Boeing, Airbus Might Secure A $4B Jet Order From Taiwan's China Airlines As Trump Secures Second Term: Report

Taiwan’s China Airlines is reportedly on the verge of splitting a substantial order for long-haul passenger jets between Boeing Co. BA and Airbus SE EADSY. This decision aligns with the recent U.S. presidential election outcome, where Republican Donald Trump reclaimed the presidency.

What Happened: The airline is evaluating Boeing’s 777X and Airbus’s A350-1000 models to replace its existing fleet of 10 Boeing 777-300ERs. The order could encompass up to 20 passenger jets, potentially divided equally between the two manufacturers. The decision on freighters remains uncertain, influenced by the political climate post-U.S. elections, Reuters reported on Thursday.

The estimated value of this passenger jet order is approximately $4 billion, considering standard industry discounts, as reported by aviation consultancy Cirium Ascend. The airline’s board is yet to finalize the decision, with no confirmation on the exact number and types of planes involved.

China Airlines, primarily owned by the Taiwan government, previously ordered 16 Boeing 787-9s in 2022. Despite past concerns, Taiwan’s government remains optimistic about maintaining robust relations with the U.S. under Trump’s leadership. The airline’s chairman, Hsieh Shih-chien, stressed that fleet decisions are made independently of political influence.

Why It Matters: The aerospace industry has been under scrutiny, with companies like Boeing and Airbus facing questions about their high valuations. Defense and aerospace stocks have shown a remarkable 22% return year-to-date, driven by geopolitical tensions.

Additionally, Boeing’s recent labor agreement ended a seven-week strike, securing significant pay increases for workers, which could impact production costs. Meanwhile, Airbus’s recent orders highlight its strong market position, with 85 new orders reported in September.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Appian Announces Third Quarter 2024 Financial Results

MCLEAN, Va., Nov. 07, 2024 (GLOBE NEWSWIRE) — Appian APPN today announced financial results for the third quarter ended September 30, 2024.

“Appian continues to grow even as we become more efficient. Growth remains our top priority. We now project positive adjusted EBITDA for the full year 2024,” said Matt Calkins, CEO & Founder.

Third Quarter 2024 Financial Highlights:

- Revenue: Cloud subscription revenue was $94.1 million, up 22% compared to the third quarter of 2023. Total subscriptions revenue, which includes sales of our cloud subscriptions, on-premises term license subscriptions, and maintenance and support, increased 19% year-over-year to $123.1 million. Professional services revenue was $30.9 million, a decrease of 7% compared to the third quarter of 2023. Total revenue was $154.1 million, up 12% compared to the third quarter of 2023. Cloud subscription revenue retention rate was 117% as of September 30, 2024.

- Operating loss and non-GAAP operating income and loss: GAAP operating loss was $(7.2) million, compared to $(15.2) million for the third quarter of 2023. Non-GAAP operating income was $8.3 million, compared to non-GAAP operating loss of $(7.7) million for the third quarter of 2023.

- Net loss and non-GAAP net income and loss: GAAP net loss was $(2.1) million, compared to $(22.3) million for the third quarter of 2023. GAAP net loss per share was $(0.03) for the third quarter of 2024, compared to $(0.30) for the third quarter of 2023. Non-GAAP net income was $11.4 million, compared to non-GAAP net loss of $(14.6) million for the third quarter of 2023. Non-GAAP diluted net income per share was $0.15, compared to $(0.20) net loss per share for the third quarter of 2023. GAAP net loss and non-GAAP net income for the third quarter of 2024 included $9.2 million of foreign currency exchange gains. GAAP and non-GAAP net loss for the third quarter of 2023 included $4.3 million of foreign currency exchange losses. We do not forecast foreign exchange rate movements.

- Adjusted EBITDA: Adjusted EBITDA was $10.8 million, compared to adjusted EBITDA loss of $(5.3) million for the third quarter of 2023.

- Balance sheet and cash flows: As of September 30, 2024, Appian had total cash, cash equivalents, and investments of $140.0 million. Net cash used by operating activities was $(8.2) million for the three months ended September 30, 2024, compared to $(65.0) million of net cash used by operating activities for the same period in 2023.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables following the financial statements in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

Recent Business Highlights:

Financial Outlook:

As of November 7, 2024, guidance for 2024 is as follows:

- Fourth Quarter 2024 Guidance:

- Cloud subscription revenue is expected to be between $95.0 million and $97.0 million, representing year-over-year growth of 14% to 17%.

- Total revenue is expected to be between $163.5 million and $165.5 million, representing a year-over-year increase of 13% to 14%.

- Adjusted EBITDA is expected to be between $6.0 million and $8.0 million.

- Non-GAAP net loss per share is expected to be between $(0.03) and breakeven, assuming weighted average common shares outstanding of 74.0 million.

- Full Year 2024 Guidance:

- Cloud subscription revenue is expected to be between $364.0 million and $366.0 million, representing year-over-year growth of 20%.

- Total revenue is expected to be between $613.0 million and $615.0 million, representing a year-over-year increase of 12% to 13%.

- Adjusted EBITDA is expected to be between $5.0 million and $7.0 million.

- Non-GAAP net loss per share is expected to be between $(0.38) and $(0.35), assuming weighted average common shares outstanding of 73.0 million.

Conference Call Details:

Appian will host a conference call today, November 7, 2024, at 8:30 a.m. ET to discuss Appian’s financial results for the third quarter ended September 30, 2024 and business outlook.

To access the call, navigate to the following link(1). Once registered, participants can dial in using their phone with a dial in and PIN, or they can choose the Call Me option for instant dial to their phone. The live webcast of the conference call can also be accessed on the Investor Relations page of our website at https://investors.appian.com.

About Appian

Appian is a software company that orchestrates business processes. The Appian Platform empowers leaders to design, automate, and optimize important processes from start to finish. With our industry-leading platform and commitment to customer success, Appian is trusted by top organizations to drive transformational process change. For more information, visit appian.com. APPN

1 https://register.vevent.com/register/BI4a3543c2295f4f5085f10a575f9a8298

Non-GAAP Financial Measures

To supplement its consolidated financial statements, which are prepared and presented in accordance with GAAP, Appian provides investors with certain non-GAAP financial performance measures. Appian uses these non-GAAP financial performance measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Appian’s management believes these non-GAAP financial measures provide meaningful supplemental information regarding Appian’s performance by excluding certain expenses that may not be indicative of our recurring core business operating results. Appian believes both management and investors benefit from referring to these non-GAAP financial measures in assessing Appian’s performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to historical performance as well as comparisons to competitors’ operating results. Appian believes these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to measures used by management in its financial and operational decision-making and (2) they are used by Appian’s institutional investors and the analyst community to help them analyze the health of Appian’s business.

The non-GAAP financial performance measures include the following: non-GAAP subscriptions cost of revenue, non-GAAP professional services cost of revenue, non-GAAP total cost of revenue, non-GAAP total operating expense, non-GAAP operating loss, non-GAAP income tax expense, non-GAAP net income (loss), and non-GAAP net income (loss) per share, basic and diluted. These non-GAAP financial performance measures exclude the effect of stock-based compensation expense, certain non-ordinary litigation-related expenses consisting of legal and other professional fees associated with the Pegasystems cases (net of insurance reimbursements), or Litigation Expense, amortization of the judgement preservation insurance policy, or JPI Amortization, severance costs related to involuntary reductions in our workforce, or Severance Costs, lease impairment and lease-related charges associated with actions taken to reduce the footprint of our leased office spaces, or Lease Impairment and Lease-Related Charges, and a short-swing profit disgorgement paid to us by an investor, or Short-Swing Profit Payment. While some of these items may be recurring in nature and should not be disregarded in the evaluation of our earnings performance, it is useful to exclude such items when analyzing current results and trends compared to other periods as these items can vary significantly from period to period depending on specific underlying transactions or events that may occur. Therefore, while we may incur or recognize these types of expenses in the future, we believe removing these items for purposes of calculating our non-GAAP financial measures provides investors with a more focused presentation of our ongoing operating performance.

Appian also discusses adjusted EBITDA, a non-GAAP financial performance measure it believes offers a useful view of the overall operation of its businesses. The company defines adjusted EBITDA as net loss before (1) other (income) expense, net, (2) interest expense, (3) income tax expense, (4) depreciation expense and amortization of intangible assets, (5) stock-based compensation expense, (6) Litigation Expense, (7) JPI Amortization, (8) Severance Costs, and (9) Lease Impairment and Lease-Related Charges. The most directly comparable GAAP financial measure to adjusted EBITDA is net loss. Users should consider the limitations of using adjusted EBITDA, including the fact this measure does not provide a complete measure of our operating performance. Adjusted EBITDA is not intended to purport to be an alternative to net loss as a measure of operating performance or to cash flows from operating activities as a measure of liquidity.

The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as a substitute for, or superior to the financial information prepared and presented in accordance with GAAP, and Appian’s non-GAAP measures may be different from non-GAAP measures used by other companies. For more information on these non-GAAP financial measures, see the reconciliation of these non-GAAP financial measures to their nearest comparable GAAP measures at the end of this press release. Appian provides guidance ranges for non-GAAP net loss per share and adjusted EBITDA; however, we are not able to reconcile these amounts to their comparable GAAP financial measures without unreasonable efforts because certain information necessary to calculate such measures on a GAAP basis is unavailable, subject to high variability, dependent on future events outside of our control, and cannot be predicted. In addition, Appian believes such reconciliations could imply a degree of precision that might be confusing or misleading to investors. The actual effect of the reconciling items that Appian may exclude from these non-GAAP expense numbers, when determined, may be significant to the calculation of the comparable GAAP measures.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release other than statements of historical facts, including statements regarding Appian’s future financial and business performance for the fourth quarter and full year 2024, future investment by Appian in its go-to-market initiatives, increased demand for the Appian Platform, market opportunity and plans and objectives for future operations, including Appian’s ability to drive continued subscriptions revenue and total revenue growth, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “will,” “plan,” and similar expressions are intended to identify forward-looking statements. Appian has based these forward-looking statements on its current expectations and projections about future events and financial trends that Appian believes may affect its financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks and uncertainties, including the risks and uncertainties associated with Appian’s ability to grow its business and manage its growth, Appian’s ability to sustain its revenue growth rate, continued market acceptance of Appian’s Platform and adoption of low-code solutions to drive digital transformation, the fluctuation of Appian’s operating results due to the length and variability of its sales cycle, competition in the markets in which Appian operates, AI being a disruptive set of technologies that may affect the markets for Appian’s software dramatically and in unpredictable ways, risks and uncertainties associated with the composition and concentration of Appian’s customer base and their demand for its platform and satisfaction with the services provided by Appian, Appian’s ability to operate in compliance with applicable laws and regulations, Appian’s strategic relationships with third parties, and additional risks and uncertainties set forth in the “Risk Factors” section of Appian’s most recent annual report on Form 10-K, quarterly reports on Form 10-Q, and other filings with the Securities and Exchange Commission. Moreover, Appian operates in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for Appian’s management to predict all risks nor can Appian assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements Appian may make. In light of these risks, uncertainties, and assumptions, Appian cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur. Appian is under no duty to update any of these forward-looking statements after the date of this press release to conform these statements to actual results or revised expectations, except as required by law.

Investor Relations

Jack Andrews

703-442-8844

investors@appian.com

Media Contact

Valerie Verlander

703-260-7947

valerie.verlander@appian.com

| APPIAN CORPORATION CONSOLIDATED BALANCE SHEETS (in thousands, except par value and share data) |

|||||||

| As of | |||||||

| September 30, 2024 |

December 31, 2023 |

||||||

| (unaudited) | |||||||

| Assets | |||||||

| Current assets | |||||||

| Cash and cash equivalents | $ | 99,193 | $ | 149,351 | |||

| Short-term investments and marketable securities | 40,798 | 9,653 | |||||

| Accounts receivable, net of allowances of $2,850 and $2,606, respectively | 140,213 | 171,561 | |||||

| Deferred commissions, current | 34,785 | 34,261 | |||||

| Prepaid expenses and other current assets | 45,483 | 49,529 | |||||

| Total current assets | 360,472 | 414,355 | |||||

| Property and equipment, net of accumulated depreciation of $30,329 and $25,141, respectively | 39,190 | 42,682 | |||||

| Goodwill | 27,462 | 27,106 | |||||

| Intangible assets, net of accumulated amortization of $5,356 and $4,152, respectively | 2,790 | 3,889 | |||||

| Right-of-use assets for operating leases | 32,231 | 39,975 | |||||

| Deferred commissions, net of current portion | 54,576 | 59,764 | |||||

| Deferred tax assets | 4,827 | 3,453 | |||||

| Other assets | 28,365 | 36,279 | |||||

| Total assets | $ | 549,913 | $ | 627,503 | |||

| Liabilities and Stockholders’ (Deficit) Equity | |||||||

| Current liabilities | |||||||

| Accounts payable | $ | 6,928 | $ | 6,174 | |||

| Accrued expenses | 11,310 | 11,046 | |||||

| Accrued compensation and related benefits | 31,171 | 38,003 | |||||

| Deferred revenue | 224,199 | 235,992 | |||||

| Debt | 9,598 | 66,368 | |||||

| Operating lease liabilities | 12,470 | 11,698 | |||||

| Other current liabilities | 2,798 | 1,891 | |||||

| Total current liabilities | 298,474 | 371,172 | |||||

| Long-term debt | 243,225 | 140,221 | |||||

| Non-current operating lease liabilities | 54,270 | 59,067 | |||||

| Deferred revenue, non-current | 3,370 | 4,700 | |||||

| Deferred tax liabilities | — | 2 | |||||

| Other non-current liabilities | 375 | — | |||||

| Total liabilities | 599,714 | 575,162 | |||||

| Stockholders’ (deficit) equity | |||||||

| Class A common stock—par value $0.0001; 500,000,000 shares authorized as of September 30, 2024 and December 31, 2023 and 42,361,024 and 42,169,970 shares issued of September 30, 2024 and December 31, 2023, respectively | 4 | 4 | |||||

| Class B common stock—par value $0.0001; 100,000,000 shares authorized as of September 30, 2024 and December 31, 2023 and 31,195,739 and 31,196,796 shares issued as of September 30, 2024 and December 31, 2023, respectively | 3 | 3 | |||||

| Additional paid-in capital | 614,204 | 595,781 | |||||

| Accumulated other comprehensive loss | (22,809 | ) | (23,555 | ) | |||

| Accumulated deficit | (598,507 | ) | (519,892 | ) | |||

| Treasury stock at cost, 1,127,138 shares as of September 30, 2024 | (42,696 | ) | — | ||||

| Total stockholders’ (deficit) equity | (49,801 | ) | 52,341 | ||||

| Total liabilities and stockholders’ (deficit) equity | $ | 549,913 | $ | 627,503 | |||

| APPIAN CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share data) |

|||||||||||||||

| Three Months Ended September 30, 2024 |

Nine Months Ended September 30, 2024 |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| (unaudited) | |||||||||||||||

| Revenue | |||||||||||||||

| Subscriptions | $ | 123,121 | $ | 103,803 | $ | 353,789 | $ | 296,554 | |||||||

| Professional services | 30,931 | 33,291 | 96,548 | 103,490 | |||||||||||

| Total revenue | 154,052 | 137,094 | 450,337 | 400,044 | |||||||||||

| Cost of revenue | |||||||||||||||

| Subscriptions | 14,082 | 11,265 | 39,614 | 32,492 | |||||||||||

| Professional services | 23,002 | 24,804 | 74,880 | 76,515 | |||||||||||

| Total cost of revenue | 37,084 | 36,069 | 114,494 | 109,007 | |||||||||||

| Gross profit | 116,968 | 101,025 | 335,843 | 291,037 | |||||||||||

| Operating expenses | |||||||||||||||

| Sales and marketing | 50,865 | 55,667 | 175,613 | 181,338 | |||||||||||

| Research and development | 38,572 | 37,135 | 117,789 | 118,502 | |||||||||||

| General and administrative | 34,688 | 23,440 | 108,327 | 82,342 | |||||||||||

| Total operating expenses | 124,125 | 116,242 | 401,729 | 382,182 | |||||||||||

| Operating loss | (7,157 | ) | (15,217 | ) | (65,886 | ) | (91,145 | ) | |||||||

| Other non-operating (income) expense | |||||||||||||||

| Other (income) expense, net | (12,544 | ) | 1,939 | (5,882 | ) | (4,637 | ) | ||||||||

| Interest expense | 6,168 | 4,917 | 17,921 | 12,790 | |||||||||||

| Total other non-operating (income) expense | (6,376 | ) | 6,856 | 12,039 | 8,153 | ||||||||||

| Loss before income taxes | (781 | ) | (22,073 | ) | (77,925 | ) | (99,298 | ) | |||||||

| Income tax expense | 1,319 | 178 | 690 | 2,137 | |||||||||||

| Net loss | $ | (2,100 | ) | $ | (22,251 | ) | $ | (78,615 | ) | $ | (101,435 | ) | |||

| Net loss per share: | |||||||||||||||

| Basic and diluted | $ | (0.03 | ) | $ | (0.30 | ) | $ | (1.08 | ) | $ | (1.39 | ) | |||

| Weighted average common shares outstanding: | |||||||||||||||

| Basic and diluted | 72,396 | 73,178 | 72,664 | 73,032 | |||||||||||

| APPIAN CORPORATION STOCK-BASED COMPENSATION EXPENSE (in thousands) |

|||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | |||||||||||

| Cost of revenue | |||||||||||

| Subscriptions | $ | 211 | $ | 211 | $ | 641 | $ | 713 | |||

| Professional services | 1,325 | 1,535 | 4,364 | 4,598 | |||||||

| Operating expenses | |||||||||||

| Sales and marketing | 1,746 | 3,245 | 6,270 | 8,462 | |||||||

| Research and development | 2,939 | 2,930 | 8,859 | 9,466 | |||||||

| General and administrative | 3,284 | 3,090 | 9,877 | 9,976 | |||||||

| Total stock-based compensation expense | $ | 9,505 | $ | 11,011 | $ | 30,011 | $ | 33,215 | |||

| APPIAN CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited, in thousands) |

|||||||

| Nine Months Ended September 30, |

|||||||

| 2024 | 2023 | ||||||

| Cash flows from operating activities | |||||||

| Net loss | $ | (78,615 | ) | $ | (101,435 | ) | |

| Adjustments to reconcile net loss to net cash used by operating activities | |||||||

| Stock-based compensation | 30,011 | 33,215 | |||||

| Depreciation expense and amortization of intangible assets | 7,503 | 7,046 | |||||

| Lease impairment charges | 5,462 | — | |||||

| Bad debt expense | 619 | 690 | |||||

| Amortization of debt issuance costs | 439 | 342 | |||||

| Benefit for deferred income taxes | (1,281 | ) | (808 | ) | |||

| Foreign currency transaction losses, net | 2,895 | — | |||||

| Changes in assets and liabilities | |||||||

| Accounts receivable | 30,859 | 30,665 | |||||

| Prepaid expenses and other assets | 12,279 | (61,555 | ) | ||||

| Deferred commissions | 4,665 | (56 | ) | ||||

| Accounts payable and accrued expenses | 1,495 | (657 | ) | ||||

| Accrued compensation and related benefits | (6,975 | ) | (6,671 | ) | |||

| Other current and non-current liabilities | 535 | (2,026 | ) | ||||

| Deferred revenue | (15,096 | ) | (3,186 | ) | |||

| Operating lease assets and liabilities | (1,788 | ) | 2,238 | ||||

| Net cash used by operating activities | (6,993 | ) | (102,198 | ) | |||

| Cash flows from investing activities | |||||||

| Proceeds from maturities of investments | 11,631 | 62,590 | |||||

| Payments for investments | (42,638 | ) | (53,443 | ) | |||

| Purchases of property and equipment | (3,287 | ) | (8,278 | ) | |||

| Net cash (used by) provided by investing activities | (34,294 | ) | 869 | ||||

| Cash flows from financing activities | |||||||

| Proceeds from borrowings | 50,000 | 92,000 | |||||

| Payments for debt issuance costs | (463 | ) | (411 | ) | |||

| Debt repayments | (3,750 | ) | (2,625 | ) | |||

| Repurchase of common stock | (50,019 | ) | — | ||||

| Payments for employee taxes related to the net share settlement of equity awards | (4,883 | ) | (7,240 | ) | |||

| Proceeds from exercise of common stock options | 619 | 664 | |||||

| Net cash (used by) provided by financing activities | (8,496 | ) | 82,388 | ||||

| Effect of foreign exchange rate changes on cash and cash equivalents | (375 | ) | (679 | ) | |||

| Net decrease in cash and cash equivalents | (50,158 | ) | (19,620 | ) | |||

| Cash, cash equivalents and restricted cash at beginning of period | $ | 149,351 | $ | 150,381 | |||

| Cash and cash equivalents at end of period | $ | 99,193 | $ | 130,761 | |||

| Supplemental disclosure of cash flow information | |||||||

| Cash paid for interest | $ | 17,193 | $ | 11,960 | |||

| Cash paid for income taxes | $ | 1,925 | $ | 2,944 | |||

| Supplemental disclosure of non-cash investing and financing activities | |||||||

| Accrued capital expenditures | $ | 109 | $ | 27 | |||

| APPIAN CORPORATION RECONCILIATION OF GAAP MEASURES TO NON-GAAP MEASURES (unaudited, in thousands, except per share data) |

|||||||||||||||||||||||||||||||

| GAAP Measure | Stock-Based Compensation | Litigation Expense | JPI Amortization | Severance Costs | Lease Impairment and Lease-Related Charges | Short-Swing Profit Payment | Non-GAAP Measure | ||||||||||||||||||||||||

| Three Months Ended September 30, 2024 | |||||||||||||||||||||||||||||||

| Subscriptions cost of revenue | $ | 14,082 | $ | (211 | ) | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 13,871 | ||||||||||||||

| Professional services cost of revenue | 23,002 | (1,325 | ) | — | — | — | — | — | 21,677 | ||||||||||||||||||||||

| Total cost of revenue | 37,084 | (1,536 | ) | — | — | — | — | — | 35,548 | ||||||||||||||||||||||

| Total operating expense | 124,125 | (7,969 | ) | (1,979 | ) | (3,635 | ) | — | (324 | ) | — | 110,218 | |||||||||||||||||||

| Operating (loss) income | (7,157 | ) | 9,505 | 1,979 | 3,635 | — | 324 | — | 8,286 | ||||||||||||||||||||||

| Income tax expense | 1,319 | 117 | — | — | — | — | — | 1,436 | |||||||||||||||||||||||

| Net (loss) income | (2,100 | ) | 9,388 | 1,979 | 3,635 | — | 324 | (1,799 | ) | 11,427 | |||||||||||||||||||||

| Net (loss) income per share, basic | $ | (0.03 | ) | $ | 0.13 | $ | 0.03 | $ | 0.05 | $ | — | $ | — | $ | (0.02 | ) | $ | 0.16 | |||||||||||||

| Net (loss) income per share, diluted(a,b) | $ | (0.03 | ) | $ | 0.13 | $ | 0.03 | $ | 0.05 | $ | — | $ | — | $ | (0.02 | ) | $ | 0.15 | |||||||||||||

| Nine Months Ended September 30, 2024 | |||||||||||||||||||||||||||||||

| Subscriptions cost of revenue | $ | 39,614 | $ | (641 | ) | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 38,973 | ||||||||||||||

| Professional services cost of revenue | 74,880 | (4,364 | ) | — | — | (1,398 | ) | — | — | 69,118 | |||||||||||||||||||||

| Total cost of revenue | 114,494 | (5,005 | ) | — | — | (1,398 | ) | — | — | 108,091 | |||||||||||||||||||||

| Total operating expense | 401,729 | (25,006 | ) | (3,442 | ) | (12,643 | ) | (4,136 | ) | (5,786 | ) | — | 350,716 | ||||||||||||||||||

| Operating (loss) income | (65,886 | ) | 30,011 | 3,442 | 12,643 | 5,534 | 5,786 | — | (8,470 | ) | |||||||||||||||||||||

| Income tax expense | 690 | 1,258 | — | — | 1,096 | — | — | 3,044 | |||||||||||||||||||||||

| Net (loss) income | (78,615 | ) | 28,753 | 3,442 | 12,643 | 4,438 | 5,786 | (1,799 | ) | (25,352 | ) | ||||||||||||||||||||

| Net (loss) income per share, basic and diluted(b) | $ | (1.08 | ) | $ | 0.40 | $ | 0.05 | $ | 0.17 | $ | 0.06 | $ | 0.08 | $ | (0.02 | ) | $ | (0.35 | ) | ||||||||||||

(a) Accounts for the impact of 1.8 million shares of dilutive securities resulting in total diluted shares of 74.2 million.

(b) Per share amounts do not foot due to rounding.

| GAAP Measure | Stock-Based Compensation | Litigation Expense | JPI Amortization | Severance Costs | Non-GAAP Measure | ||||||||||||||||||

| Three Months Ended September 30, 2023 | |||||||||||||||||||||||

| Subscriptions cost of revenue | $ | 11,265 | $ | (211 | ) | $ | — | $ | — | $ | — | $ | 11,054 | ||||||||||

| Professional services cost of revenue | 24,804 | (1,535 | ) | — | — | — | 23,269 | ||||||||||||||||

| Total cost of revenue | 36,069 | (1,746 | ) | — | — | — | 34,323 | ||||||||||||||||

| Total operating expense | 116,242 | (9,265 | ) | 4,961 | (1,485 | ) | — | 110,453 | |||||||||||||||

| Operating (loss) income | (15,217 | ) | 11,011 | (4,961 | ) | 1,485 | — | (7,682 | ) | ||||||||||||||

| Income tax expense | 178 | 88 | — | — | — | 266 | |||||||||||||||||

| Net (loss) income | (22,251 | ) | 11,099 | (4,961 | ) | 1,485 | — | (14,628 | ) | ||||||||||||||

| Net (loss) income per share, basic and diluted | $ | (0.30 | ) | $ | 0.15 | $ | (0.07 | ) | $ | 0.02 | $ | — | $ | (0.20 | ) | ||||||||

| Nine Months Ended September 30, 2023 | |||||||||||||||||||||||

| Subscriptions cost of revenue | $ | 32,492 | $ | (713 | ) | $ | — | $ | — | $ | (30 | ) | $ | 31,749 | |||||||||

| Professional services cost of revenue | 76,515 | (4,598 | ) | — | — | (158 | ) | 71,759 | |||||||||||||||

| Total cost of revenue | 109,007 | (5,311 | ) | — | — | (188 | ) | 103,508 | |||||||||||||||

| Total operating expense | 382,182 | (27,904 | ) | 2,772 | (1,485 | ) | (6,111 | ) | 349,454 | ||||||||||||||

| Operating (loss) income | (91,145 | ) | 33,215 | (2,772 | ) | 1,485 | 6,299 | (52,918 | ) | ||||||||||||||

| Income tax expense | 2,137 | 731 | — | — | 139 | 3,007 | |||||||||||||||||

| Net (loss) income | (101,435 | ) | 33,946 | (2,772 | ) | 1,485 | 6,438 | (62,338 | ) | ||||||||||||||

| Net (loss) income per share, basic and diluted(a) | $ | (1.39 | ) | $ | 0.46 | $ | (0.04 | ) | $ | 0.02 | $ | 0.09 | $ | (0.86 | ) | ||||||||

(a) Per share amounts do not foot due to rounding.

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Reconciliation of adjusted EBITDA: | |||||||||||||||

| GAAP net loss | $ | (2,100 | ) | $ | (22,251 | ) | $ | (78,615 | ) | $ | (101,435 | ) | |||

| Other (income) expense, net | (12,544 | ) | 1,939 | (5,882 | ) | (4,637 | ) | ||||||||

| Interest expense | 6,168 | 4,917 | 17,921 | 12,790 | |||||||||||

| Income tax expense | 1,319 | 178 | 690 | 2,137 | |||||||||||

| Depreciation expense and amortization of intangible assets | 2,562 | 2,340 | 7,503 | 7,046 | |||||||||||

| Stock-based compensation expense | 9,505 | 11,011 | 30,011 | 33,215 | |||||||||||

| Litigation Expense | 1,979 | (4,961 | ) | 3,442 | (2,772 | ) | |||||||||

| JPI Amortization | 3,635 | 1,485 | 12,643 | 1,485 | |||||||||||

| Severance Costs | — | — | 5,534 | 6,299 | |||||||||||

| Lease Impairment and Lease-Related Charges | 324 | — | 5,786 | — | |||||||||||

| Adjusted EBITDA | $ | 10,848 | $ | (5,342 | ) | $ | (967 | ) | $ | (45,872 | ) | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JLL Reports Financial Results for Third-Quarter 2024

Double-digit revenue growth, coupled with ongoing cost discipline, drove strong bottom-line performance

CHICAGO, Nov. 6, 2024 /PRNewswire/ — Jones Lang LaSalle Incorporated JLL today reported operating performance for the third quarter of 2024. Transactional6 revenue growth accelerated to double digits and complemented continued momentum in Resilient6 business line revenues. Diluted earnings per share were $3.20, up from $1.23 last year; adjusted diluted earnings per share1 were $3.50, up from $2.19.

- Third-quarter revenue was $5.9 billion, up 15% in local currency1

- Resilient6 revenues grew 16% in local currency and Transactional6 revenues were up 11% in local currency

- Leasing, within Markets Advisory, increased 21% with broad-based geographic and asset class growth led by U.S. office

- Capital Markets delivered 14% growth as momentum grew in investment sales and debt/equity advisory

- Work Dynamics extended its growth momentum, highlighted by a 20% increase in Workplace Management

- Continued profitability improvement led by Transactional6 revenue growth and the combination of cost discipline and platform leverage

- JLL enhanced digital leasing capabilities, closing on the acquisition of Raise Commercial Real Estate in mid-October

“JLL achieved strong third-quarter revenue and profit growth fueled by continued high demand for our outsourcing services and an acceleration in transactional activity,” said Christian Ulbrich, JLL CEO. “Amidst a dynamic macro backdrop, our combination of data insights, talented people, and investments in our platform and technology is enhancing the way we work, delivering innovative capabilities our clients value. We are excited by significant opportunities in front of us and expect to continue to capitalize on them, driving meaningful and increasingly resilient top and bottom-line growth, financial returns, and cash flow generation.”

|

Summary Financial Results ($ in millions, except per share data, “LC” = local currency) |

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||

|

2024 |

2023 |

% Change in USD |

% Change in LC |

2024 |

2023 |

% Change in USD |

% Change in LC |

||||

|

Revenue |

$ 5,868.8 |

$ 5,111.4 |

15 % |

15 % |

$ 16,622.0 |

$ 14,879.4 |

12 % |

12 % |

|||

|

Net income attributable to common shareholders |

$ 155.1 |

$ 59.7 |

160 % |

161 % |

$ 305.6 |

$ 53.0 |

477 % |

492 % |

|||

|

Adjusted net income attributable to common shareholders1 |

170.0 |

106.3 |

60 |

60 |

379.2 |

242.7 |

56 |

60 |

|||

|

Diluted earnings per share |

$ 3.20 |

$ 1.23 |

160 % |

160 % |

$ 6.32 |

$ 1.10 |

475 % |

492 % |

|||

|

Adjusted diluted earnings per share1 |

3.50 |

2.19 |

60 |

60 |

7.84 |

5.02 |

56 |

59 |

|||

|

Adjusted EBITDA1 |

$ 298.1 |

$ 217.3 |

37 % |

37 % |

$ 731.5 |

$ 555.3 |

32 % |

33 % |

|||

|

Cash flows from operating activities |

$ 261.6 |

$ 325.7 |

(20) % |

n/a |

$ (142.0) |

$ (153.6) |

8 % |

n/a |

|||

|

Free Cash Flow5 |

216.7 |

276.2 |

(22) % |

n/a |

(268.3) |

(291.3) |

8 % |

n/a |

|||

|

Note: |

For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. |

|

Consolidated Third-Quarter 2024 Performance Highlights: |

|||||||||||||||

|

Consolidated

|

Three Months Ended September 30, |

% Change in USD |

% Change in LC |

Nine Months Ended September 30, |

% Change in USD |

% Change in LC |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||||||

|

Markets Advisory |

$ 1,143.8 |

$ 992.4 |

15 % |

15 % |

$ 3,172.7 |

$ 2,924.2 |

8 % |

9 % |

|||||||

|

Capital Markets |

498.8 |

435.8 |

14 |

14 |

1,334.0 |

1,240.9 |

8 |

8 |

|||||||

|

Work Dynamics |

4,068.2 |

3,514.2 |

16 |

16 |

11,641.0 |

10,165.0 |

15 |

15 |

|||||||

|

JLL Technologies |

56.7 |

58.9 |

(4) |

(4) |

167.0 |

180.9 |

(8) |

(8) |

|||||||

|

LaSalle |

101.3 |

110.1 |

(8) |

(8) |

307.3 |

368.4 |

(17) |

(16) |

|||||||

|

Total revenue |

$ 5,868.8 |

$ 5,111.4 |

15 % |

15 % |

$ 16,622.0 |

$ 14,879.4 |

12 % |

12 % |

|||||||

|

Gross contract costs5 |

$ 3,861.8 |

$ 3,327.1 |

16 % |

16 % |

$ 11,107.9 |

$ 9,666.2 |

15 % |

15 % |

|||||||

|

Platform operating expenses |

1,787.5 |

1,633.6 |

9 |

9 |

5,014.8 |

4,848.0 |

3 |

3 |

|||||||

|

Restructuring and acquisition charges4 |

(8.8) |

31.6 |

(128) |

(128) |

4.4 |

79.1 |

(94) |

(95) |

|||||||

|

Total operating expenses |

$ 5,640.5 |

$ 4,992.3 |

13 % |

13 % |

$ 16,127.1 |

$ 14,593.3 |

11 % |

11 % |

|||||||

|

Net non-cash MSR and mortgage banking derivative activity1 |

$ (5.1) |

$ (7.1) |

28 % |

29 % |

$ (25.9) |

$ (9.5) |

(173) % |

(172) % |

|||||||

|

Adjusted EBITDA1 |

$ 298.1 |

$ 217.3 |

37 % |

37 % |

$ 731.5 |

$ 555.3 |

32 % |

33 % |

|||||||

|

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. |

Revenue

Revenue increased 15% compared with the prior-year quarter.

The collective 11% increase in Transactional6 revenue was led by Leasing, within Markets Advisory, up 21%, and Investment Sales, Debt/Equity Advisory and Other, within Capital Markets, up 18% excluding the impact of non-cash MSR and mortgage banking derivative activity.

Several businesses with Resilient6 revenues continued to deliver strong revenue growth, collectively up 16%, highlighted by Workplace Management, within Work Dynamics, up 20%, and Property Management, within Markets Advisory, up 8%. Growth in these businesses outpaced declines in LaSalle Advisory Fees, down 10%, and JLL Technologies, down 4%.

Refer to segment performance highlights for additional detail.

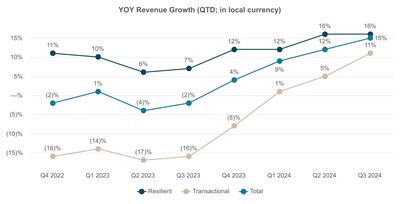

The following chart reflects the year-over-year change in revenue for each of the trailing eight quarters (QTD revenues, on a local currency basis). The chart shows the change in Transactional, Resilient and total revenue.

Net income and Adjusted EBITDA

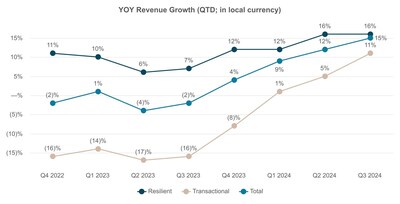

Net income attributable to common shareholders for the third quarter was $155.1 million, compared with $59.7 million in 2023, and Adjusted EBITDA was $298.1 million, compared with $217.3 million last year.

Diluted earnings per share for the third quarter were $3.20 compared with $1.23 in the prior year. The $40.4 million change in Restructuring and acquisition charges, which are excluded from adjusted measures, reflected (i) an expense credit in the current quarter associated with a lower expected earn-out payout related to a 2021 U.S. property management joint venture as well as (ii) lower employment-related costs given the significant cost-out actions in 2023. Adjusted diluted earnings per share were $3.50 for the third quarter compared with $2.19 in 2023. The effective tax rates for the third quarters of 2024 and 2023 were 19.5% and 19.6%, respectively.

The growth in consolidated profit was primarily attributable to (i) higher revenues, both Transactional and certain Resilient revenues, including Workplace Management within Work Dynamics, and (ii) cost discipline and enhanced leverage of the company’s platform. These drivers notably outpaced the timing of revenue-related expense accruals in Work Dynamics and lower contributions from LaSalle. Refer to the segment performance highlights for additional detail.

Net income attributable to common shareholders was $305.6 million for the nine months ended September 30, 2024, compared with income of $53.0 million last year, and Adjusted EBITDA was $731.5 million this year, compared with $555.3 million in 2023. Diluted earnings per share was $6.32 for the nine months ended September 30, 2024, up from diluted earnings per share of $1.10 in 2023; adjusted diluted earnings per share were $7.84, compared with $5.02 last year.

The following chart reflects the aggregation of segment Adjusted EBITDA for the third quarter of 2024 and 2023.

Cash Flows and Capital Allocation:

Net cash provided by operating activities was $261.6 million for the third quarter of 2024, compared with $325.7 million in the prior-year quarter. Free Cash Flow5 was an inflow of $216.7 million this quarter, compared with $276.2 million in the prior year. In the current quarter, and as disclosed last quarter, the company repurchased a loan from Fannie Mae, negatively impacting operating cash flows. In addition, lower cash flow performance was partially due to nearly $30.0 million of higher cash taxes paid (approximately $117.0 million of incremental cash taxes paid on a year-to-date basis) as well as a $21.0 million headwind from Net reimbursables driven by growth in Workplace Management. Partially offsetting these items was higher cash provided by earnings, driven by improved business performance.

The number of shares repurchased and cash paid for repurchases is noted in the following table:

|

Three Months Ended September 30, |

Nine Months Ended September 30, 2024 |

||||

|

($ in millions) |

2024 |

2023 |

2024 |

2023 |

|

|

Total number of shares repurchased (in 000’s) |

83.5 |

123.2 |

297.9 |

262.5 |

|

|

Total paid for shares repurchased |

$ 20.1 |

20.1 |

$ 60.3 |

40.1 |

|

As of September 30, 2024, $1,033.3 million remained authorized for repurchase.

Net Debt, Leverage and Liquidity5:

|

September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

|||

|

Total Net Debt (in millions) |

$ 1,597.3 |

1,752.0 |

1,698.6 |

||

|

Net Leverage Ratio |

1.4x |

1.7x |

1.9x |

||

|

Corporate Liquidity (in millions) |

$ 3,392.8 |

2,449.4 |

2,139.5 |

The decrease in Net Debt from June 30, 2024, reflected incremental cash flows from operating activities during the third quarter of 2024. The Net Debt reduction from September 30, 2023, was largely attributable to improved cash flows from operations over the trailing twelve months ended September 30, 2024, compared with the twelve-month period ended September 30, 2023.

In addition to the Corporate Liquidity detailed above, the company maintains a commercial paper program (the “Program”) with $2.5 billion authorized for issuance. As of September 30, 2024, there was $800.0 million outstanding under the Program.

|

Markets Advisory Third-Quarter 2024 Performance Highlights: |

|||||||||||||||

|

Markets Advisory

|

Three Months Ended September 30, |

% Change in USD |

% Change in LC |

Nine Months Ended September 30, |

% Change in USD |

% Change in LC |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||||||

|

Revenue |

$ 1,143.8 |

$ 992.4 |

15 % |

15 % |

$ 3,172.7 |

$ 2,924.2 |

8 % |

9 % |

|||||||

|

Leasing |

665.4 |

547.7 |

21 |

21 |

1,781.8 |

1,626.1 |

10 |

10 |

|||||||

|

Property Management |

452.3 |

419.2 |

8 |

8 |

1,318.6 |

1,229.3 |

7 |

8 |

|||||||

|

Advisory, Consulting and Other |

26.1 |

25.5 |

2 |

2 |

72.3 |

68.8 |

5 |

5 |

|||||||

|

Segment operating expenses |

$ 1,008.4 |

$ 923.0 |

9 % |

9 % |

$ 2,845.7 |

$ 2,715.2 |

5 % |

5 % |

|||||||

|

Segment platform operating expenses |

687.5 |

634.6 |

8 |

8 |

1,907.2 |

1,863.4 |

2 |

3 |

|||||||

|

Gross contract costs5 |

320.9 |

288.4 |

11 |

11 |

938.5 |

851.8 |

10 |

11 |

|||||||

|

Adjusted EBITDA1 |

$ 151.9 |

$ 85.1 |

78 % |

77 % |

$ 376.8 |

$ 256.1 |

47 % |

46 % |

|||||||

|

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. |

|||||||||||||||

The broad-based increase in Markets Advisory revenue was primarily driven by Leasing and was led by the office sector. Most geographies achieved double-digit growth, notably the U.S., India, UK, Australia and Greater China. Globally, industrial was flat to the prior-year quarter, ending a multi-quarter trend of declines in the sector as deal size rebounded. In addition, the number of larger-scale Leasing deals, where JLL has historically had a greater presence, increased over the prior-year quarter in nearly all asset classes. Property Management revenue growth was led by expansion in the U.S. and several countries in Asia Pacific, including incremental revenue in the U.S. associated with pass-through expenses.

Higher Adjusted EBITDA was largely driven by transactional revenue growth and continued cost discipline. In addition, the timing of prior-year incentive compensation accruals positively impacted the year-over-year profit performance.

|

Capital Markets Third-Quarter 2024 Performance Highlights: |

|||||||||||||||

|

Capital Markets

|

Three Months Ended September 30, |

% Change in USD |

% Change in LC |

Nine Months Ended September 30, |

% Change in USD |

% Change in LC |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||||||

|

Revenue |

$ 498.8 |

$ 435.8 |

14 % |

14 % |

$ 1,334.0 |

$ 1,240.9 |

8 % |

8 % |

|||||||

|

Investment Sales, Debt/Equity Advisory and Other, excluding Net non-cash MSR(a) |

376.9 |

317.3 |

19 |

18 |

976.7 |

879.8 |

11 |

11 |

|||||||

|

Net non-cash MSR and mortgage banking derivative activity (a) |

(5.1) |

(7.1) |

28 |

29 |

(25.9) |

(9.5) |

(173) |

(172) |

|||||||

|

Value and Risk Advisory |

86.0 |

87.5 |

(2) |

(3) |

262.0 |

256.1 |

2 |

2 |

|||||||

|

Loan Servicing |

41.0 |

38.1 |

8 |

8 |

121.2 |

114.5 |

6 |

6 |

|||||||

|

Segment operating expenses |

$ 455.9 |

$ 410.0 |

11 % |

11 % |

$ 1,287.8 |

$ 1,209.1 |

7 % |

7 % |

|||||||

|

Segment platform operating expenses |

444.4 |

398.5 |

12 |

11 |

1,250.9 |

1,175.2 |

6 |

6 |

|||||||

|

Gross contract costs5 |

11.5 |

11.5 |

— |

(1) |

36.9 |

33.9 |

9 |

10 |

|||||||

|

Equity earnings |

$ 0.2 |

$ 0.7 |

(71) % |

(67) % |

$ 0.8 |

$ 6.1 |

(87) % |

(86) % |

|||||||

|

Adjusted EBITDA1 |

$ 65.7 |

$ 50.3 |

31 % |

30 % |

$ 124.5 |

$ 97.0 |

28 % |

29 % |

|||||||

|

Note: |

For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. |

|

(a) |

Historically, net non-cash MSR and mortgage banking derivative activity was included in the Investment Sales, Debt/Equity Advisory and Other caption. Effective beginning Q2 2024, the net non-cash MSR and mortgage banking derivative activity revenue is separately presented in the above table and prior period financial information recast to conform with this presentation |

Capital Markets revenue growth was led by Investment Sales, Debt/Equity Advisory and Other, excluding Net non-cash MSR, as investor sentiment strengthened. This revenue growth was geographically broad-based, most notably in the United States and Europe, and was across nearly all asset classes, with hotels, office and industrial leading the way. Investment sales in the U.S. grew approximately 30%, meaningfully outperforming the broader market for investment sales, which grew 23% according to JLL Research.

The Adjusted EBITDA improvement was largely attributable to the transactional revenue growth described above and continued cost discipline.

|

Work Dynamics Third-Quarter 2024 Performance Highlights: |

|||||||||||||||

|

Work Dynamics

|

Three Months Ended September 30, |

% Change in USD |

% Change in LC |

Nine Months Ended September 30, |

% Change in USD |

% Change in LC |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||||||

|

Revenue |

$ 4,068.2 |

$ 3,514.2 |

16 % |

16 % |

$ 11,641.0 |

$ 10,165.0 |

15 % |

15 % |

|||||||

|

Workplace Management |

3,164.6 |

2,637.1 |

20 |

20 |

9,057.4 |

7,687.7 |

18 |

18 |

|||||||

|

Project Management |

771.3 |

747.0 |

3 |

3 |

2,215.8 |

2,126.5 |

4 |

4 |

|||||||

|

Portfolio Services and Other |

132.3 |

130.1 |

2 |

1 |

367.8 |

350.8 |

5 |

4 |

|||||||

|

Segment operating expenses |

$ 4,019.6 |

$ 3,472.4 |

16 % |

16 % |

$ 11,513.3 |

$ 10,081.3 |

14 % |

14 % |

|||||||

|

Segment platform operating expenses |

500.9 |

455.9 |

10 |

10 |

1,411.3 |

1,333.8 |

6 |

6 |

|||||||

|

Gross contract costs5 |

3,518.7 |

3,016.5 |

17 |

17 |

10,102.0 |

8,747.5 |

15 |

16 |

|||||||

|

Adjusted EBITDA1 |

$ 74.3 |

$ 61.6 |

21 % |

20 % |

$ 196.3 |

$ 143.5 |

37 % |

37 % |

|||||||

|

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. |

|||||||||||||||

Work Dynamics revenue growth was led by continued strong performance in Workplace Management, largely from U.S. mandate expansions. Project Management revenue performance varied across geographies given shifts in business mix as lower pass-through costs partially offset management fees increases in the mid-single digits. Greater activity in Portfolio Services and Other was largely offset by the absence of fees associated with a large transaction on behalf of a U.S. client in 2023.

Adjusted EBITDA expansion was driven by the top-line performance described above with enhanced platform leverage, which more than offset nearly $10 million of expense associated with the timing of accruals related to gross receipts taxes in a handful of U.S. states.

|

JLL Technologies Third-Quarter 2024 Performance Highlights: |

|||||||||||||||

|

JLL Technologies

|

Three Months Ended September 30, |

% Change in USD |

% Change in LC |

Nine Months Ended September 30, |

% Change in USD |

% Change in LC |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||||||

|

Revenue |

$ 56.7 |

$ 58.9 |

(4) % |

(4) % |

$ 167.0 |

$ 180.9 |

(8) % |

(8) % |

|||||||

|

Segment operating expenses |

$ 75.7 |

$ 68.5 |

11 % |

10 % |

$ 211.3 |

$ 218.0 |

(3) % |

(3) % |

|||||||

|

Segment platform operating expenses(a) |

74.3 |

65.2 |

14 |

14 |

207.3 |

207.0 |

— |

— |

|||||||

|

Gross contract costs5 |

1.4 |

3.3 |

(58) |

(59) |

4.0 |

11.0 |

(64) |

(64) |

|||||||

|

Adjusted EBITDA1 |

$ (7.8) |

$ (5.7) |

(37) % |

(39) % |

$ (23.8) |

$ (25.2) |

6 % |

6 % |

|||||||

|

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. |

|||||||||||||||

|

(a) Included in Segment platform operating expenses is carried interest expense of $2.2 million and $4.3 million for the three and nine months ended September 30, 2024, and a carried interest benefit of $0.1 million and $9.4 million for the three and nine months ended September 30, 2023, related to Equity earnings (losses) of the segment. |

|||||||||||||||

The decline in JLL Technologies revenue was due to lower contract signings over the trailing twelve months in services offerings, partially offset by continued growth in software offerings.

The increase in segment operating expenses is primarily driven by 1) $6.3 million of non-cash losses from convertible notes associated with JLL Technologies investments, which are excluded from Adjusted EBITDA consistent with equity earnings/losses from investments, 2) an approximate $5 million reduction to incentive compensation in the prior-year quarter attributable to achievement against certain targets, and 3) an incremental $2.3 million of carried interest expense associated with net equity earnings on Spark Venture Funds investments.

The lower Adjusted EBITDA was primarily attributable to lower revenue as well as the incentive compensation and carried interest expenses items described above, which overshadowed the benefits of cost discipline and improved operating efficiency over the trailing twelve months.

|

LaSalle Third-Quarter 2024 Performance Highlights: |

|||||||||||||||

|

LaSalle

|

Three Months Ended September 30, |

% Change in USD |

% Change in LC |

Nine Months Ended September 30, |

% Change in USD |

% Change in LC |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||||||

|

Revenue |

$ 101.3 |

$ 110.1 |

(8) % |

(8) % |

$ 307.3 |

$ 368.4 |

(17) % |

(16) % |

|||||||

|

Advisory fees |

92.7 |

102.7 |

(10) |

(10) |

278.1 |

306.3 |

(9) |

(8) |

|||||||

|

Transaction fees and other |

8.6 |

7.4 |

16 |

17 |

24.4 |

22.8 |

7 |

10 |

|||||||

|

Incentive fees |

— |

— |

n.m. |

n.m. |

4.8 |

39.3 |

(88) |

(87) |

|||||||

|

Segment operating expenses |

$ 89.7 |

$ 86.8 |

3 % |

3 % |

$ 264.6 |

$ 290.6 |

(9) % |

(9) % |

|||||||

|

Segment platform operating expenses |

80.4 |

79.4 |

1 |

1 |

238.1 |

268.6 |

(11) |

(11) |

|||||||

|

Gross contract costs5 |

9.3 |

7.4 |

26 |

26 |

26.5 |

22.0 |

20 |

21 |

|||||||

|

Adjusted EBITDA1 |

$ 14.0 |

$ 26.0 |

(46) % |

(45) % |

$ 57.7 |

$ 83.9 |

(31) % |

(28) % |

|||||||

|

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. |

|||||||||||||||

LaSalle’s decrease in revenue was primarily attributable to declines in assets under management (“AUM”) over the trailing twelve months, most notably in North America and Europe, and lower fees in Europe as a result of structural changes to a lower-margin business, as discussed in previous quarters this year.

The lower Adjusted EBITDA was largely driven by the decline in revenue. In addition, the prior-year quarter included a one-time reduction to a legacy incentive compensation accrual upon final determination of performance relative to target.

As of September 30, 2024, LaSalle had $84.6 billion of AUM. Compared with AUM of $92.9 billion as of September 30, 2023, the AUM as of September 30, 2024, decreased 9% in USD (7% in local currency). The net decrease in AUM over the trailing twelve months resulted from (i) $5.4 billion of dispositions and withdrawals, (ii) $3.9 billion of net valuation decreases, (iii) $1.7 billion of foreign currency decreases and (iv) a $0.8 billion decrease in uncalled committed capital and cash held, partially offset by (v) $3.5 billion of acquisitions and takeovers.

Finally, the company committed to invest an incremental $100 million in a LaSalle flagship fund, JLL Income Property Trust.

About JLL

For over 200 years, JLL JLL, a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of $20.8 billion and operations in over 80 countries around the world, our more than 111,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.

Connect with us

https://www.linkedin.com/company/jll

https://www.facebook.com/jll

https://twitter.com/jll

|

Live Webcast |

Conference Call |

||

|

Management will offer a live webcast for shareholders, analysts and investment professionals on Wednesday, November 6, 2024, at 9:00 a.m. Eastern. Following the live broadcast, an audio replay will be available. The link to the live webcast and audio replay can be accessed at the Investor Relations website: ir.jll.com. |

The conference call can be accessed live over the phone by dialing (888) 660-6392; the conference ID number is 5398158. Listeners are asked to please dial in 10 minutes prior to the call start time and provide the conference ID number to be connected. |

||

|

Supplemental Information |

Contact |

||

|

Supplemental information regarding the third quarter 2024 earnings call has been posted to the Investor Relations section of JLL’s website: ir.jll.com. |

If you have any questions, please contact Brian Hogan, Interim Head of Investor Relations. |

||

|

Phone: |

+1 312 252 8943 |

||

|

Email: |

JLLInvestorRelations@jll.com

|

||

Cautionary Note Regarding Forward-Looking Statements

Statements in this news release regarding, among other things, future financial results and performance, achievements, plans, objectives and share repurchases may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties, and other factors, the occurrence of which are outside JLL’s control which may cause JLL’s actual results, performance, achievements, plans, and objectives to be materially different from those expressed or implied by such forward-looking statements. For additional information concerning risks, uncertainties, and other factors that could cause actual results to differ materially from those anticipated in forward-looking statements, and risks to JLL’s business in general, please refer to those factors discussed under “Risk Factors,” “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures about Market Risk,” and elsewhere in JLL’s filed Annual Report on Form 10-K for the year ended December 31, 2023, soon to be filed Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 and other reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this release, and except to the extent required by applicable securities laws, JLL expressly disclaims any obligation or undertaking to publicly update or revise any forward-looking statements contained herein to reflect any change in expectations or results, or any change in events.

|

JONES LANG LASALLE INCORPORATED |

|||||||

|

Consolidated Statements of Operations (Unaudited) |

|||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

|

(in millions, except share and per share data) |

2024 |

2023 |

2024 |

2023 |

|||

|

Revenue |

$ 5,868.8 |

$ 5,111.4 |

$ 16,622.0 |

$ 14,879.4 |

|||

|

Operating expenses: |

|||||||

|

Compensation and benefits |

$ 2,854.6 |

$ 2,434.6 |

$ 7,869.4 |

$ 7,104.6 |

|||

|

Operating, administrative and other |

2,729.2 |

2,467.0 |

8,064.5 |

7,233.1 |

|||

|

Depreciation and amortization |

65.5 |

59.1 |

188.8 |

176.5 |

|||

|

Restructuring and acquisition charges4 |

(8.8) |

31.6 |

4.4 |

79.1 |

|||

|

Total operating expenses |

$ 5,640.5 |

$ 4,992.3 |

$ 16,127.1 |

$ 14,593.3 |

|||

|

Operating income |

$ 228.3 |

$ 119.1 |

$ 494.9 |

$ 286.1 |

|||

|

Interest expense, net of interest income |

38.1 |

37.1 |

110.3 |

103.9 |

|||

|

Equity losses |

(0.9) |

(11.2) |

(20.0) |

(117.3) |

|||

|

Other income |

2.9 |

3.0 |

14.1 |

1.9 |

|||

|

Income before income taxes and noncontrolling interest |

192.2 |

73.8 |

378.7 |

66.8 |

|||

|

Income tax provision |

37.4 |

14.5 |

73.8 |

13.0 |

|||

|

Net income |

154.8 |

59.3 |

304.9 |

53.8 |

|||

|

Net (loss) income attributable to noncontrolling interest |

(0.3) |

(0.4) |

(0.7) |

0.8 |

|||

|

Net income attributable to common shareholders |

$ 155.1 |

$ 59.7 |

$ 305.6 |

$ 53.0 |

|||

|

Basic earnings per common share |

$ 3.26 |

$ 1.25 |

$ 6.43 |

$ 1.11 |

|||

|

Basic weighted average shares outstanding (in 000’s) |

47,505 |

47,662 |

47,506 |

47,655 |

|||

|

Diluted earnings per common share |

$ 3.20 |

$ 1.23 |

$ 6.32 |

$ 1.10 |

|||

|

Diluted weighted average shares outstanding (in 000’s) |

48,497 |

48,394 |

48,355 |

48,317 |

|||

|

Please reference accompanying financial statement notes. |

|||||||

|

JONES LANG LASALLE INCORPORATED |

|||||||

|

Selected Segment Financial Data (Unaudited) |

|||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

|

(in millions) |

2024 |

2023 |

2024 |

2023 |

|||

|

MARKETS ADVISORY |

|||||||

|

Revenue |

$ 1,143.8 |

$ 992.4 |

$ 3,172.7 |

$ 2,924.2 |

|||

|

Platform compensation and benefits |

$ 582.5 |

$ 531.2 |

$ 1,588.4 |

$ 1,538.6 |

|||

|

Platform operating, administrative and other |

87.7 |

86.5 |

266.7 |

273.4 |

|||

|

Depreciation and amortization |

17.3 |

16.9 |

52.1 |

51.4 |

|||

|

Segment platform operating expenses |

687.5 |

634.6 |

1,907.2 |

1,863.4 |

|||

|

Gross contract costs5 |

320.9 |

288.4 |

938.5 |

851.8 |

|||

|

Segment operating expenses |

$ 1,008.4 |

$ 923.0 |

$ 2,845.7 |

$ 2,715.2 |

|||

|

Segment operating income |

$ 135.4 |

$ 69.4 |

$ 327.0 |

$ 209.0 |

|||

|

Add: |

|||||||

|

Equity earnings |

0.1 |

0.1 |

0.5 |

0.3 |

|||

|

Depreciation and amortization(a) |

16.3 |

15.9 |

49.2 |

48.5 |

|||

|

Other income |

1.4 |

1.8 |

3.0 |

0.5 |

|||

|

Net income attributable to noncontrolling interest |

(0.2) |

(0.2) |

(0.5) |

(0.8) |

|||

|

Adjustments: |

|||||||

|

Net (gain) loss on disposition |

— |

(0.9) |

— |

0.9 |

|||

|

Interest on employee loans, net of forgiveness |

(1.1) |

(1.0) |

(2.4) |

(2.3) |

|||

|

Adjusted EBITDA1 |

$ 151.9 |

$ 85.1 |

$ 376.8 |

$ 256.1 |

|||

|

(a) This adjustment excludes the noncontrolling interest portion of amortization of acquisition-related intangibles which is not attributable to common shareholders. |

|||||||

|

JONES LANG LASALLE INCORPORATED |

|||||||

|

Selected Segment Financial Data (Unaudited) Continued |

|||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

|

(in millions) |

2024 |

2023 |

2024 |

2023 |

|||

|

CAPITAL MARKETS |

|||||||

|

Revenue |

$ 498.8 |

$ 435.8 |

$ 1,334.0 |

$ 1,240.9 |

|||

|

Platform compensation and benefits |

$ 365.5 |

$ 323.8 |

$ 994.2 |

$ 943.1 |

|||

|

Platform operating, administrative and other |

62.3 |

58.3 |

206.4 |

183.6 |

|||

|

Depreciation and amortization |

16.6 |

16.4 |

50.3 |

48.5 |

|||

|

Segment platform operating expenses |

444.4 |

398.5 |

1,250.9 |

1,175.2 |

|||

|

Gross contract costs5 |

11.5 |

11.5 |

36.9 |

33.9 |

|||

|

Segment operating expenses |

$ 455.9 |

$ 410.0 |

$ 1,287.8 |

$ 1,209.1 |

|||

|

Segment operating income |

$ 42.9 |

$ 25.8 |

$ 46.2 |

$ 31.8 |

|||

|

Add: |

|||||||

|

Equity earnings |

0.2 |

0.7 |

0.8 |

6.1 |

|||

|

Depreciation and amortization |

16.6 |

16.4 |

50.3 |

48.5 |

|||

|

Other income |

1.6 |

1.3 |

3.0 |

1.5 |

|||

|

Adjustments: |

|||||||

|

Net non-cash MSR and mortgage banking derivative activity |

5.1 |

7.1 |

25.9 |

9.5 |

|||

|

Interest on employee loans, net of forgiveness |

(0.7) |

(0.6) |

(1.7) |

— |

|||

|

Gain on disposition |

— |

(0.4) |

— |

(0.4) |

|||

|

Adjusted EBITDA1 |

$ 65.7 |

$ 50.3 |

$ 124.5 |

$ 97.0 |

|||

|

JONES LANG LASALLE INCORPORATED |

||||||||

|

Selected Segment Financial Data (Unaudited) Continued |

||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||

|

(in millions) |

2024 |

2023 |

2024 |

2023 |

||||

|

WORK DYNAMICS |

||||||||

|

Revenue |

$ 4,068.2 |

$ 3,514.2 |

$ 11,641.0 |

$ 10,165.0 |

||||

|

Platform compensation and benefits |

$ 348.8 |

$ 332.9 |

$ 1,002.4 |

$ 958.9 |

||||

|

Platform operating, administrative and other |

127.3 |

103.3 |

342.6 |

316.0 |

||||

|

Depreciation and amortization |

24.8 |

19.7 |

66.3 |

58.9 |

||||

|

Segment platform operating expenses |

500.9 |

455.9 |

1,411.3 |

1,333.8 |

||||

|

Gross contract costs5 |

3,518.7 |

3,016.5 |

10,102.0 |

8,747.5 |

||||

|

Segment operating expenses |

$ 4,019.6 |

$ 3,472.4 |

$ 11,513.3 |

$ 10,081.3 |

||||

|

Segment operating income |

$ 48.6 |

$ 41.8 |

$ 127.7 |

$ 83.7 |

||||

|

Add: |

||||||||

|

Equity earnings |

1.0 |

0.1 |

2.1 |

1.3 |

||||

|

Depreciation and amortization |

24.8 |

19.7 |

66.3 |

58.9 |

||||

|

Net (income) loss attributable to noncontrolling interest |

(0.1) |

— |

0.2 |

(0.4) |

||||

|

Adjusted EBITDA1 |

$ 74.3 |

$ 61.6 |

$ 196.3 |

$ 143.5 |

||||

|

JONES LANG LASALLE INCORPORATED |

||||||||

|

Selected Segment Financial Data (Unaudited) Continued |

||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||

|

(in millions) |

2024 |

2023 |

2024 |

2023 |

||||

|

JLL TECHNOLOGIES |

||||||||

|

Revenue |

$ 56.7 |

$ 58.9 |

$ 167.0 |

$ 180.9 |

||||

|

Platform compensation and benefits(a) |

$ 50.3 |

$ 48.7 |

$ 151.1 |

$ 155.3 |

||||

|

Platform operating, administrative and other |

19.1 |

12.6 |

42.0 |

39.8 |

||||

|

Depreciation and amortization |

4.9 |

3.9 |

14.2 |

11.9 |

||||

|

Segment platform operating expenses |

74.3 |

65.2 |

207.3 |

207.0 |

||||

|

Gross contract costs5 |

1.4 |

3.3 |

4.0 |

11.0 |

||||

|

Segment operating expenses |

$ 75.7 |

$ 68.5 |

$ 211.3 |

$ 218.0 |

||||

|

Segment operating loss |

$ (19.0) |

$ (9.6) |

$ (44.3) |

$ (37.1) |

||||

|

Add: |

||||||||

|

Depreciation and amortization |

4.9 |

3.9 |

14.2 |

11.9 |

||||

|

Adjustments: |

||||||||

|

Credit losses on convertible note investments |

6.3 |

— |

6.3 |

— |

||||

|

Adjusted EBITDA1 |

$ (7.8) |

$ (5.7) |

$ (23.8) |

$ (25.2) |

||||

|

Equity earnings (losses) |

$ 11.6 |

$ (3.0) |

$ 1.6 |

$ (102.0) |

||||

|

(a) Included in Platform compensation and benefits is carried interest expense of $2.2 million and $4.3 million for the three and nine months ended September 30, 2024 and a carried interest benefit of $0.1 million and $9.4 million for the three and nine months ended September 30, 2023, related to Equity earnings (losses) of the segment. |

|

JONES LANG LASALLE INCORPORATED |

||||||||

|

Selected Segment Financial Data (Unaudited) Continued |

||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||

|

(in millions) |

2024 |

2023 |

2024 |

2023 |

||||

|

LASALLE |

||||||||

|

Revenue |

$ 101.3 |

$ 110.1 |

$ 307.3 |

$ 368.4 |

||||

|

Platform compensation and benefits |

$ 59.8 |

$ 63.2 |

$ 180.1 |

$ 216.5 |

||||

|

Platform operating, administrative and other |

18.7 |

14.0 |

52.1 |

46.3 |

||||

|

Depreciation and amortization |

1.9 |

2.2 |

5.9 |

5.8 |

||||

|

Segment platform operating expenses |

80.4 |

79.4 |

238.1 |

268.6 |

||||

|

Gross contract costs5 |

9.3 |

7.4 |

26.5 |

22.0 |

||||

|

Segment operating expenses |

$ 89.7 |

$ 86.8 |

$ 264.6 |

$ 290.6 |

||||

|

Segment operating income |

$ 11.6 |

$ 23.3 |

$ 42.7 |

$ 77.8 |

||||

|

Add: |

||||||||

|

Depreciation and amortization |

1.9 |

2.2 |

5.9 |

5.8 |

||||

|

Other (expense) income |

(0.1) |

(0.1) |

8.1 |

(0.1) |

||||

|

Net loss attributable to noncontrolling interest |

0.6 |

0.6 |

1.0 |

0.4 |

||||

|

Adjusted EBITDA1 |

$ 14.0 |

$ 26.0 |

$ 57.7 |

$ 83.9 |

||||

|

Equity losses |

$ (13.8) |

$ (9.1) |

$ (25.0) |

$ (23.0) |

||||

|

JONES LANG LASALLE INCORPORATED |

||||||||

|

Consolidated Statement of Cash Flows (Unaudited) |

||||||||

|

Nine Months Ended September 30, |

Nine Months Ended September 30, |

|||||||

|

(in millions) |

2024 |

2023 |

2024 |

2023 |

||||

|

Cash flows from operating activities7: |

Cash flows from investing activities: |

|||||||

|

Net income |

$ 304.9 |

$ 53.8 |

Net capital additions – property and equipment |

$ (126.3) |

$ (137.7) |

|||

|

Reconciliation of net income to net cash used in operating activities: |

Business acquisitions, net of cash acquired |

(40.8) |

(13.6) |

|||||

|

Depreciation and amortization |

188.8 |

176.5 |

Capital contributions to investments |

(69.2) |

(86.8) |

|||

|

Equity losses |

20.0 |

117.3 |

Distributions of capital from investments |

14.3 |

21.5 |

|||

|

Net loss on dispositions |

— |

0.5 |

Acquisition of controlling interest, net of cash acquired |

3.7 |

— |

|||

|

Distributions of earnings from investments |

10.7 |

8.2 |

Other, net |

(0.7) |

(3.8) |

|||

|

Provision for loss on receivables and other assets |

34.7 |

21.7 |

Net cash used in investing activities |

(219.0) |

(220.4) |

|||

|

Amortization of stock-based compensation |

78.9 |

59.5 |

Cash flows from financing activities: |

|||||

|

Net non-cash mortgage servicing rights and mortgage banking derivative activity |

25.9 |

9.5 |

Proceeds from borrowings under credit facility |

6,029.0 |

5,969.0 |

|||

|

Accretion of interest and amortization of debt issuance costs |

4.1 |

3.1 |

Repayments of borrowings under credit facility |

(6,309.0) |

(5,594.0) |

|||

|

Other, net |

(5.2) |

15.4 |

Proceeds from issuance of commercial paper |

800.0 |

— |

|||

|

Change in: |

Net repayments of short-term borrowings |

(73.0) |

(46.4) |

|||||

|

Receivables |

59.7 |

158.1 |

Payments of deferred business acquisition obligations and earn-outs |

(5.1) |

(22.6) |

|||

|

Reimbursable receivables and reimbursable payables |

(160.0) |

(110.7) |

Repurchase of common stock |

(60.4) |

(39.4) |

|||

|