Where Will Boeing Be In 3 Years?

Crystal balls are said to be useful items — but very hard to come by for investors. For better or worse, investors in Boeing (NYSE: BA) stock have something very close to a crystal ball: Hard numbers, laid out by management and by Wall Street analysts, telling us where Boeing stock will be in three years.

Are you planning to invest in one of the two biggest airplane manufacturers in the world, and intending to own it for the long term, rather than simply trading in and out of the stock? If so, it’s probably a good idea to at least consider these numbers before making your decision.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Boeing reported its third-quarter earnings late last month. The news wasn’t great: A 1% decline in sales to $17.8 billion, negative operating profits, and a $6.2 billion net loss on the bottom line.

This confirms that after three straight years of steady growth as Boeing emerged from the pandemic slowdown in air travel, Boeing sales are shrinking once again. Worse, the aerospace giant appears to be heading for its sixth straight year of negative profits. Over the last 12 months, Boeing’s net loss totals $8 billion — its worst loss ever since the first year of the pandemic.

Admittedly, a big chunk of Boeing’s loss is attributable to a one-time event, the company’s fourth-longest-ever labor strike, which contributed about $4 billion to losses in Q3.

This strike of course is now at an end, but not without consequence for Boeing. In addition to any sales lost during the labor stoppage, Boeing had to postpone introduction of one airplane (the 777X) and shutter production of another (the 767 Freighter) in order to preserve cash during the strike. The company announced plans to take on loans and issue up to 170 million new shares to raise additional cash.

At current high interest rates, this will increase Boeing’s payments on its debt, at the same time as the new shares dilute any profits shareholders earn in future years — by as much as 27.5%.

On top of all that, Boeing had to agree to raise its machinists’ salaries by 38% over the next four years, in order to convince them to end the strike, adding to its overhead costs and further draining profits.

The good news is that with the strike behind it, and a mountain of cash generated by its borrowings and share sales, Boeing will survive. The bad news is that the company will probably be a lot less profitable going forward.

Warren Buffett's Apple Stake Reduction Spurs $97B Cash Surge—Analysts Speculate This Could Be The Reason Behind Berkshire Hathaway's Massive Cash Pile

Warren Buffett, the legendary investor, has made a significant move by reducing his stake in Apple Inc. AAPL and other stocks, generating a whopping $97 billion in gains for his company, Berkshire Hathaway Inc. BRK BRK.

What Happened: Buffett, last week, disclosed that he continued to cut his position in Apple and other stocks in the third quarter, leading to a $97 billion gain for Berkshire Hathaway. This move has raised Berkshire’s cash levels to an all-time high of $325 billion, accounting for 28% of its asset value.

Buffett’s decision has left investors and analysts speculating about the reasons behind the sale. Some investors and analysts suggest that Buffett, a follower of renowned value investor Benjamin Graham, is sticking to his principles, citing Apple’s relatively high price-to-earnings ratio compared to its potential earnings growth.

Others speculate that Buffett, who has often lauded Apple, might be preparing for his successor or anticipating a potential crisis, hence the need to accumulate cash. “It is such a strange thing to see… [and it] begs the question, ‘Why is so much cash being built up?’” pondered Morningstar analyst Greggory Warren, reported the Financial Times.

Warren also pointed out that he didn’t think Buffett was gearing up for a major acquisition, given his recent struggle to compete with other buyers. Moreover, Berkshire hasn’t been providing capital to large US businesses like Intel that have been seeking tens of billions of dollars of capital to fund their operations.

Buffett has also reduced his buying of other stocks this year, acquiring equities worth just $5.8 billion through the end of September, a figure overshadowed by the $133.2 billion of stock sales Berkshire has carried out.

Jeff Muscatello, a research analyst at Berkshire investor Douglass Winthrop, suggested that the impending management transition could be a factor in Buffett’s decision to cash out. “The nearing inevitable management transition makes it an opportune time to clear the decks for the next generation,” he said.

Why It Matters: This move comes after Berkshire Hathaway reported a decline in third-quarter operating earnings, driven by weakness in the insurance underwriting segment. Approximately 70% of the aggregate fair value was concentrated in five companies as of September 2024.

An earlier report pointed out that Buffett’s Berkshire Hathaway missed out on $23 billion in profits by significantly reducing its stake in Apple. This move puzzled investors, with some experts suggesting that Buffett prefers round numbers, so stopping at 400 million shares might not be a big deal. Others saw Buffett positioning Apple as a key, long-term investment, similar to how he views Coca-Cola.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump presidency likely won't be a problem for Nvidia's stock

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

Donald Trump’s return to the White House has me wondering about the world’s most beloved stock, Nvidia (NVDA).

Is a Trump presidency going to be good or bad for the AI market darling? Has he ever taken CEO Jensen Huang to task on X? Does Jensen feel a certain way about Trump, and perhaps could add headline risk to the company’s stock price?

All of this matters since, as I mentioned, Nvidia has become the market — even before its inclusion in the former smokestack index known as the Dow Jones Industrial Average (^DJI).

The short answer to all of these pressing questions is, who really knows? I can’t find a lot.

Do an advanced search of Trump’s X account, and you do not unearth a single post on Jensen or Nvidia. Scour interviews of Jensen from the prior Trump presidency, and there isn’t much for Trump to feast on as he returns to the Oval Office.

“I’m optimistic about the outcome, irrespective of how, on balance, I prefer a more liberal government. I have confidence in the resilience of the institutions. We’ll find a way through and find a way forward,” Huang said in a November 2016 VentureBeat story following Trump’s first White House win.

Huang is besties with Tesla (TSLA) CEO and Trump supporter Elon Musk, but it’s unclear what that means for Nvidia’s financial fortunes over the next four years.

Chat up investors, and the early vibe is that Nvidia should do just fine, as the factors driving its business are simply too powerful to be snuffed out.

“It’s hard to draw a straight line between AI or Nvidia and Trump,” EMJ Capital founder Eric Jackson said on Yahoo Finance’s Opening Bid podcast (video above; listen below). “I think there’s some interesting ways that AI is kind of infiltrating all corners of tech. But in general, obviously, Trump is very pro-growth, low taxes, and that’s going to sweep up all of tech and that includes AI.”

Jackson thinks Nvidia could see stronger demand from the bitcoin mining industry, as Trump may open up the digital asset markets more.

Nvidia could also cash in from looser regulations on the energy industry, freeing up hyperscalers to move more quickly with AI infrastructure buildouts, Jackson reasoned.

One risk to watch, Jackson said, is if a tariff-induced trade war with China occurs. Nvidia not only sells chips in China but has important product development talent in the country. You also have to keep in mind what this trade war would mean to China’s relationship with key chip producer Taiwan.

1 Stock to Buy, 1 Stock to Sell This Week: Shopify, Occidental Petroleum

• CPI inflation, retail sales, producer prices, and more earnings will be in focus this week.

• Shopify stands out as a buy, particularly with the holiday season around the corner.

• Occidental Petroleum’s challenging landscape makes it one to approach with caution.

• Looking for more actionable trade ideas? Unlock access to InvestingPro for less than $8 a month!

U.S. stocks closed higher on Friday to cap off their best week of the year, as the Dow and S&P 500 surged to new records after Donald Trump’s decisive election victory.

Investors are betting that a Trump administration will bring lighter regulation and tax cuts that could boost the U.S. economy.

For the week, the blue-chip Dow Jones Industrial Average climbed 4.6%, the benchmark S&P 500 gained 4.7%, and the tech-heavy Nasdaq Composite popped 5.7%.

Source: Investing.com

The week ahead is expected to be an eventful one as investors assess the outlook for the economy, inflation, interest rates and corporate earnings.

On the economic calendar, most important will be Wednesday’s U.S. consumer price inflation report for October, which is forecast to show headline annual CPI rising 2.4% year-over-year.

Other noteworthy economic reports include U.S. retail sales data, as well as a report on producer prices, will help fill out the inflation picture.

Source: Investing.com

That will be accompanied by a heavy slate of Fed speakers, including Chairman Jerome Powell on Thursday.

Elsewhere, the earnings season continues, with the list of notable names due to report including Walt Disney (NYSE:DIS), Home Depot (NYSE:HD), Cisco (NASDAQ:CSCO), Applied Materials (NASDAQ:AMAT), Shopify (NYSE:SHOP), Spotify (NYSE:SPOT), and Alibaba (NYSE:BABA).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, November 11 – Friday, November 15.

Shopify stands out as a top buy this week, as the e-commerce software leader is anticipated to deliver another quarter of strong top-line growth and provide an upbeat outlook thanks to robust growth across key metrics.

Shopify’s report is set for release Tuesday at 7:00 AM ET. Market participants expect a sizable swing in SHOP stock after the print drops, according to the options market, with a possible implied move of approximately 14% in either direction. Shares gapped up 26% after its last earnings report in August.

Source: InvestingPro

Analysts have raised profit forecasts 33 times in recent weeks, as per an InvestingPro survey, highlighting confidence in Shopify’s continued expansion.

Trump Victory Signals 'Golden Era' For Crypto, Says Binance CEO As Bitcoin Tops $77K For First Time

In the wake of Donald Trump‘s triumph in the U.S. presidential election, Binance CEO Richard Teng has voiced his positive outlook for the future of the cryptocurrency sector in America.

What Happened: Teng interprets Trump’s victory as a “golden era” for the crypto industry, predicting the arrival of new U.S. regulators who are open to digital currencies, reported the Financial Times. The crypto sector, previously under strain from the preceding Democrat administration, now anticipates a substantial policy shift in Washington.

In the previous year, Binance faced a substantial $4.3 billion penalty for violations of anti-money laundering and sanctions, and its former head was incarcerated. The industry viewed the election as a pivotal moment to alter attitudes in Washington, which they believed were suppressing innovation and pushing businesses out of the U.S.

Post-election, Bitcoin BTC/USD experienced a nearly 10% surge, reaching a record high of over $76,000. On Thursday, a record $1.4 billion was invested into U.S. bitcoin exchange-traded funds, such as Grayscale Bitcoin Trust GBTC and iShares Bitcoin Trust ETF IBIT, which directly invest in the cryptocurrency, according to Bloomberg data.

Investors are optimistic that the Trump administration will establish an agenda that attracts major U.S. institutions that have so far remained uninvolved. Shervin Pishevar, a venture capitalist with close ties to Trump and Elon Musk, expressed that the US “is now on the verge of sensible crypto policy.”

Trump’s victory is perceived as “an unbelievably important day for the cryptocurrency industry,” in the words of Mike Novogratz, the billionaire founder of the crypto group Galaxy. The industry also anticipates a policy shift at the Securities and Exchange Commission, where chair Gary Gensler has initiated a comprehensive offensive.

The crypto industry’s ultimate goal is a policy shift at the Securities and Exchange Commission, where chair Gary Gensler has initiated a comprehensive offensive. The industry hopes for a halt on pending cases and a rectification of the perceived injustices of the previous leadership.

Why It Matters: The crypto industry’s optimism following Trump’s win is in line with recent predictions of a bullish cycle in the crypto market. Analysts have pointed to favorable macroeconomic conditions and the potential for more crypto-friendly legislation under the Republican administration as key drivers of this anticipated growth.

Additionally, the expected shift in regulatory policies is seen as a significant factor in the predicted strong performance of Bitcoin and gold under the Trump presidency. These assets are viewed as reliable stores of value in scenarios of currency devaluation, which could result from inflationary or expansionary fiscal policies.

Furthermore, the industry’s optimism is reflected in the projected price surge of Bitcoin to $80,000 this month. Industry experts anticipate that a more favorable regulatory climate under the Trump administration could drive further growth in the crypto market.

Price Action: Bitcoin is trading at $77,310, marking a 13.52% increase over the past week, according to data from Benzinga Pro. BTC surpassed the $77,000 threshold for the first time.

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Expect a ‘huge sucking sound’ of foreign capital flooding in as U.S. dominance of global finance increases, top economist says

Wall Street has been flying high as an expected Republican sweep in the election drives hopes for lower taxes and deregulation, and that makes U.S. financial markets more attractive to the rest of the world, a top economist said.

In an interview on Bloomberg TV on Friday, Allianz chief economic advisor Mohamed El-Erian was asked if investors should expect a positive growth shock that’s accompanied by more inflation.

“The direction of travel is clear: More growth, slightly higher inflation, a higher public sector borrowing requirement, and a huge sucking sound where a lot of foreign capital will end up in the U.S.,” he replied.

The magnitudes of those trends will become more apparent when policies from the incoming Trump administration become clearer—and when the people who will carry them out become known, El-Erian added.

Just days after the presidential election, talk of potential Cabinet appointments is already ramping up. On Friday, the Financial Times reported that Robert Lighthizer, who was U.S. Trade Representative during Trump’s first term, was asked to fill the post again.

Meanwhile, the job of Treasury secretary will likely be offered to a financier, the FT added, with hedge fund managers Scott Bessent and John Paulson seen as possibilities.

Meanwhile, the rest of the world may have more trouble coping with a period of faster growth and hotter inflation, adding to America’s relative edge, El-Erian said.

“This is a period in which U.S. dominance of the global system is going to increase, both for positive reasons and for negative reasons in the short term,” he explained. “The rest of the world simply cannot build enough pipes around the U.S. They’re trying and they’ve been doing it, but these pipes are very small compared to the size of the U.S.”

Indeed, despite fears that Trump’s tax cuts, tariffs, and immigration crackdown will be inflationary and worsen deficits, bonds yields have come back down after soaring in the immediate aftermath of the election.

El-Erian argued that’s because U.S. bonds have become more attractive relative to those from other advanced economies.

Continued demand for Treasuries would help the federal government finance what’s expected to be an explosion of debt under another Trump presidency.

Ahead of the election, the nonpartisan Committee for a Responsible Federal Budget estimated that his policies could add $7.5 trillion to the debt and possibly as much as $15.2 trillion.

But if investors, especially “bond vigilantes,” balk at the enormous volumes of debt the Treasury Department auctions, they could send yields higher and raise borrowing costs across key segments of the economy, like mortgage rates.

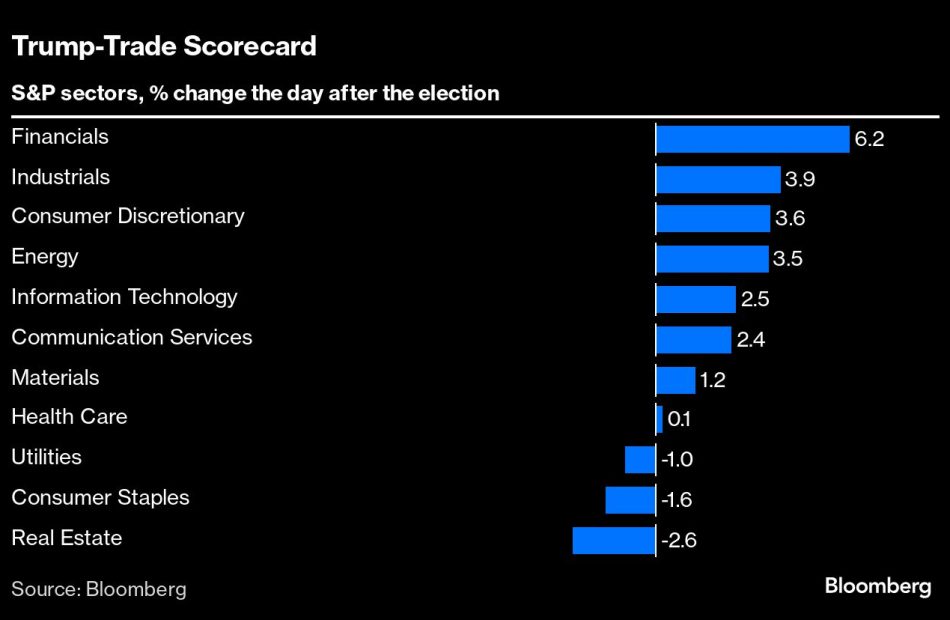

With Trump Win Boosting Stocks, Investors Hunt for Next Winners

(Bloomberg) — For investors looking past the initial risk-on rally in US equities following Donald Trump’s decisive election victory, now comes the hard part.

Most Read from Bloomberg

The Republican president-elect made plenty of campaign promises: steep tariffs, tax cuts, business-friendly deregulation and tighter immigration laws, to name some. For investors who plowed into stocks last week on speculation Trump’s policies will bolster the economy, the challenge is to figure out which sectors will get a lasting boost.

Tariffs, for example, could spark inflation and hurt large multinational firms, while potentially helping domestically oriented small-cap stocks. However, an immigration crackdown risks lifting labor costs, likely squeezing smaller businesses. Meanwhile, a friendly stance toward traditional energy that lifts production might drive down oil prices, and efforts to reverse President Joe Biden’s policies designed to help the clean-energy and electric-vehicle industries could have a hard time getting through Congress.

“I expect active investors to start using a scalpel to sift through at industry levels to see which companies and industries might benefit now,” said Eric Clark, a portfolio manager at Accuvest Global Advisors. “In time we will get more data points on what will actually be implemented and how to play that.”

Clark has already acted on some opportunities. As banks, industrials, energy and big-technology stocks pushed the equities market higher on Wednesday, he sold some tech and financial shares. He also bought stocks in luxury retail and consumer staples — which were in the red amid the surge.

Clearer Picture

Small-cap stocks rallied last week, and they appear to be in a sweet spot as traders assess the potential policy backdrop ahead. These companies, which make most of their revenue at home, stand to benefit from heightened protectionism. A possible corporate-tax cut should also help.

Trump has proposed a 10% to 20% across-the-board levy on imports, and as high as 60% on China-made goods. The prospect that at least some tariffs will come to fruition helped drive the Russell 2000 Index — a benchmark for small-cap stocks — up 8.6% last week. Digital payments company Sezzle Inc., one of the gauge’s top gainers, doubled during that time.

Financial stocks are also seen as being in a strong position, given Trump’s pledge to make changes to regulatory bodies that have pursued tougher banking rules under Biden. As Wells Fargo & Co. bank analyst Mike Mayo sees it, a new era of deregulation could boost Wall Street profitability. Shares of Citigroup Inc., Goldman Sachs Group Inc. and JPMorgan Chase & Co. soared on Trump’s victory.

Shaq Buys Out Delivery Team's Van and Car, Leaving Them To Catch An Uber

Former NBA superstar Shaquille O’Neal made an unexpected addition to his car collection, acquiring a new Mercedes-Benz Sprinter and an S-Class in a spontaneous purchase.

What Happened: O’Neal had a custom Mercedes-Benz Sprinter delivered to his Atlanta estate. The luxury vehicle, customized by Effortless Motors, features a fully decked out cabin in brown leather, ambient lighting, an LCD screen, and a refrigerator.

Upon the delivery of the Sprinter, O’Neal also decided to purchase the S-Class that the Effortless Motors team arrived in, leaving them to return via Uber, reports Autoevolution.

The S-Class, as per the Instagram post, is an S 550 model. According to the outlet Shaq had totally forgotten he’d ordered a Sprinter. “Oh, that’s right, I bought a Sprinter!” he said, surprised, when he saw it parked in his driveway.

Also Read: NBA Legend Shaq Admitted That He ‘Never Voted’ In Presidential Election Until 2020

But his attention was quickly drawn to the stylish S-Class that the tuner’s team drove over in. “I’m getting this one right now!” Shaq excitedly told the owner.

The current W223 lineup does not include an S 550 for America, suggesting the vehicle could be either the S 500 4MATIC Sedan or the S 580e 4MATIC with a plug-in hybrid system.

Why It Matters: O’Neal’s love for unique and eye-catching cars is well-known. His collection boasts several Rolls-Royces, a custom TRX Apocalypse truck, and three Tesla Cybertrucks.

The latest purchases not only expand his collection but also highlight his preference for luxury and comfort.

The customization of the Sprinter by Effortless Motors underscores the growing trend of personalized luxury vehicles among celebrities.

Read Next

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Anthony Scaramucci Sued By FTX, Says Bankman-Fried Made Investments In SkyBridge Endeavors That 'Conveyed Little To No Benefit'

FTX, once a leading crypto exchange for Bitcoin BTC/USD, Ethereum ETH/USD and Dogecoin DOGE/USD, has reportedly filed a lawsuit against former White House communications director Anthony Scaramucci as well as his hedge fund SkyBridge Capital.

What Happened: The lawsuit against Scaramucci is one among the 23 filed by FTX in the bankruptcy court of Delaware on Friday in a bid to gather money for the creditors of the now-bankrupt crypto exchange, Bloomberg reported. Plaintiffs of the lawsuit include digital-asset exchange Crypto.com and political groups such as the Mark Zuckerberg-founded FWD.US, the report added.

According to FTX, its founder Sam Bankman-Fried made “lavish and showy ‘investments’” through the crypto winter of 2022 including in Scaramucci for an “established financial, political, and social” network.

FTX claims in the court filings viewed by Bloomberg that the investments “conveyed little to no benefit,” and “instead served only to prop up Bankman-Fried’s standing in the worlds of politics and traditional finance.”

Why It Matters: According to FTX, Bankman-Fried invested $67 million into various SkyBridge endeavors in 2022 when SkyBridge’s assets under management had fallen to about $2.2 billion from a $9 billion high in 2015.

FTX Ventures bought a 30% stake in SkyBridge Capital in September 2022. Scaramucci then said that the firm plans to deploy capital raised from the FTX transaction to purchase more crypto assets.

FTX subsequently collapsed in November 2022.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

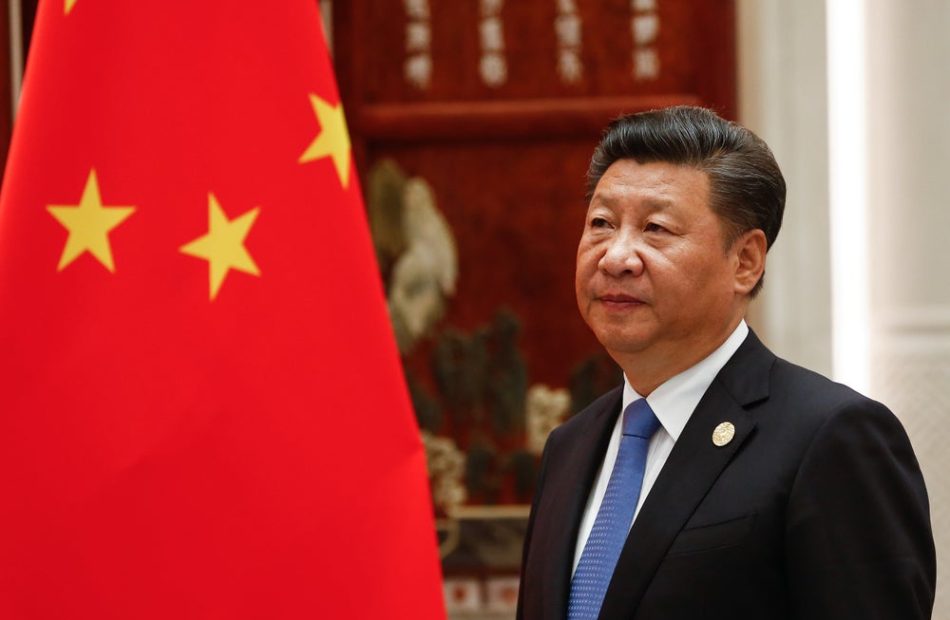

Xi Jinping Courts US Allies To Counter Trump's Trade Threats: Report

In response to President-elect Donald Trump’s threats to isolate Chinese goods from the U.S. market, China is reportedly seeking to engage U.S. allies in Europe and Asia to mitigate the potential impact on its economy.

What Happened: Trump’s campaign promise to impose tariffs of up to 60% on Chinese imports poses a significant threat to Xi Jinping‘s economic model, which is heavily reliant on manufacturing and exports, reported The Wall Street Journal on Thursday.

To counter this, the Chinese leadership is reportedly considering offering tariff cuts, visa exemptions, and other incentives to U.S. allies in Europe and Asia. This strategy, termed “unilateral opening,” represents a shift from China’s traditional quid-pro-quo approach to economic and diplomatic deals.

See Also: Kentucky Gov. Beshear: ‘The Jury Is No Longer Out,’ Kentuckians Want Medical Cannabis

Despite this, China faces resistance from U.S. allies, with the European Union (EU) expressing discontent over China’s support for Russia’s actions in Ukraine. Meanwhile, U.S. allies in Asia, such as Japan, South Korea, and the Philippines, are growing increasingly wary of China’s assertive behavior.

China has already lifted visa restrictions for travelers from over 20 nations, including Australia, New Zealand, Denmark, Finland, and South Korea. Additionally, the country is contemplating significant tariff reductions in various industries, including electrical and telecommunications equipment, seafood, and agricultural products. These moves are seen as part of China’s broader strategy to stimulate economic growth and strengthen its trade relations.

Chinese Premier Li Qiang stated at a trade fair in Shanghai that China would continue to pursue unilateral opening to provide opportunities for foreigners to access the Chinese market.

Why It Matters: Through this new strategy, Beijing aims to capitalize on fears in Europe and Asia that Trump will revive his often hostile rhetoric against U.S. allies. By taking the initiative, China hopes to increase pressure on the U.S. and attempt to divide its allies.

Trump’s victory in the U.S. presidential election has also led to a decline in U.S.-listed Chinese stocks, with analysts warning of a potential escalation in U.S.-China tensions and its impact on trade policies. Major U.S.-listed Chinese stocks Alibaba Group Holding BABA, JD.com, Inc. (NASDAQ: JD), Baidu, Inc. BIDU, NIO Inc. NIO, Li Auto Inc. LI, and XPeng Inc. (NYSE: XPEV) were trading lower in the U.S. after Trump’s victory.

Read Next: How To Earn $500 A Month From Nvidia Stock After Trump Win

Photo by Gil Corzo on Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.