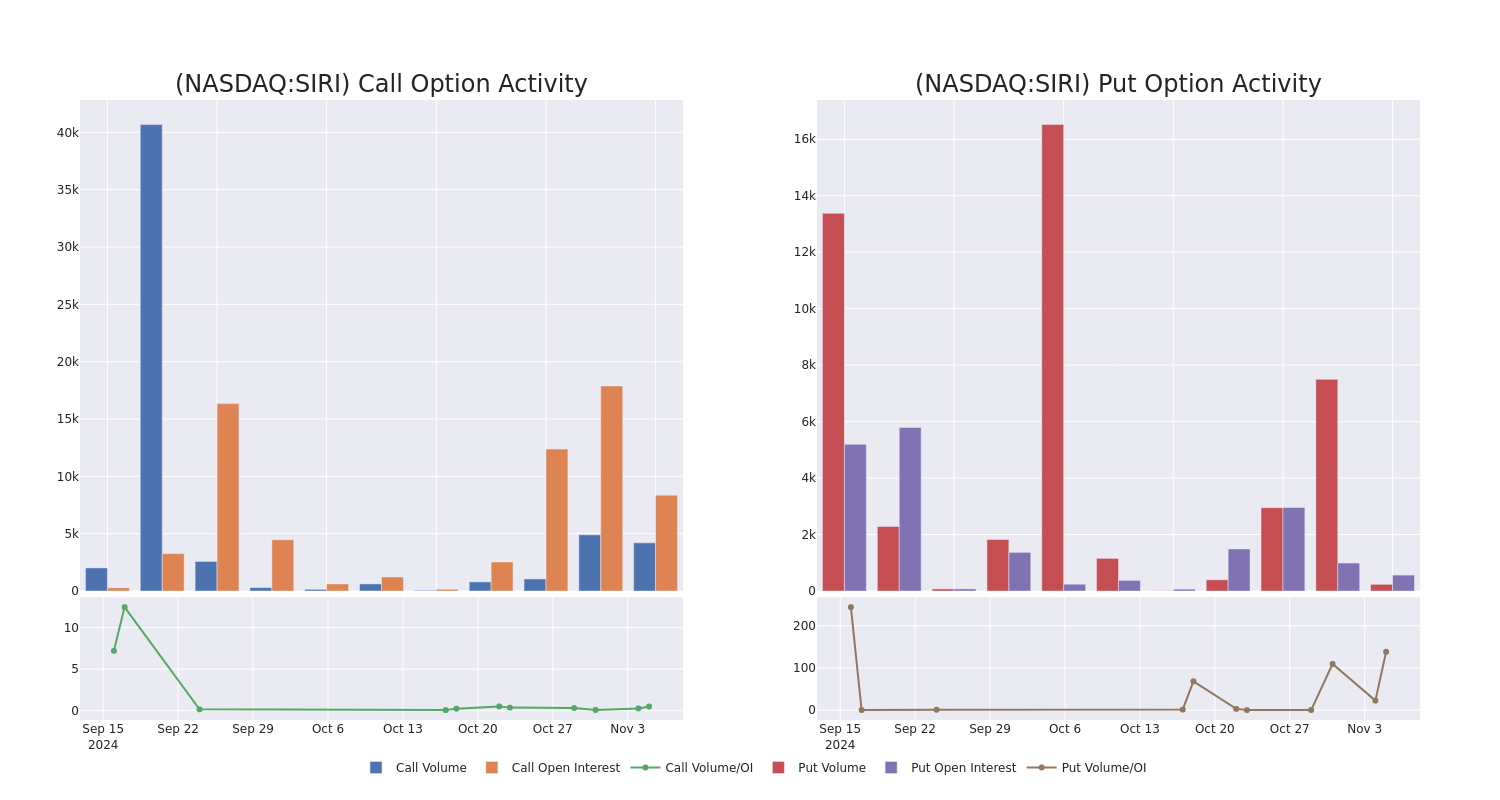

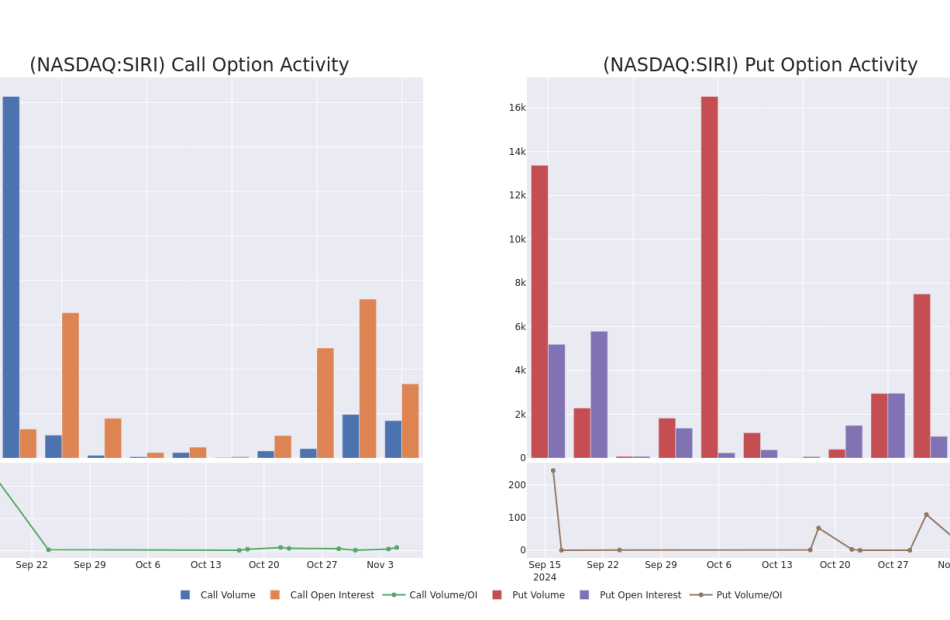

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Sirius XM Holdings’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Sirius XM Holdings’s significant trades, within a strike price range of $23.0 to $28.0, over the past month.

Sirius XM Holdings Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SIRI | CALL | TRADE | NEUTRAL | 06/20/25 | $4.3 | $3.8 | $4.02 | $25.00 | $1.0M | 71 | 2.5K |

| SIRI | PUT | SWEEP | BEARISH | 06/20/25 | $3.5 | $3.2 | $3.5 | $26.00 | $46.2K | 1 | 138 |

| SIRI | CALL | TRADE | BULLISH | 01/17/25 | $3.9 | $3.9 | $3.9 | $23.00 | $31.2K | 7.8K | 109 |

| SIRI | CALL | TRADE | BULLISH | 01/17/25 | $4.1 | $4.05 | $4.1 | $23.00 | $28.7K | 7.8K | 229 |

| SIRI | PUT | SWEEP | BULLISH | 12/20/24 | $2.84 | $2.77 | $2.77 | $28.00 | $27.7K | 564 | 100 |

About Sirius XM Holdings

Sirius XM operates almost exclusively in the US through its SiriusXM and Pandora audio services. SiriusXM is primarily a satellite radio service, which offers nationwide coverage and mostly ad-free listening, with proprietary channels and exclusive content. It makes agreements with automakers to install its radios in vehicles and give trial services to vehicle buyers, which have traditionally fed its subscriber base. The company operates the service through a handful of geostationary satellites that it owns and operates, but it now offers a streaming SiriusXM option as well. Pandora, which makes up a much smaller portion of revenue and profit, offers a subscription and ad-supported streaming music service that competes with industry giants like Spotify, Apple Music, and YouTube Music.

Where Is Sirius XM Holdings Standing Right Now?

- With a volume of 2,023,037, the price of SIRI is down -2.98% at $26.83.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 86 days.

Expert Opinions on Sirius XM Holdings

5 market experts have recently issued ratings for this stock, with a consensus target price of $33.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Pivotal Research persists with their Buy rating on Sirius XM Holdings, maintaining a target price of $37.

* An analyst from B of A Securities downgraded its action to Underperform with a price target of $23.

* An analyst from Barrington Research persists with their Outperform rating on Sirius XM Holdings, maintaining a target price of $40.

* An analyst from Benchmark downgraded its action to Buy with a price target of $43.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Neutral rating on Sirius XM Holdings with a target price of $23.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Sirius XM Holdings with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply