Trump presidency likely won't be a problem for Nvidia's stock

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

Donald Trump’s return to the White House has me wondering about the world’s most beloved stock, Nvidia (NVDA).

Is a Trump presidency going to be good or bad for the AI market darling? Has he ever taken CEO Jensen Huang to task on X? Does Jensen feel a certain way about Trump, and perhaps could add headline risk to the company’s stock price?

All of this matters since, as I mentioned, Nvidia has become the market — even before its inclusion in the former smokestack index known as the Dow Jones Industrial Average (^DJI).

The short answer to all of these pressing questions is, who really knows? I can’t find a lot.

Do an advanced search of Trump’s X account, and you do not unearth a single post on Jensen or Nvidia. Scour interviews of Jensen from the prior Trump presidency, and there isn’t much for Trump to feast on as he returns to the Oval Office.

“I’m optimistic about the outcome, irrespective of how, on balance, I prefer a more liberal government. I have confidence in the resilience of the institutions. We’ll find a way through and find a way forward,” Huang said in a November 2016 VentureBeat story following Trump’s first White House win.

Huang is besties with Tesla (TSLA) CEO and Trump supporter Elon Musk, but it’s unclear what that means for Nvidia’s financial fortunes over the next four years.

Chat up investors, and the early vibe is that Nvidia should do just fine, as the factors driving its business are simply too powerful to be snuffed out.

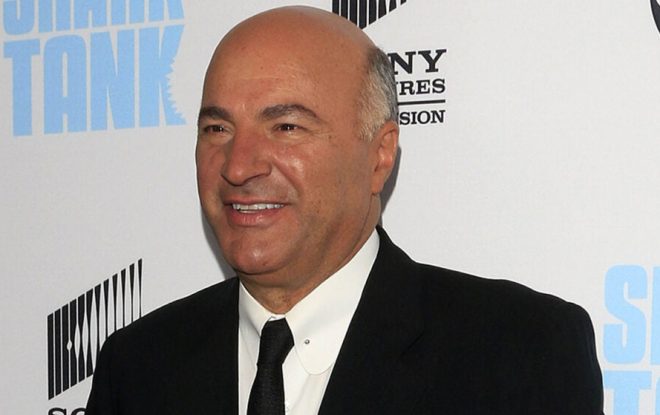

“It’s hard to draw a straight line between AI or Nvidia and Trump,” EMJ Capital founder Eric Jackson said on Yahoo Finance’s Opening Bid podcast (video above; listen below). “I think there’s some interesting ways that AI is kind of infiltrating all corners of tech. But in general, obviously, Trump is very pro-growth, low taxes, and that’s going to sweep up all of tech and that includes AI.”

Jackson thinks Nvidia could see stronger demand from the bitcoin mining industry, as Trump may open up the digital asset markets more.

Nvidia could also cash in from looser regulations on the energy industry, freeing up hyperscalers to move more quickly with AI infrastructure buildouts, Jackson reasoned.

One risk to watch, Jackson said, is if a tariff-induced trade war with China occurs. Nvidia not only sells chips in China but has important product development talent in the country. You also have to keep in mind what this trade war would mean to China’s relationship with key chip producer Taiwan.

Leave a Reply