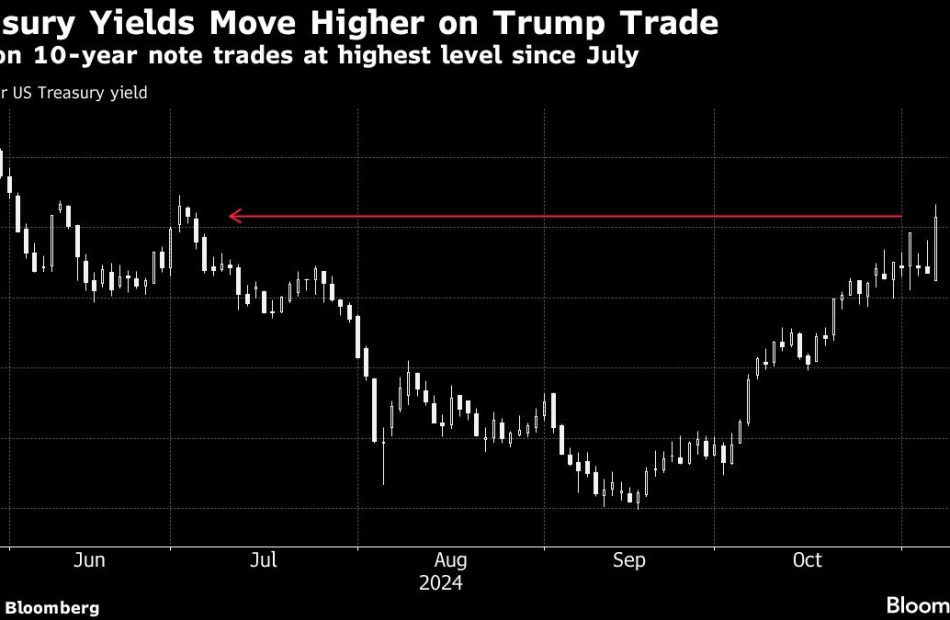

US Bonds Slide Most Since Pandemic as Trump Renews Inflation Bet

(Bloomberg) — US Treasuries slid, with the 30-year bond falling the most since the pandemic struck, as investors piled back into bets that Donald Trump’s return to the White House will boost inflation.

Most Read from Bloomberg

While long bonds led the action — with 30-year yields surging 24 basis points, the biggest daily jump since March 2020 — losses extended across the curve as traders slashed wagers on the scope of interest-rate cuts by the Federal Reserve. Yields on the two-year note rose as much as 13 basis points.

The moves — amplified by a 30-year bond auction later Wednesday — are a vindication for those who doubled down on the so-called Trump Trade for a steeper and higher yield curve. For many, the frustration will be that they eased off at the last moment after weekend polls showed US Vice President Kamala Harris gaining ground — prompting a late surge in appetite for hedges. The latest bets show investors think Trump will aim to stoke the economy.

“The bond market anticipates stronger growth and possibly higher inflation,” said Stephen Dover, head of the Franklin Templeton Institute. “That combination could slow or even halt anticipated Fed rate cuts.”

That’s led investors to double down on bets for policies such as tax cuts and tariffs that could fuel price pressures. The yield on 10-year Treasuries surged 21 basis points to 4.48%, touching its highest level since July. The move diverged from falls in European bond yields, since investors worry that the euro area’s export-reliant industries could be hit by US tariffs.

Bets on a resurgence in US inflation were shown by the two-year inflation swap rate surging 20 basis points to 2.62%, the highest since April. The price action has parallels to the aftermath of the 2016 election, when Trump’s victory sent inflation expectations surging and bonds sliding.

Freya Beamish, head of macroeconomics at TS Lombard, said the biggest topic on her clients’ minds is whether the selloff in bonds is just “a taste of things to come.”

“The question of whether Trump’s policies are capable of generating persistently higher inflation is one which we can debate for the next five years,” said Beamish. “In short, markets cannot fully price that story in today.”

The moves also signal worries that Trump’s proposals will fuel the budget deficit and spur higher bond supply. The jump in 30-year yields to a high of 4.68% comes ahead of an auction for that tenor on Wednesday, the last of three fixed-rate US debt sales this week. Buyers of 10-year notes that were sold on Tuesday face mounting losses as the yield climbs from the 4.347% auction level.

Leave a Reply