Policymakers don't want to tank the stock market

Stocks surged after election results came in and the major news outlets declared former President Donald Trump the winner.

At the same time, the strength of the market response has arguably been at odds with what many economists consider the prospect of worse economic policies under President-elect Trump.

Maybe it’s traders and investors betting that policies bad for the market won’t actually be implemented. After all, what president would want to be affiliated with wealth destruction caused by falling stock prices?

While there are many aspects of the economy (like inflation and employment) that can be tricky to define and measure, stock prices are very unambiguous. People’s investment portfolio values are regularly updated down to the penny.

I’d add that those voters with money in the stock market include the many billionaires with whom the incoming president has gotten cozy. And much of these billionaires’ wealth is tied up in the stock market.

Assuming the president does not want to be associated with destroying the investor class’ wealth, this means his administration will likely think twice about going all-in on policies that could prove costly to the companies in the stock market. More from Joe:

Trump’s presidency carries plenty of market risk, experts warn

Stocks notched their best week of the year as investors cheered President-elect Donald Trump’s economic agenda.

“Tax cuts are behind the rally … and in general, there is the perception that markets like Republican administrations, although certainly the performance for the past few years of the Democratic administration has not exactly been shabby,” Interactive Brokers’ Steve Sosnick explained to me on Yahoo Finance’s special election coverage.

The Dow Jones Industrial Average (^DJI) skyrocketed more than 1,700 points from Wednesday through Friday, closing the week up 4.6%. The S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) surged to a record, while the Russell 2000 (^RUT) hit its highest level since November 2021.

But the market should be careful what it wishes for. Experts tell me as clarity emerges, a resurgence in inflation from trade tariffs and additional government spending could pose a risk to the market’s momentum and temper rate cuts from the Fed.

“The sharp spike [in the markets] is, to some extent, a reaction to the expectation of solid growth, deregulation, tax cuts … But the other part of that, of course, is that it can lead to greater inflation and wider fiscal deficits,” Sonal Desai, Franklin Templeton Fixed Income chief investment officer, told me on Catalysts.

Stifel’s Barry Bannister, who sees a downside risk of 5,250 for the S&P 500 a year from now, is keeping a close watch for a resurgence in inflation. S&P closed out the week above 6,000.

“If inflation proves resurgent … we suspect Chairman Powell’s last 12 months in office (May 2025 to May 2026) are a significant investor risk, magnified by the repercussions of the approaching 2026 US midterm elections,” Bannister wrote in a note to clients.

Truist co-chief investment officer Keith Lerner echoed the point on a new episode of the Opening Bid podcast (listen in below).

Deutsche Bank anticipates Trump’s fiscal, trade, and immigration policies could result in an upward adjustment to its inflation forecast. The team, led by Matthew Luzzetti, projects inflation could rise by roughly 0.5% in 2026 to about 2.5%, primarily due to the inflationary impact of tariffs.

Reports Friday that Trump asked Robert Lighthizer to return to his administration as US trade Representative could signal a more aggressive approach to tariffs. During Trump’s first term, Lighthizer played a key role in his escalating trade war with China, implemented tariffs on steel and aluminum imports, and helped renegotiate the US’s trade agreement with Mexico and Canada.

TKO INVESTOR UPDATE: Did the TKO Group Holdings Board Breach its Fiduciary Duties to Shareholders? Contact BFA Law about its Investigation (NYSE:TKO)

NEW YORK, Nov. 10, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces an investigation into TKO Group Holdings, Inc. TKO, the board of directors, and the controlling stockholder for potential breaches of fiduciary duty.

If you are a holder of TKO Group Holdings, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/tko-group-holdings-inc.

Investigation Details:

TKO is controlled by Endeavor Group Holdings, Inc. (“Endeavor”) through its ownership of 53.6% of the total voting power of the Company’s voting stock. Endeavor has designated a majority of directors to the board of directors of TKO. As a result of its control, Endeavor can influence TKO to engage in conflicted transactions and control the outcome of TKO’s corporate actions that typically would require shareholder approval.

On October 24, 2024, TKO announced that it had entered into a transaction agreement with Endeavor Operating Company, LLC, a subsidiary of Endeavor, pursuant to which TKO agreed to acquire the Professional Bull Riders, On Location and IMG businesses from Endeavor for $3.25 billion in Company stock (the “Acquisition”). As a result of the Acquisition, Endeavor will increase its ownership stake in TKO from approximately 53% to 59%. Minority shareholders will have no say in the Acquisition, as Endeavor has approved the Acquisition by written consent without a minority vote.

BFA believes that the Acquisition is a conflicted transaction that may have resulted in the Company overpaying for Endeavor’s businesses. Specifically, upon announcement of the Acquisition, TKO’s stock price fell by more than 5% and likely would have fallen further had TKO not simultaneously announced a $2 billion stock repurchase program. Given Endeavor’s control over TKO, BFA believes TKO minority stockholders may possess valid claims for breach of fiduciary duty against the board of directors of TKO and/or Endeavor.

Click here if you are a holder of TKO Group Holdings: https://www.bfalaw.com/cases-investigations/tko-group-holdings-inc.

What Can You Do?

If you are a current holder of TKO Group Holdings stock, you may have legal options and are encouraged to submit your information to the firm.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/tko-group-holdings-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/tko-group-holdings-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mark Cuban Reveals Regrettable Shark Tank Deal That 'Drives Him Crazy' Was A Chocolate Covered Pretzel Company Who Offered Free Shipping

In a 2017 Q&A with Oxford Union students, Mark Cuban opened up about one of his biggest regrets on Shark Tank – and he didn’t hold back. When asked about his commitment to the companies he invests in, Cuban emphasized that he’s there “’til death do us part” as long as the founders keep grinding.

Don’t Miss:

Out of his 71 investments on the show, about 12-15 are thriving, while three have exited (although, as he joked, “none really exciting”). Then he got real: at the bottom of his portfolio, Cuban revealed, “10 out of 71 … three have gone out of business and seven have gone out of business but aren’t smart enough to know it.” The crowd laughed, but Cuban didn’t let the moment slide without giving an example of a deal that “still drives him crazy.”

The investment he was talking about? A chocolate-covered pretzel company. Although he didn’t name it in the Q&A, the company was The Painted Pretzel, founded by Raven Thomas. Cuban had put $100,000 into the company for 25% equity after being impressed by Thomas’s passion and the product’s potential. With the huge PR boost from Shark Tank, sales skyrocketed by 1,500% post-episode – you’d think it was the beginning of something big. But behind the scenes, things unraveled fast.

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

The issue? Free shipping. Cuban explained that while the pretzels cost around $14, they sold for $29.95, which should’ve left a decent $15 profit margin. But shipping? It was $16 a pop. That “free shipping” perk that was supposed to attract more customers devoured the profit. Cuban described it like watching cash “just disappear,” adding, “Cash is going like this,” motioning to show how fast it bled out. And it wasn’t just shipping. The company reportedly faced complaints about delays, adding customer service issues to the pile.

Reflecting on the deal, Cuban admitted, “I probably shouldn’t have [invested],” hinting that it was partly to prove a point to his fellow sharks, especially Kevin O’Leary, when he was new to the show. “No lie, to this day, I still get emails …” he trailed off, looking visibly frustrated.

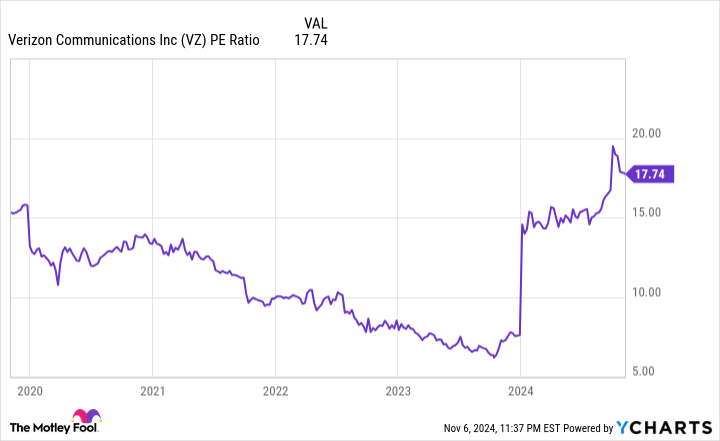

Is Verizon Stock a Buy Now?

Shares of telecom giant Verizon (NYSE: VZ) have been on an upswing. The stock is up about 14% over the past 12 months at the time of this writing. While a rising share price is welcome, perhaps the stock’s most appealing aspect is as an income investment.

Verizon’s dividend serves as a reliable source of passive income, given its 18 straight years of increases. It also sports an impressive forward-dividend yield of 6.5% as of Nov. 7.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Given these positives, it seems like Verizon’s stock is worth buying for the long haul. But there’s a wrinkle to consider. In September, Verizon announced the impending acquisition of Frontier Communications Parent. Here’s a look into how the Frontier purchase may affect whether to buy Verizon stock.

Verizon’s desire to acquire Frontier is part of its gambit to capture customers in the expanding fiber-optic internet market. Demand for high-speed internet is increasing due to data-intensive online activities such as video calls and streaming media.

A key benefit of the deal is that it would expand Verizon’s fiber network. Frontier provides fiber-optic internet service across 25 states, which would raise Verizon’s fiber footprint to 31 states.

In terms of revenue, Frontier generated $1.5 billion in the third quarter, up 4% year over year thanks to rising adoption of its fiber offering. Meanwhile, Verizon’s Fios-branded fiber product produced $3.2 billion in Q3 sales, which was essentially flat from the previous year.

Once the Frontier acquisition closes, which is expected to take 18 months, Verizon’s Fios revenue will be boosted by Frontier’s addition. The acquisition makes sense in terms of strengthening Verizon’s broadband business, but downsides exist.

The Frontier purchase will be an all-cash transaction valued at $20 billion. According to media reports, Verizon looks to take on debt to finance the deal. The telecom already shoulders a hefty $126.4 billion in unsecured debt as of Q3.

Moreover, Frontier has amassed its own debt in excess of $11 billion. The company has stated, “We have a significant amount of indebtedness, and we may incur substantially more debt in the future. Such debt and debt service obligations may adversely affect us.”

Adding to this, Verizon will incur further capital expenditures as it continues to expand its fiber network. Frontier alone plans to reach 10 million homes by 2026, up from about seven million today.

META, UBER, or AMZN: Which “Strong Buy” Tech Stock Could Offer the Highest Upside?

The Q3 earnings season for the tech giants has been a mixed bag. While some managed to impress investors with their performance and outlook, others fell short of expectations on some metrics. Wall Street remains upbeat on several tech giants, thanks to generative AI (artificial intelligence)-led tailwinds. Using TipRanks’ Stock Comparison Tool, we placed Meta Platforms (META), Uber Technologies (UBER), and Amazon (AMZN) against each other to find the “Strong Buy” stock with the highest upside potential, according to Wall Street analysts.

Social media giant Meta Platforms reported better-than-expected Q3 revenue and earnings for the third quarter of 2024. The company’s top line grew 19% year-over-year to $40.5 billion, while EPS (earnings per share) rose 37% to $6.03.

However, shares fell after the earnings report as investors were disappointed with Meta’s subdued user numbers. Daily active people (DAP), which indicates the number of users who visited at least one of the family apps (Facebook, Instagram, Messenger, and/or WhatsApp) on a given day, increased 5% to 3.29 billion but lagged analysts’ consensus of 3.31 billion.

Moreover, the company increased its capital expenditure guidance for 2024, with CEO Mark Zuckerberg cautioning investors about a significant rise in AI infrastructure capex in 2025.

Following the Q3 print, Baird analyst Colin Sebastian reaffirmed a Buy rating on META stock and increased the price target to $630 from $605. The analyst believes that the company’s strong Q3 results reflect a stable macro backdrop, healthy user growth and engagement trends, and the benefits of AI in ad products and content recommendations. He expects AI to drive further growth for Meta Platforms in the days ahead.

Like Sebastian, most analysts are bullish on Meta Platform’s prospects. META stock scores a Strong Buy consensus rating based on 41 Buys, three Holds, and one Sell recommendation. The average META stock price target of $654.23 implies 11% upside potential. Shares have rallied 66.5% year-to-date.

Uber Technologies stock fell 9.3% on October 31, as the company reported slower-than-expected bookings growth and triggered concerns among investors about the impact of macro pressures on the demand in the ride-hailing industry. The company’s gross bookings grew 16% year-over-year to $40.97 billion, falling short of analysts’ estimate of $41.25 billion.

On the positive side, Uber’s Q3 revenue increased 20% to $9.29 billion and surpassed estimates. The company’s earnings per share (EPS) jumped to $1.20 from $0.10 in the prior-year quarter, reflecting the inclusion of a $1.7 billion benefit from unrealized gains related to the reevaluation of its equity investments.

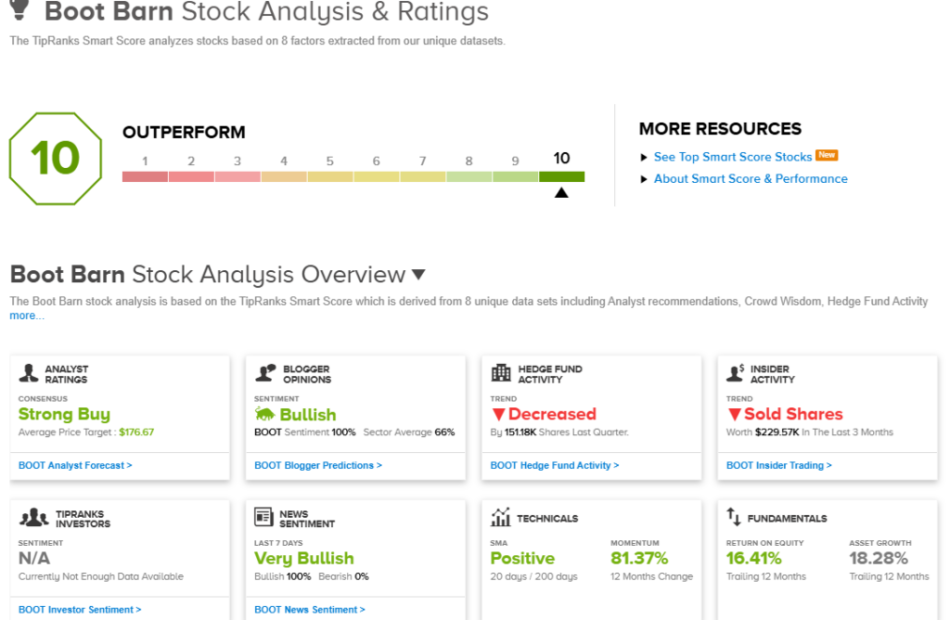

TipRanks’ ‘Perfect 10’ Picks: 2 Top-Scoring Stocks for the Rest of 2024

With the end of 2024 approaching, what could be more natural than to figure out the top stocks for the rest of the year?

Stock picking of this sort is an essential skill for every investor, and fortunately, the Smart Score make it easier. This data gathering and sorting tool from TipRanks uses a combination of AI tech and natural language algorithms to gather and comb through the aggregated data of the stock market – data derived from thousands of traders dealing in thousands of stocks for tens of millions of daily transactions – and it uses that data to give every stock a simple score, on a scale of 1 to 10 and based on the stock’s standing against a set of factors known to match up with future outperformance.

We’ve opened up the TipRanks databanks to find two of these top-scoring stocks that investors should consider for the rest of 2024. These are ‘Perfect 10’ stocks, stocks that have earned the highest possible Smart Score.

Boot Barn Holdings (BOOT)

We’ll start in the retail world, with Boot Barn. This company operates in the lifestyle niche, offering customers a range of Western-themed apparel, footwear, and accessories. The company is particularly noted for its high-end Western boots and its cold-weather outdoor gear. Boot Barn also deals in hiking shoes and work boots, rugged work clothes, Western-style fashion, and even cowboy hats. The company’s clothing is marketed to men, women, and kids and is complemented by a range of décor and gifts.

The Boot Barn company was founded in 1978 and has grown since then to become the largest Western-themed lifestyle retail firm. The company operates through a network of brick-and-mortar stores, more than 420 of them across 46 states, and through an e-commerce operation that includes three websites: bootbarn.com, sheplers.com, and countryoutfitter.com.

BOOT shares have fallen 16% following the fiscal Q2 report on October 28. Revenue showed year-over-year growth, and earnings were in line with expectations, but investors reacted to the unexpected announcement that CEO Jim Conroy will step down on November 22.

Baird analyst Jonathan Komp sees the drop in share price as an opportunity and writes about the stock: “We were surprised by the stock’s sizable decline following the news CEO Jim Conroy plans to leave for Ross Stores in November, as strong continuity across BOOT’s remaining team reduces near-term disruption risk. Factoring BOOT’s +5% raise to F2025E EPS guidance, the >25% correction in BOOT’s NTM P/E appears overdone given strong comps momentum and near-term visibility. We also view pushback to BOOT’s ending inventory as flimsy, given limited markdown risk.”

Bond Market on Risky Path as Traders Regroup From Wild Week

(Bloomberg) — The bond-market selloff unleashed by Donald Trump’s presidential victory last week ended almost as quickly as it began.

Most Read from Bloomberg

Yet firms like BlackRock Inc., JPMorgan Chase & Co. and TCW Group Inc. have issued a steady drumbeat of warnings that the bumpy ride is likely far from over.

Trump’s coming return to the White House has significantly upended the outlook for the US Treasury market, where October’s losses had already wiped out much of this year’s gains.

Less than two months after the Federal Reserve started pulling interest rates back from a more than two-decade high, the likelihood that Trump will cut taxes and throw up large tariffs is threatening to rekindle inflation by raising import costs and pouring stimulus on an already strong economy.

His fiscal plans — unless offset by massive spending cuts — would also send the federal budget deficit surging. And that, in turn, has renewed doubts about whether bondholders will start demanding higher yields in return for absorbing an ever-rising supply of new Treasuries.

One scenario is “the bond market instills fiscal discipline with an unpleasant rise in rates,” said Janet Rilling, senior portfolio manager and the head of the Plus Fixed Income team at Allspring Global Investments.

She predicted the 10-year Treasury yield could rise back to the peak of 5% hit in late 2023, about 70 basis points above where it was Friday. That “was the cycle high and it’s a reasonable level if there is a full implementation of the proposed tariffs.”

There remains considerable uncertainty about the precise policies Trump will enact, and some of the potential impact has already been priced in, since speculators started betting on his victory well ahead of the vote. While 10- and 30-year Treasury yields surged Wednesday to the highest in months, they came tumbling back down again over the next two days, ending the week lower than they began.

There’s no cash Treasuries trading on Monday due to a US holiday.

But the prospect that Trump’s policies will spur growth has driven traders to pare back expectations for how deeply the the Fed will cut rates next year, dashing hopes that bonds would rally as it eased policy aggressively.

Economists at Goldman Sachs Group Inc., Barclays Plc and JPMorgan have shifted their Fed forecasts to show fewer reductions. Swaps traders are pricing in that policymakers will reduce its benchmark rate to 4% by mid-2025, a full percentage point higher than they were predicting in September. It’s in a range of 4.5% to 4.75% now.

Chinese Stocks Slide on Disappointing Fiscal Plan, Weak Data

(Bloomberg) — Chinese stocks declined after a high-profile legislative meeting disappointed investors who had been hoping for large-scale stimulus to boost the economy and end a deflationary cycle.

Most Read from Bloomberg

The CSI 300 Index was down 0.4% as of 9:40 a.m. local time, while a gauge of Chinese stocks trading in Hong Kong dropped more than 2%. Both gauges trimmed bigger losses seen at the open. The declines followed a 4.7% tumble in the Nasdaq Golden Dragon China Index in the US on Friday.

Investors had pinned their hopes on the Standing Committee meeting of the National People’s Congress to offer fresh catalysts for the stock market, especially after Donald Trump’s presidential victory injected fresh uncertainty over tariffs. Beijing announced a 10 trillion yuan ($1.4 trillion) program to help local governments tackle their hidden debt on Friday but stopped short of providing new stimulus to bolster consumption.

Chinese data released over the weekend underscored the urgency for more pro-growth efforts, with consumer price growth remaining close to zero and factory-gate prices continuing to fall. UBS lowered its 2025 growth forecast for China following Trump’s election, expecting an “around 4%” expansion for 2025, and a “considerably lower” pace in 2026.

“With perceived emphasis on stabilization rather than stimulus, and no measures to facilitate bank recapitalization and/or boost consumption, we think this will come as a disappointment for stock investors, even though the headline debt-swap numbers were ahead of expectations,” Nomura Holdings Inc. strategists led by Chetan Seth wrote in a note.

Overseas companies are also pulling their money out of China as the growth outlook turns gloomier. Foreign direct investment slid almost $13 billion in the first nine months of the year, a sign that some investors are still pessimistic even as Beijing rolls out stimulus measures aimed at stabilizing growth.

The CSI 300 Index, a benchmark for onshore shares, fell 1% on Friday as traders grew jittery before the NPC announcement. The gauge rallied nearly 35% from a September low through Oct. 8, but has largely moved sideways since then.

–With assistance from Winnie Hsu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

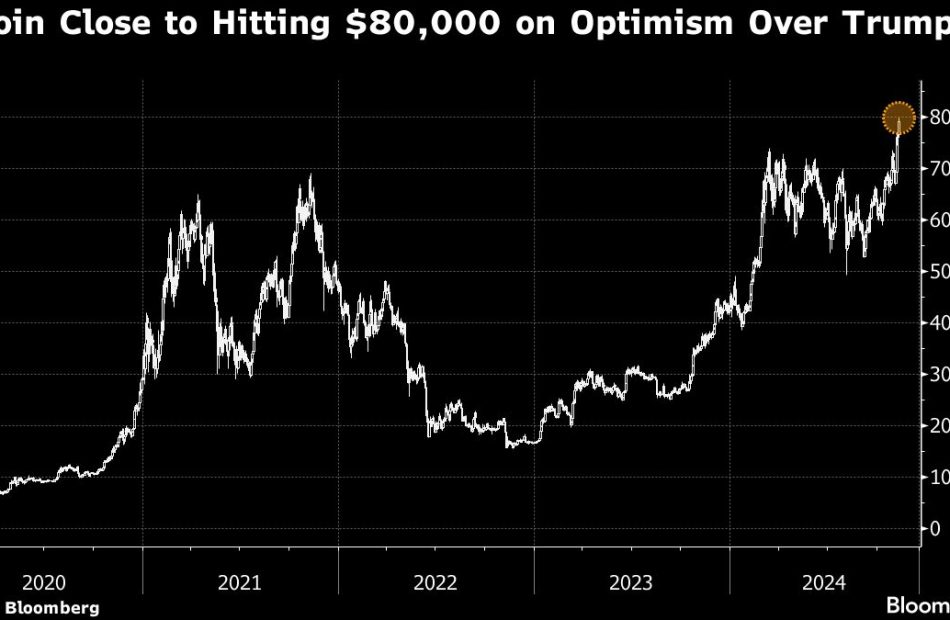

Bitcoin Rises Above $81,000 as Token Becomes Totem for Trump Era

(Bloomberg) — Bitcoin rallied past $81,000 for the first time, boosted by President-elect Donald Trump’s embrace of digital assets and the prospect of a Congress featuring pro-crypto lawmakers.

Most Read from Bloomberg

Trump was declared the winner in Arizona, marking a clean sweep of the seven US battleground states. His decisive victory in the presidential election has prompted celebratory chest-thumping from the digital-asset industry, which spent over $100 million backing a range of crypto-friendly candidates.

The largest token climbed as much as 6.1% on Sunday and hit an unprecedented $81,497 early in Asia on Monday, before changing hands at $80,835 as of 9:30 a.m. in Singapore. Bullish sentiment lifted smaller coins too, including a surge in Dogecoin, a meme-crowd favorite promoted by Trump supporter Elon Musk.

“With the dust from Trump’s victory still settling down, it was only a matter of time before a run-up of some sort occurred given the perception of Trump being pro-crypto, and that’s what we’re seeing now,” said Le Shi, Hong Kong managing director at market-making firm Auros.

Trump’s Agenda

Trump vowed on the campaign trail to put the US at the center of the digital-asset industry, including creating a strategic Bitcoin stockpile and appointing regulators enamored with digital assets. Jubilant traders for the moment are paying little heed to questions such as the speed of likely implementation or whether a strategic stockpile is a realistic possibility.

His broader agenda of stoking domestic economic growth, tax cuts and reducing red tape has fueled a buying spree across stocks, credit and crypto. The S&P 500 equity index last week hit its 50th record this year.

Bitcoin has added about 93% so far in 2024, helped by robust demand for dedicated US exchange-traded funds and interest-rate cuts by the Federal Reserve. The rise in the token, which scaled fresh records after Tuesday’s US vote, exceeds the returns from investments such as stocks and gold.

The ETFs, powered by BlackRock Inc.’s $35 billion iShares Bitcoin Trust, posted a record daily net inflow of almost $1.4 billion on Thursday, according to data compiled by Bloomberg. A day earlier, the iShares ETF’s trading volume jumped to an all-time peak — all signs of how Trump’s victory is reshaping crypto.

Institutional Demand