Trump’s win brings good news for savers

The U.S. election results are producing opportunities for retirees and other savers — as long as they have some money set aside.

The rate on 10-year Treasury notes BX: TMUBMUSD10Y has leapt toward last year’s highs in the wake of Tuesday’s result, which has put the Republican Party in control of the White House and the Senate and may also leave it in control of the House of Representatives. The interest rates on inflation-protected U.S. government bonds are nearing the highest levels seen since the global financial crisis in 2008.

In fact, 10-year Treasury yields of nearly 4.7%, and long-term inflation-protected yields of nearly 2.3%, represent appealing low-risk savings opportunities for those looking for security and income rather than the volatile growth that comes from stocks.

Savers can buy these bonds directly at many brokerage firms, or they can buy a basket of bonds through mutual funds or exchange-traded funds.

A big risk is that these interest rates could keep rising. But they are already a dramatic improvement from where they were before the polls closed on Election Day, and from the lows seen in September.

The interest rate on the 10-year Treasury note jumped by 0.2 percentage points to 4.44% on news of the “red wave” election. The rate on inflation-protected TIPS bonds rose as high as 2.25% on long-term bonds, a four-month high.

Long-term interest rates rose as the market digested the budgetary and economic implications of the election sweep.

“For a Treasury market that was already reeling, Trump’s victory has put additional pressure on rates, as evidenced by the historic move higher in Treasury yields as the Trump victory became clearer overnight,” Lawrence Gillum, chief fixed-income strategist for LPL Financial, said in a note to clients.

“Treasurys began to sharply bear steepen on a Trump victory as markets pencil in higher deficits and inflation,” the strategy team at TD Securities reported. “A Red Wave is likely to bring a wholesale renewal of the [2017] tax cuts and some additional tax cuts. This amounts to additional deficits of approximately $5 [trillion] over the coming decade relative to the current Congressional Budget Office (CBO) baseline.”

Someone Asked Nancy Pelosi, 'The Greatest Options Trader Of All Time,' What Stocks To Buy – To Her Face. It Went Exactly As You'd Imagine

In a viral interaction, comedian Alex Strenger confronted former House Speaker Nancy Pelosi during a book signing at the Texas Tribune Festival in Austin. Strenger, who posed as a Democrat, showered Pelosi with praise before asking the question everyone has on their mind: what stocks should they buy?

Don’t Miss:

Strenger went up to Pelosi as she autographed copies of her recently released book, “The Art of Power.” He called her “the greatest options trader of all time” and asked her head-on what stocks he should buy. Wearing a COVID mask and a Bernie Sanders cap, Strenger acted as a sincere supporter, praising Pelosi’s commitment to democracy and voicing worries about Donald Trump.

Trending: With over 7.8K investors including Meta, Google, And Amazon Execs — this AI Startup’s valuation has skyrocketed from $5 million to $85 million in just three years. Be an early investor with just $1,000 for only $0.50/share today before the offer closes in 2 weeks.

“Nancy, you’re the greatest options trader of all time,” Strenger said, maintaining a satirical tone. “I just want to know what stocks I should buy.” The crowd – and security – didn’t seem to find the humor in his request. Security guards eventually stepped in and escorted Strenger away, but not before he added a jab about Pelosi’s wealth compared to her congressional salary.

Pelosi, whose husband Paul has made headlines for his well-timed stock trades, mostly kept her composure. She briefly responded to Strenger’s remarks before security moved him aside.

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

The interaction went viral, drawing a range of reactions online. Reddit users were divided – some found Strenger’s questioning amusing and brave, while others thought he lacked confidence, noting his trembling voice.

Car dealer who will be US Senator says he and Trump want to overhaul car industry

The first car dealer ever elected to the U.S. Senate says the Trump agenda for the U.S. auto industry is one that, if enacted, would upend the strategy Detroit’s automakers have spent billions of dollars pursuing: The transition to electric cars.

For one thing, Republicans will look to freeze fuel economy standards for at least a decade — which would slow EV adoption and anger environmentalists. A second Donald Trump administration may also look to take away California’s ability to set its own strict emissions standards. Also, it is likely to repeal parts of the Inflation Reduction Act, including the $7,500 tax credit consumers receive now toward the purchase of an EV, a benefit that’s helped the Detroit automakers sell the cars.

Trump’s agenda could also include rewarding companies with big tax breaks if they build cars in the United States. These initiatives were laid out to the Detroit Free Press in an exclusive interview with Bernie Moreno, a former car dealer who won election Tuesday to the U.S. Senate from Ohio. Moreno said he and Trump, who endorsed each other, have discussed the industry and “I think we are on the same page here.”

The ideas are eye-popping considering General Motors has set 2035 as the date to be all-electric. Ford Motor Co. and Stellantis also have aggressive targets to add electrification to their lineups over the next decade. Industry watchers have warned that government action to slow EV research and production will ultimately leave American automakers behind as the world electrifies automotive transportation.

Environmental activists expressed alarm.

“Gutting the clean car standards makes no sense for drivers and their wallets, autoworkers or really anyone who breathes,” said Kathy Harris, director for clean vehicles at Natural Resources Defense Council. “The vehicle standards are the largest single action taken to address climate change, cutting as much carbon pollution as the entire U.S. economy now emits annually. With climate-fueled storms and heat waves harming so many already, the only winners would be Trump’s donors in the oil industry, as drivers would pay more at the pump.”

But Moreno, 57, backed by more than 1,000 auto dealers in a campaign that cost him and his rival, incumbent Democrat Sherrod Brown, a record $500 million, said the industry must focus on cars that people want to buy and can afford.

Ignoring market and making ‘cars people don’t want’

Moreno touched on several topics, most notably his issue with automakers pushing out EVs to meet what he said are unrealistic government fuel economy standards. That, he said, is causing sky-high prices for gasoline vehicles so companies can offset the billions they are losing by producing EVs. According to Kelley Blue Book, the average transaction price for a new vehicle in the U.S. was $48,397 in September.

“Anybody who even has a (basic) understanding of how the automobile industry works in America would tell you that the secret sauce is the marketplace,” Moreno said Thursday, noting that sales signal to automakers what consumers want and don’t want.

“But for the first time in automotive history, car companies decided, ‘We’re not going to pay attention to our customers. We’re going to pay attention to our political leaders and make cars people don’t want,’ ” Moreno said. “The money that has been wasted and lost in this … move to electric vehicles is just absolutely insane. Ford has lost billions of dollars trying to pacify political leaders that were completely unqualified to be giving any kind of advice.”

Ford’s EV division, called Ford Model e, lost $1.2 billion in pretax profits during the third quarter and is expected to lose about $5 billion by the year’s end.

While EVs are not yet profitable, GM has promised Wall Street it would get its EVs to a variable profit position — meaning the revenue GM earns from selling the vehicle exceeds the direct cost of producing it — by year-end.

Kelley Blue Book reported 346,309 EVs were sold in the third quarter in the country, a 7.8% increase from the year-ago quarter and putting the EV share of sales at 8.9%, the highest level recorded. But EV sales are still not growing at the pace the industry had been expecting, and Moreno’s contention is that most EV sales are being driven by incentives such as the $7,500 federal tax credit.

Making an ‘American automotive renaissance’

Moreno, the first car dealer elected to the Senate, is a 1989 graduate of the University of Michigan with a bachelor’s degree in business administration.

He said he and President-elect Trump share the same vision for overhauling the American auto industry: They want to create more jobs, bring down prices of new vehicles, repeal many of the environmental regulations that are driving automakers’ aggressive EV push and keep foreign-built cars offshore with high barriers to entry.

The plan includes lowering energy prices and incentivizing automakers to shift all manufacturing to the United States.

“We’re going to have an American energy and American automotive renaissance in this country unlike anything you’ve seen,” Moreno said.

He noted that all the initiatives would have to pass through Congress and Trump would have to support them as well, but Moreno said the two are like-minded.

It’s “the reason President Trump endorsed me and I endorsed President Trump,” Moreno said. A Trump spokesperson had not responded Friday morning to a message seeking comment.

Keeping China’s ‘garbage cars’ offshore

That includes the idea of doing whatever it takes to ensure vehicles are made in America, not China or Mexico and then imported here.

“The minute that China thinks they can come here with their cheap, fully electric garbage cars … they’re sadly mistaken. These cars will come in here with dramatically high tariffs that will make those cars unsellable,” Moreno said. “We’re not going to be suckers anymore. We’re going to protect American workers and American jobs.”

Industry watchers have praised the quality of cars and their advanced battery technology produced by China’s BYD, which late last year briefly slipped ahead of Tesla in global EV sales.

Trump has said he would impose a 10% to 20% tariff, the taxes put on goods coming into a country, on all imports, including tariffs as high as 60% to 100% for goods from China. Moreno said if some auto parts can’t be made here, “we’re not going to tariff those things immediately,” but anything that can be made here should be made here, he said.

“Look, Lincoln has decided to make a lot of its cars in China and that’s a bad decision,” Moreno said. “They’re going to find that it’s a very bad decision. They should be making those cars here.”

Ford builds the Lincoln Nautilus in China and GM builds its Buick Envision in China, both SUVs that are sold in the United States. All three Detroit automakers build various vehicles in Mexico that are sold in the U.S.

Ford said that over the past five years, it has exported more vehicles made in America to China than the other way around. Also, while its luxury brand, Lincoln, imports one model into the U.S., Ford has exported many more models, such as F-150, Mustang, Bronco, Explorer and Lincoln Continental, Aviator and Navigator.

Ford spokeswoman Robyn Jackson said in a statement to the Free Press, “Ford has bet on U.S. production and American workers more than any other automaker. As the No. 1 automaker in terms of production, employment and exporting vehicles from the USA to other markets, we look forward to working with the new administration and new Congress on policies that will ensure a thriving American auto industry and manufacturing sector. We are committed to offering customers the freedom of choice — great gas, hybrid and electric vehicles.”

Stern words for Stellantis

Moreno also had stern words for another member of the Detroit Three, noting that “companies like, Stellantis, which the United States government handed Chrysler Corp. for free in essence, they are laying off workers and shipping our jobs to Mexico. CEO Carlos Tavares needs to understand the United States government is not going to allow him to gut Chrysler, and Jeep, and Dodge, and Ram, and ship those cars and the direction overseas, in managing a company that was handed to them for free, which never should have been done.”

Moreno was referencing the way Chrysler came to be part of Stellantis predecessor Fiat Chrysler Automobiles in connection with the company’s 2009 bankruptcy.

Stellantis has come under fire for numerous job cuts this year as it has struggled to manage its inventory levels, and on Wednesday announced it would eliminate a shift at the Toledo Assembly Complex, meaning layoffs for 1,100 workers. The company has also confirmed it is expanding its truck plant in Saltillo, Mexico.

Jodi Tinson, a spokeswoman for Stellantis, said in a statement to the Free Press: “Stellantis congratulates Senator-elect Bernie Moreno on his election to the U.S. Senate. Because Toledo, Ohio, is an important part of our manufacturing footprint as the production home of the iconic Jeep Wrangler and Jeep Gladiator sold worldwide, we look forward to working with the senator-elect on policies that support a strong and competitive manufacturing base in the U.S.”

Old GM plant is symbolic of what needs to happen next

A native of Colombia, Moreno grew up in Florida before attending U-M. He had a dream of working for an automaker and at age 14, wrote a letter to General Motors’ then-CEO Roger Smith, suggesting ways Smith could improve the company. Smith wrote a lengthy reply, which Moreno still has, that began: “It’s not often I receive a letter from someone who is planning to take over my job,” according to a 2017 article on Moreno in Automotive News.

After a stint from 1987 to 1993 with then-GM brand Saturn, Moreno segued into auto retail, eventually building an empire of 15 dealerships across Ohio, Kentucky, Massachusetts and Florida that represented 30 brands. In 2017, he told Automotive News his brands generated more than $700 million in annual revenue. But by 2020, he sold all of his car dealerships.

Moreno’s entrepreneurial drive centered on the car business. In 2018, when GM first announced it would permanently close its Lordstown Assembly plant in northeast Ohio, which built the Chevrolet Cruze sedan, Moreno tried to save it.

As the Free Press reported in 2019, Moreno met with GM leaders. He wanted to buy 150,000 to 180,000 Cruze cars to start a global ride-hailing company similar to Uber. GM CEO Mary Barra rejected the idea. GM shuttered Lordstown that spring.

At that time, then-President Trump targeted GM and a local UAW president in tweets urging the carmaker to reopen the plant. But GM sold it to electric-truck maker Lordstown Motors that year. Lordstown Motors filed for federal bankruptcy protection in June 2023.

Foxconn, a Taiwan-based electronics assembler, now owns the 6.2 million-square-foot auto assembly plant in Lordstown, but it sits idle. Moreno drives past it often and he said it serves inspiration for his U.S. auto industry overhaul plans.

“I want to see that plant producing automobiles again,” Moreno said. “It is symbolic of what we need to do. We need to turn things around. That community did everything right. These are people who went to work every single day. They followed the rules, they tried to raise their families, and make ends meet and the rug got pulled out from under them. That’s got to end.”

Toyota is poised to win as the EV tax credit goes away

Moreno said he knows Barra and considers her a “very capable CEO.”

Asked to comment on Moreno’s initiatives for the auto industry, GM spokeswoman Liz Winter sent the following statement: “We look forward to working with Senator-elect Moreno on important issues ahead for the auto industry. GM remains committed to supporting jobs, driving innovation, and keeping America competitive globally. We’ve invested more than $5.6 billion in GM facilities in Ohio since 2013, including a joint venture with LG Energy Solution that employs 2,200 people and positions the industry for the future.”

Moreno said he is eager to meet Ford CEO Jim Farley and Stellantis CEO Tavares. His closest relationships now are with leaders at Toyota Motor North America, which he said helped organize the coalition of car dealers that supported his Senate run.

“The winner in this whole thing will probably be Toyota because they were the one company that said, ‘We’re just not going to do that,’ ” Moreno said. By “that” he means follow what he and Trump refer to as the “EV mandate.”

To be clear: No law or rule forces carmakers to make EVs or consumers to purchase them. Moreno is referring to tightened fuel-economy standards under the Biden administration. The administration ruled earlier this year that new vehicles sold in the U.S. will have to meet a fleet average about 38 mpg by 2031 in real-world driving, up from about 29 mpg, according to The Associated Press.

Also, the Environmental Protection Agency has adopted stricter tailpipe-emissions rules. Biden has set a goal for 50% of all sales be EVs by 2030, but it is a target not a mandate.

But Moreno said the strict requirements essentially force carmakers to push EVs. He said Toyota bucked the trend and set a model the rest of the industry should follow by investing heavily in hybrids rather than all-electric. Toyota did not respond to a request for comment on this story.

“The problem with GM, Ford and Stellantis is that they made the decision to pacify the Biden-Harris administration and not call them out for the ridiculousness of their electric vehicle policies,” Moreno said. “Toyota, in listening to their car dealers, they planned to have the cars that consumers wanted. So the big winner now is Toyota because they don’t have to pivot.”

The Detroit Three need to revisit their strategies because the electric vehicle tax credit will likely disappear.

“The United States government — if I have anything to do with it, I’m one of 100 people and President Trump obviously makes a decision on this as well — but my suspicion is that electric vehicle subsidies are gone,” Moreno said. “So now there’s no subsidy. You buy an electric vehicle, the car stands on its own.”

Some more proposed changes

Here are some more of Moreno’s specific proposals:

-

Repealing the emission standards that, in effect, can only be met through selling electric vehicles.

-

Freezing Corporate Average Fuel Economy standards for “at least a decade.”

-

Prohibiting California from following a separate set of emission standards from the rest of the nation.

The CAFE standards are part of the Clean Air Act. California gets a waiver to set its own, tougher requirements, which now require that all new vehicles sold there by 2035 be only zero-emission vehicles in an effort to fight pollution and climate change.

That influences manufacturers’ vehicle mix because California is the nation’s largest car market. For all of last year, 1.78 million cars were sold in California alone, according to the California New Car Dealers Association.

Moreno said it makes sense to hit pause on fuel-economy standards because, “We hit an incredibly high number, let’s pause these requirements for at least a decade to let the marketplace catch up, the technology catch up.”

Katherine García, Sierra Club’s director of Clean Transportation for All, said that won’t happen without a fight.

“The nation’s clean vehicle standards are a bedrock environmental safeguard that slash an enormous amount of health-threatening pollution, and we are prepared to fight any rollback of them, including threats to CAFE standards and California’s authority to set its own more protective standards,” she said. “We’ve been here before, and we have and will fight back against Trump’s extreme anti-environment, anti-middle class agenda and defend and build on the progress we’ve made over the last four years on clean transportation and climate.”

Less competitive in global markets, adverse health affects

Abhilasha Bhola, auto supply chain director on the climate team at the consumer advocacy group Public Citizen, warned that Moreno’s idea to freeze CAFE standards would hurt communities.

“His vision has the potential to turn every auto town in America into a version of what happened to Flint, Michigan, in the 1990s,” she said of a time when numerous auto plants had closed there.

With countries in Europe and East Asia continuing to invest in electrification and with CAFE standards supporting electrification here, the U.S. auto industry would suffer if those standards are pulled, she said.

”We risk falling further behind other countries and reducing demand for American-made cars abroad,” she said. “Bernie Moreno and Trump’s auto policy makes us less competitive in global markets and that causes regular people to face some of the worst impacts.”

It would also directly lead to worse health outcomes for Americans, she said.

“Doubling down on (internal) combustion engines through reduced efficiency standards is sentencing millions of Americans to dirty air and increased respiratory illness,” she said. “Smog from cars causes incredible health impacts. It means upper respiratory illness. It means people are missing work, school. There’s increased impacts and stress on our healthcare system, and this reduces quality of life.”

California’s leadership in reducing harmful emissions is important, she said.

“California is also the largest auto market in the country. It’s not just Californians that are impacted by those emissions. That smog travels to other states. So by getting rid of the California waiver and forcing the state to not have stricter standards, it means that the rest of the country suffers, too,” Bhola said.

A spokesman for the California Air Resources Board declined comment on what the next Trump administration might do. California Gov. Gavin Newsome on Thursday called a special legislative session to strengthen the state’s progressive policies.

Despite the possibility that the incoming administration might make such sweeping changes to vehicle standards, Bhola said she doesn’t believe “all hope is lost.” It will simply require a shift in focus.

“I think there is an opportunity for states and cities to put forward their own environmental regulations,” she said, noting that those areas can continue to create incentives for EV uptake and to lower emissions and create good jobs.

Moreno: Give automakers tax write-off for US wages

Another proposed agenda item for Moreno is bringing down new vehicle prices, which he said can be done by lowering interest rates as inflation comes down. Also, lowering the regulatory environment for the car companies will help lower prices.

“We need to repeal the part of the infrastructure law that requires all 2026 model-year vehicles to have an alcohol-impairment device each time the car starts,” Moreno said. “The reason is very simple: Those of us, like myself, who do not drink alcohol, why am I paying for a device to check my impairment? It adds cost.”

But in 2022, more than 13,000 people were killed in incidents related to drunken driving, according to federal statistics. U.S. Rep. Debbie Dingell, D-Ann Arbor, who pushed for the law, said the technology can save lives.

Finally, he suggests a new tax code that rewards American companies.

“I’ll give you an example, if you’re an American company that employs American workers, maybe you can write off whatever you pay in salaries twice,” Moreno said. “So if you pay $10 million in salary and wages, you get an additional $10 million tax write-off. That encourages companies to pay their employees more money.”

But some say the U.S. auto industry would actually suffer

Sam Fiorani, vice president of global vehicle forecasting for AutoForecast Solutions, questioned the logic behind any plans that would effectively discourage innovation and efficiency improvements, such as California’s ability to set its own emissions standards.

“It’s good to have somebody pushing the boundaries of what’s available in the marketplace,” Fiorani said. “Focusing strictly on what the American consumer wants today will make (automakers) less competitive in five to 10 years.”

Trump and the economy: How Trump’s victory could affect the US economy

Whether it’s the incoming administration’s desire to limit what California can do or to freeze fuel economy standards for a decade, the impact would hurt automakers and everyone who depends on them in the long run, Fiorani said.

“The global automotive industry is progressing at such a rate at the moment that American companies will be left behind if we concentrate on full-size pickups and SUVs,” Fiorani said

He noted that he also writes about automotive history and offered a lesson from the past that would appear to have relevance in this discussion.

“These cars from the ‘70s that were bloated and only in demand in the United States meant that foreign auto manufacturers could come in here and appeal to the customers with newer products and more efficient products and products that existing companies wouldn’t see as profitable,” he said.

American car companies were woefully noncompetitive on a global scale 50 years ago, and pushing for higher fuel economy standards at least pulled them up to the level of the competition, he said. Fiorani warned that electric vehicles and hybridization are the future, and delaying any investments would be detrimental for automakers.

As for what gets produced in Mexico, Fiorani said the Detroit Three currently produce a handful of vehicles there and usually for competitive reasons. Bringing all those vehicles to the United States would likely increase prices and decrease the demand for them.

Ohio and Michigan will lead the way

More: Experts: Trump presidency could benefit Detroit automakers, but cost car buyers more

One of Trump’s biggest supporters has been Tesla CEO Elon Musk, and as a reward for it, Trump has promised Musk a quasi-Cabinet position. Moreno said it’s a brilliant plan.

“We could take $2 trillion a year in savings out of the federal government, there’s no question in my mind about that,” Moreno said of Musk. “We can’t afford the government we have right now.”

He believes Musk would help add efficiency, remove unnecessary departments and rid Washingon of bureaucrats who are “spinning their wheels.” He noted how Musk built some 25,000 Tesla charging stations across the country and the U.S. government has still built just a fraction of that.

Moreno promises if Trump’s autos agenda is enacted, “It’ll be the golden age of manufacturing in America with Ohio and Michigan leading the way.”

Contact Jamie L. LaReau: jlareau@freepress.com. Follow her on Twitter @jlareauan. Read more on General Motors and sign up for our autos newsletter. Become a subscriber.

This story has been updated with additional information.

This article originally appeared on Detroit Free Press: Senator-elect says he joins Trump in wanting to overhaul car industry

ASML Was Hit by an IT Outage That Disrupted Facilities Worldwide

(Bloomberg) — ASML Holding NV, the maker of the world’s most advanced chipmaking machines, was struck by an IT outage on Friday that affected its facilities around the world.

Most Read from Bloomberg

The disruption began on Friday morning and was resolved later in the afternoon, an ASML spokesperson said by phone. The incident forced some employees to work remotely, and local Dutch newspaper Eindhovens Dagblad reported that the company’s cleanrooms, offices, customer support departments and communications with suppliers were affected.

The company said it’s investigating the cause of the outage.

ASML is a critical part of the world’s semiconductor supply chain, and as a result, has found itself continually caught in the middle of the escalating fight between the US and China over chip-market dominance. It has a monopoly on manufacturing the machines that help companies such as Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. produce the most-advanced chips that power everything from Apple Inc.’s smartphones to Nvidia Corp.’s AI accelerators.

Last month, the company mistakenly released its financial report a day earlier than scheduled due to a “technical error.” The premature publication of the release worked to amplify weak results, sending both its shares and those of chip companies globally falling.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Prospect Capital Plunges on First Dividend Cut Since 2017

(Bloomberg) — Shares of Prospect Capital Corp., a $7.6 billion publicly-traded private credit fund, tumbled more than 16% Friday after the firm cut its dividend for the first time in seven years.

Most Read from Bloomberg

Prospect said in a statement that the 25% dividend cut is needed as it shifts holdings away from the riskiest slices of collateralized loan obligations and real estate investments into its core business of first-lien senior-secured loans and equity stakes in mid-sized companies.

The firm also attributed the dividend cut to the Federal Reserve’s recent rate reductions, which will lessen the amount of interest it gets from providing floating-rate loans.

Prospect has faced increased scrutiny in recent months over the share of borrowers that pay it by accumulating more debt with the fund, its relationship with a real estate investment trust it fully controls and its reliance on retail investors for financing. In late September Moody’s Ratings cut the outlook on its Baa3 credit grade to negative, the second such revision by a ratings firm in as many weeks.

Analysts say the dividend cut — to 4.5 cents per share monthly from 6 cents per share — is likely in part an effort by the private credit fund to maintain its investment-grade rating.

Shares in the fund, which trades under the PSEC ticker, were down 16% on Friday at $4.41 as of 1:01 p.m. New York time, the lowest since May 2020.

Prospect reported net investment income of $89.9 million for its first fiscal quarter, a drop of 28% compared to the same period last year. Its net asset value per share, a measure of the value of its investments, dropped to $8.10 at the end the quarter, the lowest reading since 2020, according to data compiled by Bloomberg.

Prospect also significantly marked down several loans on its book, including to real estate investment trust National Property REIT Corp. and dental practice support provider InterDent Inc. The private credit firm wrote down its investment in market research firm Dynata, previously know as Research Now SSI, after the company emerged from Chapter 11 having extinguished almost 40% of its total debt.

A Bloomberg News analysis of data from fixed-income specialist Solve, which collects filings from publicly-traded private credit funds, previously found Prospect to be among the most reluctant firms to mark down their loans compared to peers.

Cathie Wood Can't Stop Buying Archer Aviation Stock. Should You Invest While It's Still Below $5?

Cathie Wood of Ark Invest is best known for her high conviction in emerging themes, disrupting sectors such as technology or life sciences. While Wood has earned her share of media coverage, I’ll admit that sometimes I find her investment takes to be somewhat far-fetched.

Recently, I noticed that Ark Invest has added a significant chunk to its position in electric takeoff and landing company Archer Aviation (NYSE: ACHR). With shares of Archer trading for just $3.26 as of this writing, is Wood getting a good deal? Let’s dig in and find out.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

In some ways, Ark’s ownership of Archer stock makes a lot of sense. Wood was an early bull on Tesla, often publishing research with stock price targets for the electric vehicle (EV) maker that seemed completely disconnected from reality — that is, until Tesla eclipsed those price ranges despite widespread skepticism from those less optimistic on the company’s potential.

To me, Archer represents a different form of exposure to the broader EV sector — one that’s tangential to Tesla. While this notion might support the idea of investing in Archer, Wood’s recent buying activity suggests that she is more than a little optimistic about the company.

Between Oct. 28 and Oct. 30, Ark scooped up 2.5 million shares of Archer, spread across three separate purchases. Given Archer’s seemingly low stock price, it may look like Wood is buying the dip on a potentially lucrative opportunity set to disrupt the EV market.

In my eyes, Archer is stuck between proof-of-concept and product-market fit. Anecdotally, I am intrigued by the idea of airborne EV taxis augmenting mobility patterns — particularly in more densely populated environments such as cities.

But with that said, Archer hasn’t gotten enough traction yet to really prove if its vision is sustainable. I say that because despite its billion-dollar book of purchase orders, the company is yet to recognize $1 of revenue yet.

So long as sales aren’t coming through the door, Archer will continue racking up costs in the form of hefty capital expenditures (capex) and ongoing research and development (R&D).

Just as Tesla isn’t the only EV car manufacturer, Archer’s presence in the electric takeoff and landing vehicles is not exclusive. The company competes heavily with Joby Aviation, another position in Ark’s portfolio — and one that Wood also scooped up shares in around the same time as her recent Archer purchases. There ae also several other private competitors.

2 Magnificent S&P 500 Dividend Stocks Down 28% or More to Buy and Hold Forever

The S&P 500 has surged to new highs recently, but some of the strongest companies that pay regular dividends are trading well off their highs. This has pushed their dividend yields up and signals they might be undervalued.

Here are two top dividend stocks to buy for the long term.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Realty Income (NYSE: O) is a top real estate investment trust (REIT) that has a 55-year record of paying dividends to investors. As a REIT, it is required to pay out at least 90% of its taxable income (excluding capital gains) to investors, and another attractive aspect of the company is that it pays dividends on a monthly schedule.

The first thing that stands out is that half-century-long dividend record. This means Realty Income has profitably operated its business through several recessions in the economy. This record ultimately reflects its diversification and quality tenant portfolio. Its portfolio totals more than 15,400 properties around the world. Its largest clients include industry leaders such as FedEx, Wynn Resorts, Walmart, and Home Depot.

Realty Income makes it a priority to invest in properties where clients are leaders or could become leaders in their industries. Management is clearly interested in sustainable cash flow generation, which helps sustain dividend payments over many years.

The company still sees a lot of opportunities to invest in new properties and grow the value of the business. Management raised its investment volume guidance to $3.5 billion for 2024 and expects to report full-year adjusted funds from operations per share between $4.17 to $4.21, representing an increase of nearly 5% at the midpoint of the range.

Realty Income currently pays a monthly dividend of $0.2635 per share. With the stock trading 28% off its recent highs, the forward yield has increased to 5.41%. This is a great time to consider adding shares. If interest rates stabilize or come down, there will be more demand for high-yield stocks, which could push Realty Income’s share price higher over the next year.

Hershey (NYSE: HSY) is the leading confectionary brand and also has a stable of leading snack foods like Skinny Pop in its arsenal. Brands like Reese’s, Kit Kat, Jolly Rancher, and Hershey have been around a long time and aren’t going anywhere, but Wall Street has discounted the value of the business significantly over recent weakness in discretionary spending. The stock is currently down about 35% from its previous peak.

Super Micro Computer Stock Has Dropped 60% on Troubling News. Here's What You Need to Know After the Company's Latest Update.

Super Micro Computer (NASDAQ: SMCI) started the year off as a star of the artificial intelligence (AI) market. The equipment maker has been around for more than 30 years, selling servers and rack scale solutions, but it truly saw earnings take off with the AI boom. In recent quarters, Supermicro has reported triple-digit increases in revenue and soaring demand for its products. The company works hand-in-hand with Nvidia and other top chipmakers, incorporating their innovations into its equipment.

All this helped the stock rise 2,000% over the last five years through 2023, and even beat Nvidia’s performance in the first half of this year, gaining 188%. Then, in late August, troubles emerged that began to weigh on this top stock. From a short report alleging problems at the company to the recent resignation of Supermicro’s auditor, these times have been difficult for Supermicro and its investors. Since the Aug. 27 short report, the stock has dropped about 60%.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

More news arrived this week, with Supermicro releasing a preliminary and unaudited quarterly earnings report and a general update. Here’s what you need to know before making any investment decisions.

First, let’s consider the elements that have been weighing on the stock. It all began with a short report from Hindenburg Research, alleging troubles at the company such as “glaring accounting red flags.” Since Hindenburg had a short position in the stock at the time of the report, meaning it would benefit from declines in the stock, it held a bias. That makes it impossible to fully rely on Hindenburg as a source.

Meanwhile, Supermicro delayed the filing of its 10-K annual report. This may not have been a clear reason to sell or avoid the stock, but it still weighed on investors’ minds.

Supermicro addressed both the Hindenburg report and the 10-K delay in a letter to customers, offering encouraging words. Regarding the short report, Supermicro called the statements “false or inaccurate,” and concerning the 10-K delay, the company said it didn’t foresee any significant changes to its fourth-quarter or full-year earnings.

But investors’ concerns deepened when an article by The Wall Street Journal spoke of a potential Department of Justice probe into Supermicro — Supermicro declined to comment — and when Ernst & Young resigned as Supermicro’s auditor.

In its resignation, Ernst & Young said it would “no longer be able to rely on management’s and the Audit Committee’s representations” and it was “unwilling to be associated with the financial statements prepared by management.”

My 2 Favorite Stocks That Investors Will Be Piling Into Next Year

Investing isn’t about living in the past, but buying companies that will do well in the future. You want to buy stocks that can grow sales and earnings while also trading at a reasonable valuation. A tough task, especially when the broad S&P 500 index is trading at a price-to-earnings ratio (P/E) close to all-time highs.

In bull markets, smart investors stray away from the red-hot and popular stocks trading at nosebleed earnings multiples. Instead, they target stocks that are flying under the radar.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

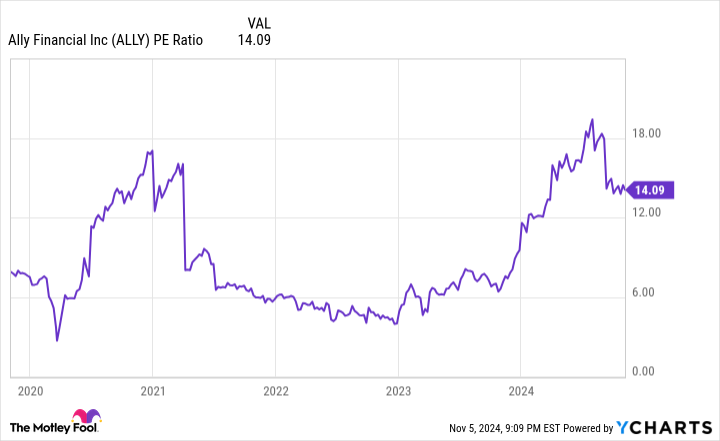

Two of my favorite under-the-radar stocks I think investors will be piling into next year are Coupang (NYSE: CPNG) and Ally Financial (NYSE: ALLY). Here’s why I think the companies are fantastic buy-and-hold investments for the next decade.

One of the fastest-growing large-cap stocks in the world is Coupang. The e-commerce platform, which started out selling in South Korea and has now expanded into Taiwan, has seen its stock rise 70% year to date, crushing the performance of the broad market indexes.

With close to half the South Korean population using its e-commerce website, Coupang is now as ubiquitous as Amazon in the United States and is widening its advantage over competitors. Last quarter, net revenue across its South Korean e-commerce business hit close to $7 billion and grew 20% year over year in constant currency.

Customers are attracted to Coupang’s ultra-fast delivery and the variety of services it offers with its Rocket Wow premium subscription service. Similar to Amazon Prime, Rocket Wow gives customers access to premium streaming video content, discounts on food delivery, and groceries delivered in as little as a few hours.

Coupang has more ambitions than just being an e-commerce website in South Korea. It has a fintech subsidiary, has expanded internationally to Taiwan, and has an internal food delivery service called Coupang Eats.

These segments are combined into Coupang’s Developing Offerings revenue line, which is growing like gangbusters. Last quarter, revenue for the segment soared 347% year over year to $975 million. Excluding its acquisition of fashion website Farfetch, the segment would have still grown sales by 146% year over year in the quarter.

Despite all these investments for growth, Coupang generates positive net income. It had only a slight profit of $64 million last quarter but is able to self-fund its reinvestment as it targets a market opportunity of hundreds of billions of dollars every year.

3 Top High-Yield Financial Stocks to Buy in November With Yields as High as 6.3%

The yield of the average financial stock is just 1.5%. And if you are willing to buy good companies working through what are likely to be temporary problems, you can get much higher yields.

Right now, long-term investors looking for high yields should dig into T. Rowe Price (NASDAQ: TROW), Toronto-Dominion Bank (NYSE: TD), and W.P. Carey (NYSE: WPC). Here’s a quick primer on each one of these high-yield stocks.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

T. Rowe Price is an asset manager. It charges fees for providing financial services to customers who buy its mutual funds, exchange-traded funds (ETFs), and other investment products.

The key figure for investors here is assets under management (AUM), which rise and fall as customers deposit and withdraw funds and as the market goes up and down. The market tends to be more impactful than customer money flows. In fact, customers tend to stick around for a long time because moving money between financial providers is a difficult and time-consuming task. In other words, T. Rowe Price has an annuity-like business in some ways.

That said, T. Rowe Price’s historical strength is in mutual funds, a product type that is being displaced by ETFs and alternative assets. That’s not good, and it has investors worried about the stock. However, assets are sticky, and management is shifting into the areas to which customers are gravitating.

That suggests T. Rowe Price will adjust in time to changing industry dynamics. And it has more than enough financial power to revamp its business, noting that the company has no long-term debt on its balance sheet.

That’s why the 38-year dividend streak isn’t likely to end anytime soon, and why long-term dividend investors can be confident in the hefty 4.4% dividend yield.

Toronto-Dominion Bank, usually just called TD Bank, is the second-largest bank in Canada by deposits. It is the sixth-largest bank in North America when you include its U.S. business in the picture. And it has paid a dividend every year since 1857!

Note that neither the Great Depression nor the Great Recession ended that streak. TD Bank knows how to deal with tough times.

And the Canadian banking giant, which has a hefty dividend yield of 5.3%, is dealing with tough times today. To be fair, the pain is self-inflicted because the company’s U.S. business failed to detect and stop money laundering. That cost the company financially and in reputation.