Traders Think It’s 2016, While Stock Market Has to Live in 2024

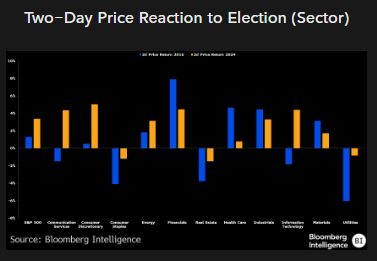

(Bloomberg) — A sense of déjà vu overwhelmed Wall Street this week, as Donald Trump’s election win gave the stock market a jolt similar to what happened after his victory eight years ago. Small caps soared, banks leaped and the S&P 500 Index had its best Election Day in history and strongest week in 12 months.

Most Read from Bloomberg

The challenge, however, is this is 2024, not 2016. Things have changed a lot since then.

“As Mark Twain once said, ‘History does not repeat itself, but it often rhymes,’” Matt Maley, chief market strategist at Miller Tabak + Co., LLC, said. “So investors should remember the old playbook, but they shouldn’t memorize it.”

When Trump ran for president in early 2016, US equities were on shaky footing, posting their worst start to a year since the financial crisis with a drop of more than 5% in January. By the time of his inauguration, the S&P 500 was coming off a 9.5% gain in 2016 after ending 2015 in the red. The index was trading at 17 times projected earnings. The yield on 10-year Treasuries was around 2.5%, and the fed funds rate sat at 0.75%.

Fast forward eight years and the landscape is very different. Equity valuations are soaring. The S&P 500 is at an all-time high and briefly surpassed 6,000 for the first time ever after rising 56% in the past two years. The tech-heavy Nasdaq 100 Index is also at a record after nearly doubling since the start of 2023. The S&P is trading at just 23 times projected earnings, some 40% above its average since 2000. The yield on 10-year Treasuries is 4.3%, and the fed funds rate is at 4.75%.

In other words, the stock market was pretty well set up to rip at the start of Trump’s first term in office. But this time, the stocks appear to be at a peak or nearing one, and there may not be much more room to go.

“It’s not what you would normally think — that rates go way up, and that the stock market goes up substantially with rates going up — unless inflation’s going up with it,” said David Miller, co-founder and chief investment officer at Catalyst Funds. “Which is, I think, what’s happening.”

Inflationary Policies

The premise behind traders’ reaction to Trump’s win is that his promises of tax cuts and deregulation will keep propelling equities to new heights. The flip side, however, is that the president-elect’s protectionist trade stance and plans for mass deportations of undocumented workers are seen as inflationary and potentially threatening growth.

Leave a Reply