MLL Legal Selects Anaqua's AQX Law Firm Platform to Enhance IP Management and Drive Operational Efficiency

BOSTON, Nov. 07, 2024 (GLOBE NEWSWIRE) — Anaqua, the leading provider of innovation and intellectual property (IP) management technology, today announced that MLL Legal, one of Switzerland’s largest law firms, has selected Anaqua’s AQX® Law Firm platform to enhance its IP management capabilities for its clients.

MLL Legal is known for its expertise in innovative sectors such as fintech, blockchain, artificial intelligence, and life sciences. With over 250 professionals, including 150 lawyers, MLL Legal operates from offices in Zurich, Geneva, Lausanne, Zug, as well as international locations in London and Madrid. The firm is consistently recognized in prestigious legal publications and rankings for its extensive knowledge in commercial law. MLL Legal has been one of Switzerland’s leading law firms in the field of IP for decades.

By adopting Anaqua’s AQX Law Firm platform, MLL Legal will replace its current IP management system with a unified, scalable solution that integrates email archiving, document sharing, and workflow enhancements—all with an emphasis on design and trademark management. The platform’s multi-tiered access controls offer customizable security ensuring the safe handling of sensitive client data, while its collaborative features facilitate seamless teamwork both within the firm and with external clients.

“We chose Anaqua primarily for three reasons: its robust reporting tools, the intuitive user experience, and the out-of-the-box system functionality,” said Franziska Schweizer, head of the IP Prosecution Team at MLL Legal. “The AQX platform’s reporting tools enable us to quickly generate clear and comprehensible reports without the need for manual processing. This efficiency allows our team to focus more on delivering high-quality legal advice.”

Bob Romeo, CEO of Anaqua, added: “MLL Legal’s decision underscores the growing demand for innovative IP solutions within the European legal market. Our platform’s capabilities are designed to ensure increased efficiency and flexibility, enabling law firms like MLL Legal to better manage their clients’ IP portfolios while providing exceptional service.”

About Anaqua

Anaqua, Inc. is a premium provider of integrated technology solutions and services for the management of intellectual property (IP). Anaqua’s AQX® and PATTSY WAVE® IP management solutions combine best practice workflows with big data analytics and technology-enabled services to create an intelligent environment that informs IP strategies, enables IP decisions and streamlines IP processes. Today, nearly half of the 100 largest U.S. patent applicants and global brands, as well as a growing number of law firms worldwide, use Anaqua’s solutions. Over one million IP executives, lawyers, paralegals, administrators and innovators use the platform for their IP management. The company is headquartered in Boston, with additional offices in the United States, Europe, Asia, and Australia. For more information, please visit anaqua.com or LinkedIn.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bonds And Fed Front And Center As Bonds Approach Bottom Support Zone After Trump Win

To gain an edge, this is what you need to know today.

Bonds Fall On Trump Win

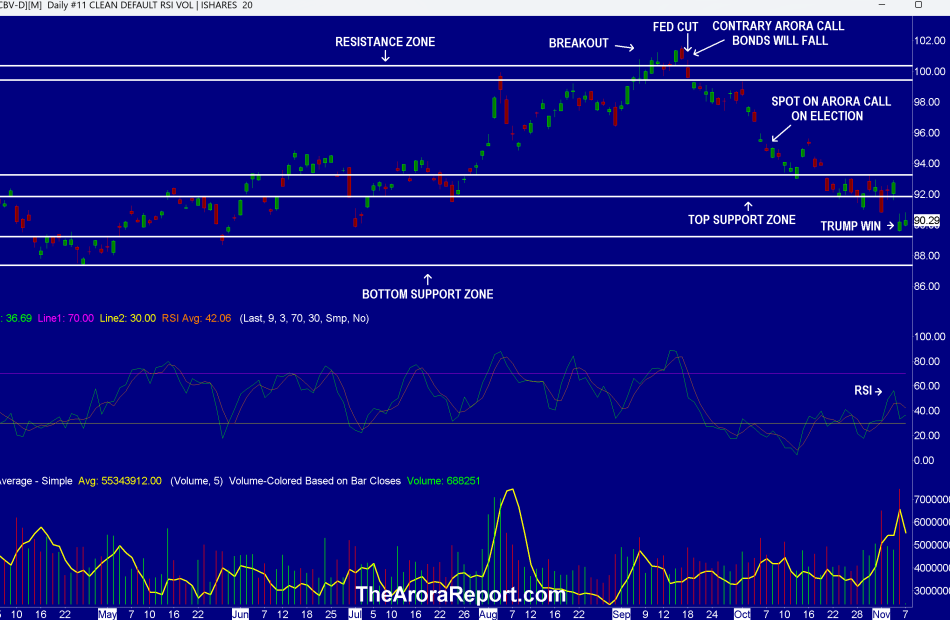

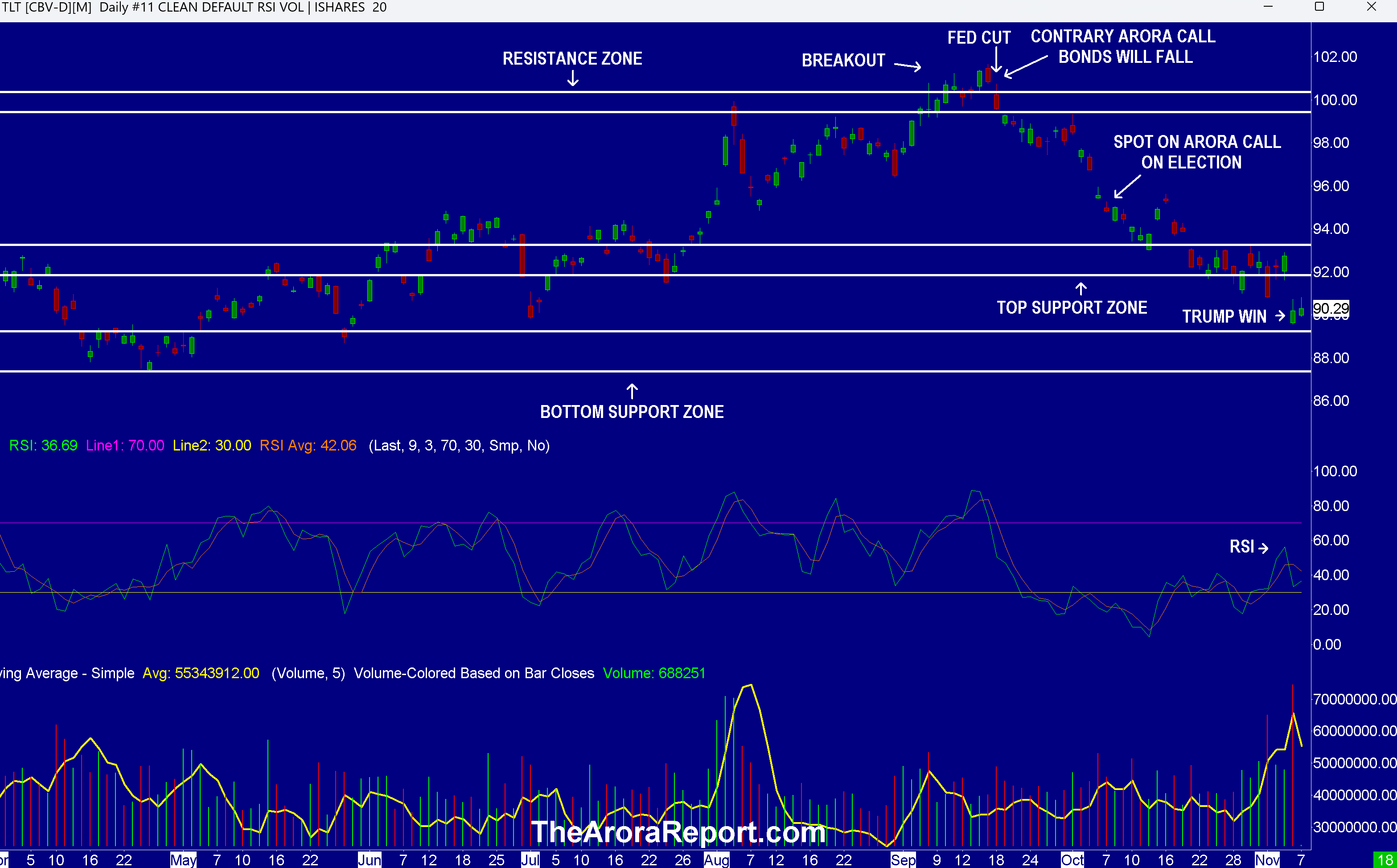

Please click here for an enlarged chart of iShares 20+ Year Treasury Bond ETF TLT.

Note the following:

- After Trump’s win, bonds are front and center.

- The chart shows when the contrary Arora call was made that bonds would fall. That call was made at a time when everyone was predicting that bonds would rise.

- The chart shows when the Arora call was made about the election. We wrote in the Morning Capsule on October 8, “In the event of a one party sweep, TLT can potentially fall to the bottom support zone.”

- The chart shows that the second Arora call on bonds has proven accurate after Trump’s win.

- The chart shows when Trump won the election.

- The chart shows that on Trump’s win, TLT gapped down and opened close to the top and of the bottom support zone. Yesterday’s bar does not show premarket data. In the premarket, TLT touched the top band of the support zone. On The Arora Report charts, premarket data is included on the current day, but not on the previous days. This methodology provides the most clarity.

- The FOMC will announce its rate decision at 2pm ET, followed by Powell’s press conference at 2:30pm ET.

- The consensus is that the Fed will cut rates by 25 bps.

- In The Arora Report analysis, the Fed could not possibly be happy about the large drop in bonds after the last rate cut. We will be paying careful attention to what Powell says about the drop in bonds in his press conference. If Powell says anything about this subject, it will be the most important new information that can be gleaned today.

- Most institutional investors and many retail investors have suffered massive losses in bonds. It is important to remember that the largest amount of money is still managed using the 60/40 portfolio as a starting point. This means 60% in stocks and 40% in bonds. The Arora Report has long shown that following the protection band is heads and shoulders above following the 60/40 portfolio. Nonetheless, the dogma of 60/40 remains popular. This is the reason we publish information on 60/40 portfolios. For those following the 60/40 portfolio, The Arora Report call has been to limit the duration to less than five years. The Arora Report call on duration has been consistent at a time when a vast majority of money managers were significantly increasing duration. The longer the bond duration, the larger the losses investors have suffered.

- In The Arora Report analysis, after Trump’s election the Fed is faced with two important issues:

- In The Arora Report analysis, depending upon how Trump implements his tariff plan, it may add 0.5% – 1% to inflation.

- According to the nonpartisan Committee for a Responsible Federal Budget, Trump’s tax plans will increase the national deficit by $7.8T over the next 10 years. All of this deficit will have to be financed by borrowing. This will increase the supply of Treasuries. A higher supply of Treasuries will lead to higher interest rates on the long end, unless the Fed decides to manipulate it with quantitative easing or some other artificial method.

- At a time when the stock market is at an all time high and bonds are suffering major losses, there is not good news on the economic data front.

- Unit labor costs are spiking. Q3 Unite Labor Costs – Preliminary came at 1.9% vs. 0.5% consensus.

- As of this writing, the momo crowd is oblivious. However, expect smart money to pay attention to this important, highly inflationary data. Also expect the Fed to pay attention to this data.

- Initial jobless claims came at 221K vs. 222K consensus. This indicates that the employment picture remains strong, especially at the low end.

- In The Arora Report analysis, there is another important question that the Fed will have to face. Trump plans to deport undocumented immigrants. According to the Department of Homeland Security, there are about 11M undocumented immigrants in the U.S. What happens to labor supply at the low end if 11M workers are taken out of the workforce? What does it do to inflation? What does it do to economic growth, and in turn the stock and bond markets?

England

The Bank of England has cut interest rates. The key interest has been reduced to 4.75% from 5%.

This is the first cut by a major central bank after Trump’s election. Investors should keep an eye on how the European Central Bank and the Bank of Japan act after Trump’s election. Remember, the U.S. economy is intertwined with the global economy.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Apple Inc AAPL, Amazon.com, Inc. AMZN, Alphabet Inc Class C GOOG, Meta Platforms Inc META, Microsoft Corp MSFT, and NVIDIA Corp NVDA.

In the early trade, money flows are negative in Tesla Inc TSLA.

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust Series 1 QQQ.

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Bitcoin BTC/USD is range bound.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror. The proprietary protection band from The Arora Report is very popular. The protection band puts all of the data, all of the indicators, all of the news, all of the crosscurrents, all of the models, and all of the analysis in an analytical framework that is easily actionable by investors.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Interra Capital Group Successfully Closes on the Acquisition of Remington Square

HOUSTON, Nov. 7, 2024 /PRNewswire/ — Interra Capital Group, a leader in commercial real estate investments, is pleased to announce the successful acquisition of Remington Square, a distinguished three-building class A office portfolio strategically located in Houston, Texas. The financial terms of the transaction remain undisclosed, underscoring the private nature of this significant real estate deal.

Jack Polatsek, CEO of Interra Capital Group, expressed his enthusiasm about the acquisition, stating, “Closing on Remington Square comes at a pivotal time when we see a strengthening trend of return to office that aligns with the Federal Reserve cutting their benchmark rates, enhancing the intrinsic value of well-located office properties. This property represents not just an investment in real estate but an opportunity to capitalize on market dynamics that favor well-positioned assets like Remington Square.”

Judah Westreich, Chief Financial Officer at Interra Capital Group, also shared his insights: “This acquisition reflects our strategic initiative to enhance our portfolio’s quality and performance. Remington Square stands out as a prime example of the type of asset that can deliver robust returns in the current economic climate, where discerning investment and proactive management are key.”

Anita Kundaje, Director of Acquisitions at Interra Capital Group, highlighted the company’s strategy in the real estate market. “Interra is decisively in acquisition mode, aggressively pursuing opportunities to expand our portfolio with assets that demonstrate significant upside potential and strategic value,” said Kundaje. “We are actively seeking properties that align with our rigorous criteria for sustainable growth and investment returns. Our recent acquisition of Remington Square is a testament to this focused approach, as we continue to capitalize on favorable market conditions to enhance our holdings.”

About Remington Square Remington Square is a premium office complex totaling 392,357 square feet across approximately 16.96 acres in Houston, Texas. It serves as a hub for diverse businesses, featuring state-of-the-art amenities such as an on-site restaurant, a modern fitness center, tenant lounges, and ample parking with a ratio of 4.57/1,000 SF. Its strategic location affords excellent regional accessibility and proximity to Houston’s rapidly growing residential areas, making it a coveted location for existing and prospective tenants.

About Interra Capital Group Interra Capital Group is a prominent real estate investment firm specializing in the acquisition and management of commercial properties across the United States. Interra is committed to creating value through strategic investments and diligent asset management.

![]() View original content:https://www.prnewswire.com/news-releases/interra-capital-group-successfully-closes-on-the-acquisition-of-remington-square-302296998.html

View original content:https://www.prnewswire.com/news-releases/interra-capital-group-successfully-closes-on-the-acquisition-of-remington-square-302296998.html

SOURCE Interra Capital Group

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nasdaq 100 Extends Record Levels Ahead Of Fed Meeting, Tesla Hits 26-Month Highs, Small Caps Stall: What's Driving Markets Thursday?

After Wednesday’s “everything rally” spurred by the election results, investors took a less euphoric approach on Thursday ahead of the Federal Open Market Committee (FOMC) meeting.

The Fed is widely expected to cut interest rates by 25 basis points, bringing them to a range of 4.5%-4.75%, following a previous 50-basis-point cut in September.

Yet, all eyes are on Fed Chair Jerome Powell’s comments at 2:30 p.m. ET regarding the potential for future rate hikes and his views on inflation risks. Concerns from the market center on the possibility of a policy U-turn driven by higher fiscal deficits and price pressures from trade tariffs under a Trump administration.

Tech stocks led gains, with the Nasdaq 100 extending its record-breaking levels, surpassing 21,000 points and eyeing a third consecutive positive session. The S&P 500 and Dow Jones posted more modest gains, while the Russell 2000 paused after Wednesday’s 5.8% leap.

Tesla Inc. TSLA remained a top performer among mega-cap stocks, bolstered by expectations of Elon Musk‘s influence in the upcoming administration.

Treasury yields reversed a substantial portion of Wednesday’s post-election increase, while the U.S. dollar dipped by 0.7%.

Metal commodities rebounded after Wednesday’s sharp losses, with gold rising 1.3%, silver up 2% and copper rallying over 4%.

Oil prices strengthened by 1%, with West Texas Intermediate trading around $72 per barrel.

Bitcoin BTC/USD rose 0.8%, reaching $76,000 to extend its record highs, while Ethereum ETH/USD outperformed with a gain of over 4%.

| Major Indices | Price | 1-day % chg |

| Nasdaq 100 | 21,050.78 | 1.3% |

| S&P 500 | 5,968.27 | 0.7% |

| Dow Jones | 43,748.20 | 0.0% |

| Russell 2000 | 2,389.10 | -0.2% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY rose 0.7% to $594.84.

- The SPDR Dow Jones Industrial Average DIA stalled at $437.25.

- The tech-heavy Invesco QQQ Trust Series QQQ soared 1.3% to $512.38.

- The iShares Russell 2000 ETF IWM eased 0.3% to $236.67.

- The Technology Select Sector SPDR Fund XLK outperformed, rising 1.3%. The Financials Select Sector SPDR Fund XLF lagged, down 1.2%.

Some relevant reactions to earnings reports are:

- Qualcomm Inc. QCOM, up 0.1%,

- Gilead Sciences Inc. GILD, up 6.2%,

- MercadoLibre Inc. MELI, down 16%,

- APPLovin Corp. APP, up 43%,

- McKesson Corp. MCK, up 11%,

- Take-Two Interactive Software Inc. TTWO, up 6.3%,

- Transdigm Group Inc. TDG, down 4.4%

Read Next:

This image was created using artificial intelligence.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lyft Teams Up With Intel's Mobileye, May Mobility For Robotaxi Services As Tesla Gears Up To Enter Autonomous Riding Hailing Market

Uber’s rival ride-hailing platform, Lyft Inc. LYFT said on Wednesday that it has partnered with Intel Corp.-owned INTC Mobileye, and May Mobility to provide autonomous vehicle rides to its customers.

What Happened: As part of Lyft’s partnership with Intel-owned Mobileye, the company will make its scaled rideshare platform available to all vehicles with Mobileye’s self-driving technology.

“The objective is for future AV operators who want to deploy and manage large-scale fleets in various metropolitan areas in North America to purchase Mobileye Drive equipped, “Lyft-ready” vehicles from vehicle builders, access Lyft’s rider demand and optimize utilization and profitability of their fleets,” Mobileye said about the partnership.

The companies, however, did not reveal when the first vehicles with Mobileye’s self-driving technology will show on the Lyft app.

May Mobility, meanwhile, will directly deploy autonomous vehicles to the Lyft platform in Atlanta starting in 2025, Lyft said. Lyft customers in Atlanta can be matched with a fleet of autonomous Toyota Sienna minivans equipped with May Mobility’s autonomous technology as part of the partnership. The company, however, did not specify the number of vehicles that will be deployed.

“Lyft’s aim is to connect AVs, drivers, riders, and partners to create new opportunities for all. Our rideshare network will continue to evolve as millions of people will have the opportunity to earn billions of dollars whether they choose to drive, put their AVs into service, or both,” David Risher, CEO of Lyft, said.

Why It Matters: Lyft’s AV comes on the heels of Tesla Inc.’s TSLA announcement that it expects to start an autonomous ride-hail service in Texas and California starting next year, subject to regulatory approval.

However, the vehicles might not all operate as driverless robotaxis initially as some states demand a safety driver until the company touches certain milestones in terms of miles and hours driven, the company then said.

However, company CEO Elon Musk expressed confidence that the company will be operating driverless paid rides sometime next year.

Tesla also unveiled a no-pedal, no-steering wheel dedicated robotaxi product last month called the Cybercab. Cybercab, Musk then said, will enter production ‘before 2027′ and will be priced below $30,000. Until then, the ride-hail fleet will be composed of the company’s Model 3 and Model Y.

Uber, meanwhile, has a partnership with Alphabet Inc’s Waymo since 2023. Earlier this year, Uber said that Waymo and Uber would bring the latter’s fully autonomous, all-electric Jaguar I-PACE vehicles to Austin and Atlanta starting in early 2025 on the Uber app.

Price Action: Lyft shares closed up 4.4% at $14.4 on Wednesday, and surged over 20% in after-hours trading. The stock is up 4.4% year-to-date, according to data from Benzinga Pro.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Novo Nordisk's stock hits 9-month low as 2025 guidance underwhelms

MILAN (Reuters) — Danish drugmaker Novo Nordisk’s (NVO, NOVO-B.CO) shares hit an over 9-month low on Thursday after surging more than 8% the previous day, as underwhelming guidance for next year overshadowed strong sales growth for its popular Wegovy weight-loss drug.

The two-day move saw Europe’s biggest company by market cap trade in a wide 14-percentage-point range from low to high. On Thursday morning, the stock was down 3% in Copenhagen, after earlier falling 5.5% to its lowest since January.

In an analyst call on Wednesday, following a quarterly release that eased concerns that demand for Wegowy was slowing, Novo’s finance chief Karsten Munk Knudsen said sales growth next year could be in the high percentage teens.

Barclays said commentary on 2025 weighed on the shares. “We had a call back with IR and the moving parts seem to indicate (at least what we know now) a midpoint for FY25 top line a touch lower than current company consensus,” Emily Field, analyst at the UK bank, wrote in a note, affirming her overweight rating on the stock.

The company will formally guide for 2025 in February.

US-listed Novo shares were up 1.6% in premarket trading on Thursday, having lost over 4% the prior session.

Gilles Guibout, head of European equity strategies at AXA Investment Managers in Paris, said the sharp moves in Novo’s shares were probably due to hedge fund action.

“Novo Nordisk is a widely held stock. Its market has significant potential. However, it’s easier to find sellers than buyers for the stock, as everyone already holds plenty of it,” he said.

“It’s a stock that needs to be normalised. At the beginning of the year, there was too much hype around it,” he added.

Novo Nordisk shares are up around 4% so far this year, but they have fallen almost 30% from the record high set in June.

The stock trades at a 27 times its expected earnings, a 22% premium to its 20-year average valuation, according to LSEG Datastream data. It is worth around $470 billion.

(Reporting by Danilo Masoni; Editing by Amanda Cooper)

OpenAI Acquires Dharmesh Shah's $15.5M Domain Chat.com: What's Behind The Move?

ChatGPT-parent OpenAI, under the leadership of Sam Altman, has taken over the domain chat.com, which was previously under the ownership of HubSpot‘s founder and CTO, Dharmesh Shah.

What Happened: On Wednesday, Altman posted a cryptic post on X, formerly Twitter, using the words, “chat.com,” only. The URL now redirects to ChatGPT.

Following Altman’s post, Shah also took to X and confirmed the purchase, indicating that he might have received OpenAI shares in exchange for the domain.

See Also: Google Delivers New AI Features To Maps, Google Earth, Waze Apps

Shah had initially bought the domain for $15.5 million in early 2023 but sold it a few months later for an undisclosed amount, which he confirmed was higher than the purchase price.

Shah’s initial purchase of chat.com was driven by his belief in the potential of Chat-based UX, facilitated by Generative AI.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: OpenAI’s acquisition of chat.com follows its recent transition from a nonprofit to a for-profit model, a move that sparked a financial and governance tug-of-war with Microsoft Corporation MSFT.

The ChatGPT parent has been on a financial upswing, with its valuation soaring to $157 billion in its latest funding round. Previously, it was reported that the AI startup intends to more than double the price of its flagship product, ChatGPT, over the next five years.

Last month, OpenAI rolled out ChatGPT Search, a feature that allows the AI to crawl the web for up-to-date news, sports scores, stock quotes, and more.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kimbell Royalty Partners Announces Third Quarter 2024 Results

Q3 2024 Run-Rate Daily Production of 23,846 Boe/d (6:1)

Activity on Acreage Remains Robust with 90 Active Rigs Drilling Representing 16%1 Market Share of U.S. Land Rig Count

Net Drilled But Uncompleted Wells (“DUCs”) Increased by 34% Quarter Over Quarter Led by the Permian Basin

Record Lease Bonuses Confirming Increased Operator Activity

Announces Q3 2024 Cash Distribution of $0.41 per Common Unit

FORT WORTH, Texas, Nov. 7, 2024 /PRNewswire/ — Kimbell Royalty Partners, LP KRP (“Kimbell” or the “Company”), a leading owner of oil and natural gas mineral and royalty interests in over 129,000 gross wells across 28 states, today announced financial and operating results for the quarter ended September 30, 2024.

Third Quarter 2024 Highlights

- Q3 2024 run-rate daily production of 23,846 barrels of oil equivalent (“Boe”) per day (6:1)

- Q3 2024 oil, natural gas and NGL revenues of $71.1 million

- Q3 2024 net income of approximately $25.8 million and net income attributable to common units of approximately $17.4 million

- Q3 2024 consolidated Adjusted EBITDA of $63.1 million

- As of September 30, 2024, Kimbell’s major properties2 had 7.84 net DUCs and net permitted locations on its acreage (5.13 net DUCs and 2.71 net permitted locations) compared to an estimated 5.8 net wells needed to maintain flat production

- As of September 30, 2024, Kimbell had 90 rigs actively drilling on its acreage, representing 16% market share of all land rigs drilling in the continental United States as of such time

- Announced a Q3 2024 cash distribution of $0.41 per common unit, reflecting a payout ratio of 75% of cash available for distribution; implies a 10.0% annualized yield based on the November 6, 2024 closing price of $16.38 per common unit; Kimbell intends to utilize the remaining 25% of its cash available for distribution to repay a portion of the outstanding borrowings under Kimbell’s revolving credit facility

- Conservative Balance Sheet with Net Debt to Trailing Twelve Month Consolidated Adjusted EBITDA of 0.8x

- Kimbell affirms its financial and operational guidance ranges for 2024 previously disclosed in its Q4 2023 earnings release

Robert Ravnaas, Chairman and Chief Executive Officer of Kimbell Royalty GP, LLC, Kimbell’s general partner (the “General Partner”), commented, “Activity on Kimbell’s acreage remained strong with 90 rigs actively drilling on our acreage, which represents 16% market share of all rigs drilling in the lower 48. In addition, lease bonuses during the quarter were the highest in Kimbell’s history and reflect increased operator interest in developing Kimbell’s acreage. Line-of-site wells continue to be well above the number of wells needed to maintain flat production, giving us confidence in the resilience of our production as we wrap-up 2024. More specifically, the number of net DUCs increased by 34% quarter over quarter to 5.1 net DUCs, the second highest level in Kimbell’s history, led by the Permian Basin.

“We are pleased to declare the Q3 2024 distribution of 41 cents per common unit. We estimate that approximately 100% percent of this distribution is expected to be considered return of capital and not subject to dividend taxes, further enhancing the after-tax return to our common unitholders.”

Third Quarter 2024 Distribution and Debt Repayment

Today, the Board of Directors of the General Partner (the “Board of Directors”) approved a cash distribution payment to common unitholders of 75% of cash available for distribution for the third quarter of 2024, or $0.41 per common unit. The distribution will be payable on November 25, 2024 to common unitholders of record at the close of business on November 18, 2024. Kimbell plans to utilize the remaining 25% of cash available for distribution for the third quarter of 2024 to pay down a portion of the outstanding borrowings under its secured revolving credit facility. Since May 2020 (excluding the expected upcoming pay-down from the remaining 25% of Q3 2024 projected cash available for distribution), Kimbell has paid down approximately $179.0 million of outstanding borrowings under its secured revolving credit facility by allocating a portion of its cash available for distribution for debt pay-down.

Kimbell expects that approximately 100% of its third quarter 2024 distribution should not constitute dividends for U.S. federal income tax purposes, but instead are estimated to constitute non-taxable reductions to the basis of each distribution recipient’s ownership interest in Kimbell common units. The reduced tax basis will increase unitholders’ capital gain (or decrease unitholders’ capital loss) when unitholders sell their common units. The Form 8937 containing additional information may be found at www.kimbellrp.com under “Investor Relations” section of the site. Kimbell currently believes that the portion that constitute dividends for U.S. federal income tax purposes will be considered qualified dividends, subject to holding period and certain other conditions, which are subject to a tax rate of 0%, 15% or 20% depending on the income level and tax filing status of a unitholder for 2024. Kimbell believes these estimates are reasonable based on currently available information, but they are subject to change.

Financial Highlights

Kimbell’s third quarter 2024 average realized price per Bbl of oil was $74.19, per Mcf of natural gas was $1.71, per Bbl of NGLs was $21.46 and per Boe combined was $31.57.

During the third quarter of 2024, the Company’s total revenues were $83.8 million, net income was approximately $25.8 million and net income attributable to common units was approximately $17.4 million, or $0.22 per common unit.

Total third quarter 2024 consolidated Adjusted EBITDA was $63.1 million (consolidated Adjusted EBITDA is a non-GAAP financial measure. Please see a reconciliation to the nearest GAAP financial measures at the end of this news release).

In the third quarter of 2024, G&A expense was $9.5 million, $5.6 million of which was Cash G&A expense, or $2.57 per BOE (Cash G&A and Cash G&A per Boe are non-GAAP financial measures. Please see definition under Non-GAAP Financial Measures in the Supplemental Schedules included in this news release). Unit-based compensation in the third quarter of 2024, which is a non-cash G&A expense, was $3.8 million or $1.75 per Boe.

As of September 30, 2024, Kimbell had approximately $252.2 million in debt outstanding under its secured revolving credit facility, had net debt to third quarter 2024 trailing twelve month consolidated Adjusted EBITDA of approximately 0.8x and was in compliance with all financial covenants under its secured revolving credit facility. Kimbell had approximately $297.8 million in undrawn capacity under its secured revolving credit facility as of September 30, 2024.

As of September 30, 2024, Kimbell had outstanding 80,969,651 common units and 14,524,120 Class B units. As of November 7, 2024, Kimbell had outstanding 80,969,651 common units and 14,524,120 Class B units.

Production

Third quarter 2024 run-rate average daily production was 23,846 Boe per day (6:1), which was composed of approximately 52% from natural gas (6:1) and approximately 48% from liquids (30% from oil and 18% from NGLs).

Operational Update

As of September 30, 2024, Kimbell’s major properties had 831 gross (5.13 net) DUCs and 527 gross (2.71 net) permitted locations on its acreage. In addition, as of September 30, 2024, Kimbell had 90 rigs actively drilling on its acreage, which represents an approximate 15.9% market share of all land rigs drilling in the continental United States as of such time.

|

Basin |

Gross DUCs as of |

Gross Permits as of |

Net DUCs as of |

Net Permits as of |

|

Permian |

457 |

349 |

2.62 |

1.71 |

|

Eagle Ford |

100 |

32 |

0.63 |

0.13 |

|

Haynesville |

50 |

10 |

0.54 |

0.13 |

|

Mid-Continent |

131 |

54 |

1.04 |

0.43 |

|

Bakken |

79 |

75 |

0.20 |

0.28 |

|

Appalachia |

5 |

3 |

0.02 |

0.01 |

|

Rockies |

9 |

4 |

0.08 |

0.02 |

|

Total |

831 |

527 |

5.13 |

2.71 |

|

(1) These figures pertain only to Kimbell’s major properties and do not include possible additional DUCs and permits from Kimbell’s minor properties, which generally have a net revenue interest of 0.1% or below and are time consuming to quantify but, in the estimation of Kimbell’s management, could add an additional 15% to Kimbell’s net inventory. |

Hedging Update

The following provides information concerning Kimbell’s hedge book as of September 30, 2024:

|

Fixed Price Swaps as of September 30, 2024 |

||||

|

Weighted Average |

||||

|

Volumes |

Fixed Price |

|||

|

Oil |

Nat Gas |

Oil |

Nat Gas |

|

|

BBL |

MMBTU |

$/BBL |

$/MMBTU |

|

|

4Q 2024 |

141,588 |

1,332,712 |

$ 74.60 |

$ 4.19 |

|

1Q 2025 |

140,400 |

1,289,520 |

$ 71.55 |

$ 4.32 |

|

2Q 2025 |

140,686 |

1,310,127 |

$ 67.64 |

$ 3.52 |

|

3Q 2025 |

136,068 |

1,261,964 |

$ 74.20 |

$ 3.74 |

|

4Q 2025 |

146,372 |

1,291,680 |

$ 68.26 |

$ 3.68 |

|

1Q 2026 |

146,880 |

1,296,000 |

$ 70.38 |

$ 4.07 |

|

2Q 2026 |

148,512 |

1,310,400 |

$ 70.78 |

$ 3.33 |

|

3Q 2026 |

150,144 |

1,324,800 |

$ 66.60 |

$ 3.42 |

Conference Call

Kimbell Royalty Partners will host a conference call and webcast today at 10:00 a.m. Central Time (11:00 a.m. Eastern Time) to discuss third quarter 2024 results. To access the call live by phone, dial 201-389-0869 and ask for the Kimbell Royalty Partners call at least 10 minutes prior to the start time. A telephonic replay will be available through November 14, 2024 by dialing 201-612-7415 and using the conference ID 13748350#. A webcast of the call will also be available live and for later replay on Kimbell’s website at http://kimbellrp.investorroom.com under the Events and Presentations tab.

Presentation

On November 7, 2024, Kimbell posted an updated investor presentation on its website. The presentation may be found at http://kimbellrp.investorroom.com under the Events and Presentations tab. Information on Kimbell’s website does not constitute a portion of this news release.

About Kimbell Royalty Partners, LP

Kimbell KRP is a leading oil and gas mineral and royalty company based in Fort Worth, Texas. Kimbell owns mineral and royalty interests in approximately 17 million gross acres in 28 states and in every major onshore basin in the continental United States, including ownership in more than 129,000 gross wells. To learn more, visit http://www.kimbellrp.com.

Forward-Looking Statements

This news release includes forward-looking statements, in particular statements relating to Kimbell’s financial, operating and production results and prospects for growth (including financial and operational guidance), drilling inventory, growth potential, identified locations and all other estimates and predictions resulting from Kimbell’s portfolio review, the tax treatment of Kimbell’s distributions, changes in Kimbell’s capital structure, future natural gas and other commodity prices and changes to supply and demand for oil, natural gas and NGLs. These and other forward-looking statements involve risks and uncertainties, including risks that the anticipated benefits of acquisitions are not realized and uncertainties relating to Kimbell’s business, prospects for growth and acquisitions and the securities markets generally, as well as risks inherent in oil and natural gas drilling and production activities, including risks with respect to potential declines in prices for oil and natural gas that could result in downward revisions to the value of proved reserves or otherwise cause operators to delay or suspend planned drilling and completion operations or reduce production levels, which would adversely impact cash flow, risks relating to the impairment of oil and natural gas properties, risks relating to the availability of capital to fund drilling operations that can be adversely affected by adverse drilling results, production declines and declines in oil and natural gas prices, risks relating to Kimbell’s ability to meet financial covenants under its credit agreement or its ability to obtain amendments or waivers to effect such compliance, risks relating to Kimbell’s hedging activities, risks of fire, explosion, blowouts, pipe failure, casing collapse, unusual or unexpected formation pressures, environmental hazards, and other operating and production risks, which may temporarily or permanently reduce production or cause initial production or test results to not be indicative of future well performance or delay the timing of sales or completion of drilling operations, risks relating to delays in receipt of drilling permits, risks relating to unexpected adverse developments in the status of properties, risks relating to borrowing base redeterminations by Kimbell’s lenders, risks relating to the absence or delay in receipt of government approvals or third-party consents, risks relating to acquisitions, dispositions and drop downs of assets, risks relating to Kimbell’s ability to realize the anticipated benefits from and to integrate acquired assets, including the Acquired Production, risks relating to tax matters and other risks described in Kimbell’s Annual Report on Form 10-K and other filings with the Securities and Exchange Commission (the “SEC”), available at the SEC’s website at www.sec.gov. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release. Except as required by law, Kimbell undertakes no obligation and does not intend to update these forward-looking statements to reflect events or circumstances occurring after this news release. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in Kimbell’s filings with the SEC.

Contact:

Rick Black

Dennard Lascar Investor Relations

krp@dennardlascar.com

(713) 529-6600

– Financial statements follow –

|

Kimbell Royalty Partners, LP Condensed Consolidated Balance Sheet (Unaudited, in thousands) |

||

|

September 30, |

||

|

2024 |

||

|

Assets: |

||

|

Current assets |

||

|

Cash and cash equivalents |

$ |

34,706 |

|

Oil, natural gas and NGL receivables |

48,975 |

|

|

Derivative assets |

6,818 |

|

|

Accounts receivable and other current assets |

1,671 |

|

|

Total current assets |

92,170 |

|

|

Property and equipment, net |

361 |

|

|

Oil and natural gas properties |

||

|

Oil and natural gas properties (full cost method) |

2,048,712 |

|

|

Less: accumulated depreciation, depletion and impairment |

(936,054) |

|

|

Total oil and natural gas properties, net |

1,112,658 |

|

|

Right-of-use assets, net |

1,929 |

|

|

Derivative assets |

1,763 |

|

|

Loan origination costs, net |

5,790 |

|

|

Total assets |

$ |

1,214,671 |

|

Liabilities and unitholders’ equity: |

||

|

Current liabilities |

||

|

Accounts payable |

$ |

6,865 |

|

Other current liabilities |

10,875 |

|

|

Total current liabilities |

17,740 |

|

|

Operating lease liabilities, excluding current portion |

1,605 |

|

|

Derivative liabilities |

2 |

|

|

Long-term debt |

252,160 |

|

|

Other liabilities |

104 |

|

|

Total liabilities |

271,611 |

|

|

Commitments and contingencies |

||

|

Mezzanine equity: |

||

|

Series A preferred units |

315,608 |

|

|

Kimbell Royalty Partners, LP unitholders’ equity: |

||

|

Common units |

531,294 |

|

|

Class B units |

726 |

|

|

Total Kimbell Royalty Partners, LP unitholders’ equity |

532,020 |

|

|

Non-controlling interest in OpCo |

95,432 |

|

|

Total unitholders’ equity |

627,452 |

|

|

Total liabilities, mezzanine equity and unitholders’ equity |

$ |

1,214,671 |

|

Kimbell Royalty Partners, LP Condensed Consolidated Statements of Operations (Unaudited, in thousands, except per-unit data and unit counts) |

|||||

|

Three Months Ended |

Three Months Ended |

||||

|

September 30, 2024 |

September 30, 2023 |

||||

|

Revenue |

|||||

|

Oil, natural gas and NGL revenues |

$ |

71,069 |

$ |

69,238 |

|

|

Lease bonus and other income |

3,163 |

2,543 |

|||

|

Gain (loss) on commodity derivative instruments, net |

9,553 |

(4,577) |

|||

|

Total revenues |

83,785 |

67,204 |

|||

|

Costs and expenses |

|||||

|

Production and ad valorem taxes |

4,347 |

4,986 |

|||

|

Depreciation and depletion expense |

32,155 |

23,060 |

|||

|

Marketing and other deductions |

3,607 |

3,509 |

|||

|

General and administrative expense |

9,472 |

10,359 |

|||

|

Total costs and expenses |

49,581 |

41,914 |

|||

|

Operating income |

34,204 |

25,290 |

|||

|

Other expense |

|||||

|

Interest expense |

(6,492) |

(6,681) |

|||

|

Net income before income taxes |

27,712 |

18,609 |

|||

|

Income tax expense |

1,907 |

128 |

|||

|

Net income |

25,805 |

18,481 |

|||

|

Distribution and accretion on Series A preferred units |

(5,296) |

(1,041) |

|||

|

Net income attributable to non-controlling interests |

(3,119) |

(3,839) |

|||

|

Distributions on Class B units |

(15) |

(21) |

|||

|

Net income attributable to common units of Kimbell Royalty Partners, LP |

$ |

17,375 |

$ |

13,580 |

|

|

Basic |

$ |

0.22 |

$ |

0.20 |

|

|

Diluted |

$ |

0.22 |

$ |

0.19 |

|

|

Weighted average number of common units outstanding |

|||||

|

Basic |

78,977,450 |

68,540,786 |

|||

|

Diluted |

116,414,205 |

94,969,077 |

|||

Kimbell Royalty Partners, LP

Supplemental Schedules

NON-GAAP FINANCIAL MEASURES

Adjusted EBITDA, Cash G&A and Cash G&A per Boe are used as supplemental non-GAAP financial measures by management and external users of Kimbell’s financial statements, such as industry analysts, investors, lenders and rating agencies. Kimbell believes Adjusted EBITDA is useful because it allows us to more effectively evaluate Kimbell’s operating performance and compare the results of Kimbell’s operations period to period without regard to its financing methods or capital structure. In addition, management uses Adjusted EBITDA to evaluate cash flow available to pay distributions to Kimbell’s unitholders. Kimbell defines Adjusted EBITDA as net income (loss), net of depreciation and depletion expense, interest expense, income taxes, impairment of oil and natural gas properties, non-cash unit-based compensation, loss on extinguishment of debt, unrealized gains and losses on derivative instruments and operational impacts of variable interest entities, which include general and administrative expense and interest income. Adjusted EBITDA is not a measure of net income (loss) or net cash provided by operating activities as determined by GAAP. Kimbell excludes the items listed above from net income (loss) in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within Kimbell’s industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as historic costs of depreciable assets, none of which are components of Adjusted EBITDA. Adjusted EBITDA should not be considered an alternative to net income, oil, natural gas and natural gas liquids revenues, net cash provided by operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Kimbell’s computations of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. Kimbell expects that cash available for distribution for each quarter will generally equal its Adjusted EBITDA for the quarter, less cash needed for debt service and other contractual obligations, tax obligations, and fixed charges and reserves for future operating or capital needs that the Board of Directors may determine is appropriate.

Kimbell believes Cash G&A and Cash G&A per Boe are useful metrics because they isolate cash costs within overall G&A expense and measure cash costs relative to overall production, which is a widely utilized metric to evaluate operational performance within the energy sector. Cash G&A is defined as general and administrative expenses less unit-based compensation expense. Cash G&A per Boe is defined as Cash G&A divided by total production for a period. Cash G&A should not be considered an alternative to G&A expense presented in accordance with GAAP. Kimbell’s computations of Cash G&A and Cash G&A per Boe may not be comparable to other similarly titled measures of other companies.

|

Kimbell Royalty Partners, LP |

|||||

|

Three Months Ended |

Three Months Ended |

||||

|

September 30, 2024 |

September 30, 2023 |

||||

|

Reconciliation of net cash provided by operating activities |

|||||

|

to Adjusted EBITDA and cash available for distribution |

|||||

|

Net cash provided by operating activities |

$ |

62,417 |

$ |

36,387 |

|

|

Interest expense |

6,492 |

6,681 |

|||

|

Income tax expense |

1,907 |

128 |

|||

|

Amortization of right-of-use assets |

(87) |

(84) |

|||

|

Amortization of loan origination costs |

(532) |

(405) |

|||

|

Unit-based compensation |

(3,830) |

(3,326) |

|||

|

Gain (loss) on derivative instruments, net of settlements |

7,066 |

(4,098) |

|||

|

Changes in operating assets and liabilities: |

|||||

|

Oil, natural gas and NGL revenues receivable |

(4,243) |

16,314 |

|||

|

Accounts receivable and other current assets |

(719) |

(280) |

|||

|

Accounts payable |

(310) |

(855) |

|||

|

Other current liabilities |

(1,899) |

(2,200) |

|||

|

Operating lease liabilities |

97 |

88 |

|||

|

Consolidated EBITDA |

$ |

66,359 |

$ |

48,350 |

|

|

Add: |

|||||

|

Unit-based compensation |

3,830 |

3,326 |

|||

|

(Gain) loss on derivative instruments, net of settlements |

(7,066) |

4,098 |

|||

|

Consolidated Adjusted EBITDA |

$ |

63,123 |

$ |

55,774 |

|

|

Adjusted EBITDA attributable to non-controlling interest |

(9,601) |

(12,279) |

|||

|

Adjusted EBITDA attributable to Kimbell Royalty Partners, LP |

$ |

53,522 |

$ |

43,495 |

|

|

Adjustments to reconcile Adjusted EBITDA to cash available |

|||||

|

for distribution |

|||||

|

Less: |

|||||

|

Cash interest expense |

5,123 |

4,645 |

|||

|

Cash distributions on Series A preferred units |

4,156 |

750 |

|||

|

Distributions on Class B units |

15 |

21 |

|||

|

Cash available for distribution on common units |

$ |

44,228 |

$ |

38,079 |

|

|

Kimbell Royalty Partners, LP Supplemental Schedules (Unaudited, in thousands, except for per-unit data and unit counts) |

||

|

Three Months Ended |

||

|

September 30, 2024 |

||

|

Net income |

$ |

25,805 |

|

Depreciation and depletion expense |

32,155 |

|

|

Interest expense |

6,492 |

|

|

Income tax expense |

1,907 |

|

|

Consolidated EBITDA |

$ |

66,359 |

|

Unit-based compensation |

3,830 |

|

|

Gain on derivative instruments, net of settlements |

(7,066) |

|

|

Consolidated Adjusted EBITDA |

$ |

63,123 |

|

Adjusted EBITDA attributable to non-controlling interest |

(9,601) |

|

|

Adjusted EBITDA attributable to Kimbell Royalty Partners, LP |

$ |

53,522 |

|

Adjustments to reconcile Adjusted EBITDA to cash available |

||

|

for distribution |

||

|

Less: |

||

|

Cash interest expense |

5,123 |

|

|

Cash distributions on Series A preferred units |

4,156 |

|

|

Distributions on Class B units |

15 |

|

|

Cash available for distribution on common units |

$ |

44,228 |

|

Common units outstanding on September 30, 2024 |

80,969,651 |

|

|

Common units outstanding on November 18, 2024 Record Date |

80,969,651 |

|

|

Cash available for distribution per common unit outstanding |

$ |

0.55 |

|

Third quarter 2024 distribution declared (1) |

$ |

0.41 |

|

(1) The difference between the declared distribution and the cash available for distribution is primarily attributable to Kimbell allocating 25% of cash available for distribution to pay outstanding borrowings under its secured revolving credit facility. |

|

Kimbell Royalty Partners, LP Supplemental Schedules (Unaudited, in thousands, except for per-unit data and unit counts) |

||

|

Three Months Ended |

||

|

September 30, 2023 |

||

|

Net income |

$ |

18,481 |

|

Depreciation and depletion expense |

23,060 |

|

|

Interest expense |

6,681 |

|

|

Income tax expense |

128 |

|

|

Consolidated EBITDA |

$ |

48,350 |

|

Unit-based compensation |

3,326 |

|

|

Loss on derivative instruments, net of settlements |

4,098 |

|

|

Consolidated Adjusted EBITDA |

$ |

55,774 |

|

Adjusted EBITDA attributable to non-controlling interest |

(12,279) |

|

|

Adjusted EBITDA attributable to Kimbell Royalty Partners, LP |

$ |

43,495 |

|

Adjustments to reconcile Adjusted EBITDA to cash available |

||

|

for distribution |

||

|

Less: |

||

|

Cash interest expense |

4,645 |

|

|

Cash distributions on Series A preferred units |

750 |

|

|

Distributions on Class B units |

21 |

|

|

Cash available for distribution on common units |

$ |

38,079 |

|

Common units outstanding on September 30, 2023 |

73,851,458 |

|

|

Common units outstanding on November 13, 2023 Record Date |

73,851,458 |

|

|

Cash available for distribution per common unit outstanding |

$ |

0.52 |

|

Third quarter 2023 distribution declared (1) |

$ |

0.51 |

|

(1) The difference between the declared distribution and the cash available for distribution is primarily attributable to Kimbell allocating 25% of cash available for distribution to pay outstanding borrowings under its secured revolving credit facility. Additionally, Kimbell utilized approximately $12.4 million of cash flows received from the Q3 2023 Acquired Production after the effective date of June 1, 2023, but prior to the closing date of September 13, 2023, to pay outstanding borrowings under its credit facility and to distribute the additional cash flows to common unitholders. Revenues, production and other financial and operating results from the Q3 2023 acquisition are reflected in Kimbell’s condensed consolidated financial statements from September 13, 2023 onward. |

|

Kimbell Royalty Partners, LP |

||

|

Three Months Ended |

||

|

September 30, 2024 |

||

|

Net income |

$ |

25,805 |

|

Depreciation and depletion expense |

32,155 |

|

|

Interest expense |

6,492 |

|

|

Income tax expense |

1,907 |

|

|

Consolidated EBITDA |

$ |

66,359 |

|

Unit-based compensation |

3,830 |

|

|

Gain on derivative instruments, net of settlements |

(7,066) |

|

|

Consolidated Adjusted EBITDA |

$ |

63,123 |

|

Q4 2023 – Q2 2024 Consolidated Adjusted EBITDA (1) |

208,927 |

|

|

Trailing Twelve Month Consolidated Adjusted EBITDA |

$ |

272,050 |

|

Long-term debt (as of 9/30/24) |

252,160 |

|

|

Cash and cash equivalents (as of 9/30/24) (2) |

(25,000) |

|

|

Net debt (as of 9/30/24) |

$ |

227,160 |

|

Net Debt to Trailing Twelve Month Consolidated Adjusted EBITDA |

0.8x |

|

|

(1) Consolidated Adjusted EBITDA for each of the quarters ended December 31, 2023, March 31, 2024 and June 30, 2024 was previously reported in a news release relating to the applicable quarter, and the reconciliation of net income to consolidated Adjusted EBITDA for each quarter is included in the applicable news release. |

|

(2) In accordance with Kimbell’s secured revolving credit facility, the maximum deduction of cash and cash equivalents to be included in the net debt calculation for compliance purposes is $25 million. |

_______________________________

1 Based on Kimbell rig count of 90 and Baker Hughes U.S. land rig count of 567 as of September 30, 2024.

2 These figures pertain only to Kimbell’s major properties and do not include possible additional DUCs and permits from Kimbell’s minor properties, which generally have a net revenue interest of 0.1% or below and are time consuming to quantify but, in the estimation of Kimbell’s management, could add an additional 15% to Kimbell’s net inventory.

![]() View original content:https://www.prnewswire.com/news-releases/kimbell-royalty-partners-announces-third-quarter-2024-results-302298264.html

View original content:https://www.prnewswire.com/news-releases/kimbell-royalty-partners-announces-third-quarter-2024-results-302298264.html

SOURCE Kimbell Royalty Partners, LP

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Moderna Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Moderna, Inc. MRNA will release earnings results for its third quarter, before the opening bell on Thursday, Nov. 7.

Analysts expect the Cambridge, Massachusetts-based company to report a quarterly loss at $1.9 per share, versus a year-ago loss of $9.53 per share. Moderna projects to report revenue of $1.25 billion for the quarter, compared to $1.83 billion a year earlier, according to data from Benzinga Pro.

On Oct. 28, On Monday, Merck & Co Inc MRK and Moderna announced the initiation of INTerpath-009, a pivotal Phase 3 trial of V940 (mRNA-4157).

Moderna shares fell 2.8% to close at $51.81 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Jessica Fye maintained an Underweight rating and cut the price target from $70 to $59 on Oct. 4. This analyst has an accuracy rate of 61%.

- Jefferies analyst Michael Yee maintained a Hold rating and slashed the price target from $65 to $55 on Oct. 15. This analyst has an accuracy rate of 63%.

- B of A Securities analyst Geoff Meacham maintained a Neutral rating and cut the price target from $130 to $110 on Sept. 13. This analyst has an accuracy rate of 60%.

- Needham analyst Joseph Stringer reiterated a Hold rating on Sept. 13. This analyst has an accuracy rate of 77%.

- Evercore ISI Group analyst Cory Kasimov maintained an In-Line rating with a price target of $120 on June 27. This analyst has an accuracy rate of 70%.

Considering buying MRNA stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.