This Magnificent Artificial Intelligence (AI) Stock Could Hit a $2 Trillion Valuation in the Next 3 Years

Artificial intelligence (AI) has turned out to be a tremendous catalyst for many companies, thanks to its growing adoption in multiple industries ranging from cloud computing to factory automation to retail to advertising. The good part is that the technology is currently in its early phases of growth.

Bloomberg Intelligence forecasts that generative AI could become a $1.3 trillion industry in 2032 (compared to just $40 billion in 2022), clocking an annual growth rate of 42%. It’s worth noting that the adoption of AI within the advertising industry is forecast to grow at a stronger rate during this period. More specifically, generative AI-driven ad spending is expected to grow at an annual rate of 125% through 2032, generating $192 billion in annual revenue, compared to just $57 million in 2022.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The rapid adoption of generative AI within the advertising market is playing a key role in driving impressive growth for Meta Platforms (NASDAQ: META), the world’s seventh-largest company, with a market cap of $1.43 trillion. Let’s take a closer look at how this social media giant is using AI to set itself up for long-term growth, and why it seems on track to become a $2 trillion company.

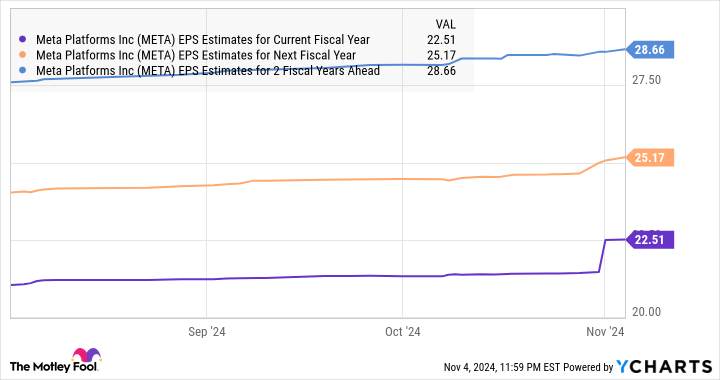

Meta Platforms released its third-quarter 2024 results on Oct. 30. The company’s revenue increased 10% year over year to $40.6 billion, while its non-GAAP earnings per share shot up at a faster pace of 37% to $6.03 per share. Wall Street would have settled for $5.25 per share in earnings from Meta on revenue of $40.3 billion.

The “Magnificent Seven” stock’s robust year-over-year growth was driven by a combination of an increase in ad impressions delivered and a jump in the average price per ad. More specifically, Meta’s ad impressions increased by 7% from the same period last year, while the average price per ad was up 11% on a year-over-year basis. The stronger growth in the company’s earnings can be attributed to the fact that its costs and expenses increased at a slower pace of 14% year over year to $23.2 billion.

However, Meta stock dipped 4% following its quarterly report, despite reporting better-than-expected numbers. That was because of management’s guidance about an increase in capital spending. Meta has increased its 2024 capital expenditure budget from the earlier range of $37 billion to $40 billion to an updated range of $38 billion to $40 billion.

Leave a Reply