Smart Money Is Betting Big In GOOGL Options

Deep-pocketed investors have adopted a bearish approach towards Alphabet GOOGL, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GOOGL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 60 extraordinary options activities for Alphabet. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 43% bearish. Among these notable options, 17 are puts, totaling $838,080, and 43 are calls, amounting to $2,307,217.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $120.0 to $350.0 for Alphabet over the recent three months.

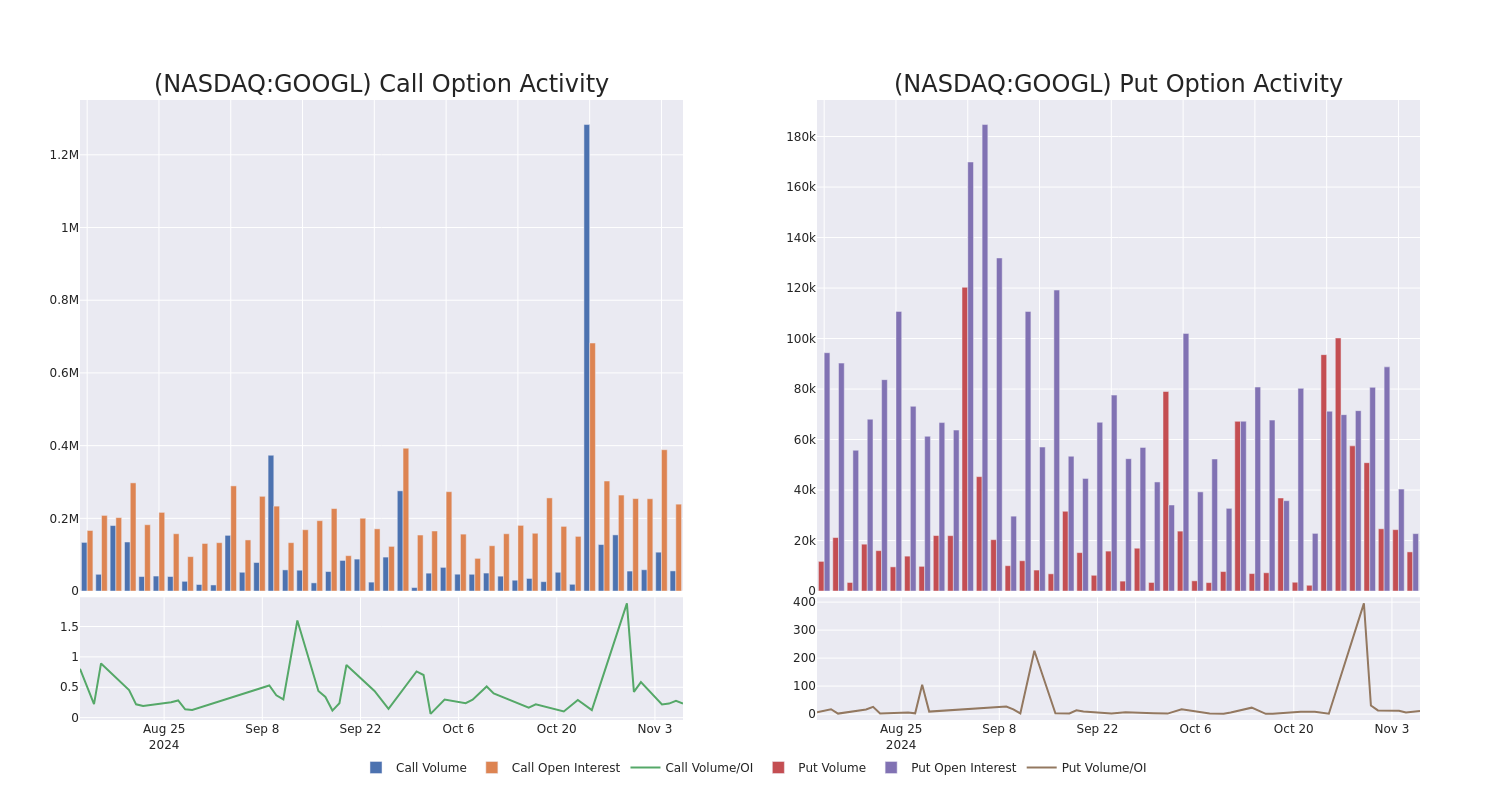

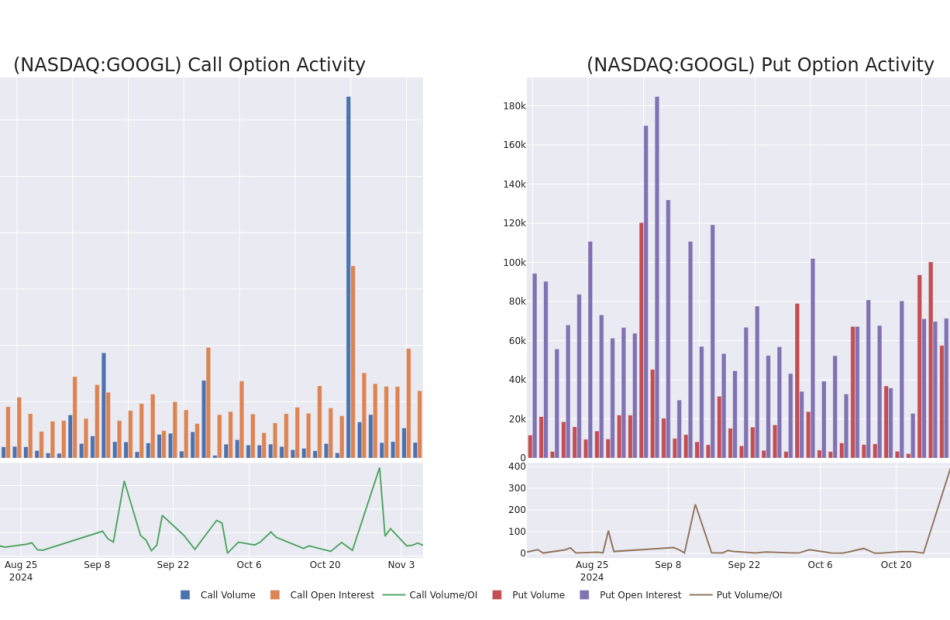

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Alphabet’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Alphabet’s significant trades, within a strike price range of $120.0 to $350.0, over the past month.

Alphabet 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOOGL | CALL | SWEEP | NEUTRAL | 12/13/24 | $7.25 | $7.15 | $7.18 | $175.00 | $272.1K | 806 | 390 |

| GOOGL | CALL | SWEEP | BEARISH | 11/08/24 | $3.45 | $3.4 | $3.4 | $175.00 | $245.2K | 21.4K | 1.6K |

| GOOGL | PUT | SWEEP | BEARISH | 01/16/26 | $171.95 | $168.1 | $170.54 | $350.00 | $136.4K | 0 | 8 |

| GOOGL | CALL | SWEEP | BULLISH | 01/17/25 | $10.5 | $10.4 | $10.45 | $175.00 | $129.5K | 12.9K | 203 |

| GOOGL | CALL | TRADE | BEARISH | 03/21/25 | $11.7 | $11.65 | $11.65 | $180.00 | $116.5K | 4.8K | 403 |

About Alphabet

Alphabet is a holding company that wholly owns internet giant Google. The California-based company derives slightly less than 90% of its revenue from Google services, the vast majority of which is advertising sales. Alongside online ads, Google services houses sales stemming from Google’s subscription services (YouTube TV, YouTube Music among others), platforms (sales and in-app purchases on Play Store), and devices (Chromebooks, Pixel smartphones, and smart home products such as Chromecast). Google’s cloud computing platform, or GCP, accounts for roughly 10% of Alphabet’s revenue with the firm’s investments in up-and-coming technologies such as self-driving cars (Waymo), health (Verily), and internet access (Google Fiber) making up the rest.

In light of the recent options history for Alphabet, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Alphabet

- With a trading volume of 12,298,312, the price of GOOGL is down by -1.03%, reaching $178.88.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 81 days from now.

What The Experts Say On Alphabet

5 market experts have recently issued ratings for this stock, with a consensus target price of $209.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Piper Sandler downgraded its rating to Overweight, setting a price target of $210.

* An analyst from Roth MKM persists with their Buy rating on Alphabet, maintaining a target price of $212.

* An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $205.

* In a cautious move, an analyst from BMO Capital downgraded its rating to Outperform, setting a price target of $217.

* An analyst from Evercore ISI Group persists with their Outperform rating on Alphabet, maintaining a target price of $205.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Alphabet, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply