Chevron Unusual Options Activity

Benzinga’s options scanner has just identified more than 10 option transactions on Chevron CVX, with a cumulative value of $857,330. Concurrently, our algorithms picked up 2 puts, worth a total of 67,694.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $148.0 and $175.0 for Chevron, spanning the last three months.

Volume & Open Interest Trends

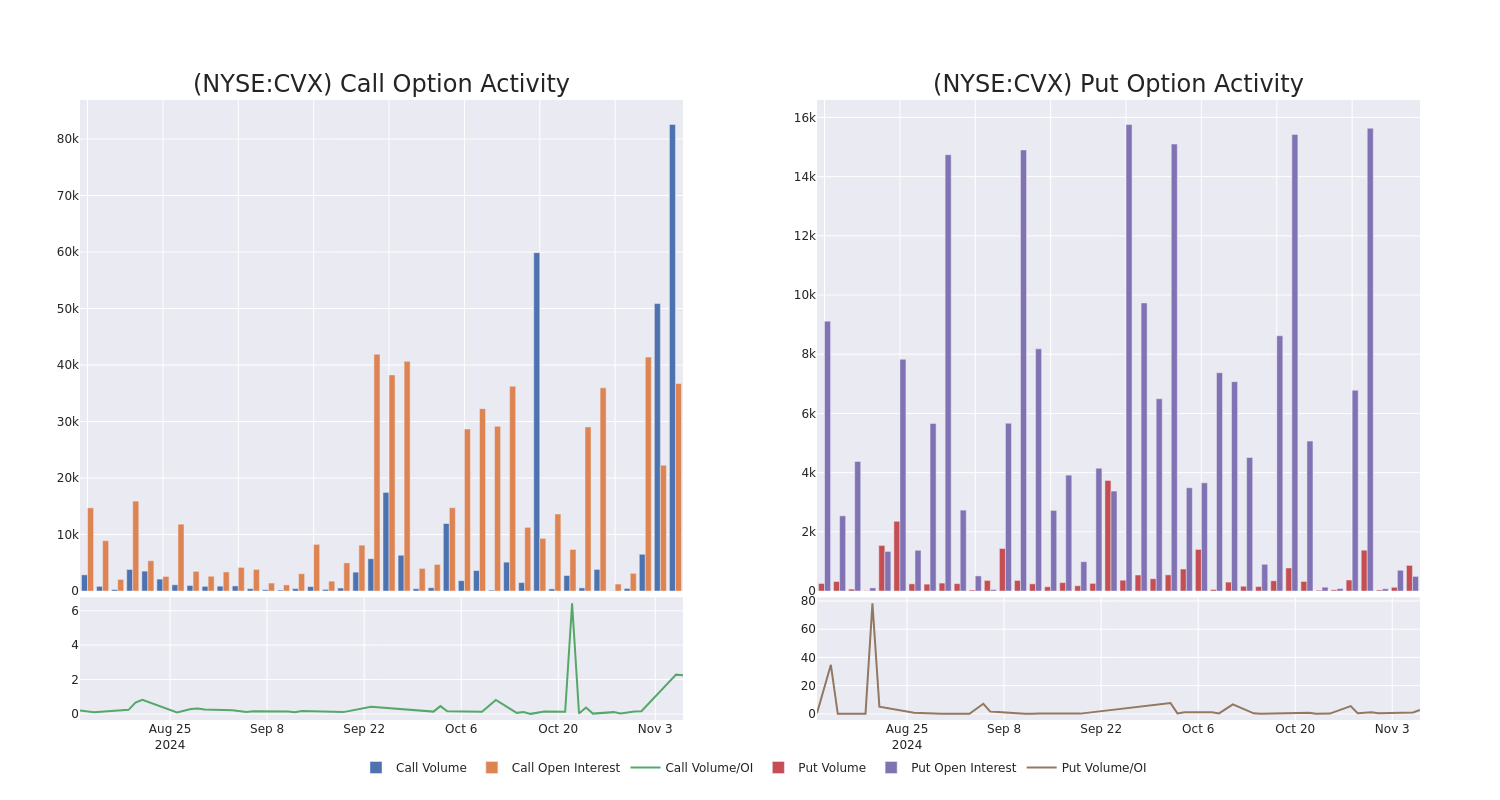

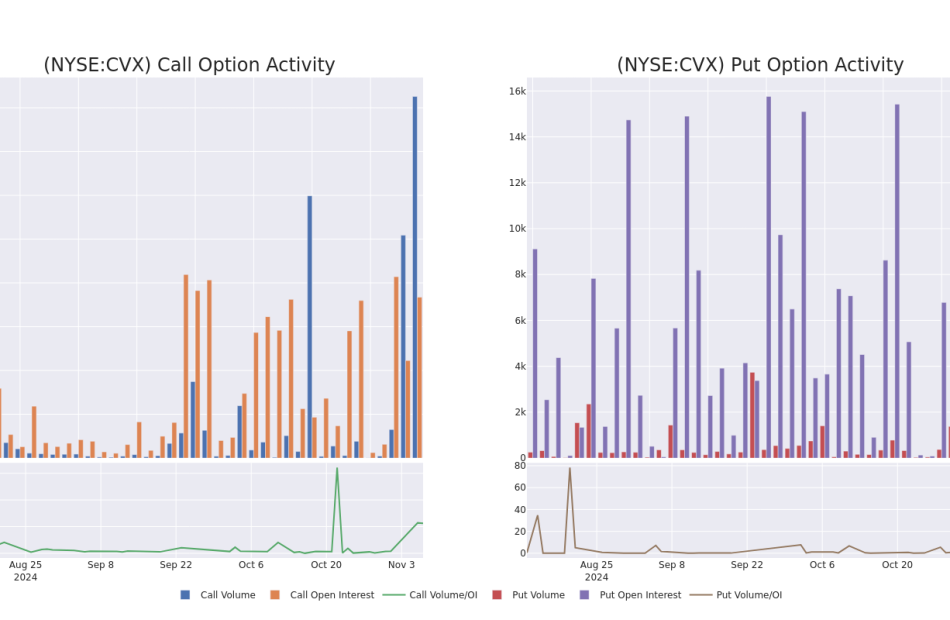

In terms of liquidity and interest, the mean open interest for Chevron options trades today is 7446.8 with a total volume of 83,433.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Chevron’s big money trades within a strike price range of $148.0 to $175.0 over the last 30 days.

Chevron Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | CALL | SWEEP | BULLISH | 01/17/25 | $2.54 | $2.42 | $2.54 | $165.00 | $254.1K | 10.8K | 1.0K |

| CVX | CALL | SWEEP | BULLISH | 01/17/25 | $1.52 | $1.47 | $1.47 | $170.00 | $181.9K | 23.8K | 18.9K |

| CVX | CALL | TRADE | BULLISH | 06/20/25 | $11.75 | $11.65 | $11.75 | $155.00 | $77.5K | 2.0K | 348 |

| CVX | CALL | TRADE | BULLISH | 06/20/25 | $11.75 | $11.4 | $11.65 | $155.00 | $76.8K | 2.0K | 1.0K |

| CVX | CALL | TRADE | BULLISH | 06/20/25 | $11.65 | $11.55 | $11.65 | $155.00 | $76.8K | 2.0K | 414 |

About Chevron

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

After a thorough review of the options trading surrounding Chevron, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Chevron

- With a volume of 4,985,443, the price of CVX is up 0.3% at $158.19.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 85 days.

What Analysts Are Saying About Chevron

5 market experts have recently issued ratings for this stock, with a consensus target price of $171.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Truist Securities persists with their Hold rating on Chevron, maintaining a target price of $155.

* Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Outperform rating for Chevron, targeting a price of $163.

* An analyst from RBC Capital persists with their Outperform rating on Chevron, maintaining a target price of $175.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Chevron with a target price of $194.

* An analyst from B of A Securities has revised its rating downward to Buy, adjusting the price target to $168.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Chevron, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply