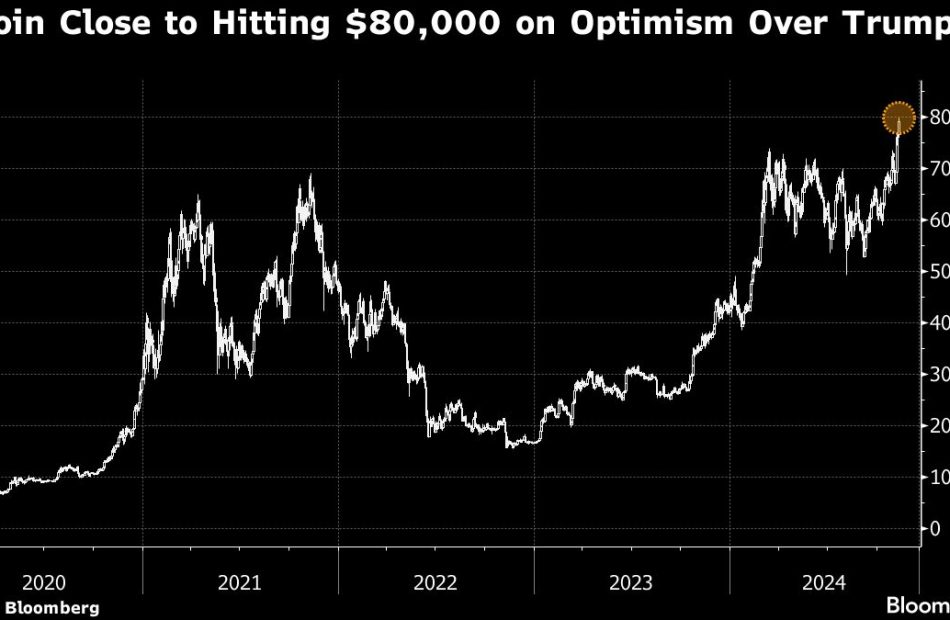

Bitcoin Rises Above $81,000 as Token Becomes Totem for Trump Era

(Bloomberg) — Bitcoin rallied past $81,000 for the first time, boosted by President-elect Donald Trump’s embrace of digital assets and the prospect of a Congress featuring pro-crypto lawmakers.

Most Read from Bloomberg

Trump was declared the winner in Arizona, marking a clean sweep of the seven US battleground states. His decisive victory in the presidential election has prompted celebratory chest-thumping from the digital-asset industry, which spent over $100 million backing a range of crypto-friendly candidates.

The largest token climbed as much as 6.1% on Sunday and hit an unprecedented $81,497 early in Asia on Monday, before changing hands at $80,835 as of 9:30 a.m. in Singapore. Bullish sentiment lifted smaller coins too, including a surge in Dogecoin, a meme-crowd favorite promoted by Trump supporter Elon Musk.

“With the dust from Trump’s victory still settling down, it was only a matter of time before a run-up of some sort occurred given the perception of Trump being pro-crypto, and that’s what we’re seeing now,” said Le Shi, Hong Kong managing director at market-making firm Auros.

Trump’s Agenda

Trump vowed on the campaign trail to put the US at the center of the digital-asset industry, including creating a strategic Bitcoin stockpile and appointing regulators enamored with digital assets. Jubilant traders for the moment are paying little heed to questions such as the speed of likely implementation or whether a strategic stockpile is a realistic possibility.

His broader agenda of stoking domestic economic growth, tax cuts and reducing red tape has fueled a buying spree across stocks, credit and crypto. The S&P 500 equity index last week hit its 50th record this year.

Bitcoin has added about 93% so far in 2024, helped by robust demand for dedicated US exchange-traded funds and interest-rate cuts by the Federal Reserve. The rise in the token, which scaled fresh records after Tuesday’s US vote, exceeds the returns from investments such as stocks and gold.

The ETFs, powered by BlackRock Inc.’s $35 billion iShares Bitcoin Trust, posted a record daily net inflow of almost $1.4 billion on Thursday, according to data compiled by Bloomberg. A day earlier, the iShares ETF’s trading volume jumped to an all-time peak — all signs of how Trump’s victory is reshaping crypto.

Institutional Demand

Leave a Reply