Missed Out on Nvidia? Buy These 3 AI Stocks.

Perhaps no stock benefited more from the boom in artificial intelligence (AI) than Nvidia. Its dominance in the AI chip market redefined the direction of the company and much of the industry at large.

Unfortunately, many AI investors missed out on Nvidia’s boom. The good news is that most analysts expect AI-driven gains in the technology market for years to come.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

To this end, three Motley Fool contributors have ideas on where investors should look next for these gains: Palantir Technologies (NYSE: PLTR), Meta Platforms (NASDAQ: META), and Tesla (NASDAQ: TSLA).

Jake Lerch (Palantir Technologies): I’ve been bullish on Palantir for a while, and the company’s most recent earnings report gives me no reason to change my mind. In short, it is executing at a level that should make every investor sit up and take notice.

The company, which operates an AI-driven platform for government and commercial clients, sits at the forefront of the AI revolution. It helps organizations implement large language models for highly specific purposes.

For example, the company has helped with jobs as diverse as speeding up the underwriting process for insurance companies and managing battlefield assets for the military.

The proof of Palantir’s success can be seen in its results. In the most recent quarter (the three months ending on Sept. 30), the company achieved the following:

-

U.S. revenue increased 44% to $499 million.

-

Total revenue grew 30% to $726 million.

-

Adjusted operating margin was 38%.

-

Customer count grew 39%.

Analysts expect that growth to continue. We’re just getting started in the AI revolution, and many organizations have yet to fully explore how they can drive efficiencies with it.

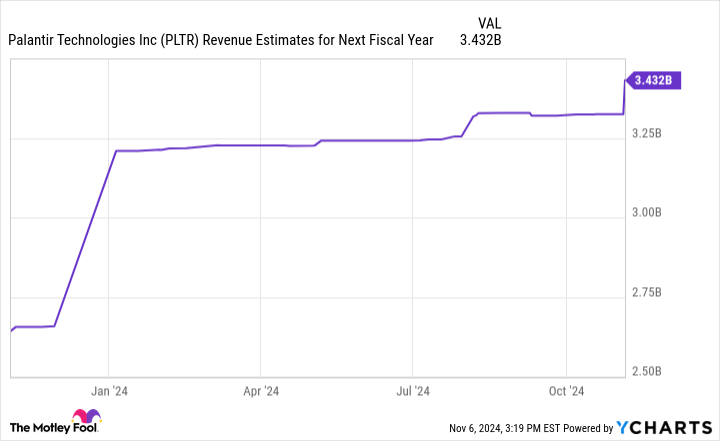

Consensus estimates suggest that Palantir’s revenue will increase 23% in 2025 to roughly $3.4 billion. Those estimates have been rising since the company’s excellent earnings report, and I believe it’s likely that they continue to increase as we head into 2025.

In short, Palantir is my top choice for an AI company to own in 2025.

Justin Pope (Meta Platforms): There hasn’t been anything wrong with Meta Platforms’ stock, which cruised more than 380% higher since the start of last year. Yet, I think there is still a lot of juice to squeeze here.

First, the stock remains a bargain for the growth you’re getting. Meta trades at a price-to-earnings ratio (P/E) of 25. And analysts estimate the company will grow earnings by an average of 20% annually over the next three to five years.

Leave a Reply