St. Joe Insider Trades Send A Signal

On November 6, a recent SEC filing unveiled that BRUCE BERKOWITZ, 10% Owner at St. Joe JOE made an insider sell.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that BERKOWITZ sold 388,400 shares of St. Joe. The total transaction amounted to $20,676,880.

St. Joe shares are trading up 0.26% at $53.4 at the time of this writing on Thursday morning.

About St. Joe

The St. Joe Co is a real estate development, asset management, and operating company and it has three operating segments; the Residential segment plans and develops residential communities and sells homesites to homebuilders or retail consumers, the Hospitality segment features a private membership club (the Watersound Club), hotel operations, food and beverage operations, golf courses, beach clubs, retail outlets, gulf-front vacation rentals, management services, marinas, and other entertainment assets, and Commercial segment include leasing of commercial property, multi-family, senior living, self-storage, and other assets and it also oversees the planning, development, entitlement, management, and sale of commercial and rural land holdings.

St. Joe: Delving into Financials

Revenue Challenges: St. Joe’s revenue growth over 3 months faced difficulties. As of 30 September, 2024, the company experienced a decline of approximately -2.35%. This indicates a decrease in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Real Estate sector.

Holistic Profitability Examination:

-

Gross Margin: The company shows a low gross margin of 38.03%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): St. Joe’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 0.29.

Debt Management: St. Joe’s debt-to-equity ratio surpasses industry norms, standing at 0.88. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 45.64 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 8.09 is above industry norms, reflecting an elevated valuation for St. Joe’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): St. Joe’s EV/EBITDA ratio stands at 21.58, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes To Focus On

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of St. Joe’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pason Reports Third Quarter 2024 Results and Declares Quarterly Dividend

CALGARY, AB, Nov. 7, 2024 /CNW/ – Pason Systems Inc. (“Pason” or the “Company”) PSI announced today its 2024 third quarter results and the declaration of a quarterly dividend. The following news release should be read in conjunction with the Company’s Management Discussion and Analysis (“MD&A”), the unaudited Condensed Consolidated Interim Financial Statements and related notes for the three and nine months ended September 30, 2024, as well as the Annual Information Form for the year ended December 31, 2023. All of these documents are available on SEDAR+ at www.sedarplus.ca.

Financial Highlights

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||

|

2024 |

2023 |

Change |

2024 |

2023 |

Change |

|||||

|

(CDN 000s, except per share data) |

($) |

($) |

( %) |

($) |

($) |

( %) |

||||

|

North American Drilling Revenue |

74,141 |

72,163 |

3 |

211,510 |

219,256 |

(4) |

||||

|

International Drilling Revenue |

15,327 |

15,313 |

— |

45,243 |

45,883 |

(1) |

||||

|

Completions Revenue (3) |

12,512 |

— |

nmf |

38,963 |

— |

nmf |

||||

|

Solar and Energy Storage Revenue |

3,909 |

5,618 |

(30) |

10,788 |

10,875 |

(1) |

||||

|

Total Revenue |

105,889 |

93,094 |

14 |

306,504 |

276,014 |

11 |

||||

|

Adjusted EBITDA (1) |

44,148 |

42,281 |

4 |

119,708 |

132,578 |

(10) |

||||

|

As a % of revenue |

41.7 |

45.4 |

(370) bps |

39.1 |

48.0 |

(890) bps |

||||

|

Funds flow from operations |

36,119 |

40,233 |

(10) |

99,009 |

117,017 |

(15) |

||||

|

Per share – basic |

0.45 |

0.50 |

(9) |

1.24 |

1.45 |

(14) |

||||

|

Per share – diluted |

0.45 |

0.50 |

(9) |

1.24 |

1.45 |

(14) |

||||

|

Cash from operating activities |

30,375 |

31,698 |

(4) |

87,365 |

107,621 |

(19) |

||||

|

Net capital expenditures (2) |

13,721 |

6,682 |

105 |

50,947 |

29,907 |

70 |

||||

|

Free cash flow (1) |

16,654 |

25,016 |

(33) |

36,418 |

77,714 |

(53) |

||||

|

Cash dividends declared (per share) |

0.13 |

0.12 |

8 |

0.39 |

0.36 |

8 |

||||

|

Net income |

23,717 |

27,399 |

(13) |

103,124 |

87,815 |

17 |

||||

|

Net income attributable to Pason |

24,158 |

27,732 |

(13) |

104,577 |

89,044 |

17 |

||||

|

Per share – basic |

0.30 |

0.35 |

(13) |

1.31 |

1.10 |

19 |

||||

|

Per share – diluted |

0.30 |

0.35 |

(13) |

1.31 |

1.10 |

19 |

||||

|

As at |

September 30, 2024 |

December 31, 2023 |

Change |

|||||||

|

(CDN 000s) |

($) |

($) |

( %) |

|||||||

|

Cash and cash equivalents |

70,848 |

171,773 |

(59) |

|||||||

|

Short-term investments |

3,101 |

— |

nmf |

|||||||

|

Total Cash (1) |

73,949 |

171,773 |

(57) |

|||||||

|

Working capital |

118,059 |

212,561 |

(44) |

|||||||

|

Total interest bearing debt |

— |

— |

— |

|||||||

|

Shares outstanding end of period (#) |

79,621,109 |

79,685,025 |

nmf |

|||||||

|

(1) |

Non-GAAP and supplementary financial measures are defined under Non-GAAP Financial Measures in this press release. |

|

(2) |

Includes additions to property, plant, and equipment and development costs, net of proceeds on disposal from Pason’s Condensed Consolidated Interim Statements of Cash Flows |

|

(3) |

The Completions segment includes results generated by IWS, which were not part of the Company’s consolidated reporting group until January 1, 2024 following the IWS Acquisition |

Pason generated $105.9 million in consolidated revenue in the third quarter of 2024, representing a 14% increase from the $93.1 million generated in the comparative period of 2023 and a result that continues to outpace the changes in underlying North American industry drilling activity.

The North American Drilling business unit generated $74.1 million of revenue in the third quarter of 2024, a 3% increase over the comparative period of 2023 despite a 5% decline in North American industry drilling activity. Pason’s Revenue per Industry Day in the third quarter of 2024 of $1,058 increased by 9% from the comparative 2023 period. Revenue per Industry Day in the current quarter represents increased product adoption across Pason’s technology offering and benefited from strength in the US dollar versus the Canadian dollar. Segment gross profit of $45.5 million during the third quarter of 2024 compared to $44.2 million in the comparative period of 2023 demonstrates the Company’s ability to outpace industry activity levels on a mostly fixed cost base.

The International Drilling business unit generated $15.3 million of revenue in the third quarter of 2024, a level comparable to the third quarter of 2023. Gross profit was impacted by higher levels of depreciation and amortization expense in the current quarter and declined slightly from $7.9 million in Q3 2023 to $7.6 million in Q3 2024.

The Company’s new Completions business unit, formed after the acquisition of IWS on January 1, 2024, generated $12.5 million in revenue while averaging 28 IWS Active Jobs with Revenue per IWS day of $4,868 through very challenging industry conditions in the third quarter. Segment gross profit of $0.3 million in the quarter includes $5.1 million of depreciation and amortization expense, of which $2.2 million relates to amortization expense on intangible assets acquired through the IWS Acquisition.

Revenue generated by the Solar and Energy Storage business unit was $3.9 million, a $1.7 million decrease from the comparative period in 2023 due to the timing of revenue recognized on the delivery of control systems. Resulting segment gross profit was $0.4 million for the third quarter of 2024 compared to a segment gross profit of $0.6 million in the comparable period in 2023.

Pason generated $44.1 million in Adjusted EBITDA, or 41.7% of revenue in the third quarter of 2024, compared to $42.3 million or 45.4% of revenue in the third quarter of 2023, highlighting the Company’s mostly fixed cost base and associated operating leverage. A comparison of Adjusted EBITDA margin year over year reflects the inclusion of IWS financial results at lower margins, reflecting the Completions segment’s investments made for its current stage of growth.

The Company recorded net income attributable to Pason of $24.2 million ($0.30 per share) in the third quarter of 2024, compared to net income attributable to Pason of $27.7 million ($0.35 per share) recorded in the corresponding period in 2023. The year over year increase in Adjusted EBITDA was offset by higher levels of depreciation and amortization with increased capital expenditures in recent quarters, as well as amortization of fixed assets and intangibles acquired through the IWS acquisition in the first quarter of 2024. Further, the Company saw lower levels of interest income year over year with lower average cash balances in 2024, and a declining interest rate environment in Canada.

Sequentially, Q3 2024 consolidated revenue of $105.9 million was a 10% increase from consolidated revenue of $95.9 million generated in the second quarter of 2024 largely driven by improved drilling activity in Canada coming out of seasonal lows in the second quarter. Highlighting the Company’s mostly fixed cost base and significant operating leverage, Adjusted EBITDA was $44.1 million in the third quarter of 2024 compared to $33.1 million in the second quarter of 2024.

The Company recorded net income attributable to Pason in the third quarter of 2024 of $24.2 million ($0.30 per share) compared to net income attributable to Pason of $10.9 million ($0.14 per share) in the second quarter of 2024 where the increase is primarily driven by the factors noted above, along with lower stock based compensation expense in the third quarter which reflects changes in the Company’s share price.

Pason’s balance sheet remains strong, with no interest bearing debt, and $73.9 million in Total Cash as at September 30, 2024, compared to $171.8 million as at December 31, 2023. The decrease is the result of funding the IWS Acquisition in Q1 2024 with a total of $88.2 million in cash and the repayment of $13.3 million in interest bearing debt assumed through the acquisition. Pason generated cash from operating activities of $30.4 million in the third quarter of 2024, compared to $31.7 million in the third quarter of 2023, with the increase in Adjusted EBITDA being offset by lower levels of interest income recognized.

During the three months ended September 30, 2024, Pason invested $13.7 million in net capital expenditures, an increase from $6.7 million in the third quarter of 2023 as the Company executes on its 2024 capital budget. Net capital expenditures in the current quarter includes investments associated with supporting the continued growth of IWS’ pressure automation technology offering, for which there would be no associated capital expenditures during the 2023 comparative period given the effective date of the IWS Acquisition was January 1, 2024. Net capital expenditures in Q3 2024 also includes investments associated with the ongoing refresh of Pason’s drilling related technology platform and continued investments in the new Pason Mud Analyzer. Resulting Free Cash Flow in the third quarter of 2024 was $16.7 million, compared to $25.0 million in the same period in 2023.

In the third quarter of 2024, Pason returned $11.3 million to shareholders through the Company’s quarterly dividend of $10.3 million and $1.0 million in share repurchases. Year to date, Pason returned $38.0 million to shareholders through the Company’s quarterly dividend of $31.0 million and $7.0 million in share repurchases.

President’s Message

Pason’s President and Chief Executive Officer Jon Faber stated:

“The resilience of Pason’s business was demonstrated in our financial and operating results for the third quarter of 2024. Consolidated revenue increased by 14% compared to the third quarter of 2023, while North American land drilling activity decreased by 5% year-over-year.”

“As a daily rental business, our results will be strongly influenced by activity levels, but we remain focused on outpacing underlying North American land drilling activity in three ways: (1) growing Revenue per Industry Day in North America, primarily through increased product adoption and technology enhancements; (2) increasing revenue from international drilling markets; and (3) generating revenue from less mature, higher growth markets including technology offerings in the completions market and solar and energy storage. By focusing on these three priorities, we expect to be able to achieve meaningful growth and strong financial results even in periods of flat North American land drilling activity.”

“North American Revenue per Industry Day of $1,058 in the third quarter represented a 9% increase from 2023. On a year-to-date basis, North American Revenue per Industry Day was also up 9% at $1,018 per industry day. North American Drilling revenue increased by 3% year-over-year to $74.1 million in the third quarter, while International Drilling was unchanged year-over-year at $15.3 million.”

“Our Completions segment generated revenue of $12.5 million in the third quarter, with the sequential decline in revenue from the second quarter mirroring the decline in the reported number of frac spreads in the United States. Given its stage of development, Intelligent Wellhead Systems (“IWS”) is much more sensitive to customer mix and changes in the activity of specific customers than our drilling-related businesses, where our financial results are more strongly correlated to overall industry activity given our substantial market share. IWS continued to post strong Revenue per IWS Day, at $4,868 in the third quarter on 28 IWS Active Jobs in the quarter. Revenue per IWS Day will fluctuate between quarters based on job type and customer mix.”

“Energy Toolbase (“ETB”) generated revenue of $3.9 million in the third quarter, up 24% sequentially from the second quarter of 2024, driven primarily by increased sales of control systems. Quarterly revenue for the Solar and Energy Storage segment will fluctuate with the timing of control system deliveries, and the 30% year-over-year decline in third quarter revenue was the result of additional control system deliveries in the prior year period. Our pipeline of control systems sales and opportunities remains robust.”

“Adjusted EBITDA of $44.1 million represented a 4% increase from the third quarter of 2023 and a 33% sequential increase from the second quarter of 2024. The $11 million sequential increase in Adjusted EBITDA exceeded the $10 million sequential revenue increase, highlighting the operating leverage in our business and continued cost discipline. Free Cash Flow decreased by 33% year-over-year to $16.7 million in the quarter, reflecting our increased capital expenditures with the full inclusion of IWS in 2024, while sequentially Free Cash Flow increased by $8.6 million. Net income attributable to Pason totaled $23.7 million in the third quarter.”

In the first nine months of 2024, we returned $38.0 million to shareholders through our regular dividend and share repurchases. Net capital expenditures for the first nine months totaled $50.9 million.”

“Drilling and completions activity continued to soften in the third quarter, with US land drilling activity down 3% sequentially from the second quarter and US completions down 8% over the same period. We expect that North American land drilling will remain near current levels in the remainder of 2024 before beginning to increase in 2025, with completions activity following a similar trajectory.”

“The gains we have made in (1) increasing North American Revenue per Industry Day in our drilling segment and (2) expanding our customer base while maintaining a strong Revenue per IWS Day in our completions business should translate into continued outperformance against industry conditions. We continue to prioritize flexibility within our approach to shareholder returns and our quarterly dividend remains unchanged at $0.13 per share. We will make required capital investments in both our drilling and completion segments to position ourselves for further free cash flow generation and expect to spend approximately $70 million in capital expenditures in 2024, which is lower than the $75 million to $80 million range previously provided, and approximately $65 million in 2025.”

“As customers continue to deploy data-driven automation and analytics technologies in their operations, our drilling and completions-related businesses stand to benefit. Our innovative new drilling mud analyzer provides continuous, real-time readings of critical drilling mud parameters and we are seeing higher adoption of our automation products. Our wellsite automation products provide valuable safety and efficiency benefits for customers in their completions operations, and we are working closely with customers to develop compelling data aggregation and management solutions for the completions market, benefiting both operators and service companies. Our technology solutions are supported by a best-in-class service and support organization.”

“Our continued success remains rooted in the quality of our product and service offering, the dedication of our people, and the confidence of our customers and shareholders” concluded Mr. Faber.

Quarterly Dividend

Pason announced today that the Board of Directors have declared a quarterly dividend of thirteen cents (C$0.13) per share on the company’s common shares. The dividend will be paid on December 31, 2024, to shareholders of record at the close of business on December 17, 2024.

Third Quarter Conference Call

Pason will be conducting a conference call for interested analysts, brokers, investors, and media representatives to review its 2024 third quarter results at 9:00 a.m. (MT) on Friday, November 8, 2024. The conference call dial-in numbers are 1-888-510-2154 or 1-437-900-0527, and the call will be simultaneously audio webcast via: www.pason.com/webcast. You can access the fourteen-day replay by dialing 1-888-660-6345 or 1-289-819-1450, using password 06411#.

An archived audio webcast of the conference call will also be available on Pason’s website at www.pason.com/investors.

Non-GAAP Financial Measures

A non-GAAP financial measure has the definition set out in National Instrument 52-112 “Non-GAAP and Other Financial Measures Disclosure”.

The following non-GAAP measures may not be comparable to measures used by other companies. Management believes these non-GAAP measures provide readers with additional information regarding the Company’s operating performance, and ability to generate funds to finance its operations, fund its research and development and capital expenditure program, and return capital to shareholders through dividends or share repurchases.

EBITDA and Adjusted EBITDA

EBITDA is defined as net income before interest income and expense, income taxes, stock-based compensation expense, and depreciation and amortization expense. Adjusted EBITDA is defined as EBITDA, adjusted for foreign exchange, impairment of property, plant, and equipment, restructuring costs, net monetary adjustments, government wage assistance, revaluation of put obligation, gain or loss on mark-to-market of short-term investments, gain on previously held equity interest and other items, which the Company does not consider to be in the normal course of continuing operations.

Management believes that EBITDA and Adjusted EBITDA are useful supplemental measures as they provide an indication of the results generated by the Company’s principal business activities prior to the consideration of how these results are taxed in multiple jurisdictions, how the results are impacted by foreign exchange or how the results are impacted by the Company’s accounting policies for equity-based compensation plans.

Reconcile Net Income to EBITDA

|

Three Months Ended |

Dec 31, |

Mar 31, |

Jun 30, |

Sep 30, |

Dec 31, |

Mar 31, |

Jun 30, |

Sep 30, |

|

(000s) |

($) |

($) |

($) |

($) |

($) |

($) |

($) |

($) |

|

Net income |

35,994 |

35,454 |

24,962 |

27,399 |

8,012 |

69,123 |

10,284 |

23,717 |

|

Add: |

||||||||

|

Income taxes |

9,405 |

12,374 |

7,906 |

7,356 |

6,710 |

9,057 |

6,048 |

6,148 |

|

Depreciation and amortization |

5,399 |

6,616 |

5,815 |

6,988 |

7,797 |

11,730 |

12,901 |

13,659 |

|

Stock-based compensation |

5,129 |

(82) |

1,986 |

5,082 |

4,732 |

3,011 |

4,634 |

(117) |

|

Net interest (income) expense |

(2,679) |

(2,607) |

(2,847) |

(3,858) |

(5,082) |

(1,411) |

(522) |

(803) |

|

EBITDA |

53,248 |

51,755 |

37,822 |

42,967 |

22,169 |

91,510 |

33,345 |

42,604 |

Reconcile EBITDA to Adjusted EBITDA

|

Three Months Ended |

Dec 31, |

Mar 31, |

Jun 30, |

Sep 30, |

Dec 31, |

Mar 31, |

Jun 30, |

Sep 30, |

|

(000s) |

($) |

($) |

($) |

($) |

($) |

($) |

($) |

($) |

|

EBITDA |

53,248 |

51,755 |

37,822 |

42,967 |

22,169 |

91,510 |

33,345 |

42,604 |

|

Add: |

||||||||

|

Foreign exchange loss (gain) |

1,959 |

233 |

1,597 |

681 |

14,247 |

714 |

(1,202) |

(1,245) |

|

Put option revaluation |

(5,815) |

— |

— |

— |

(149) |

— |

— |

— |

|

Net monetary gain |

(536) |

(159) |

(1,196) |

(1,477) |

— |

— |

— |

— |

|

Gain on previously held equity interest |

— |

— |

— |

— |

— |

(50,830) |

— |

— |

|

Unrealized loss on short-term investments |

— |

— |

— |

— |

— |

— |

— |

1,103 |

|

Other |

88 |

581 |

(336) |

110 |

2,621 |

1,031 |

992 |

1,686 |

|

Adjusted EBITDA |

48,944 |

52,410 |

37,887 |

42,281 |

38,888 |

42,425 |

33,135 |

44,148 |

Free cash flow

Free cash flow is defined as cash from operating activities plus proceeds on disposal of property, plant, and equipment, less capital expenditures (including changes to non-cash working capital associated with capital expenditures), and deferred development costs. This metric provides a key measure on the Company’s ability to generate cash from its principal business activities after funding capital expenditure programs, and provides an indication of the amount of cash available to finance, among other items, the Company’s dividend and other investment opportunities.

Reconcile cash from operating activities to free cash flow

|

Three Months Ended |

Dec 31, |

Mar 31, |

Jun 30, |

Sep 30, |

Dec 31, |

Mar 31, |

Jun 30, |

Sep 30, |

|

(000s) |

($) |

($) |

($) |

($) |

($) |

($) |

($) |

($) |

|

Cash from operating activities |

19,942 |

46,265 |

29,658 |

31,698 |

27,412 |

31,014 |

25,976 |

30,375 |

|

Less: |

||||||||

|

Net additions to property, plant and equipment |

(16,112) |

(11,404) |

(11,303) |

(6,474) |

(7,720) |

(17,834) |

(16,695) |

(12,444) |

|

Deferred development costs |

(121) |

(151) |

(367) |

(208) |

(375) |

(1,447) |

(1,250) |

(1,277) |

|

Free cash flow |

3,709 |

34,710 |

17,988 |

25,016 |

19,317 |

11,733 |

8,031 |

16,654 |

Supplementary Financial Measures

A supplementary financial measure: (a) is, or is intended to be, disclosed on a periodic basis to depict the historical or expected future financial performance, financial position or cash flow of the Company; (b) is not presented in the financial statements of the Company; (c) is not a non-GAAP financial measure; and (d) is not a non-GAAP ratio. Supplementary financial measures found within this press release are as follows:

Revenue per Industry Day

Revenue per Industry Day is defined as the total revenue generated from the North American Drilling segment over all active drilling rig days in the North American market. This metric provides a key measure of the North American Drilling segment’s ability to evaluate and manage product adoption, pricing, and market share penetration. Drilling rig days are calculated by using accepted industry sources.

IWS Active Jobs

IWS Active Jobs represents the average number of jobs per day that IWS is generating revenue on through the rental of its technology offering to customers during the reporting period. This metric provides a key measure of IWS’ market penetration.

Revenue per IWS Day

Revenue per IWS Day is defined as the total revenue generated by the Completions segment over all IWS active days during the quarter. IWS active days are calculated by using IWS Active Jobs in the reporting period. This metric provides a key measure of the IWS’ ability to evaluate and manage product adoption and pricing.

Adjusted EBITDA as a percentage of revenue

Calculated as adjusted EBITDA divided by revenue.

Total Cash

Calculated as the sum of cash and cash equivalents, and short-term investments from the Company’s Condensed Consolidated Interim Balance Sheets. The Company’s short term-investments are comprised of US dollar bonds.

Forward Looking Information

Certain statements contained herein constitute “forward-looking statements” and/or “forward-looking information” under applicable securities laws (collectively referred to as “forward-looking statements”). Forward‐looking statements can generally be identified by the words “anticipate”, “expect”, “believe”, “may”, “could”, “should”, “will”, “estimate”, “project”, “intend”, “plan”, “outlook”, “forecast” or expressions of a similar nature suggesting a future outcome or outlook.

Without limiting the foregoing, this document includes, but is not limited to, the following forward‐looking statements: the Company’s growth strategy and related schedules; divergence in activity levels between the geographic regions in which we operate; demand fluctuations for our products and services; the Company’s ability to increase or maintain market share; projected future value, forecast operating and financial results; planned capital expenditures; expected product performance and adoption, including the timing, growth and profitability thereof; potential dividends and dividend growth strategy; future use and development of technology; our financial ability to meet long-term commitments not included in liabilities; the collectability of accounts receivable; the application of critical accounting estimates and judgements; treatment under governmental regulatory and taxation regimes; and projected increasing shareholder value.

These forward-looking statements reflect the current views of Pason with respect to future events and operating performance as of the date of this document. They are subject to known and unknown risks, uncertainties, assumptions, and other factors that could cause actual results to be materially different from results that are expressed or implied by such forward-looking statements.

Although we believe that these forward-looking statements are reasonable based on the information available on the date such statements are made and processes used to prepare the information, such statements are not guarantees of future performance and readers are cautioned against placing undue reliance on forward-looking statements. By their nature, these statements involve a variety of assumptions, known and unknown risks and uncertainties and other factors, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, but are not limited to: the state of the economy; volatility in industry activity levels and resulting customer expenditures on exploration and production activities; customer demand for existing and new products; the industry shift towards more efficient drilling and completions activity and technology to assist in that efficiency; the impact of competition; the loss of key customers; the loss of key personnel; cybersecurity risks; reliance on proprietary technology and ability to protect the Company’s proprietary technologies; changes to government regulations (including those related to safety, environmental, or taxation); the impact of extreme weather events and seasonality on our suppliers and on customer operations; and war, terrorism, pandemics, social or political unrest that disrupts global markets.

These risks, uncertainties and assumptions include but are not limited to those discussed in Pason’s Annual Information Form for the year ended December 31, 2023 under the heading, “Risk and Uncertainty,” in our management’s discussion and analysis for the year ended December 31, 2023, and in our other filings with Canadian securities regulators. These documents are on file with the Canadian securities regulatory authorities and may be accessed through the SEDAR+ website (www.sedarplus.ca) or through Pason’s website (www.pason.com).

Forward-looking statements contained in this document are expressly qualified by this cautionary statement. Except to the extent required by applicable law, Pason assumes no obligation to publicly update or revise any forward-looking statements made in this document or otherwise, whether as a result of new information, future events or otherwise.

Pason Systems Inc.

Pason is a leading global provider of specialized data management systems for drilling rigs. Our solutions, which include data acquisition, wellsite reporting, remote communications, web-based information management, and analytics, enable collaboration between the rig and the office. Through Intelligent Wellhead Systems Inc. (“IWS”), we also provide engineered controls, data acquisition, and software, to automate workflows and processes for oil and gas well completions operations, improving wellsite safety and efficiency. Through Energy Toolbase Software, Inc. (“ETB”), we also provide products and services for the solar power and energy storage industry. ETB’s solutions enable project developers to model, control and monitor economics and performance of solar energy and storage projects.

Pason’s common shares trade on the Toronto Stock Exchange under the symbol PSI. For more information about Pason Systems Inc., visit the company’s website at www.pason.com or contact investorrelations@pason.com.

Additional information on risks and uncertainties and other factors that could affect Pason’s operations or financial results are included in Pason’s reports on file with the Canadian securities regulatory authorities and may be accessed through the SEDAR+ website (www.sedarplus.ca) or through Pason’s website (www.pason.com).

SOURCE Pason Systems Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/07/c6890.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/07/c6890.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stocks: Is It Time To Buy The Dip After Elections And Legalization Setbacks?

The cannabis sector is showing signs of stabilization following a harsh post-election sell-off triggered by election results.

With Donald Trump’s return to the presidency, a GOP-controlled Senate, and Florida’s rejection of Amendment 3, which would have legalized cannabis, investor sentiment turned cautious, leading to widespread panic selling.

Yet, as of Thursday, some stocks are making a modest comeback, suggesting that Wednesday’s declines may have been oversold.

Cannabis Watchist created using Benzinga Pro

Tilray Brands TLRY: A Tentative Recovery

Tilray experienced a sharp drop yesterday, trading down to $1.51 amid panic selling, but has recovered slightly to $1.56, marking a 1.3% gain.

The RSI stands near 41.85, indicating that the stock is approaching oversold.

This could attract buyers, but the stock’s movement remains tentative, with resistance around $1.60, and a figure turning into a hammer, which could indicate final dip levels.

Chart created using Benzinga Pro

SNDL SNDL: Holding Support

SNDL is showing resilience at the $2.00 support level, recovering slightly to $2.02 with a neutral RSI at 45.90. The stock has managed to absorb some of the selling pressure, though it remains below its recent high near $2.60. This indicates that traders may be taking a wait-and-see approach for clearer signs of sustained support before fully stepping back in.

Chart created using Benzinga Pro

Trulieve TCNNF: Strong Bounce

Trulieve, which suffered a drastic drop yesterday following Florida’s failed cannabis legalization effort, is now up 6.53%, trading at $7.67. The RSI of 28.54 highlighted an oversold condition, drawing in buyers looking for value. This recovery suggests the initial selling may have been excessive.

Chart created using Benzinga Pro

AdvisorShares Pure US Cannabis ETF MSOS: ETF Stability May

MSOS, a popular cannabis ETF, has risen by 4.83% to $5.21, rebounding from an RSI of 31.15, which flagged oversold conditions. With many cannabis stocks attempting recoveries, MSOS is holding above the $5.00 level, a critical support.

Chart created using Benzinga Pro

Is Buying The Dip A Good Idea?

While the sector is showing early signs of stabilization, the underlying risks remain. Still, most stocks look heavily oversold or reaching that point.

Fundaments are relevant to understand what the outcome might look like in the mid-turn.

With a GOP-majority Senate likely to stall cannabis reform, there’s a possibility of four more years of cannabis protectionism – a period marked by minimal legislative progress and regulatory insularity.

Nevertheless, an argument could be made that the fundamentals of cannabis have not changed and, particularly, that the impact of rescheduling on balance sheets, due to the suppression of 280E burden, would be formidable for the industry. Rescheduling does not require a Senate majority or presidential involvement.

That said, stock prices for cannabis rely heavily on the upcoming DEA administrative hearing and ruling.

Investors should weigh the potential for long-term industry growth against the immediate political headwinds.

Cover: AI generated image

Disclosure: this article is not intended to provide financial advice. Consult a professional before making investment decisions.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mexco Energy Corporation Reports Financial Results for first Six Months

MIDLAND, TX, Nov. 07, 2024 (GLOBE NEWSWIRE) — Mexco Energy Corporation MXC today reported net income of $608,237, or $0.29 per diluted share, for the six months ending September 30, 2024.

Operating revenues in the first six months of fiscal 2025 were $3,477,062, an increase of 10% when compared to the first six months of fiscal 2024. This increase was primarily due to an increase in oil and natural gas production volumes and an increase in average oil prices partially offset by a decrease in average natural gas prices. Oil contributed 87% of our operating revenues for the first six months of fiscal 2025.

Net income of $317,198, or $0.15 per diluted share, for the Company’s second quarter of fiscal 2025 compared with $269,433, or $0.12 per diluted share for the comparable quarter ending September 30, 2023. Operating revenues in the second quarter of fiscal 2025 were $1,749,227.

The Company currently expects to participate in the drilling of 30 and completion of 19 horizontal wells at an estimated aggregate cost of approximately $2.3 million for the fiscal year ending March 31, 2025, of which approximately $890,000 has been expended to date. The Company is evaluating other prospects for participation during this fiscal year.

During fiscal 2025, the Company has expended to date, approximately $1.5 million for royalty and mineral interest acquisitions in approximately 600 producing wells with additional potential development located in 37 counties in 9 states.

Mexco Energy Corporation, a Colorado corporation, is an independent oil and gas company located in Midland, Texas engaged in the acquisition, exploration, and development of oil and gas properties primarily in the Permian Basin. For more information on Mexco Energy Corporation, go to www.mexcoenergy.com.

In accordance with the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995, Mexco Energy Corporation cautions that statements in this press release which are forward-looking and which provide other than historical information involve risks and uncertainties that may impact the Company’s actual results of operations. These risks include, but are not limited to, production variance from expectations, volatility of oil and gas prices, the need to develop and replace reserves, exploration risks, uncertainties about estimates of reserves, competition, government regulation, and mechanical and other inherent risks associated with oil and gas production. A discussion of these and other factors, including risks and uncertainties, is set forth in the Company’s Form 10-K for the fiscal year ended March 31, 2024. Mexco Energy Corporation disclaims any intention or obligation to revise any forward-looking statements.

For additional information, please contact: Tammy L. McComic, President and Chief Financial Officer of Mexco Energy Corporation, (432) 682-1119.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Market Whales and Their Recent Bets on RIVN Options

Investors with a lot of money to spend have taken a bullish stance on Rivian Automotive RIVN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with RIVN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Rivian Automotive.

This isn’t normal.

The overall sentiment of these big-money traders is split between 66% bullish and 33%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $152,300, and 6 are calls, for a total amount of $232,551.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $10.0 to $20.0 for Rivian Automotive during the past quarter.

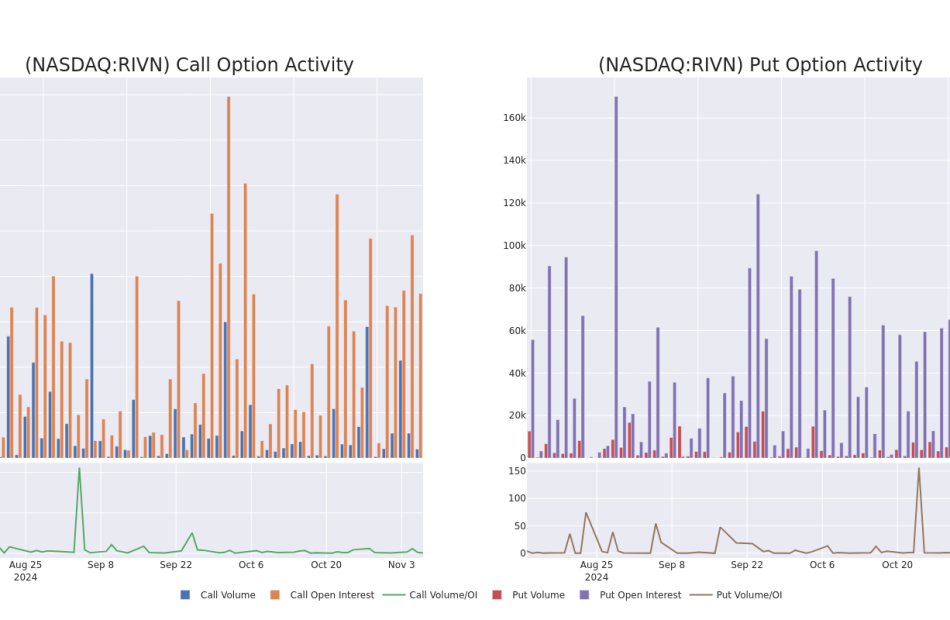

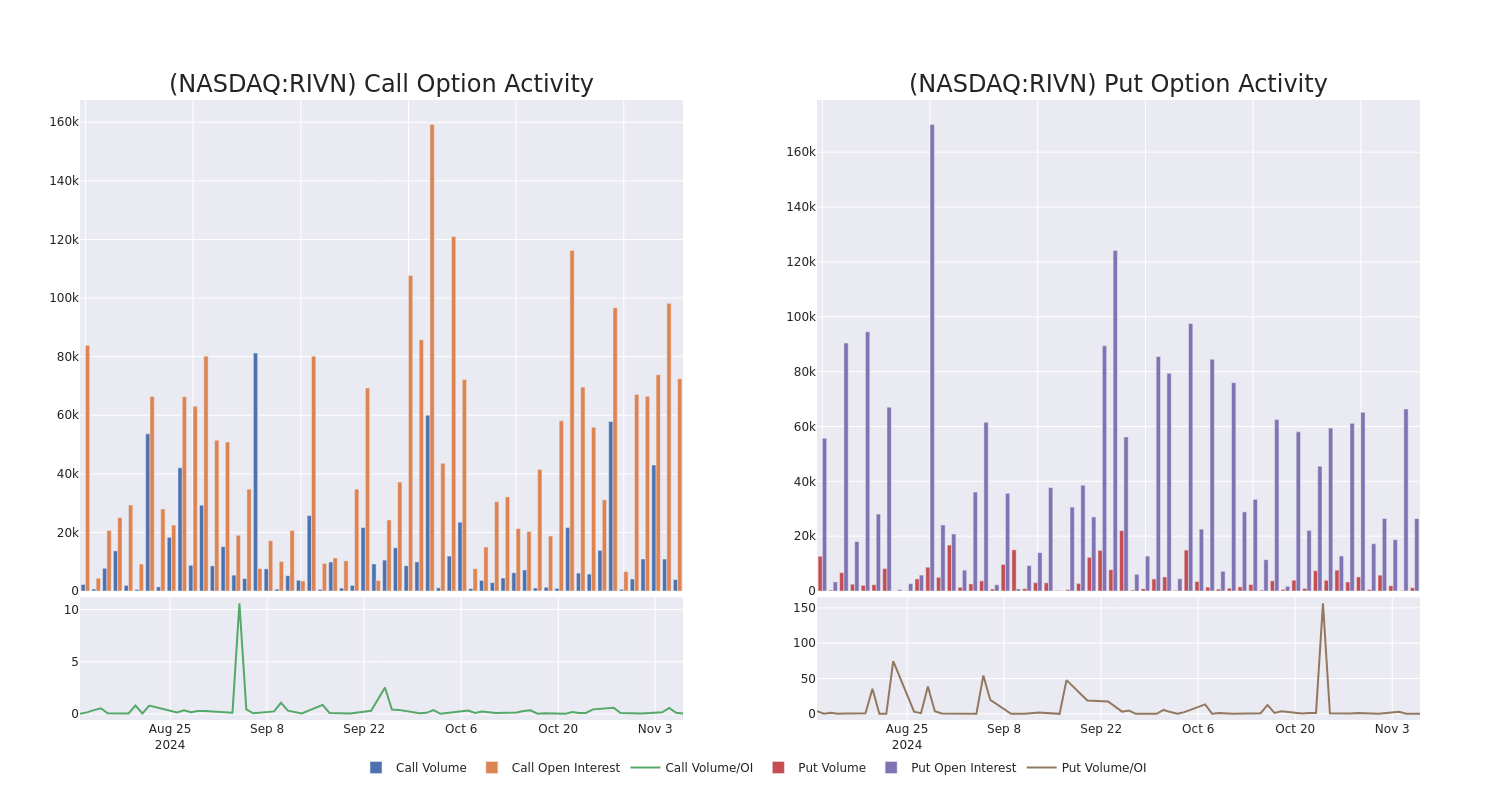

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Rivian Automotive options trades today is 14125.0 with a total volume of 5,139.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Rivian Automotive’s big money trades within a strike price range of $10.0 to $20.0 over the last 30 days.

Rivian Automotive Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIVN | PUT | SWEEP | BEARISH | 12/20/24 | $1.22 | $1.02 | $1.22 | $10.00 | $60.2K | 25.8K | 1 |

| RIVN | PUT | SWEEP | BULLISH | 12/20/24 | $1.11 | $1.08 | $1.08 | $10.00 | $54.0K | 25.8K | 1.0K |

| RIVN | CALL | SWEEP | BEARISH | 03/21/25 | $0.7 | $0.65 | $0.66 | $15.00 | $53.8K | 7.5K | 1.6K |

| RIVN | CALL | TRADE | BULLISH | 09/19/25 | $2.93 | $2.93 | $2.93 | $10.00 | $49.8K | 3.4K | 177 |

| RIVN | PUT | TRADE | BULLISH | 11/15/24 | $2.55 | $2.54 | $2.54 | $12.50 | $38.1K | 614 | 152 |

About Rivian Automotive

Rivian Automotive Inc designs, develops, and manufactures category-defining electric vehicles and accessories. In the consumer market, the company launched the R1 platform with the first generation of consumer vehicles: the R1T, a two-row, five-passenger pickup truck, and the R1S, a three-row, seven-passenger sport utility vehicle (SUV).

Having examined the options trading patterns of Rivian Automotive, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Rivian Automotive

- With a volume of 42,000,347, the price of RIVN is up 4.38% at $10.13.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 0 days.

Expert Opinions on Rivian Automotive

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $13.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Guggenheim persists with their Buy rating on Rivian Automotive, maintaining a target price of $18.

* An analyst from JP Morgan has decided to maintain their Underweight rating on Rivian Automotive, which currently sits at a price target of $12.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Rivian Automotive, targeting a price of $11.

* Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Rivian Automotive, targeting a price of $13.

* Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Rivian Automotive, targeting a price of $12.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Rivian Automotive options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Board Member Of T-Mobile US Makes $24.67M Sale

MARCELO RAUL CLAURE, Board Member at T-Mobile US TMUS, disclosed an insider sell on November 6, according to a recent SEC filing.

What Happened: CLAURE’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday unveiled the sale of 110,000 shares of T-Mobile US. The total transaction value is $24,673,000.

T-Mobile US‘s shares are actively trading at $232.01, experiencing a down of 0.08% during Thursday’s morning session.

All You Need to Know About T-Mobile US

Deutsche Telekom merged its T-Mobile USA unit with prepaid specialist MetroPCS in 2013, and that firm merged with Sprint in 2020, creating the second-largest wireless carrier in the US. T-Mobile now serves 77 million postpaid and 21 million prepaid phone customers, equal to around 30% of the US retail wireless market. The firm entered the fixed-wireless broadband market aggressively in 2021 and now serves more than 5 million residential and business customers. In addition, T-Mobile provides wholesale services to resellers.

T-Mobile US: A Financial Overview

Revenue Growth: T-Mobile US’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 4.73%. This indicates a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Communication Services sector.

Navigating Financial Profits:

-

Gross Margin: With a low gross margin of 65.14%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): T-Mobile US’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 2.62.

Debt Management: T-Mobile US’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.81.

Market Valuation:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 26.47 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 3.44 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 12.52 positions the company as being more valued compared to industry benchmarks.

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Transaction Codes To Focus On

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of T-Mobile US’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Doximity Reports Strong Q2 Earnings Results, Shares Soar

Doximity Inc DOCS shares are surging in Thursday’s after-hours session after the company reported better-than-expected financial results for the second quarter.

- Q2 Revenue: $136.83 million, versus estimates of $127.15 million

- Q2 Adjusted EPS: 30 cents, versus estimates of 25 cents

Revenue was up 20% year-over-year. The company generated $68.3 million in operating cash flow and $66.8 million in free cash flow during the quarter. Free cash flow was up 475% year-over-year.

“Our clinical workflow tools saw record use in the second quarter with over 600,000 unique active prescribers. We’re proud to help physicians save time, so they can provide better care for their patients,” said Jeff Tangney, co-founder and CEO of Doximity.

Guidance: Doximity expects third-quarter revenue to be in the range of $152 million to $153 million. The company anticipates third-quarter Adjusted EBITDA of $83 million to $84 million.

Doximity sees full-year revenue between $535 million and $540 million. The company expects full-year Adjusted EBITDA to be in the range of $274 million to $279 million.

DOCS Price Action: Doximity shares were up 37.91% after hours at $59.88 at the time of publication Thursday, according to Benzinga Pro.

Read Next:

Photo: Courtesy of Doximity.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

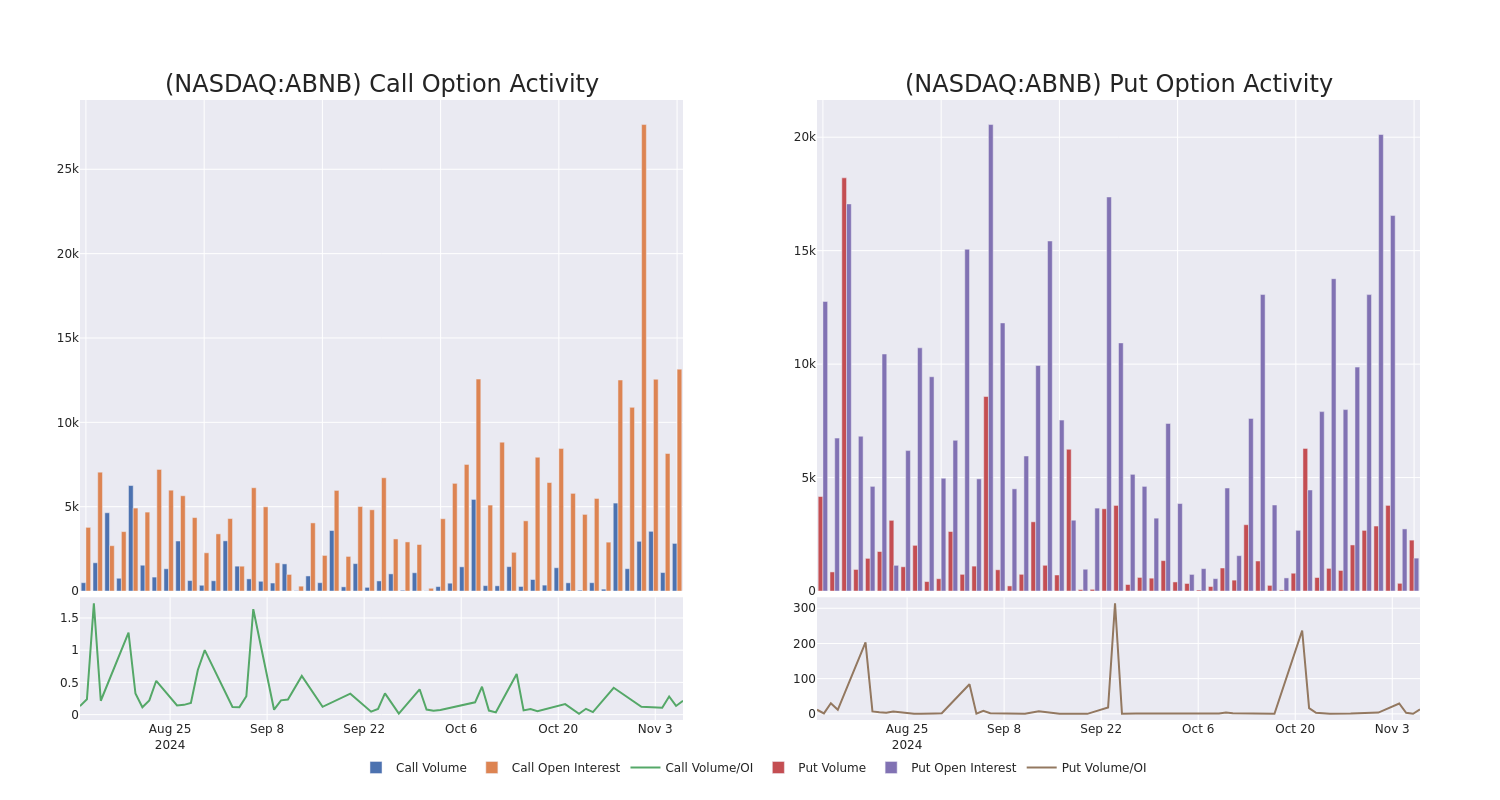

A Closer Look at Airbnb's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on Airbnb ABNB.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ABNB, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 17 uncommon options trades for Airbnb.

This isn’t normal.

The overall sentiment of these big-money traders is split between 47% bullish and 41%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $227,369, and 11 are calls, for a total amount of $558,152.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $90.0 to $160.0 for Airbnb over the last 3 months.

Volume & Open Interest Development

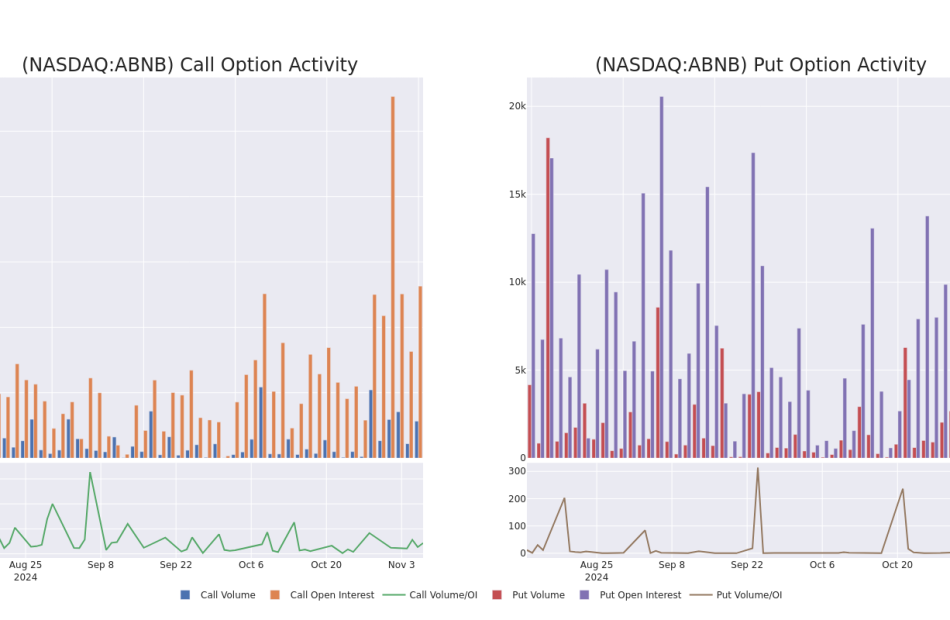

In terms of liquidity and interest, the mean open interest for Airbnb options trades today is 1123.46 with a total volume of 5,067.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Airbnb’s big money trades within a strike price range of $90.0 to $160.0 over the last 30 days.

Airbnb 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABNB | CALL | TRADE | BEARISH | 12/20/24 | $9.05 | $8.9 | $8.9 | $145.00 | $226.0K | 882 | 776 |

| ABNB | PUT | SWEEP | BEARISH | 11/08/24 | $3.9 | $3.85 | $3.85 | $140.00 | $64.6K | 188 | 822 |

| ABNB | PUT | TRADE | BEARISH | 11/08/24 | $5.4 | $5.15 | $5.4 | $143.00 | $54.0K | 28 | 107 |

| ABNB | CALL | SWEEP | NEUTRAL | 11/08/24 | $5.35 | $4.9 | $5.31 | $146.00 | $53.2K | 70 | 144 |

| ABNB | CALL | SWEEP | BEARISH | 11/08/24 | $5.4 | $5.2 | $5.25 | $147.00 | $40.6K | 181 | 82 |

About Airbnb

Started in 2008, Airbnb is the world’s largest online alternative accommodation travel agency, also offering booking services for boutique hotels and experiences. Airbnb’s platform offered over 8 million active accommodation listings as of June 30, 2024. Listings from the company’s over 5 million hosts are spread over almost every country in the world. In 2023, 50% of revenue was from the North American region. Transaction fees for online bookings account for all its revenue.

Airbnb’s Current Market Status

- With a trading volume of 6,380,131, the price of ABNB is up by 5.33%, reaching $148.42.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 0 days from now.

What Analysts Are Saying About Airbnb

3 market experts have recently issued ratings for this stock, with a consensus target price of $140.33333333333334.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B of A Securities has decided to maintain their Neutral rating on Airbnb, which currently sits at a price target of $142.

* An analyst from UBS persists with their Neutral rating on Airbnb, maintaining a target price of $144.

* Consistent in their evaluation, an analyst from Jefferies keeps a Hold rating on Airbnb with a target price of $135.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Airbnb, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Denison Reports Financial and Operational Results for Q3'2024, Including Positive Progress on Phoenix Engineering and Regulatory Review

TORONTO, Nov. 7, 2024 /PRNewswire/ – Denison Mines Corp. (‘Denison’ or the ‘Company’) DML DNN today filed its Condensed Consolidated Financial Statements and Management’s Discussion & Analysis (‘MD&A’) for the three and nine months ended September 30, 2024. Both documents will be available on the Company’s website at www.denisonmines.com, SEDAR+ (at www.sedarplus.ca) and EDGAR (at www.sec.gov/edgar.shtml). The highlights provided below are derived from these documents and should be read in conjunction with them. All amounts in this release are in Canadian dollars unless otherwise stated. View PDF version

David Cates, President and CEO of Denison commented, “Our third quarter report includes an update on the positive progress of our engineering and regulatory approval efforts for our planned Phoenix In-Situ Recovery (‘ISR’) uranium mining operation. We continue to rapidly advance detailed design engineering efforts and achieved completion of 45% of total engineering by the end of the third quarter. Long-lead procurement efforts continued to ramp up. Currently, $21 million in milestone payments or commitments have been made for items included in our estimates of initial project capex, with several additional procurement packages in progress.

On the regulatory side, we are pleased to report that substantially all outstanding information requests (‘IRs’) from the Canadian Nuclear Safety Commission’s (‘CNSC’) review of the Wheeler River draft Environmental Impact Statement (‘EIS’) have been resolved, and the Federal review process is nearing completion. Given this positive progress with the Federal review, we have opted to submit a final Provincial EIS to the Saskatchewan Ministry of Environment to advance the process of obtaining formal approval from the Province.

Beyond Wheeler River, we are pleased with the progress of the SABRE program at the McClean North deposit, which remains on track for production in 2025. Our team is also active on our portfolio of other development and exploration projects, with study work advancing on both the Midwest project and the Tthe Heldeth Túé (‘THT’) deposit, with the potential to result in updated or new technical studies in the coming months.

Also notable is our recent transaction with Foremost Clean Energy, which involves Denison optioning up to 70% of its interests in a portfolio of 10 exploration properties. The transaction was designed to amplify our exposure to future discovery by encouraging exploration on – and retaining significant ownership of – properties that would otherwise have received little attention from Denison with our current focus on development and mining-stage projects.”

Q3 2024 MD&A Highlights

- Signing of Wheeler River Benefit Agreements with Kineepik Métis Local #9 and the Village of Pinehouse Lake

In July 2024, Denison announced the signing of a Mutual Benefits Agreement (‘MBA’) with Kineepik Métis Local #9 (‘KML’), and a Community Benefit Agreement (‘CBA’) with the northern Village of Pinehouse Lake (‘Pinehouse‘), in support of the development and operation of Denison’s 95% owned Wheeler River Project.

The MBA acknowledges that the project is located within KML’s Land and Occupancy Area in northern Saskatchewan and provides KML’s consent and support to advance the project. Additionally, the MBA recognizes that the development and operation of the project can support KML in advancing its social and economic development aspirations while mitigating the impacts on the local environment and KML members. The MBA provides KML and its Métis members an important role in environmental monitoring and commits to the sharing of benefits from the successful operation of the project – including benefits from community investment, business opportunities, employment and training opportunities, and financial compensation.

The CBA acknowledges that Pinehouse is the closest residential community to the project by road, which relies on much of the same regional infrastructure that Denison will rely on as it advances the project. Pinehouse has provided its consent and support for the project, while Denison, on behalf of the Wheeler River Joint Venture, is committed to helping Pinehouse develop its own capacity to take advantage of economic and other development opportunities in connection with the advancement and operation of the project.

- Continued Advancement of Phoenix Engineering and Federal Regulatory Review of the Draft EIS

During the third quarter, the Company continued to focus its efforts on the advancement of the Phoenix project towards a final investment decision in support of its objective to achieve first production by 2027 / 2028, including:

-

- Phoenix engineering activities are advancing within expected timelines to support a financial investment decision (‘FID’) by mid-2025. Total engineering completion at end of the third quarter was 45%, supported by finalization of process design, piping and instrumentation diagrams (P&ID’s), hazard and operability studies (‘HAZOPs’), as well as the selection of major process equipment and electrical distribution infrastructure.

- The review of the draft EIS continues to advance and Denison has been in regular contact with CNSC staff to support the conclusion of any remaining IRs. In September 2024, Denison received confirmation that the majority of outstanding IRs have been resolved, which suggests that the Federal review process is nearing completion.

- Phoenix engineering activities are advancing within expected timelines to support a financial investment decision (‘FID’) by mid-2025. Total engineering completion at end of the third quarter was 45%, supported by finalization of process design, piping and instrumentation diagrams (P&ID’s), hazard and operability studies (‘HAZOPs’), as well as the selection of major process equipment and electrical distribution infrastructure.

- Option of Non-Core Exploration Projects to Foremost Clean Energy Ltd.

In September 2024, Denison executed an option agreement with Foremost Clean Energy Ltd (‘Foremost’), which grants Foremost an option to acquire up to 70% of Denison’s interests in 10 non-core uranium exploration properties (collectively, the ‘Foremost Transaction’). Pursuant to the Foremost Transaction, Foremost would acquire such total interests upon completion of a combination of direct payments to Denison and funding of exploration expenditures with an aggregate value of up to approximately $30 million. The Foremost Transaction provides the following benefits to Denison:

-

- Collaboration with Foremost is expected to increase exploration activity on a portfolio of non-core Denison properties with the potential to increase the probability of discovery within Denison’s vast Athabasca Basin exploration portfolio.

- In October 2024, Denison received an upfront payment in Foremost common shares (representing a ~19.95% ownership interest in Foremost). If Foremost completes the remaining two phases of the Foremost Transaction Denison will receive further cash and/or common share milestone payments of $4.5 million and Foremost will fund $20 million in project exploration expenditures.

- In addition to becoming Foremost’s largest shareholder, Denison retains direct interests in the optioned exploration properties and also secures certain strategic pre-emptive rights to participate in future exploration success from the optioned properties.

- Collaboration with Foremost is expected to increase exploration activity on a portfolio of non-core Denison properties with the potential to increase the probability of discovery within Denison’s vast Athabasca Basin exploration portfolio.

About Denison

Denison Mines Corp. was formed under the laws of Ontario and is a reporting issuer in all Canadian provinces and territories. Denison’s common shares are listed on the Toronto Stock Exchange (the ‘TSX’) under the symbol ‘DML’ and on the NYSE American exchange under the symbol ‘DNN’.

Denison is a uranium mining, exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. The Company has an effective 95% interest in its flagship Wheeler River Uranium Project, which is the largest undeveloped uranium project in the infrastructure rich eastern portion of the Athabasca Basin region of northern Saskatchewan. In mid-2023, the Phoenix FS was completed for the Phoenix deposit as an ISR mining operation, and an update to the previously prepared 2018 Pre-Feasibility Study (‘PFS’) was completed for Wheeler River’s Gryphon deposit as a conventional underground mining operation. Based on the respective studies, both deposits have the potential to be competitive with the lowest cost uranium mining operations in the world. Permitting efforts for the planned Phoenix ISR operation commenced in 2019 and have advanced significantly, with licensing in progress and a draft Environmental Impact Study (‘EIS’) submitted for regulatory and public review in October 2022.

Denison’s interests in Saskatchewan also include a 22.5% ownership interest in the McClean Lake Joint Venture (‘MLJV’), which includes unmined uranium deposits (planned for extraction via the MLJV’s SABRE mining method starting in 2025) and the McClean Lake uranium mill (currently utilizing a portion of its licensed capacity to process the ore from the Cigar Lake mine under a toll milling agreement), plus a 25.17% interest in the Midwest Joint Venture (‘MWJV’)’s Midwest Main and Midwest A deposits, and a 69.44% interest in the Tthe Heldeth Túé (‘THT’) and Huskie deposits on the Waterbury Lake Property (‘Waterbury’). The Midwest Main, Midwest A, THT and Huskie deposits are located within 20 kilometres of the McClean Lake mill. Taken together, the Company has direct ownership interests in properties covering ~384,000 hectares in the Athabasca Basin region.

Additionally, through its 50% ownership of JCU (Canada) Exploration Company, Limited (‘JCU’), Denison holds interests in various uranium project joint ventures in Canada, including the Millennium project (JCU, 30.099%), the Kiggavik project (JCU, 33.8118%) and Christie Lake (JCU, 34.4508%).

Technical Disclosure and Qualified Person

The technical information contained in this press release has been reviewed and approved by Chad Sorba, P.Geo., Denison’s Vice President Technical Services & Project Evaluation, and Andy Yackulic, P.Geo., Denison’s Vice President Exploration, who are both Qualified Persons in accordance with the requirements of NI 43-101.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this press release constitutes ‘forward-looking information’, within the meaning of the applicable United States and Canadian legislation concerning the business, operations and financial performance and condition of Denison. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as ‘plans’, ‘expects’, ‘budget’, ‘scheduled’, ‘estimates’, ‘forecasts’, ‘intends’, ‘anticipates’, or ‘believes’, or the negatives and/or variations of such words and phrases, or state that certain actions, events or results ‘may’, ‘could’, ‘would’, ‘might’ or ‘will be taken’, ‘occur’, ‘be achieved’ or ‘has the potential to’.

In particular, this press release contains forward-looking information pertaining to the following: projections with respect to exploration, development and expansion plans and objectives, including the scope, objectives and interpretations of FS, PFS and the Wheeler River technical de-risking process for the proposed ISR operation for the Phoenix deposit; expectations with respect to the EA, EIS and licensing and permitting for proposed operations at Wheeler River; anticipated benefits of the transaction with Foremost; expectations regarding the restart of mining operations at McClean Lake; expectations regarding the assessment of the amenability of ISR for THT and advancement of technical studies for the Midwest deposit; expectations regarding the performance of the uranium market and global sentiment regarding nuclear energy; expectations regarding Denison’s joint venture ownership interests; and expectations regarding the objectives and continuity of its agreements with third parties. Statements relating to ‘mineral reserves’ or ‘mineral resources’ are deemed to be forward-looking information, as they involve the implied assessment, based on certain estimates and assumptions that the mineral reserves and mineral resources described can be profitably produced in the future.

Forward looking statements are based on the opinions and estimates of management as of the date such statements are made, and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Denison to be materially different from those expressed or implied by such forward-looking statements. For example, the results and underlying assumptions and interpretations of the FS and PFS may not be maintained after further testing or be representative of actual conditions within the applicable deposits. In addition, Denison may decide or otherwise be required to discontinue testing, evaluation, engineering, and development work if it is unable to maintain or otherwise secure the necessary approvals or resources (such as testing facilities, capital funding, etc.). Denison believes that the expectations reflected in this forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be accurate and results may differ materially from those anticipated in this forward-looking information. For a discussion in respect of risks and other factors that could influence forward-looking events, please refer to the factors discussed in the Company’s Annual Information Form dated March 28, 2024 under the heading ‘Risk Factors’. These factors are not, and should not be, construed as being exhaustive.

Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking information contained in this press release is expressly qualified by this cautionary statement. Any forward-looking information and the assumptions made with respect thereto speaks only as of the date of this press release. Denison does not undertake any obligation to publicly update or revise any forward-looking information after the date of this press release to conform such information to actual results or to changes in Denison’s expectations except as otherwise required by applicable legislation.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/denison-reports-financial-and-operational-results-for-q32024-including-positive-progress-on-phoenix-engineering-and-regulatory-review-302299445.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/denison-reports-financial-and-operational-results-for-q32024-including-positive-progress-on-phoenix-engineering-and-regulatory-review-302299445.html

SOURCE Denison Mines Corp.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

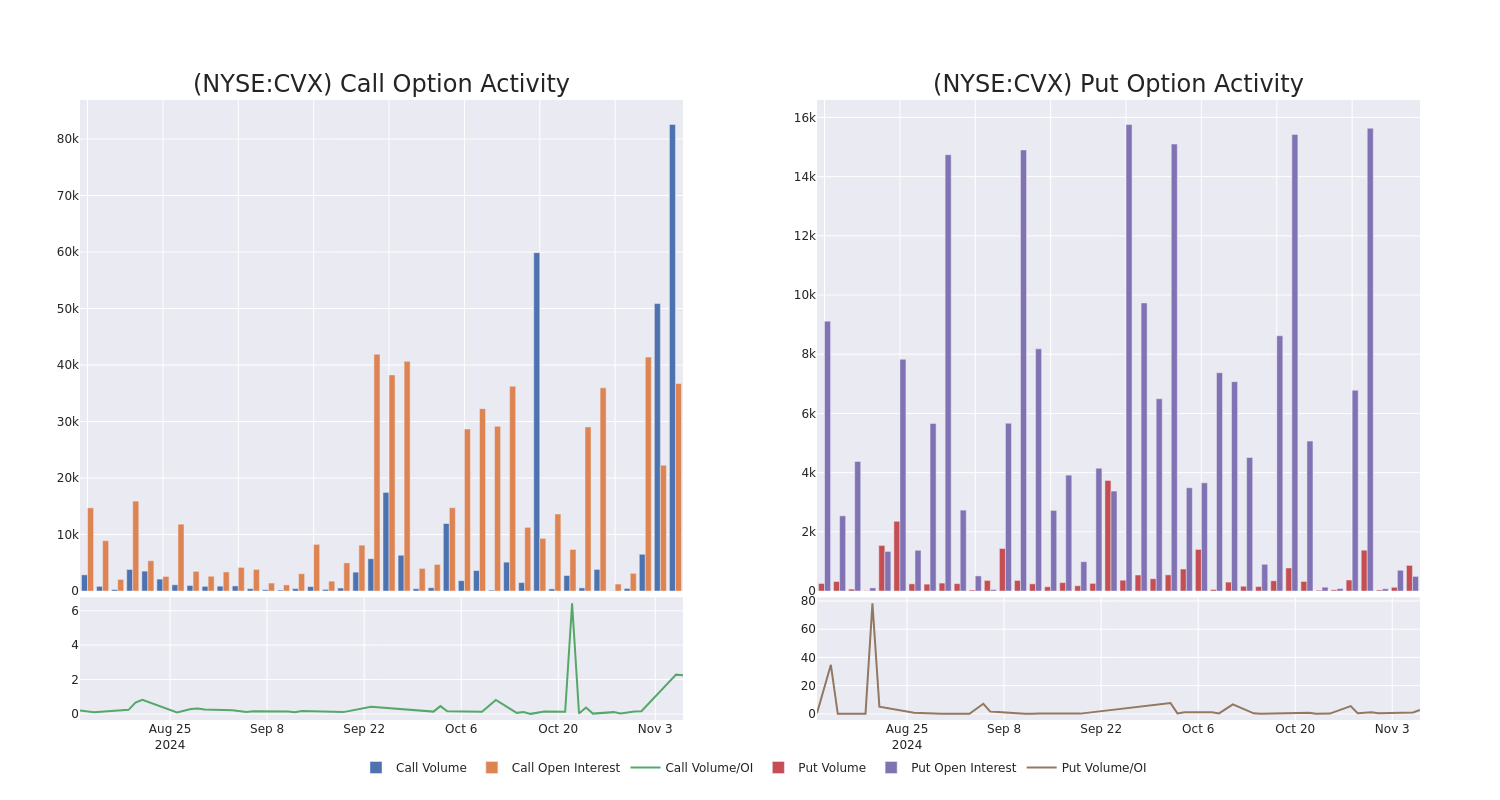

Chevron Unusual Options Activity

Benzinga’s options scanner has just identified more than 10 option transactions on Chevron CVX, with a cumulative value of $857,330. Concurrently, our algorithms picked up 2 puts, worth a total of 67,694.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $148.0 and $175.0 for Chevron, spanning the last three months.

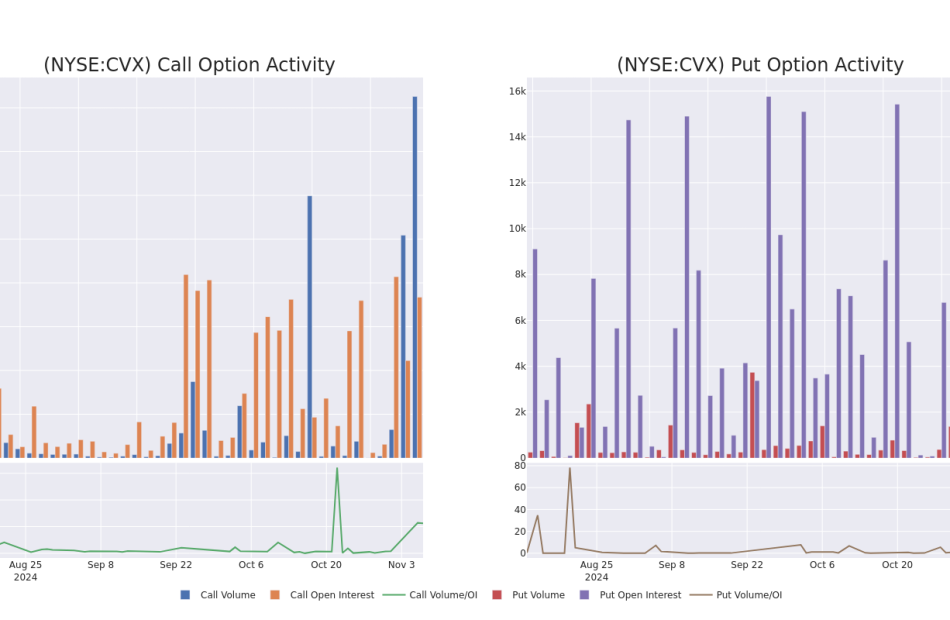

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Chevron options trades today is 7446.8 with a total volume of 83,433.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Chevron’s big money trades within a strike price range of $148.0 to $175.0 over the last 30 days.

Chevron Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | CALL | SWEEP | BULLISH | 01/17/25 | $2.54 | $2.42 | $2.54 | $165.00 | $254.1K | 10.8K | 1.0K |

| CVX | CALL | SWEEP | BULLISH | 01/17/25 | $1.52 | $1.47 | $1.47 | $170.00 | $181.9K | 23.8K | 18.9K |

| CVX | CALL | TRADE | BULLISH | 06/20/25 | $11.75 | $11.65 | $11.75 | $155.00 | $77.5K | 2.0K | 348 |

| CVX | CALL | TRADE | BULLISH | 06/20/25 | $11.75 | $11.4 | $11.65 | $155.00 | $76.8K | 2.0K | 1.0K |

| CVX | CALL | TRADE | BULLISH | 06/20/25 | $11.65 | $11.55 | $11.65 | $155.00 | $76.8K | 2.0K | 414 |

About Chevron

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

After a thorough review of the options trading surrounding Chevron, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Chevron

- With a volume of 4,985,443, the price of CVX is up 0.3% at $158.19.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 85 days.

What Analysts Are Saying About Chevron

5 market experts have recently issued ratings for this stock, with a consensus target price of $171.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Truist Securities persists with their Hold rating on Chevron, maintaining a target price of $155.

* Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Outperform rating for Chevron, targeting a price of $163.

* An analyst from RBC Capital persists with their Outperform rating on Chevron, maintaining a target price of $175.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Chevron with a target price of $194.

* An analyst from B of A Securities has revised its rating downward to Buy, adjusting the price target to $168.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Chevron, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.