Trump Family Shake-Up: Who's In, Who's Out

In the wake of President-elect Donald Trump‘s victory this week, the Trump family is preparing to step back into the limelight. However, not all family members will be returning to Washington. Instead, some unexpected individuals are anticipated to join the advisory team.

What Happened: Donald Trump Jr. is expected to play a crucial role in his father’s second term. He says he will play a bit role in selecting his father’s Cabinet, thereby enhancing his clout within the returning First Family.

As per a report by The Daily Beast, despite being Trump’s senior fundraiser, the position of Don Jr.’s fiancée Kimberly Guilfoyle, seems to be unstable position. Her relationship with Don Jr. and his children appears to be tense, which could affect her future role.

Meanwhile, Don Jr.’s daughter, Kai Trump, is emerging as an important figure in the next generation of Trumps. Her ability to portray her grandfather in a relatable way could be a strategic advantage in preserving the Trump legacy.

Barron Trump, the President-elect’s youngest child, is speculated to be the force behind his father’s podcast appearances and interviews. His influence within the family is predicted to increase.

Despite her difficulty in connecting with the MAGA fanbase, returning First Lady Melania Trump will continue to be a part of Trump’s presidency. Meanwhile, Tiffany Trump‘s popularity has recently surged, and Lara Trump has demonstrated her value as co-chair of the RNC.

However, Ivanka Trump has decided to not participate in this presidency, which could limit her potential impact on the administration. Nevertheless, her closeness to Trump’s Mar-a-Lago residence ensures her continued influence within the family.

Why It Matters: The changing dynamics within the Trump family could have significant implications for the administration’s future policies and strategies.

The involvement of new faces in the advisory team and the shifting roles of existing members could bring fresh perspectives and potentially alter the course of the presidency.

The family’s influence on the administration’s decisions and their ability to connect with the public could be key factors in shaping the legacy of Trump’s second term.

Read Next

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Massive Day For BlackRock's Bitcoin ETF As Trading Volume Reaches Unseen Levels With $4.1 Billion Traded

On Nov. 6, BlackRock’s iShares Bitcoin Trust (IBIT) achieved an unprecedented trading milestone, with volume spiking to $4.1 billion in a single day – its highest ever. This surge, following Donald Trump’s reelection as President of the United States, signals a potent wave of institutional and potentially retail interest in cryptocurrency ETFs.

Don’t Miss:

Bloomberg ETF analyst Eric Balchunas noted on X (formerly Twitter) that this massive trading volume exceeded that of established stocks like Berkshire Hathaway, Netflix and Visa, making it an extraordinary day for Bitcoin on the ETF front. To add perspective, many Bitcoin ETFs also saw a significant uptick, trading at nearly twice their typical volume. This is reminiscent of Bitcoin ETFs’ highly volatile early days in January.

Analysts attribute this remarkable performance to a mix of factors, including Bitcoin’s price momentum, which saw the asset climb to a record high of $76,500. However, based on TradingView data shortly after, the asset’s price dipped slightly to $75,267. Nevertheless, it remains one of the dominant assets in 2024’s ETF outlook.

Trending: 1 in 4 Americans own a share of Bitcoin according to NASDAQ — this platform touts returns as high as 12.5% APY and is giving $100 in welcome rewards if you sign up today.

As ETF Store president Nate Geraci highlighted in an X post, Bitcoin ETFs have become some of the most successful launches this year. Additionally, Trump’s return to office has sparked optimism in the crypto space, with many pointing to his pro-crypto stance and anticipated policy support as potential catalysts for Bitcoin’s continued growth.

As Bitcoin ETFs break new ground, the broader landscape has seen asset managers scramble to file for a range of altcoin-focused ETFs, including those for Solana, XRP and Litecoin. They’ve also proposed several crypto index ETFs, allowing investors to hold diversified digital assets.

Balchunas previously described these filings as “call options on a Trump victory,” indicating that fund managers may be banking on a favorable regulatory climate under the new administration. Should pro-crypto policies become a reality, experts believe the market may see even more significant inflows and innovations in the ETF space.

$HAREHOLDER ALERT: The M&A Class Action Firm Investigates the Merger and Upcoming Vote of CAC, OB, SMAR and PFC

NEW YORK, Nov. 10, 2024 (GLOBE NEWSWIRE) — NEW YORK, November 10, 2024 /GlobeNewswire/–

Monteverde & Associates PC (the “M&A Class Action Firm”), has recovered millions of dollars for shareholders and is recognized as a Top 50 Firm by ISS Securities Class Action Services Report. We are headquartered at the Empire State Building in New York City and are investigating:

- Camden National Corp. (Nasdaq: CAC), relating to its proposed merger with Northway Financial, Inc. Under the terms of the agreement, Camden common stock will automatically be converted into the right to receive 0.83 shares of Northway stock.

ACT NOW! The Shareholder Vote is scheduled for December 17, 2024.

Click here for more information https://monteverdelaw.com/case/camden-national-corp/. It is free and there is no cost or obligation to you.

- Outbrain Inc. (NYSE: OB), relating to its proposed merger with Teads S.A. Under the terms of the agreement, Outbrain will acquire Teads in exchange for a cash payment of $725 million, subject to certain customary adjustments, 35 million newly issued shares of Outbrain common stock, par value $0.001 per share, of Outbrain and, 10.5 million newly issued Outbrain Series A Convertible Preferred Shares.

ACT NOW! The Shareholder Vote is scheduled for December 5, 2024.

Click here for more information https://monteverdelaw.com/case/outbrain-inc-ob/. It is free and there is no cost or obligation to you.

- Smartsheet Inc. (NYSE: SMAR), relating to its proposed merger with Einstein Parent, Inc. Under the terms of the agreement, Smartsheet shareholders will be entitled to receive $56.50 in cash per share they own.

ACT NOW! The Shareholder Vote is scheduled for December 9, 2024.

Click here for more information: https://monteverdelaw.com/case/smartsheet-inc/. It is free and there is no cost or obligation to you.

- Premier Financial Corp. (Nasdaq: PFC), relating to its proposed merger with WesBanco, Inc. Under the terms of the agreement, shareholders will receive 0.80 shares of WesBanco common stock per share of Premier Financial stock they own.

ACT NOW! The Shareholder Vote is scheduled for December 11, 2024.

Click here for more information https://monteverdelaw.com/case/premier-financial-corp/. It is free and there is no cost or obligation to you.

NOT ALL LAW FIRMS ARE THE $AME. Before you hire a law firm, you should talk to a lawyer and ask:

- Do you file class actions and go to Court?

- When was the last time you recovered money for shareholders?

- What cases did you recover money in and how much?

About Monteverde & Associates PC

Our firm litigates and has recovered money for shareholders…and we do it from our offices in the Empire State Building. We are a national class action securities firm with a successful track record in trial and appellate courts, including the U.S. Supreme Court.

No company, director or officer is above the law. If you own common stock in any of the above listed companies and have concerns or wish to obtain additional information free of charge, please visit our website or contact Juan Monteverde, Esq. either via e-mail at jmonteverde@monteverdelaw.com or by telephone at (212) 971-1341.

Contact:

Juan Monteverde, Esq.

MONTEVERDE & ASSOCIATES PC

The Empire State Building

350 Fifth Ave. Suite 4740

New York, NY 10118

United States of America

jmonteverde@monteverdelaw.com

Tel: (212) 971-1341

Attorney Advertising. (C) 2024 Monteverde & Associates PC. The law firm responsible for this advertisement is Monteverde & Associates PC (www.monteverdelaw.com). Prior results do not guarantee a similar outcome with respect to any future matter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tariffs and retail prices: What consumers need to know

Tariffs on retail goods don’t usually directly control the final price that consumers pay.

When products are brought into the U.S., the tariff is calculated based on the declared value of the goods at the point of import, not on the retail price at which they’re sold.

This declared value omits additional costs such as labor, marketing, logistics, rent and the profit margin that retailers add. Consequently, the price on the shelf can be significantly higher than the tariffed import value.

For instance, the markup on big-ticket items like cars might be relatively modest, around 5%, whereas luxury goods can see markups up to 500%. However, most consumer products are typically marked up by over 100% over their import value.

Consumers worry that retailers will just pass on the cost of tariffs in terms of wholesale costs. The more likely answer is that companies will look for cheaper suppliers, countries for sourcing or domestic manufacturers. Sourcing is not static or fixed.

Importers’ strategies:

-

Absorbing tariffs: Importers might pay the tariff out of their profit margin to stabilize consumer prices.

-

Sourcing from alternatives: They could shift production to countries with more favorable trade agreements with the U.S.

-

Increasing prices: As a last resort, if neither absorbing the cost nor changing suppliers is feasible, the price to consumers might increase.

If importers discover cheaper alternatives, they’ll shift their sourcing to maintain profitability. Otherwise, they have to decide whether to absorb the cost or pass it on to consumers, depending on how much the market will tolerate the price hike.

Manufacturers, especially those exporting to the U.S., face similar decisions.

The U.S. is the world’s largest consumer market. A significant drop in demand due to high tariffs can push suppliers to reduce prices to remain competitive, offsetting some or all of the costs of tariffs.

Some foreign governments will likely subsidize their manufacturers to ensure they don’t lose U.S. market share to foreign or domestic competitors. For decades, U.S. manufacturers and policymakers have complained about China subsidizing manufacturing to steal market share from U.S. domestic manufacturers. This means consumer prices could stay the same while the tariff cost is offset by reducing the foreign manufacturer’s price and margin.

Ultimately, the level of demand sets a ceiling on how much prices can rise. If prices get too high, sales diminish.

Biden's Internal Polls Reportedly Predicted Trump Landslide

Jon Favreau, a former official in the Obama administration, said that President Joe Biden‘s internal campaign polling had foreseen Donald Trump winning “400 electoral votes” against Biden.

What Happened: Favreau made the startling statement on his “Pod Save America” podcast.

“Then we find out when the Biden campaign becomes the Harris campaign, that the Biden campaign’s own internal polling at the time when they were telling us he was the strongest candidate, showed that Donald Trump was going to win 400 electoral votes,” Favreau said in the podcast and as posted on social media platform X.

Favreau’s assertions indicate that the Biden campaign’s internal polling had predicted Trump’s potential landslide victory, even while they were projecting Biden as the most formidable candidate.

Favreau took the Biden team to task for their delayed recognition of public dissatisfaction over inflation and for undermining Vice President Kamala Harris‘ prospects of victory.

He also voiced his disillusionment with Biden and his team, mirroring feelings expressed by other alumni of the Obama administration.

Also Read: Pelosi Faults Biden’s Late Withdrawal For Trump’s Victory

“Joe Biden’s decision to run for president again was a catastrophic mistake. They refused to acknowledge until very late, that anyone could be upset about inflation. And they just kept telling us that his presidency was historic and it was the greatest economy ever,” Favreau added.

Contrary to these accusations, a source from within the Biden campaign has refuted these allegations, asserting that their internal polling never indicated Biden losing by such a wide margin, reports the New York Post.

Trump won 312 electoral votes in his victory over Harris last week.

Why It Matters: This revelation could potentially shed light on the internal dynamics of the Biden campaign and its decision-making process.

It also raises questions about the reliability of internal polling and the potential impact of such predictions on campaign strategies.

Furthermore, it underscores the importance of addressing public concerns promptly and effectively, as well as the potential consequences of undermining potential successors within the same party.

Read Next

Pentagon Officials Weigh Responses To Possible Illegal Orders Under Trump

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

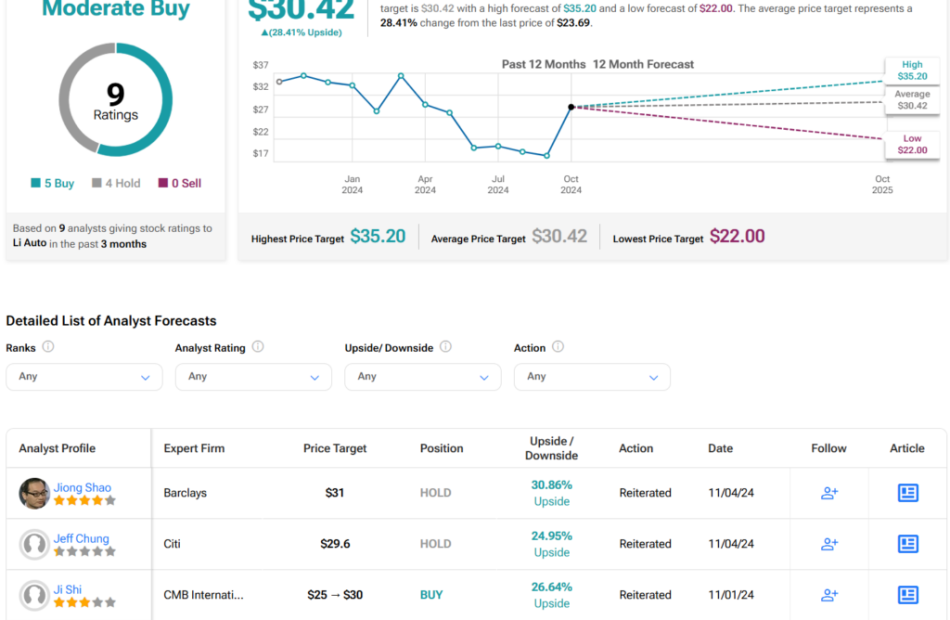

Is Li Auto Stock’s (LI) Selloff Justified as Trump Vows to Raise Tariffs?

Li Auto (LI) stock is down more than 7% in Friday’s trading session. The selloff appeared to be a direct reaction to the U.S. election result, with president-elect Donald Trump vowing to raise tariffs on Chinese imports. However, Li Auto doesn’t export to the U.S. and doesn’t have plans to. As such, I think the selloff is unwarranted. More broadly, I think the stock is oversold and undervalued based on projected earnings growth. That’s why I’m bullish.

Donald Trump is the president-elect and tariffs are going to be headline news when he takes to the White House. While his exact plans for vehicles and electric vehicles (EVs) are uncertain, the former president said he’d look to implement tariffs of 100% or even 200% on Chinese-made vehicles entering the U.S. market. This aggressive stance is part of Trump’s broader strategy to protect the American auto industry and address concerns about Chinese competition.

Of course, tariffs aren’t good for Chinese auto companies exporting to the U.S. In fact, a 100% tariff would almost certainly make any vehicle uncompetitive against a like-for-life peer. Analysts have hypothesized that Trump’s tariffs aim to force Chinese automakers to produce in the U.S. or will be used as a bargaining chip for other concessions.

However, a reason why I am bullish on Li Auto is because its global expansion strategy appears to be focused on markets outside the United States, with a particular emphasis on the Middle East. According to reports, the company planned to enter overseas markets starting in 2024, targeting countries like the UAE and Saudi Arabia.

More recently, Li Auto’s CEO, Li Xiang, indicated that the company’s immediate plans do not include international expansion before 2025, with the boss stating, “We have no plans to expand globally until 2025.” Reports now suggest that the company has pushed its export plan back further, focusing on its position in the Chinese luxury EV market.

This lack of appetite to export could be seen as a sensible option. The Chinese EV market is the biggest globally, with sales surging 82% in 2023 and capturing nearly 60% of global EV purchases. Overall, China’s EV market is expected to grow at a CAGR of 17.15% from 2024 to 2030.

Although I am bullish on Li auto, there are risks worth considering. Of course, there is an issue about being geographically focused on one country — even if it represents 20% of the global population — and that’s a form of concentration risk. China’s economy is widely considered to be faltering, and more economic stimulus will likely be required to enhance domestic demand.

Here's How Trump's Policies Might Shape The Market's Future

As the era of the “Trump trade” draws to a close, the market’s attention is shifting towards the potential impacts of President-elect Donald Trump‘s policy priorities on investments.

What Happened: A recent report by The Wall Street Journal suggests that investors are attempting to predict which of Trump’s campaign pledges will become actual policy actions.

This task is complicated by the fact that some of Trump’s promises, such as lower corporate taxes and deregulation, are seen as beneficial for the economy and stock prices, while others, like immigration clampdowns and high tariffs, are viewed as potential economic obstacles.

The report by the Journal suggests that during his first term, Trump quickly enacted policies that were not favored by the markets, including stringent immigration rules and withdrawal from the Trans-Pacific Partnership trade deal.

However, his firm stance on reducing illegal immigration and the eventual implementation of expected tax cuts and regulatory easing had significant impacts on the market.

Meanwhile, Trump has proposed making billionaire Elon Musk his “efficiency czar,” hinting at a potential return to lighter regulations reminiscent of the pre-Nixon era.

Also Read: Trump’s Escalating Threats To Rivals: 100 And Counting

Yet, clean air, safe drinking water, dependable vehicles, and stable banks remain high priorities for voters.

Carefully evaluating which regulations to remove or uphold will take time, and a drastic approach to cutting red tape might risk losing support from many backers.

Investors are currently optimistic, purchasing U.S. stocks and selling Treasurys, betting on higher growth and less red tape.

However, the sequence in which Trump’s policies will be implemented remains unknown, introducing an element of uncertainty to the market’s outlook.

Chris Brightman, CEO of Research Affiliates, pointed out that stocks have historically trended upward for approximately 20 trading days following elections as uncertainty is resolved, before the effect fades.

Whether this pattern will hold true in the current scenario is yet to be determined.

Why It Matters: As the markets navigate this uncertain landscape, the challenge of distinguishing between Trump’s literal and serious intentions continues to be a crucial factor for investors.

The potential impacts of Trump’s policy priorities on investments could significantly shape the future of the market, making it essential for investors to stay informed and prepared.

Read Next

Trump Aims To Make US ‘Crypto Capital Of The Planet’: ‘We’ll Get It Done’

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

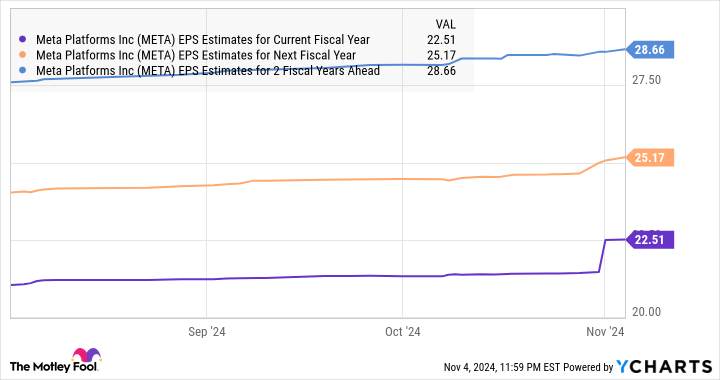

This Magnificent Artificial Intelligence (AI) Stock Could Hit a $2 Trillion Valuation in the Next 3 Years

Artificial intelligence (AI) has turned out to be a tremendous catalyst for many companies, thanks to its growing adoption in multiple industries ranging from cloud computing to factory automation to retail to advertising. The good part is that the technology is currently in its early phases of growth.

Bloomberg Intelligence forecasts that generative AI could become a $1.3 trillion industry in 2032 (compared to just $40 billion in 2022), clocking an annual growth rate of 42%. It’s worth noting that the adoption of AI within the advertising industry is forecast to grow at a stronger rate during this period. More specifically, generative AI-driven ad spending is expected to grow at an annual rate of 125% through 2032, generating $192 billion in annual revenue, compared to just $57 million in 2022.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The rapid adoption of generative AI within the advertising market is playing a key role in driving impressive growth for Meta Platforms (NASDAQ: META), the world’s seventh-largest company, with a market cap of $1.43 trillion. Let’s take a closer look at how this social media giant is using AI to set itself up for long-term growth, and why it seems on track to become a $2 trillion company.

Meta Platforms released its third-quarter 2024 results on Oct. 30. The company’s revenue increased 10% year over year to $40.6 billion, while its non-GAAP earnings per share shot up at a faster pace of 37% to $6.03 per share. Wall Street would have settled for $5.25 per share in earnings from Meta on revenue of $40.3 billion.

The “Magnificent Seven” stock’s robust year-over-year growth was driven by a combination of an increase in ad impressions delivered and a jump in the average price per ad. More specifically, Meta’s ad impressions increased by 7% from the same period last year, while the average price per ad was up 11% on a year-over-year basis. The stronger growth in the company’s earnings can be attributed to the fact that its costs and expenses increased at a slower pace of 14% year over year to $23.2 billion.

However, Meta stock dipped 4% following its quarterly report, despite reporting better-than-expected numbers. That was because of management’s guidance about an increase in capital spending. Meta has increased its 2024 capital expenditure budget from the earlier range of $37 billion to $40 billion to an updated range of $38 billion to $40 billion.

Should You Buy Nvidia Stock After It Notched 200% Gains in 2024? Wall Street Is Providing a Nearly Unanimous Answer.

Another week, another new all-time high for Nvidia (NASDAQ: NVDA). The stock climbed to record-setting territory again on Thursday after setting a new watermark on Wednesday. Over the past couple of years, the stock has regularly hit new heights, fueled by the roaring adoption of artificial intelligence (AI). In 2024 alone, Nvidia is up 200% (as of this writing) and appears poised to vault higher.

After a rally of that magnitude, some investors are understandably wary, concerned about the potential for a slowdown in the adoption of AI and Nvidia’s lofty valuation. Let’s take a look at the general state of AI, Nvidia’s place in the vast scheme of things, and what Wall Street is saying about the company’s potential.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Investors looking to understand the state of generative AI adoption need look no further than the cloud infrastructure providers that are the biggest purveyors of AI to the masses. Amazon, Microsoft, and Alphabet are the big three cloud providers, and all three reported their calendar third-quarter results during the last week of October.

Executives from each of the companies vowed to continue spending heavily on AI, with most of those capital expenditures going toward the servers and data centers needed to further their AI efforts. Meta Platforms, which has used its treasure trove of customer data to fuel its Llama AI model, also plans to continue ramping spending to support its AI development.

Investors can also review the results of other notable companies at the forefront of AI technology. Just last week, Palantir Technologies (NYSE: PLTR) delivered third-quarter results that sailed past expectations, driven by “unrelenting AI demand,” according to CEO Alex Karp. Revenue grew 30% year over year, driving earnings per share (EPS) up 100%.

The results were fueled by demand for its Artificial Intelligence Platform (AIP), the flagship product of its commercial AI segment. U.S. commercial revenue grew 54%, driven by a customer count that surged 77%. As a result, the segment’s remaining deal value jumped 73%.

Taiwan Semiconductor Manufacturing (NYSE: TSM) is a chip foundry and the leading producer of high-end chips used for AI. The company also reported results, adding to the growing mound of evidence that demand for AI is alive and well. Revenue grew 39% year over year, while EPS surged 54%. The company cited strong “AI-related demand” as fueling the results.

Bitcoin Surges Past $80,000 Milestone For First Time On Optimism Over Trump

In a historic development, Bitcoin BTC/USD has surpassed the $80,000 milestone, propelled by President-elect Donald Trump‘s supportive stance on cryptocurrencies and the potential for a crypto-friendly Congress.

What Happened: According to CoinMarketCap, Bitcoin’s value surged as much as 4.7% to an unprecedented $80,092 before falling back to around $79,700 early Sunday.

Bitcoin and other cryptocurrencies have seen a sharp rise, marking a significant day for liquidations. Data from Coinglass.com reveals that more than $430 million in derivatives positions were cleared in just 24 hours.

Digital currencies, such as Cardano ADA/USD and Dogecoin DOGE/USD, also experienced a surge.

During his campaign, Trump made commitments to place the US at the forefront of the digital-asset industry.

His strategies include establishing a strategic Bitcoin reserve and appointing regulators who are in favor of digital assets.

Also Read: This Crypto Analyst Sees Bitcoin Hitting $80,000 This Month

After last week’s election, the Republican Party, led by Trump, gained control of the Senate and is close to retaining a slim majority in the House.

Le Shi, the Hong Kong managing director at market-making firm Auros, told Bloomberg, “With the dust from Trump’s victory still settling down, it was only a matter of time before a run-up of some sort occurred given the perception of Trump being pro-crypto.”

At the time of writing, Bitcoin was trading at $79,741.85, up by almost 5 per cent in the last 24 hours, 18% up in the last seven days.

Why It Matters: Bitcoin’s value has seen a 90% increase in 2024, driven by robust demand for dedicated US exchange-traded funds and interest-rate cuts by the Federal Reserve.

The surge in Bitcoin, which hit new highs following the US election, outperforms returns from other investments like stocks and gold.

This significant rise underscores the growing acceptance and adoption of digital currencies, further solidifying their place in the global financial landscape.

Read Next

Michaël Van De Poppe Predicts Massive Bitcoin Surge, Says Price May Soar By 890%

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.