Warning: Warren Buffett Keeps Selling His Favorite Stock for a Surprising Reason

Warren Buffett is a big believer in long-term investing. In fact, many of his largest positions have been in his portfolio for decades. And while he and his lieutenants regularly adjust the publicly traded portfolio at Berkshire Hathaway, there’s a lot less turnover than most professionally managed funds. So when Buffett and company start to heavily sell one of Berkshire’s biggest investments of all time, every investor should pay attention.

In early 2016, Buffett and his investing team began accumulating shares of Apple (NASDAQ: AAPL). Soon, Apple became the largest public holding in Berkshire’s history, with a stake worth roughly $100 billion.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

What do Buffett and Berkshire like so much about Apple? Earlier this year, Buffett compared Apple to two other fixtures in Berkshire’s portfolio: Coca-Cola and American Express:

I can’t really think of a company like American Express that has a position and a credit card that is extremely strong. It has strengthened dramatically over the last 20 years for a lot of reasons. That’s the story of why we own American Express, which is a wonderful business. We own Coca-Cola, which is a wonderful business. And we own Apple, which is an even better business, and we will own, unless something really extraordinary happens, we will own Apple and American Express and Coca-Cola.

It’s quite amazing that Buffett not only compared Apple to Coca-Cola and American Express — blue chip stocks that have been in his portfolio for decades — but he also declared that Apple’s business model was even better than those iconic businesses.

When discussing American Express, he highlighted the company’s immense brand value. American Express cardholders often remain loyal to the company for huge portions of their life, and spend disproportionately more than other card providers like Visa and Mastercard. Buffett’s comments about Apple show the same enthusiasm for its brand power.

“If you’re an Apple user and somebody offers you $10,000, but the only proviso is they’ll take away your iPhone and you’ll never be able to buy another, you’re not going to take it,” Buffett told CNBC last year.

But if Buffett likes Apple so much, declaring that it will remain in Berkshire’s portfolio “unless something really extraordinary happens,” why has Berkshire been consistently trimming its Apple stake? Last quarter alone it nearly cut its Apple position in half.

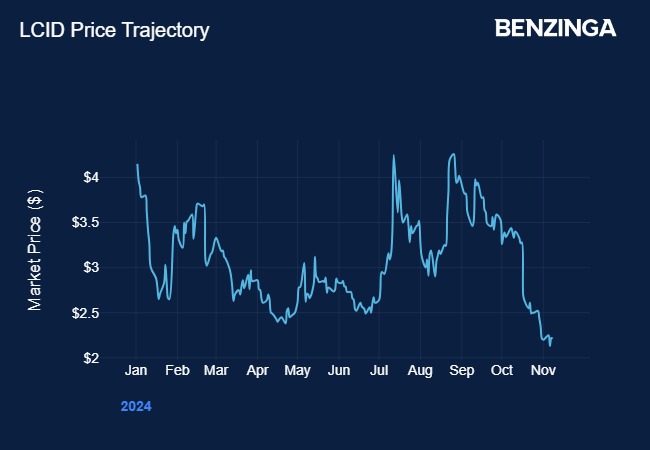

Lucid CEO Scrambles For Damage Control As Shares Plunge 47% This Year: 'As A Major Shareholder…Believe Me, Nobody Is More Incentivized Than Me For Success'

Shares of EV maker Lucid Motors LCID closed at $2.21 on Friday, down by nearly 47% since the start of this year.

What Happened: Lucid CEO Peter Rawlinson sought to assuage investor concerns of dropping share value at the company’s third-quarter earnings call this week.

“I want to assure you that we’re taking significant steps to deliver long-term shareholder value,” Rawlinson said while adding that “challenging” market conditions combined with a number of factors have affected the company’s share price. “This is a long-term play, and we’re indeed, we’re actively working on several initiatives both to drive growth and to improve our financial performance.”

Rawlinson pointed to his holding in the EV company and said, “…as a major shareholder myself personally, believe me, nobody is more incentivized than me for success. And what’s less known, I relate to you all because I put so many of my own savings into this company to make it happen.”

Rawlinson added that he has not sold a single share of his Lucid stock “except what was necessary for tax purposes.”

Rawlinson evaded another question on whether Saudi Arabia’s Public Investment Fund (PIF) will consider buying out Lucid saying it is not his place to speak for the sovereign wealth fund. PIF is a majority stakeholder in Lucid with a nearly 60% stake in the company. It has invested about $8 billion in Lucid since 2018.

Why It Matters: According to data from Benzinga Pro, Rawlinson currently owns about 18.5 million shares of Lucid, worth roughly $41 million as of the stock’s closing price on Friday of $2.21.

Rawlinson, however, is not the sole CEO with a stake in the company they run.

Tesla Inc CEO Elon Musk holds 411 million shares of his EV giant, worth about $132 billion as of the company’s closing share price on Friday of $321.22.

Rivian Automotive CEO RJ Scaringe, meanwhile, holds about 3.5 million shares of his company, worth about $37 million.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo by Around the World Photos on Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Schwab Plans Actively Managed Bond ETF

Schwab Asset Management is bulking up its fixed income ETF lineup with plans to offer an actively managed bond strategy, the Schwab Core Bond ETF.

According to a filing with the Securities and Exchange Commission, the new ETF, which does not yet have a ticker symbol, will be available to investors starting in January.

This represents just the third active ETF for Schwab, which lists 31 total ETFs that combine for $375 billion. The new active Core Bond ETF will seek to provide total return while generating income through U.S. debt securities, including corporate bonds, municipal bonds, and Treasuries, according to the SEC filing.

“Investors have shown an appetite for active bond strategies all year, and Schwab has responded to that demand with ETFs, which is a formula that has worked well for other fund providers throughout 2024.,” said Ryan Jackson, senior manager research analyst at Morningstar.

Jackson added that Schwab is tapping a potentially rich vein of opportunity by building out a presence in the active bond ETF category.

“Active ETFs have enjoyed a tremendous year of flows, and that is especially true when it comes to bond funds,” he said. “About 36% of bond ETF flows streamed into active products for the year to date through October, compared with 24% for active stock ETFs.”

Later this month, Schwab is slated to roll out the Schwab Mortgage-Backed Securities ETF (SMBS) that will track the Bloomberg US MBS Float Adjusted Total Return Index with an expense ratio of 0.03%.

Schwab did not respond to a request for comment for this story.

While the expense ratio is not included in the SEC filing, Nate Geraci, president of the ETF Store, said the trend is veering toward lower fees for active management, and that’s what he is expecting from Schwab.

“What’s remarkable is that players like Vanguard and Schwab are now entering the space with rock-bottom fees, and investors are getting active management from highly respected issuers at basically the cost of index funds,” he said. “The narrative has always been that it’s much easier to generate alpha in fixed income compared to equities, and with an uncertain rate environment moving forward, it makes sense that investors and advisors might want an active manager helping to navigate the bond market.”

Generative AI Software Sales Could Soar 2,790%: 2 AI Stocks to Buy Now That Come Highly Rated by Wall Street

Generative artificial intelligence (AI) leans on large language models and other machine learning models to create media content like images, text, and videos. The technology had its big bang moment when OpenAI introduced ChatGPT in November 2022, and demand for such products is forecast to surge.

Bloomberg Intelligence estimates generative AI software spending will increase 2,790% to approach $320 billion by 2032, compounding at 52% annually. That puts investors in front of a significant opportunity, one that may rival the opportunity created by the internet in the 1990s.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Microsoft (NASDAQ: MSFT) and Datadog (NASDAQ: DDOG) are well positioned to capitalize on growing demand for generative AI software, and both stocks come highly rated by Wall Street:

-

Among the 57 analysts who follow Microsoft, 91% rate the stock a buy. The median price target of $500 per share implies 18% upside from the current share price of $425.

-

Among the 44 analysts who follow Datadog, 88% rate the stock a buy. The median price target of $150 per share implies 18% upside from the current share price of $127.

Here’s what investors should know about Microsoft and Datadog.

Microsoft is largest commercial software company in the world due to strength in business productivity (Office), enterprise resource planning (Dynamics), and several cybersecurity verticals. The company is leaning into that strength with generative AI copilots, and early results are encouraging. Already, nearly 70% of Fortune 500 companies use Microsoft 365 Copilot, which automates tasks in applications like Word and Excel.

Beyond software, Microsoft also operates the second-largest public cloud in the world. Azure accounted for 20% of cloud infrastructure and platform services in the recent quarter, down 3 percentage points from the previous year. However, a recent CIO survey from Morgan Stanley showed Microsoft as the vendor most likely to gain share over the next three years, due in large part to strength in AI arising from its partnership with OpenAI.

Microsoft reported solid financial results in the first quarter of fiscal 2025, which ended in September 2024, beating estimates on the top and bottom lines. Revenue rose 16% to $65.6 billion on particularly strong sales growth in advertising and cloud services. Meanwhile, generally accepted accounting principles (GAAP) net income increased 10% to $3.30 per diluted share. Importantly, the recent acquisition of Activision added 3 percentage points to sales growth and subtracted 2 points from earnings growth.

Want $10 Million in Retirement? 1 Simple ETF to Buy and Hold for Decades.

Most of us would love to have $10 million stashed away when we retire. Yet most of us will never get there. In fact, most of us will get nowhere close. But that doesn’t mean attaining a $10 million nest egg is out of the question. You’ll have to remain incredibly disciplined, but if you follow the investing tricks below, you’ll only need one exchange-traded fund (ETF) to get you to that magic mark.

Before we jump into where you should invest your money, it’s critical that we cover how you should be investing your money. After all, this is the real secret behind acquiring massive long-term wealth.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Perhaps the greatest trick of all time for building wealth is recurring investments. Instead of spending the next few minutes researching which stocks or ETFs you want to buy, take a moment to activate automated investing in your online brokerage account. The long-term results will be tremendous.

Recurring investments simply mean that your brokerage account is automatically investing a set amount of money per month for you, without you needing to lift a finger. For example, your brokerage account can withdraw $500 from your savings account on the first of each month, investing the proceeds into an ETF that tracks the S&P 500. While choosing good investment vehicles is important, putting more money to work on a regular basis is equally important. This not only ensures regular saving, but also helps you dollar-cost average, locking in attractive entry points for new deposits.

Let’s say you start with exactly zero dollars. If you invest $500 automatically per month and earn the long-term market average of roughly 10%, you’ll wind up with a $10 million portfolio in less than 53 years. That means a recent high school graduate who employs this investment method will be worth $10 million at age 71. Not bad!

If you want to get to $10 million faster, there are a few things you can do. First, start with more than zero dollars. Second, invest more than $500 per month. Third, earn more than 10% per year. But regardless of which lever you try to play with, automated investments is a must-have for investors looking to reach the $10 million mark.

This leaves only one question: Where should your automated investments be invested?

If you’re ready to start saving, the only ETF you’ll ever need is the Vanguard S&P 500 ETF (NYSEMKT: VOO). That’s because over many decades, this ETF has produced average returns of more than 10%. And because it’s a Vanguard fund, its expense ratio is just 0.03% — nearly as low as it gets!

US Inflation Progress Gets Harder in Last Mile Down

(Bloomberg) — US inflation probably moved sideways at best in October, highlighting the uneven path of easing price pressures in the home stretch toward the Federal Reserve’s target.

Most Read from Bloomberg

The core consumer price index due on Wednesday, which excludes food and energy, likely rose at the same pace on both a monthly and annual basis compared to September’s readings.

The overall CPI probably increased 0.2% for a fourth month, while the year-over-year measure is projected to have accelerated for the first time since March.

“The October CPI report will likely support the notion that the last mile of inflation’s journey back to target will be the hardest,” Wells Fargo & Co. economists Sarah House and Aubrey Woessner wrote in a report. “Excluding the more volatile energy and food components, the unwinding of pandemic-era price distortions has proven to be frustratingly slow.”

They added that prices of core goods probably rose again in October, due in part to higher demand for cars and auto parts after Hurricanes Helene and Milton. Evacuation orders from the storms also forced more people to stay in hotels, continuing what’s been a “glacial slowing” in services prices.

What Bloomberg Economics Says:

“We expect both CPI and PPI to come in hot, pushing long-end rates even higher — and further restraining the economy over the next couple months. We expect control-group retail sales to slow and the unemployment rate to continue to climb, reaching 4.5% by year end,”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou, Chris G. Collins, economists. For full analysis, click here.

Even so, “the story is very consistent, with inflation continuing to come down on a bumpy path,” and one or two bad reports won’t change that pattern, Fed Chair Jerome Powell said Thursday after the central bank cut interest rates by a quarter point.

The US government will also release wholesale inflation figures in the coming week, which probably picked up after stalling in September. Meantime, earnings growth that continues to outpace inflation likely contributed to another decent gain in retail sales, in data due Friday.

On Tuesday, Fed Governor Christopher Waller is due to speak at a banking conference before the central bank releases its latest Senior Loan Officer Opinion Survey. Powell is scheduled for an event later in the week, while New York Fed President John Williams and Dallas Fed President Lorie Logan are also on the calendar.

Trump Rally Runs On As Tesla, Palantir Fly; Five Stocks Near Buy Points

Dow Jones futures will open Sunday evening, along with S&P 500 futures and Nasdaq futures, after stocks surged to record highs following Donald Trump’s presidential victory.

The Dow Jones and S&P 500 had their best weeks in a year while hundreds of leading stocks gapped out to new highs betting on a tailwind under a second Trump administration Tesla (TSLA) skyrocketed back above a $1 trillion market cap, with CEO Elon Musk was a huge backer of the Trump election effort. Palantir Technologies (PLTR) had an even better week, with earnings leading the way.

There were many big earnings winners this week, though also notable losers.

↑

X

This Stock Could Be The Next Chipotle. But Can It Maintain Stellar Earnings Growth?

Earnings season remains active. Monday.com (MNDY) will report Q3 results before the open. MNDY stock is extended, a common problem for leading stocks.

But not Meta Platforms (META), Google-parent Alphabet (GOOGL), CrowdStrike (CRWD), Vertex Pharmaceuticals (VRTX) and brand-new Dow Jones component Nvidia (NVDA). Meta and Google stock are just below buy points. CrowdStrike stock, Vertex and Nvidia are actionable now.

Nvidia, Meta and Vertex stock are on IBD Leaderboard, with Tesla stock on the Leaderboard watchlist. Nvidia stock is on SwingTrader. Palantir stock, Nvidia and Monday.com are on the IBD 50. Google was Friday’s IBD Stock Of The Day.

Dow Jones Futures Today

Dow Jones futures open at 6 p.m. ET on Sunday, along with S&P 500 futures and Nasdaq 100 futures.

Remember that overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Stock Market Rally

The stock market rally saw huge gains in the past week. The Dow Jones Industrial Average jumped 4.6% in last week’s stock market trading, the S&P 500 index popped 4.7% and the Nasdaq composite leaped 5.7% — all hitting record highs.

The small-cap Russell 2000 spiked 8.6% to its best levels since its all-time high in November 2021.

Markets are booming on hopes that Trump’s return to the White House, backed by a GOP Congress, will mean tax cuts, deregulation and increased merger activity.

Meanwhile, the Federal Reserve cut rates again on Thursday. Fed Chief Jerome Powell signaled that rate cuts would continue. And he said policymakers won’t consider Trump’s fiscal policies until they actually take shape.

As the sector ETFs below show, stock market gains were broad and deep.

Dozens, if not hundreds of stocks had double-digit weekly gains. Tesla skyrocketed 29%, but Palantir stock shot up 39%, Axon Enterprise (AXON) nearly 42% and on and on.

The 10-year Treasury yield fell 5 basis points to 4.31%, tumbling from Wednesday’s four-month intraday high of 4.48%. The two-year Treasury yield, more closely tied to Fed policy, rose 5 basis points to 4.25%.

U.S. crude oil futures rose 1.3% to $70.38 a barrel for the week.

ETFs

Among growth ETFs, the Innovator IBD 50 ETF (FFTY) leaped 11.5% last week. The iShares Expanded Tech-Software Sector ETF (IGV) ran up 9.7%, with Palantir and CrowdStrike both notable members. The VanEck Vectors Semiconductor ETF (SMH) gained 6%, with Nvidia stock the dominant member.

ARK Innovation ETF (ARKK) spiked 15.9% last week and ARK Genomics ETF (ARKG) bolted 7.9%. Tesla stock is still a big holding across Ark Invest’s ETFs. Cathie Wood has also built up a big Nvidia position.

SPDR S&P Metals & Mining ETF (XME) jumped 8.5% last week. The Global X U.S. Infrastructure Development ETF (PAVE) advanced 9.2%. U.S. Global Jets ETF (JETS) ascended 5.6%. SPDR S&P Homebuilders ETF (XHB) gained 3.6%. The Energy Select SPDR ETF (XLE) popped 6.5%. The Health Care Select Sector SPDR Fund (XLV) was up 1.65%, with Vertex stock a holding. The Industrial Select Sector SPDR Fund (XLI) bounced 6%.

The Financial Select SPDR ETF (XLF) rallied 5.5% and the SPDR S&P Regional Banking ETF (KRE) spiked 10.45%.

Time The Market With IBD’s ETF Market Strategy

Stocks Near Buy Points

Meta stock rose 3.9% to 589.34 last week, rebounding from the 10-week line and retaking the 21-day. The Facebook and Instagram parent now has a new flat base, base-on-base pattern with a 602.95 buy point.

Google stock gained 4.1% to 178.54 last week, nearing a 182.02 cup-with-handle buy point. A move above Thursday’s high of 181.08 would offer a slightly early entry. The relative strength line is still near the lowest levels since March, reflecting Google’s underperformance vs. the S&P 500.

CrowdStrike stock jumped 8.9% to 330.03, retaking the 200-day line and clearing a 323.94 cup-with-handle buy point, according to MarketSmith analysis. The RS line still well off June’s peak, though it’s making a comeback. CrowdStrike plunged after triggering a global IT outage on July 19, with fears of hefty liability costs and long-term reputational damage in focus. The cybersecurity giant reports earnings in late November, with investors curious to see if CrowdStrike is finding its footing.

Vertex stock surged 9.7% in the week to 516.74. Shares peeked past early entries on Thursday then ran past the 510.63 flat-base buy point on Friday. Vertex earnings and sales beat on Nov. 4, but the focus is on the pipeline. In January, the FDA will consider approving Vertex’s next-generation cystic fibrosis drug and its pain treatment.

Nvidia stock, which joined the Dow Jones on Nov. 8, rallied 8.7% in the week to 147.15, back above a 140.76 consolidation buy point. The buy zone runs to 147.80. Investors also could treat the Oct. 22 high of 144.42 as a high-handle entry. Nvidia earnings are due Nov. 20.

Five S&P 500 Stocks On This Elite IBD List Near Buy Points

Tesla Stock

Tesla stock spiked 29% to 321.22, the biggest weekly gain since the week ended Jan. 27, 2023. Tesla stock now a $1.03 trillion valuation, topping the $1 trillion for the first time in two years.

Musk was a huge Trump supporter, and could join the new administration in an official or advisory capacity.

It’s not clear how much Trump could or will do regarding EVs, or even if those moves would be a net benefit to Tesla. On self-driving, it’s technology not regulators that are holding back Tesla, though there’s likely less risk from regulatory probes of Tesla crashes.

But what is clear is that TSLA stock reflects an investor belief that Trump will be a boon to Tesla.

What To Do Now

The stock market rally is in great shape. The major indexes and leading stocks suggest that this could be the start of another big bull run.

So you want to be heavily invested. If you aren’t, build up your exposure gradually, buying leading stocks that aren’t extended. If you are, you can make more buys, depending on how your risk tolerance is. But also go through your portfolio and see if you there are can prune some laggards and funnel that cash into winners.

A pullback in the indexes or near-vertical stocks would not be a surprise. And while a massive period of news is in the rearview mirror, earnings season will remain heavy for the next few weeks.

Work on your watchlists to spot stocks that are in range or setting up.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.

YOU MIGHT ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Best Growth Stocks To Buy And Watch

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

How To Invest: Rules For When To Buy And Sell Stocks In Bull And Bear Markets

‘Roaring 20s’ on Wall Street could extend into the 2030s after likely Republican sweep, market veteran says

Since the U.S. economy began rebounding from the pandemic, market veteran Ed Yardeni has been banging the drum that a new “Roaring 20s” will drive Wall Street.

Now, with Donald Trump headed back to the White House, Republicans retaking the Senate, and the House likely staying in GOP control, a decade of bullish returns not only looks more probable, it could have longer legs.

“Indeed, it increases the odds that the good times will continue through the end of the decade and possibly into the 2030s,” Yardeni, the president of Yardeni Research, wrote in a note on Wednesday.

This decade is already off to a strong start. Except for a down year in 2022, when the Federal Reserve began an aggressive rate-hiking cycle, the S&P 500 has notched double-digit returns each year and is already up nearly 26% so far in 2024.

That comes after markets had their best week in a year, soaring after Trump’s decisive win with a Republican sweep looking likely. For the week, the S&P 500 finished up 4.7%, the Dow Jones Industrial Average gained 4.6%, the Nasdaq jumped 5.7%, and the small-cap Russell 2000 soared 8.6% as investors bet on lower taxes and deregulation juicing the economy further.

“We’re sticking with our investment recommendation to Stay Home rather than to Go Global,” Yardeni wrote. “In other words, overweight the US in global stock portfolios.”

Of course, the Roaring 20s from a century ago infamously ended with the stock market crash in 1929, which sparked the Great Depression that lasted through the 1930s.

And for his part, Yardeni sees other scenarios this century. But his view for a new Roaring 20s is the most likely with 50% odds, while a 1990s-style stock market “meltup” has 20% odds, and a 1970s-style geopolitical crisis with a possible US debt crisis has a 30% probability.

“But we are considering raising the odds of the Roaring 2020s scenario as a looser regulatory environment and lower corporate and income taxes under Trump 2.0 should boost investment and propel productivity-led economic growth,” he added.

Yardeni has also been warning about “bond vigilantes” sending yields higher as the outlook for U.S. debt and deficits continues to deteriorate. Trump’s tax cuts and tariffs are also seen as inflationary, limiting the Fed’s ability to cut rates further.

But Scott Bessent, who has been floated as a possible Treasury secretary under Trump, has noted that lower energy prices and deregulation are disinflationary and could offset the potential inflationary effects of higher tariffs.

Super Micro Computer Shares Fall Again on Latest Update. Is the Bottom In, or Is There More Downside Ahead for the Stock?

Shares of Super Micro Computer (NASDAQ: SMCI) were once again tumbling after the company provided investors with an update on its fiscal first-quarter results, as well as its current audit and filing process. Supermicro was a huge winner early in the year, with its stock quadrupling within the first three months of 2024. However, its shares are now solidly in negative territory year to date after this latest dip.

Let’s take a closer look at Supermicro’s latest wows and consider what investors should do with the stock.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

In an update to investors, Supermicro said it now expects its fiscal Q1 sales to be in the range of $5.9 billion to $6.0 billion. Earlier guidance was for revenue to be between $6 billion and $7 billion. While clearly a disappointment, it is notable that last year, the company produced revenue of $2.1 billion. So even with the lowered expectation, revenue will still nearly have tripled year over year.

Supermicro is now looking for adjusted earnings per share (EPS) to be in a range of $0.75 to $0.76, down from its prior guidance range of $0.67 to $0.83. That would be up from $0.34 a year ago when adjusting for the stock’s earlier 10-for-1 stock split.

Gross margins, which were a big issue for the company last quarter when they slipped to 11.2% from 15.5% in the fiscal third quarter and 17% a year ago, were projected to come in at 13.3%. This is a sequential improvement that moves it back closer to its more historic 15% to 17% range. However, this is very much a low-margin business. Chip companies like Nvidia and Broadcom have gross margins closer to 75%.

Looking ahead to its second fiscal quarter, Supermicro forecast revenue to come in between $5.5 billion to $6.1 billion, with adjusted EPS of between $0.56 to $0.65. A year ago, the company recorded fiscal Q2 sales of $3.66 billion and adjusted EPS of $0.56 split adjusted.

As for its accounting, Supermicro said that the Special Committee it formed found no evidence of fraud by management, but that it will issue some remedial measures to help the company strengthen its internal governance and oversight functions. However, the company is unable to determine when it will file its 10-K annual report, which was due on Aug. 29.

With the company not currently able to file its annual report, the stock is at risk of being delisted by the Nasdaq. The stock exchange sent Supermicro a letter of non-compliance on Sept. 17, and it has 60 days to file or submit a plan to regain compliance. At the moment, it appears the stock is in serious danger of getting delisted, since the company does not even currently have an auditor after Ernst and Young recently resigned.

Can Anything Save Super Micro Computer?

What is going on at Super Micro Computer (NASDAQ: SMCI)?

Shares of the once high-flying artificial intelligence (AI) server company have collapsed after a growing scandal has enveloped the business.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

This timeline shows how the story has unfolded:

-

Aug. 27: In a short-seller report, Hindenburg Research accuses the company of accounting manipulation, self-dealing, sanctions evasion, and channel stuffing. The stock plunges.

-

Aug. 28: Supermicro files notice that it’s unable to submit its 10-K in a timely manner. At the time, it said it needed more time to “complete its assessment of the effectiveness of its internal controls over financial reporting.” It also said it didn’t anticipate any changes to the fiscal 2024 results it had reported on Aug. 6.

-

Sept. 3: Supermicro sends a letter to customers and partners, reasserting it didn’t anticipate material changes to its fiscal 2024 results. It also called the short-seller report false and inaccurate while reminding customers that recent events don’t impact its products.

-

Sept. 20: Supermicro says it received a letter from Nasdaq saying it was out of compliance because of its late 10-K filing. The company has 60 days to regain compliance or submit a plan for doing so.

-

Sept. 26: The Wall Street Journal reports the Justice Department is investigating Super Micro Computer, apparently in response to accusations from a former employee about accounting violations.

-

Oct. 30: Supermicro says its auditing firm, Ernst & Young (EY), has resigned. In July, EY had communicated concerns about Supermicro’s financial reporting, warning that a timely filing of the 10-K was at risk. EY ultimately told the company it couldn’t rely on management’s representations and is unwilling to be associated with the financial statements prepared by the company.

-

Nov. 5: Supermicro reports preliminary fiscal 2025 first-quarter earnings, missing estimates. The stock tumbles further.

Supermicro reported preliminary first-quarter results, and the numbers were both incomplete and below expectations. It said revenue would fall in the range of $5.9 billion to $6.0 billion, below its previous guidance of $6.0 billion to $7.0 billion. On the bottom line, it expects adjusted earnings per share of $0.75 to $0.76, at the middle of its previous range of $0.67 to $0.83.

For the fiscal second quarter, management sees revenue falling sequentially to $5.5 billion to $6.1 billion with adjusted earnings per share of $0.56 to $0.65.