Economist Peter Schiff Sees 'A Silver Lining' As Gold Plummets, While Investors Rush To Snap Up Bitcoin Gains: 'Typically…Silver Would Be Down Twice As Much'

As cryptocurrency prices hover around record levels, investors have been keen on adding them to their portfolios. This is evident by the rise in various Bitcoin BTC/USD ETF levels. However, gold prices have declined by nearly 1% in the morning hours as cryptocurrency prices surged. While silver prices have been down too, Peter Schiff, the chairman of SchiffGold.com and chief economist and global strategist at Europac.com suggests that investors should go for silver over Bitcoin as the precious yellow metal declines.

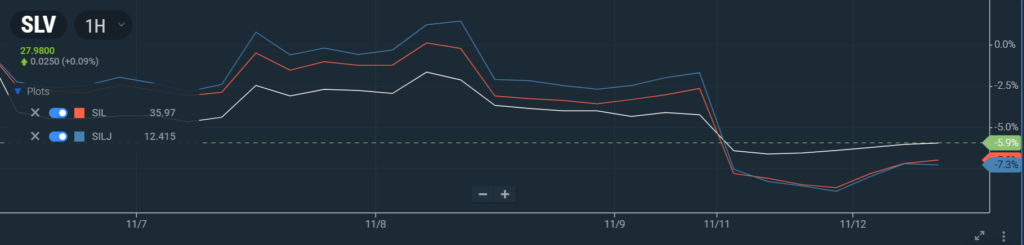

What Happened: Schiff suggests that “typically” silver prices should drop to about half the rate of gold. However, with silver prices holding steady amid market fluctuations, he views this resilience as a “silver lining.” Schiff believes this unusual performance makes silver an attractive investment alternative to Bitcoin and gold ETFs, given its relative stability in the current market.

Also read: Bitcoin Blasts Through $88,000 As Market ‘Euphoria,’ Regulatory Optimism Take Hold

Why It Matters: Comparing the ETFs of all three assets, we see that gold and silver ETFs have underperformed bitcoin ETFs. Gold spot rates XAU were down 1.05% at $2,591.34 per ounce, Silver spot rates XAG were down by 1.25% at $30.30 per ounce and Bitcoin BTC/USD trading at $87,504.28 per coin at the time of publication.

Also read: Here’s How Much $100 In Dogecoin Today Could Be Worth If DOGE Hits New All-Time Highs

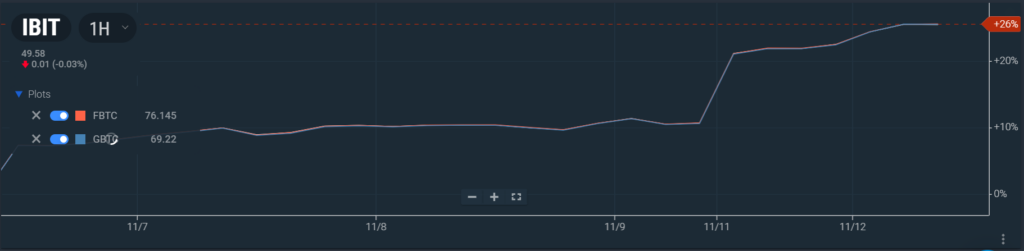

The iShares Bitcoin Trust IBIT was up by 13.5% as of Monday’s close. Additionally, the Fidelity Wise Origin Bitcoin Fund FBTC and the Grayscale Bitcoin Trust GBTC ETFs rose by 13.4% on Monday, as per Benzinga Pro data.

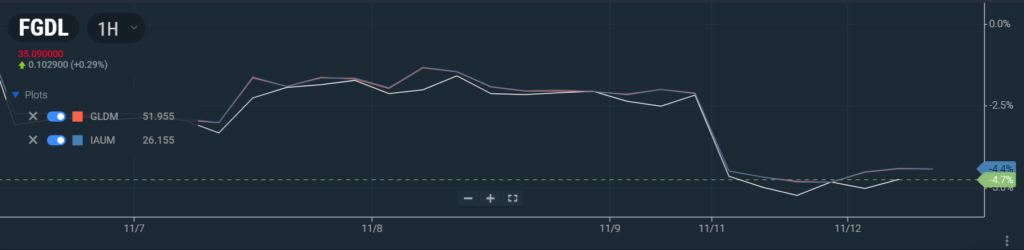

According to Benzinga Pro, Franklin Responsibility Sourced Gold ETF FGDL declined 2.25% as of Monday’s close, whereas the SPDR Gold MiniShares Trust GLDM was down by 2.35% on the same day. iShares Gold Trust Micro Shares IAUM declined by 2.39% on Monday.

Also Read: Gold ETF Hit With $1 Billion Outflow: Investors Dump Safe Haven Asset After Trump Win

While the gold ETFs fell by over 2% on Monday, silver ETFs were down too. As per Benzinga Pro data, iShares Silver Trust SLV was down 1.79% on Monday. Similarly, Global X Silver Miners ETF SIL and Amplify ETF Trust Amplify Junior Silver Miners ETF SILJ were down by 4.39% and 5.77% as of Monday’s close.

Also read: Why Trump’s Win Has 2 Market Experts Betting On Small Caps, Financials

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply