PACS Group, Inc. ANNOUNCEMENT: If You Have Suffered Losses in PACS Group, Inc. (NYSE: PACS), You Are Encouraged to Contact The Rosen Law Firm About Your Rights

NEW YORK, Nov. 09, 2024 (GLOBE NEWSWIRE) —

Why: Rosen Law Firm, a global investor rights law firm, announces an investigation of potential securities claims on behalf of shareholders of PACS Group, Inc. PACS resulting from allegations that PACS Group may have issued materially misleading business information to the investing public.

So What: If you purchased PACS Group securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

What to do next: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=30617 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

What is this about: On November 4, 2024, Hindenburg Research issued a report entitled “PACS Group: How To Become A Billionaire In The Skilled Nursing Industry By Systematically Scamming Taxpayers.” The report stated “[d]espite operating in a highly competitive and highly regulated industry, PACS claims to have discovered a winning ‘turnaround’ formula for transforming poorly performing [skilled nursing facilities] into cash spigots”, and the “5-month investigation, including interviews with 18 former employees, competitors, and an analysis of 900+ detailed facility-level cost reports, revealed that PACS’ ‘turnaround’ strategy largely boils down to systematically scamming taxpayer-funded healthcare programs.”

On this news, PACS Group’s stock fell 27.7% on November 4, 2024.

Why Rosen Law: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm achieved the largest ever securities class action settlement against a Chinese Company at the time. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

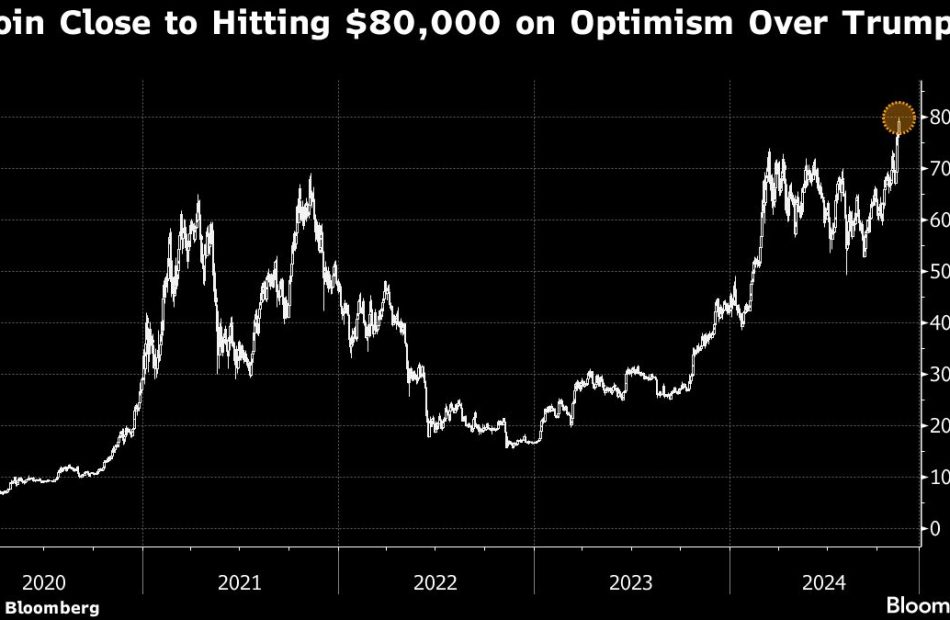

Bitcoin on Cusp of $80,000 for First Time on Optimism Over Trump

(Bloomberg) — Bitcoin is closing in on $80,000 for the first time, boosted by President-elect Donald Trump’s embrace of digital assets and the prospect of a Congress featuring pro-crypto lawmakers.

Most Read from Bloomberg

The cryptocurrency climbed as much as 4.3% to an unprecedented $79,771 on Sunday and remained near $79,000 as of 2:05 p.m. in Singapore. Smaller tokens like Cardano and meme-crowd favorite Dogecoin also rallied.

Trump vowed on the campaign trail to put the US at the center of the digital-asset industry, including creating a strategic Bitcoin stockpile and appointing regulators enamored with digital assets. He emerged from Tuesday’s election in a stronger position than expected — his Republican Party has control of the Senate and is on the verge of holding a narrow majority in the House.

“With the dust from Trump’s victory still settling down, it was only a matter of time before a run-up of some sort occurred given the perception of Trump being pro-crypto, and that’s what we’re seeing now,” said Le Shi, Hong Kong managing director at market-making firm Auros.

ETFs, Fed

Bitcoin has added about 90% so far in 2024, helped by robust demand for dedicated US exchange-traded funds and interest-rate cuts by the Federal Reserve. The rise in the largest digital token, which scaled fresh records after the US vote, exceeds the returns from investments such as stocks and gold.

The ETFs, powered by BlackRock Inc.’s $35 billion iShares Bitcoin Trust, posted a record daily net inflow of almost $1.4 billion on Thursday, according to data compiled by Bloomberg. A day earlier, the iShares ETF’s trading volume jumped to an all-time peak — all signs of how Trump’s victory is reshaping crypto.

Trump’s stance contrasts with a crackdown on digital assets under President Joe Biden. Securities & Exchange Commission Chair Gary Gensler repeatedly labeled the sector as rife with fraud and misconduct. The agency turned the screws on crypto following a 2022 market rout and a litany of collapses, notably the bankruptcy of Sam Bankman-Fried’s fraudulent FTX exchange.

Digital-asset companies and executives spent heavily during the US election campaign to promote candidates viewed as favorable toward their interests.

“Trump has promised supportive regulation, and the sweep of the House and the Senate makes the passage of crypto bills much more likely,” wrote Noelle Acheson, author of the Crypto Is Macro Now newsletter.

Match Group, Inc. Announcement: If You Have Suffered Losses Match Group, Inc. (NASDAQ: MTCH), You Are Encouraged to Contact The Rosen Law Firm About Your Rights

NEW YORK, Nov. 09, 2024 (GLOBE NEWSWIRE) —

Why: Rosen Law Firm, a global investor rights law firm, announces an investigation of potential securities claims on behalf of shareholders of Match Group, Inc. MTCH resulting from allegations that Match Group may have issued materially misleading business information to the investing public.

So What: If you purchased Match Group securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

What to do next: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=12766 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

What is this about: On November 7, 2024, Investopedia published an article entitled “Match Group Stock Slips as Fourth Quarter Outlook Disappoints.” This article said that “[s]hares of online dating giant Match Group tumbled Thursday morning despite a third-quarter earnings beat released after the bell Wednesday. [. . .] Match said Tinder Direct revenue came in below its own expectations, as the app’s monthly active users (MAUs) declined 9% from the same time last year and its revenue per payer (RPP) grew less than expected. Some new features tested with Tinder users in the quarter negatively impacted subscription revenue, which the company said will likely also have an impact on fourth quarter revenue.”

On this news, the price of Match Group stock fell by 17.8% to close at $31.11 per share on November 7, 2024.

Why Rosen Law: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm achieved the largest ever securities class action settlement against a Chinese Company at the time. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Want Decades of Passive Income? Buy This Warren Buffett Stock and Hold On

A common misconception among beginner investors is that choosing growth stocks is required to generate lucrative portfolio gains. Many times, the best-performing stocks are actually blue chip businesses that grow sales and profits steadily and consistently over a long period of time. In turn, these companies may reward shareholders in the form of a dividend.

Warren Buffett has perfected this approach to portfolio management. His Berkshire Hathaway portfolio owns very few smaller growth stocks. Instead, Buffett is known for taking positions in industry-leading brands that sport strong cash flow and dividend payments.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

One Buffett stock that looks particularly tempting right now is credit card company Visa (NYSE: V). Below, I’ll explore why Visa is a solid choice for passive income and assess how owning the stock for decades could prove to be a wise move.

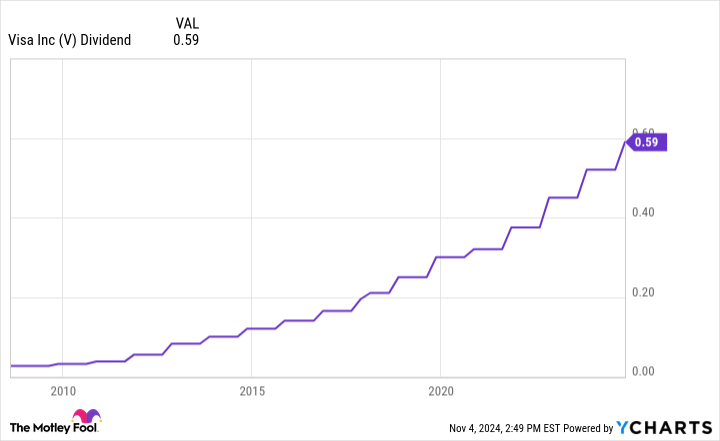

On Oct. 29, Visa reported financial and operating results for its fiscal fourth quarter and full year 2024. One of the highlights of the report was that Visa’s board of directors approved a 13% increase to the company’s quarterly dividend, bringing it to $0.59 per share.

As the chart below shows, Visa has raised its dividend steadily since the company’s initial public offering (IPO) in 2008.

Investors hold on to dividend stocks for different reasons. For retirees, dividend income can be a good source of cash and help prevent dipping into your savings for unnecessary reasons.

However, younger demographics may want to augment their stocks with reliable dividend players as well.

The chart above shows how Visa stock has performed since its IPO both on a stand-alone and total return basis. The big difference between these two lines is that the total return includes reinvesting dividend income into Visa stock as opposed to receiving the payment as cash. As you can see, reinvesting dividends has added significant appreciation to Visa’s long-run return.

Unlike retirees, younger investors may not need to supplement their cash savings each month or quarter. But as the chart makes clear, reinvesting dividend income into your stock portfolio can bolster your gains in a material way.

An important thing for dividend investors to consider is whether or not these payments are sustainable. In other words, does the company in question have the financial wherewithal not only to maintain paying a dividend, but hopefully raise it?

Trump's Tariff Plans On Canadian Goods Would 'Inevitably Hurt' American Workers, Warns Justin Trudeau

Canadian Prime Minister Justin Trudeau warned that any tariffs or trade barriers imposed by the U.S. on Canadian goods could harm American workers.

What Happened: During a press conference in Vancouver on Friday, Trudeau highlighted the deep-seated interconnectedness of the supply chains between the US and Canada. He asserted that any increase in border restrictions or imposition of tariffs would “inevitably hurt” American jobs and workers, given Canada’s reliability as a trade partner, reported Bloomberg.

Trudeau’s comments were directed at President-elect Donald Trump, who has proposed a minimum 10% tariff on all U.S. imports, with no exemptions for Canada. Economists at Desjardins estimate that this policy could lead to a 1.7% reduction in Canada’s real GDP by the end of 2028.

Trump has expressed his intention to implement a “pro-American trade policy that uses tariffs to encourage production here and bring trillions and trillions of dollars back home.”

Trudeau reiterated Canada’s alignment with the U.S. in addressing “overcapacity” from China, proposing 100% tariffs on electric vehicles from China and 25% tariffs on steel and aluminum.

“There’s an awful lot Canada and the US are going to be able to do together to successfully compete with the world,” the Canadian PM said.

Why It Matters: The warning from Trudeau comes in the wake of Trump’s victory in the U.S. presidential election. Analysts have suggested that Trump’s return to the White House could lead to a shift in the commodity market, with a potential impact on the steel industry. Trump’s history of deregulation and tariff-heavy policies could result in greater domestic support for the U.S. steel industry, according to analysts at JPMorgan Chase & Co.

Trump’s proposed tariffs have also raised concerns about their potential impact on American consumers. A study by the National Retail Federation (NRF) warned that the proposed tariffs could significantly impact American consumers, potentially reducing annual spending by $78 billion.

Trump’s specific plans concerning tariffs and taxes have been unclear and have varied greatly. The 2024 Republican Party platform calls for “baseline Tariffs on Foreign-made goods.” According to the Tax Policy Center, Trump most often promotes a 10% worldwide tariff and a 60% tax on imported Chinese goods.

Read Next: Jim Cramer Calls Trump’s Return To White House A ‘Huge Win For The Stock Market’

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.