Unpacking the Latest Options Trading Trends in Expedia Group

Whales with a lot of money to spend have taken a noticeably bearish stance on Expedia Group.

Looking at options history for Expedia Group EXPE we detected 32 trades.

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 53% with bearish.

From the overall spotted trades, 16 are puts, for a total amount of $1,361,552 and 16, calls, for a total amount of $954,831.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $200.0 for Expedia Group during the past quarter.

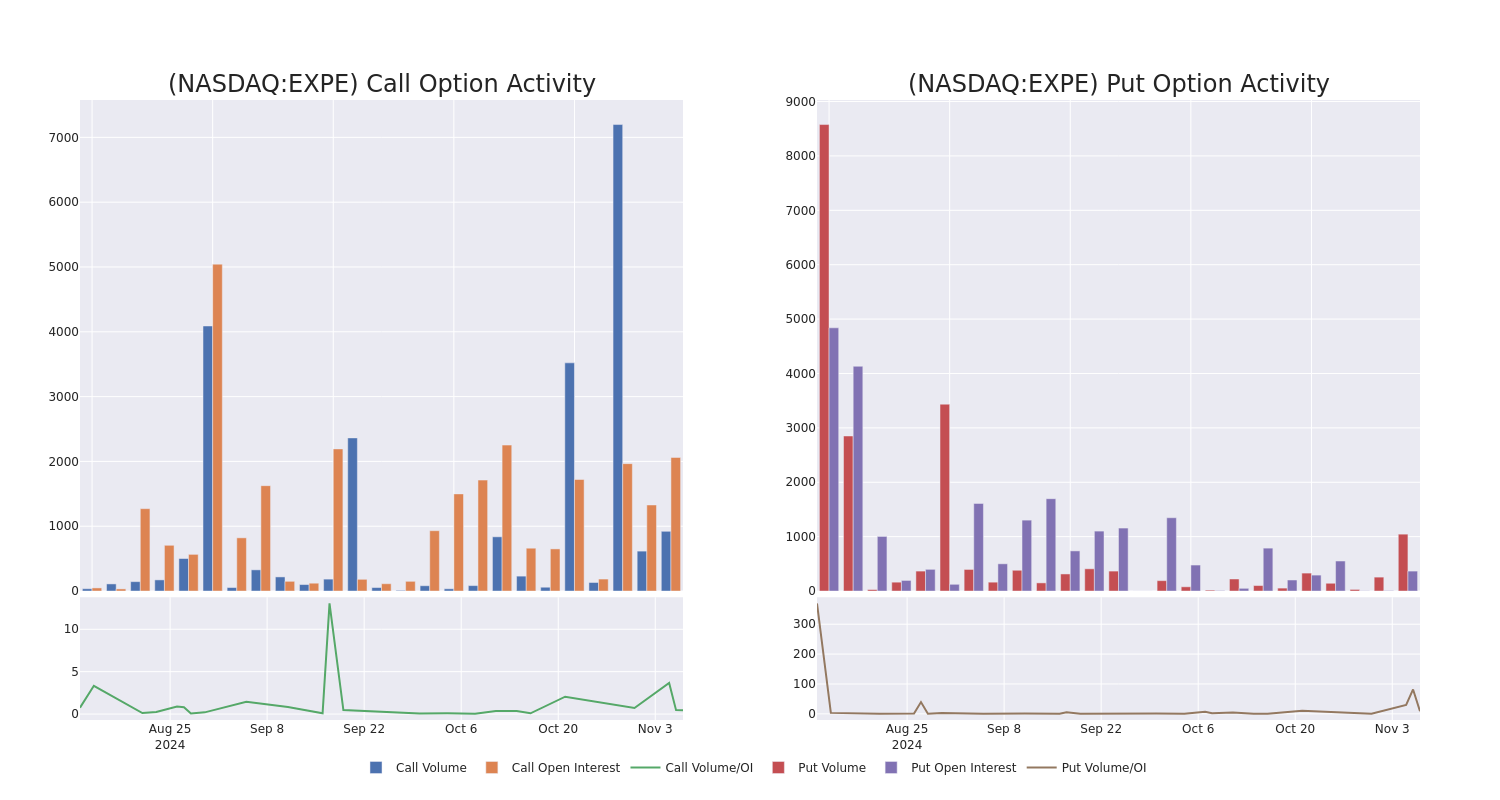

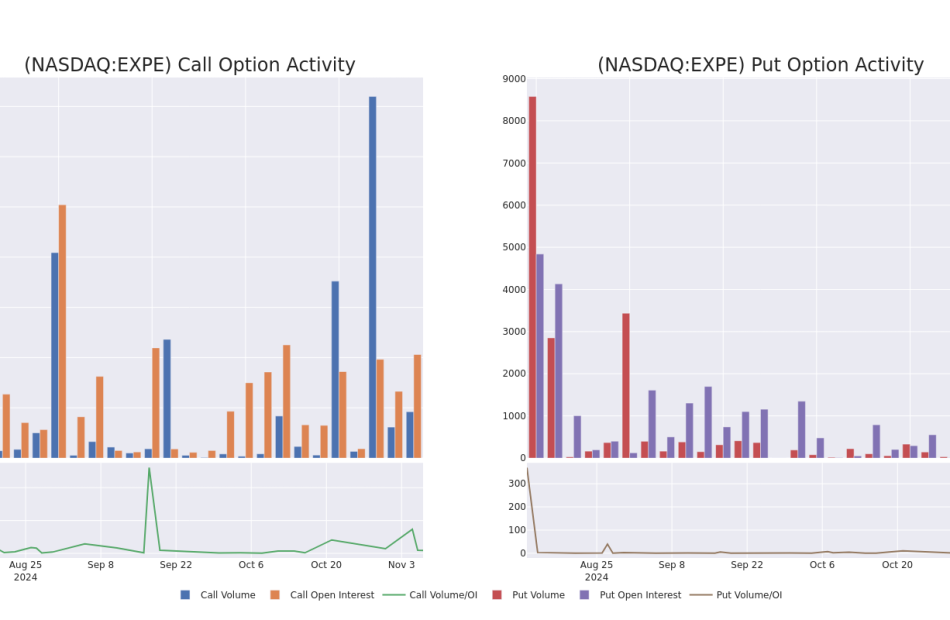

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Expedia Group’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Expedia Group’s substantial trades, within a strike price spectrum from $100.0 to $200.0 over the preceding 30 days.

Expedia Group Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EXPE | PUT | TRADE | NEUTRAL | 01/16/26 | $11.35 | $9.1 | $10.4 | $150.00 | $520.0K | 45 | 0 |

| EXPE | CALL | SWEEP | BEARISH | 11/08/24 | $47.95 | $45.7 | $45.7 | $140.00 | $182.8K | 93 | 40 |

| EXPE | PUT | SWEEP | BEARISH | 04/17/25 | $13.0 | $11.7 | $12.8 | $185.00 | $95.5K | 4 | 76 |

| EXPE | CALL | SWEEP | BULLISH | 11/22/24 | $39.75 | $38.75 | $38.75 | $150.00 | $93.0K | 38 | 33 |

| EXPE | CALL | TRADE | BULLISH | 06/20/25 | $17.7 | $15.9 | $17.7 | $200.00 | $88.5K | 59 | 60 |

About Expedia Group

Expedia is the world’s second-largest online travel agency by bookings, offering services for lodging (80% of total 2023 sales), air tickets (3%), rental cars, cruises, in-destination, and other (11%), and advertising revenue (6%). Expedia operates a number of branded travel booking sites, but its three core online travel agency brands are Expedia, Hotels.com, and Vrbo. It also has a metasearch brand, Trivago. Transaction fees for online bookings account for the bulk of sales and profits.

After a thorough review of the options trading surrounding Expedia Group, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Expedia Group’s Current Market Status

- Currently trading with a volume of 3,695,283, the EXPE’s price is up by 3.48%, now at $180.19.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 90 days.

What The Experts Say On Expedia Group

5 market experts have recently issued ratings for this stock, with a consensus target price of $182.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Expedia Group with a target price of $210.

* An analyst from B of A Securities has decided to maintain their Neutral rating on Expedia Group, which currently sits at a price target of $166.

* An analyst from UBS has decided to maintain their Neutral rating on Expedia Group, which currently sits at a price target of $156.

* Maintaining their stance, an analyst from Wedbush continues to hold a Neutral rating for Expedia Group, targeting a price of $180.

* Maintaining their stance, an analyst from BTIG continues to hold a Buy rating for Expedia Group, targeting a price of $200.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Expedia Group options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply