My 2 Favorite Stocks That Investors Will Be Piling Into Next Year

Investing isn’t about living in the past, but buying companies that will do well in the future. You want to buy stocks that can grow sales and earnings while also trading at a reasonable valuation. A tough task, especially when the broad S&P 500 index is trading at a price-to-earnings ratio (P/E) close to all-time highs.

In bull markets, smart investors stray away from the red-hot and popular stocks trading at nosebleed earnings multiples. Instead, they target stocks that are flying under the radar.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

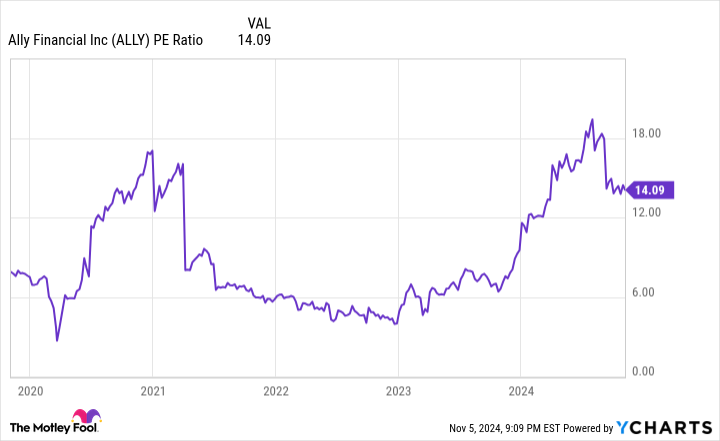

Two of my favorite under-the-radar stocks I think investors will be piling into next year are Coupang (NYSE: CPNG) and Ally Financial (NYSE: ALLY). Here’s why I think the companies are fantastic buy-and-hold investments for the next decade.

One of the fastest-growing large-cap stocks in the world is Coupang. The e-commerce platform, which started out selling in South Korea and has now expanded into Taiwan, has seen its stock rise 70% year to date, crushing the performance of the broad market indexes.

With close to half the South Korean population using its e-commerce website, Coupang is now as ubiquitous as Amazon in the United States and is widening its advantage over competitors. Last quarter, net revenue across its South Korean e-commerce business hit close to $7 billion and grew 20% year over year in constant currency.

Customers are attracted to Coupang’s ultra-fast delivery and the variety of services it offers with its Rocket Wow premium subscription service. Similar to Amazon Prime, Rocket Wow gives customers access to premium streaming video content, discounts on food delivery, and groceries delivered in as little as a few hours.

Coupang has more ambitions than just being an e-commerce website in South Korea. It has a fintech subsidiary, has expanded internationally to Taiwan, and has an internal food delivery service called Coupang Eats.

These segments are combined into Coupang’s Developing Offerings revenue line, which is growing like gangbusters. Last quarter, revenue for the segment soared 347% year over year to $975 million. Excluding its acquisition of fashion website Farfetch, the segment would have still grown sales by 146% year over year in the quarter.

Despite all these investments for growth, Coupang generates positive net income. It had only a slight profit of $64 million last quarter but is able to self-fund its reinvestment as it targets a market opportunity of hundreds of billions of dollars every year.

Leave a Reply