What the Options Market Tells Us About Super Micro Computer

Financial giants have made a conspicuous bearish move on Super Micro Computer. Our analysis of options history for Super Micro Computer SMCI revealed 39 unusual trades.

Delving into the details, we found 43% of traders were bullish, while 51% showed bearish tendencies. Out of all the trades we spotted, 23 were puts, with a value of $1,781,693, and 16 were calls, valued at $804,721.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $13.0 and $87.0 for Super Micro Computer, spanning the last three months.

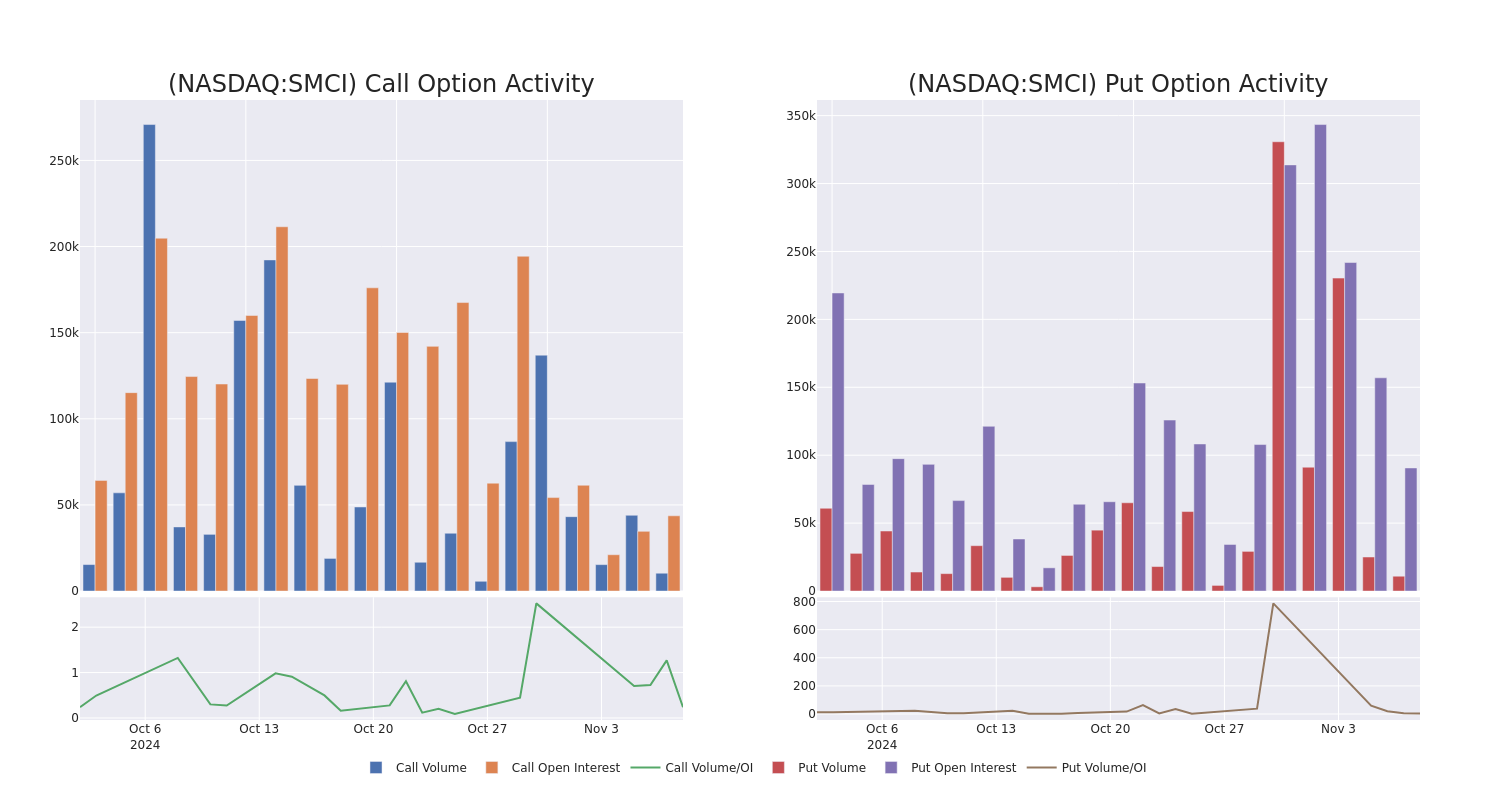

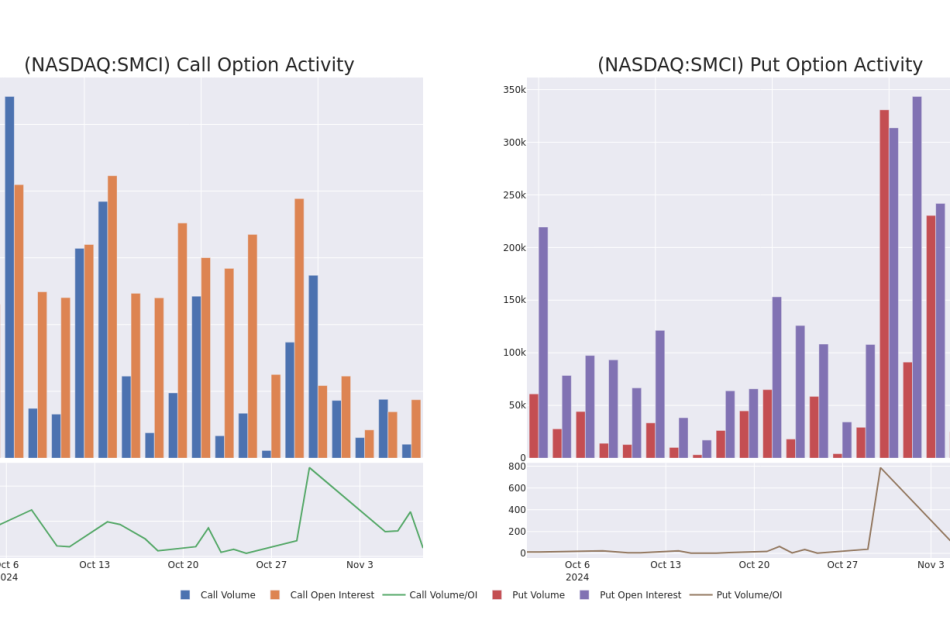

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Super Micro Computer’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Super Micro Computer’s significant trades, within a strike price range of $13.0 to $87.0, over the past month.

Super Micro Computer 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | PUT | SWEEP | NEUTRAL | 06/20/25 | $12.3 | $12.25 | $12.27 | $33.00 | $576.5K | 2.1K | 753 |

| SMCI | PUT | TRADE | BULLISH | 11/15/24 | $13.55 | $13.5 | $13.5 | $38.00 | $135.0K | 5.0K | 115 |

| SMCI | CALL | SWEEP | BULLISH | 02/21/25 | $6.65 | $6.6 | $6.65 | $24.00 | $129.0K | 100 | 350 |

| SMCI | PUT | SWEEP | BEARISH | 11/08/24 | $0.58 | $0.54 | $0.61 | $25.00 | $88.8K | 9.9K | 6.2K |

| SMCI | CALL | TRADE | BEARISH | 01/15/27 | $17.85 | $17.7 | $17.7 | $13.00 | $88.5K | 512 | 72 |

About Super Micro Computer

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and “Internet of Things” embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm’s revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

After a thorough review of the options trading surrounding Super Micro Computer, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Super Micro Computer’s Current Market Status

- With a volume of 53,554,019, the price of SMCI is down -3.89% at $24.49.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 17 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Super Micro Computer options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply