Want Decades of Passive Income? Buy This Warren Buffett Stock and Hold On

A common misconception among beginner investors is that choosing growth stocks is required to generate lucrative portfolio gains. Many times, the best-performing stocks are actually blue chip businesses that grow sales and profits steadily and consistently over a long period of time. In turn, these companies may reward shareholders in the form of a dividend.

Warren Buffett has perfected this approach to portfolio management. His Berkshire Hathaway portfolio owns very few smaller growth stocks. Instead, Buffett is known for taking positions in industry-leading brands that sport strong cash flow and dividend payments.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

One Buffett stock that looks particularly tempting right now is credit card company Visa (NYSE: V). Below, I’ll explore why Visa is a solid choice for passive income and assess how owning the stock for decades could prove to be a wise move.

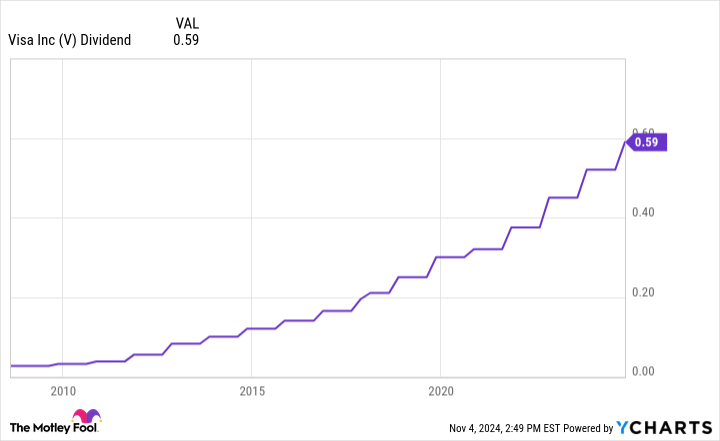

On Oct. 29, Visa reported financial and operating results for its fiscal fourth quarter and full year 2024. One of the highlights of the report was that Visa’s board of directors approved a 13% increase to the company’s quarterly dividend, bringing it to $0.59 per share.

As the chart below shows, Visa has raised its dividend steadily since the company’s initial public offering (IPO) in 2008.

Investors hold on to dividend stocks for different reasons. For retirees, dividend income can be a good source of cash and help prevent dipping into your savings for unnecessary reasons.

However, younger demographics may want to augment their stocks with reliable dividend players as well.

The chart above shows how Visa stock has performed since its IPO both on a stand-alone and total return basis. The big difference between these two lines is that the total return includes reinvesting dividend income into Visa stock as opposed to receiving the payment as cash. As you can see, reinvesting dividends has added significant appreciation to Visa’s long-run return.

Unlike retirees, younger investors may not need to supplement their cash savings each month or quarter. But as the chart makes clear, reinvesting dividend income into your stock portfolio can bolster your gains in a material way.

An important thing for dividend investors to consider is whether or not these payments are sustainable. In other words, does the company in question have the financial wherewithal not only to maintain paying a dividend, but hopefully raise it?

Leave a Reply