Decoding Arista Networks's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bullish stance on Arista Networks.

Looking at options history for Arista Networks ANET we detected 26 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 23% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $522,189 and 21, calls, for a total amount of $964,976.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $370.0 to $600.0 for Arista Networks during the past quarter.

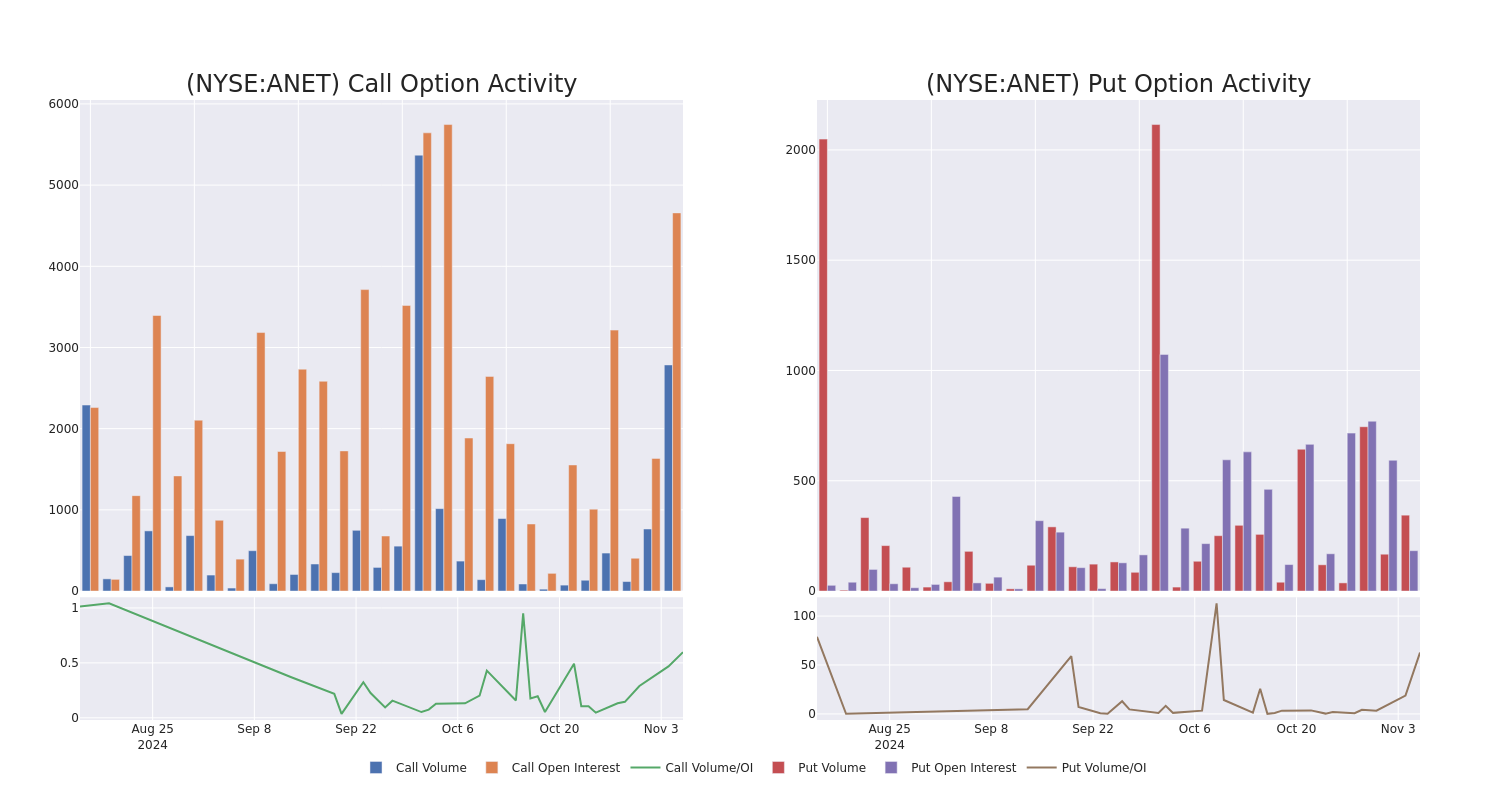

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Arista Networks’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Arista Networks’s whale activity within a strike price range from $370.0 to $600.0 in the last 30 days.

Arista Networks Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | PUT | SWEEP | NEUTRAL | 01/17/25 | $9.5 | $9.2 | $9.36 | $370.00 | $362.4K | 115 | 392 |

| ANET | CALL | TRADE | NEUTRAL | 01/16/26 | $88.5 | $86.2 | $87.3 | $430.00 | $87.3K | 60 | 49 |

| ANET | CALL | TRADE | NEUTRAL | 01/16/26 | $88.3 | $84.9 | $86.65 | $430.00 | $86.6K | 60 | 24 |

| ANET | CALL | SWEEP | BULLISH | 01/16/26 | $88.4 | $88.0 | $88.0 | $430.00 | $70.4K | 60 | 115 |

| ANET | CALL | TRADE | BULLISH | 11/08/24 | $14.0 | $14.0 | $14.0 | $440.00 | $70.0K | 692 | 51 |

About Arista Networks

Arista Networks is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

In light of the recent options history for Arista Networks, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Arista Networks Standing Right Now?

- Trading volume stands at 1,293,445, with ANET’s price up by 1.21%, positioned at $428.26.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 0 days.

What Analysts Are Saying About Arista Networks

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $460.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Arista Networks with a target price of $460.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Arista Networks, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply