Nu Holdings Options Trading: A Deep Dive into Market Sentiment

Investors with a lot of money to spend have taken a bullish stance on Nu Holdings NU.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with NU, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 14 uncommon options trades for Nu Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 57% bullish and 42%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $123,988, and 10 are calls, for a total amount of $369,648.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $8.0 to $18.0 for Nu Holdings during the past quarter.

Analyzing Volume & Open Interest

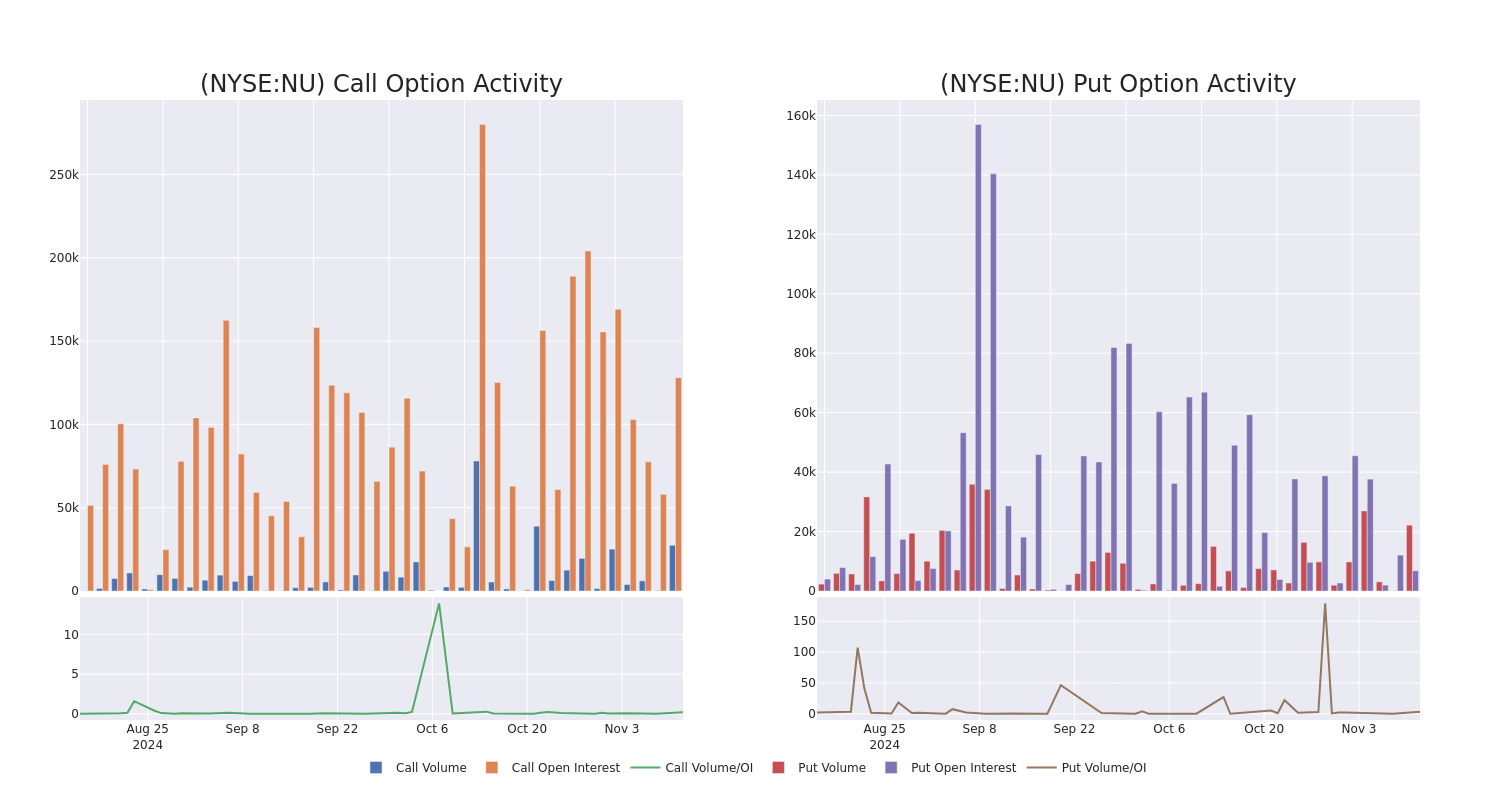

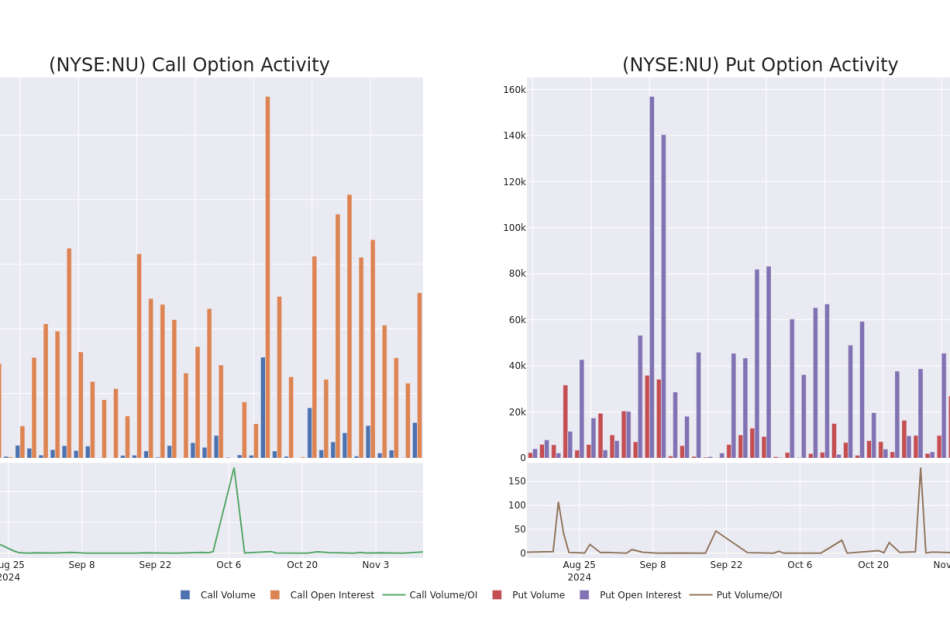

In today’s trading context, the average open interest for options of Nu Holdings stands at 14980.44, with a total volume reaching 49,651.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Nu Holdings, situated within the strike price corridor from $8.0 to $18.0, throughout the last 30 days.

Nu Holdings Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NU | CALL | SWEEP | BEARISH | 11/15/24 | $1.25 | $1.22 | $1.22 | $15.00 | $61.0K | 26.8K | 749 |

| NU | CALL | SWEEP | BEARISH | 11/15/24 | $0.54 | $0.53 | $0.54 | $16.00 | $42.6K | 65.3K | 17.5K |

| NU | CALL | TRADE | BULLISH | 01/15/27 | $9.2 | $8.9 | $9.1 | $8.00 | $41.8K | 402 | 48 |

| NU | CALL | SWEEP | BULLISH | 11/15/24 | $2.05 | $2.02 | $2.05 | $14.00 | $40.9K | 17.9K | 250 |

| NU | PUT | SWEEP | BULLISH | 11/15/24 | $0.19 | $0.18 | $0.18 | $14.50 | $38.4K | 6.8K | 3.8K |

About Nu Holdings

Nu Holdings Ltd is engaged in providing digital banking services. It offers several financial services such as Credit cards, Personal Account, Investments, Personal Loans, Insurance, Mobile payments, Business Accounts, and Rewards. The company earns the majority of its revenue in Brazil.

Following our analysis of the options activities associated with Nu Holdings, we pivot to a closer look at the company’s own performance.

Present Market Standing of Nu Holdings

- Trading volume stands at 26,423,790, with NU’s price down by -0.03%, positioned at $15.88.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 1 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Nu Holdings, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply