American Electric Power Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

American Electric Power Company, Inc. AEP will release earnings results for its third quarter, before the opening bell on Wednesday, Nov. 6.

Analysts expect the Columbus, Ohio-based company to report quarterly earnings at $1.8 per share, up from $1.77 per share in the year-ago period. American Electric Power projects to report revenue of $5.43 billion for the quarter, compared to $5.37 billion a year earlier, according to data from Benzinga Pro.

On Oct. 24, American Electric Power named Matthew Fransen senior vice president, Finance and Treasurer, effective Dec. 1.

American Electric Power shares gained 2% to close at $100.40 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

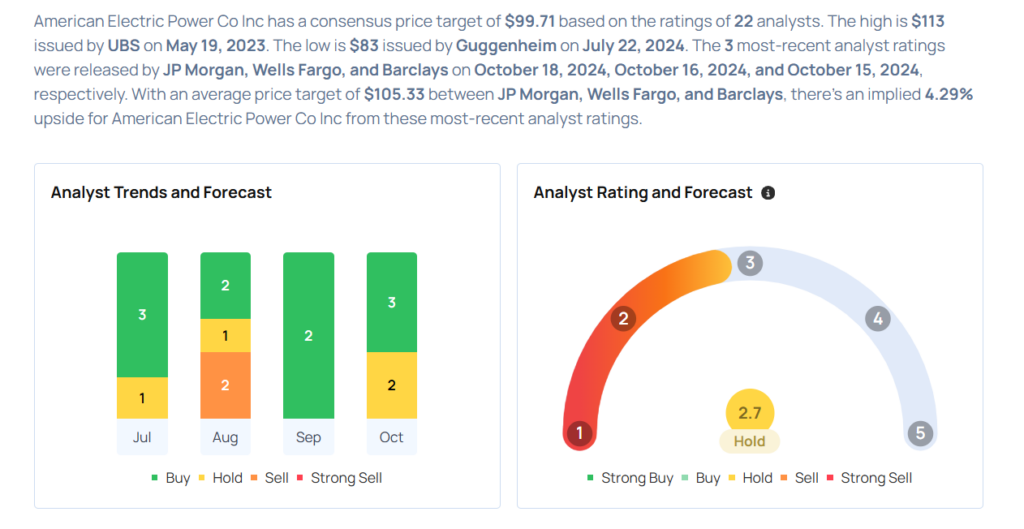

- JP Morgan analyst Jeremy Tonet maintained an Overweight rating and raised the price target from $108 to $112 on Oct. 18. This analyst has an accuracy rate of 62%.

- Wells Fargo analyst Neil Kalton maintained an Equal-Weight rating and increased the price target from $98 to $104 on Oct. 16. This analyst has an accuracy rate of 67%.

- Barclays analyst Nicholas Campanella maintained an Equal-Weight rating and raised the price target from $96 to $100 on Oct. 15. This analyst has an accuracy rate of 65%.

- BMO Capital analyst James Thalacker maintained an Outperform rating and slashed the price target from $114 to $111 on Oct. 4. This analyst has an accuracy rate of 73%.

- Jefferies analyst Julien Dumoulin-Smith initiated coverage on the stock with a Hold rating and a price target of $107 on Sept. 19. This analyst has an accuracy rate of 67%.

Considering buying AEP stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply