Deplay Cash And Reduce Hedges, Short Term Opportunities At Hand, Prepare For Long Term Opportunties

To gain an edge, this is what you need to know today.

Deploy Cash And Reduce Hedges

In addition to Trump winning the presidency, here are the key points:

- Republicans have won control of the Senate.

- Mainstream media is calling control of the House too close to call. However, betting markets are at a 90% probability of Republicans winning the House.

- If Republicans win the House, there will be a complete red sweep, allowing Trump to more easily implement his agenda.

- Trump is on track to win the popular vote. If Trump wins the popular vote, he will use that to overcome objections from Democrats.

- The prevailing wisdom is that Trump’s agenda will be highly inflationary. However, in The Arora Report analysis, there are several things that Trump can easily do to prevent inflation from surging again while growing the economy and bringing manufacturing back to the U.S.

- On the other hand, if Trump embarks on a $2T cut in the Federal budget as he and Elon Musk said on the campaign trail, there is a 70% probability of a recession and the stock market falling 20% – 30%. Trump has said that he would appoint Musk as the efficiency czar. However, the probability of Trump embarking on such a program that he campaigned on is low.

- In The Arora Report analysis, investors will need to pay attention to how Trump implements his agenda. The method of execution can be the difference between a 20% rise in the stock market versus a 20% drop in the stock market.

Consider deploying cash and reducing hedges. Consider making these moves slowly, taking advantage of opportunities that the market may present by scaling in.

Opportunities

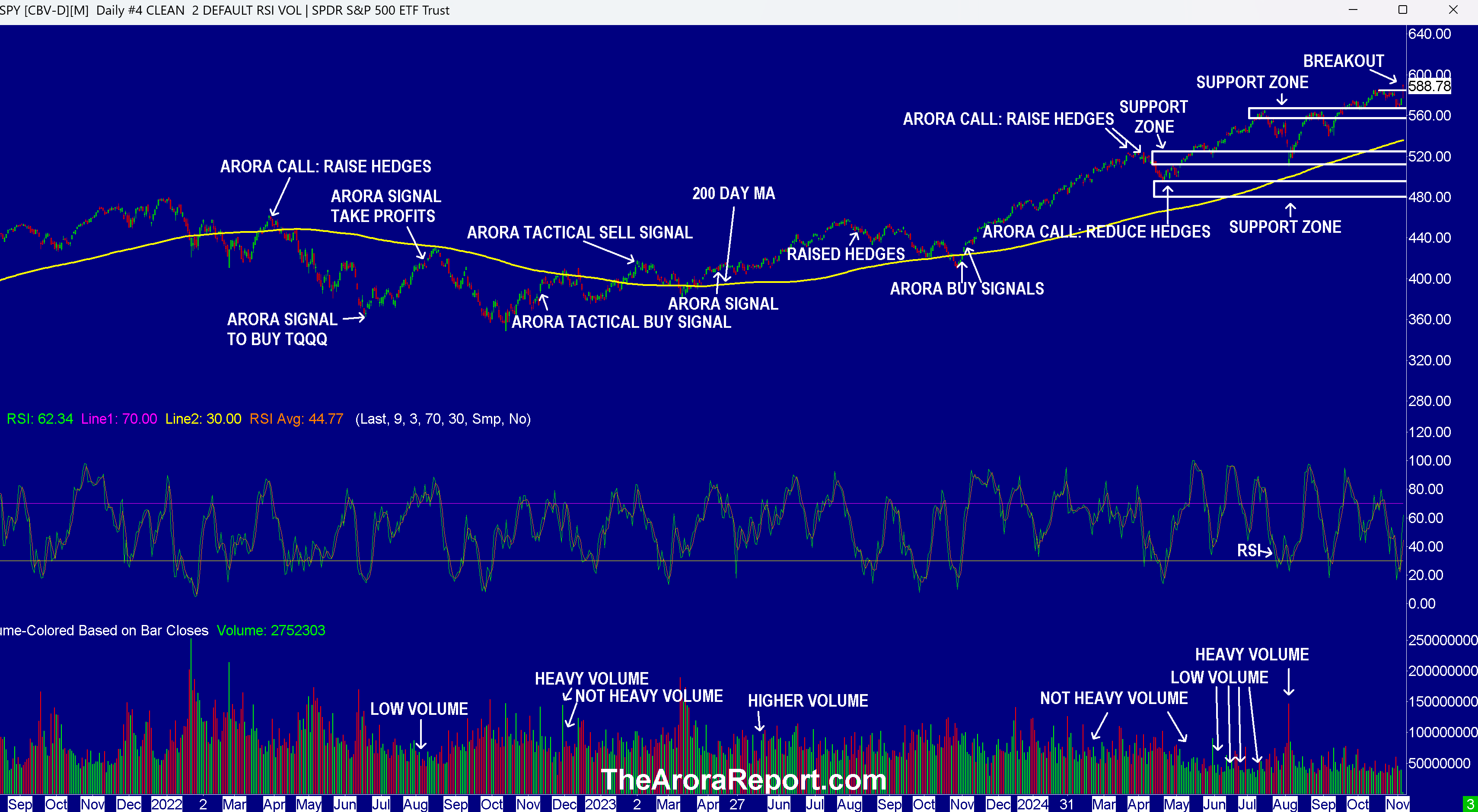

Please click here for an enlarged chart of SPDR S&P 500 ETF Trust SPY which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- The chart shows in the early trade the stock market is technically breaking out. The Arora Report will be carefully watching to see if the breakout is sustained or if it fails.

- RSI on the chart shows there is room for the stock market to run higher.

- Investors need to be cognizant that after the initial euphoria of Trump’s win wears off, there may be a ‘sell the news’ reaction.

- In The Arora Report analysis, if there is a late ‘sell the news’ reaction, the dip should be bought.

- Here are the money flows in various asset classes in the early trade after Trump’s victory:

- Extremely positive in the dollar

- Extremely positive in stocks

- Very positive in bitcoin

- Extremely negative in bonds

- Negative in gold

- Negative in oil

- Instead of acting out of emotion, consider taking a measured approach. There are many short term opportunities, but they are suitable only for aggressive investors. There have been a number of posts in the Real Time Feeds giving signals from both the long and short sides. If you are not aggressive, be patient; there will be plenty of opportunities for investors who are not aggressive.

- In addition to short term opportunities, plenty of long term opportunities are developing. There is no need to rush for long term opportunities. Consider being patient and waiting for dips in the buy zones.

- The FOMC is meeting. The Fed decision is ahead and may have a significant impact on the markets.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Amazon.com, Inc. AMZN, Alphabet Inc Class C GOOG, Microsoft Corp MSFT, NVIDIA Corp NVDA, and Tesla Inc TSLA.

In the early trade, money flows are neutral in Apple Inc AAPL.

In the early trade, money flows are negative in Meta Platforms Inc META.

In the early trade, money flows are extremely positive in SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust Series 1 QQQ.

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Bitcoin BTC/USD is seeing buying. Crypto bulls are targeting $100,000 bitcoin in a short time.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror. The proprietary protection band from The Arora Report is very popular. The protection band puts all of the data, all of the indicators, all of the news, all of the crosscurrents, all of the models, and all of the analysis in an analytical framework that is easily actionable by investors.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply