This Is What Whales Are Betting On Applied Mat

Whales with a lot of money to spend have taken a noticeably bearish stance on Applied Mat.

Looking at options history for Applied Mat AMAT we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 35% of the investors opened trades with bullish expectations and 57% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $133,910 and 10, calls, for a total amount of $443,864.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $150.0 and $210.0 for Applied Mat, spanning the last three months.

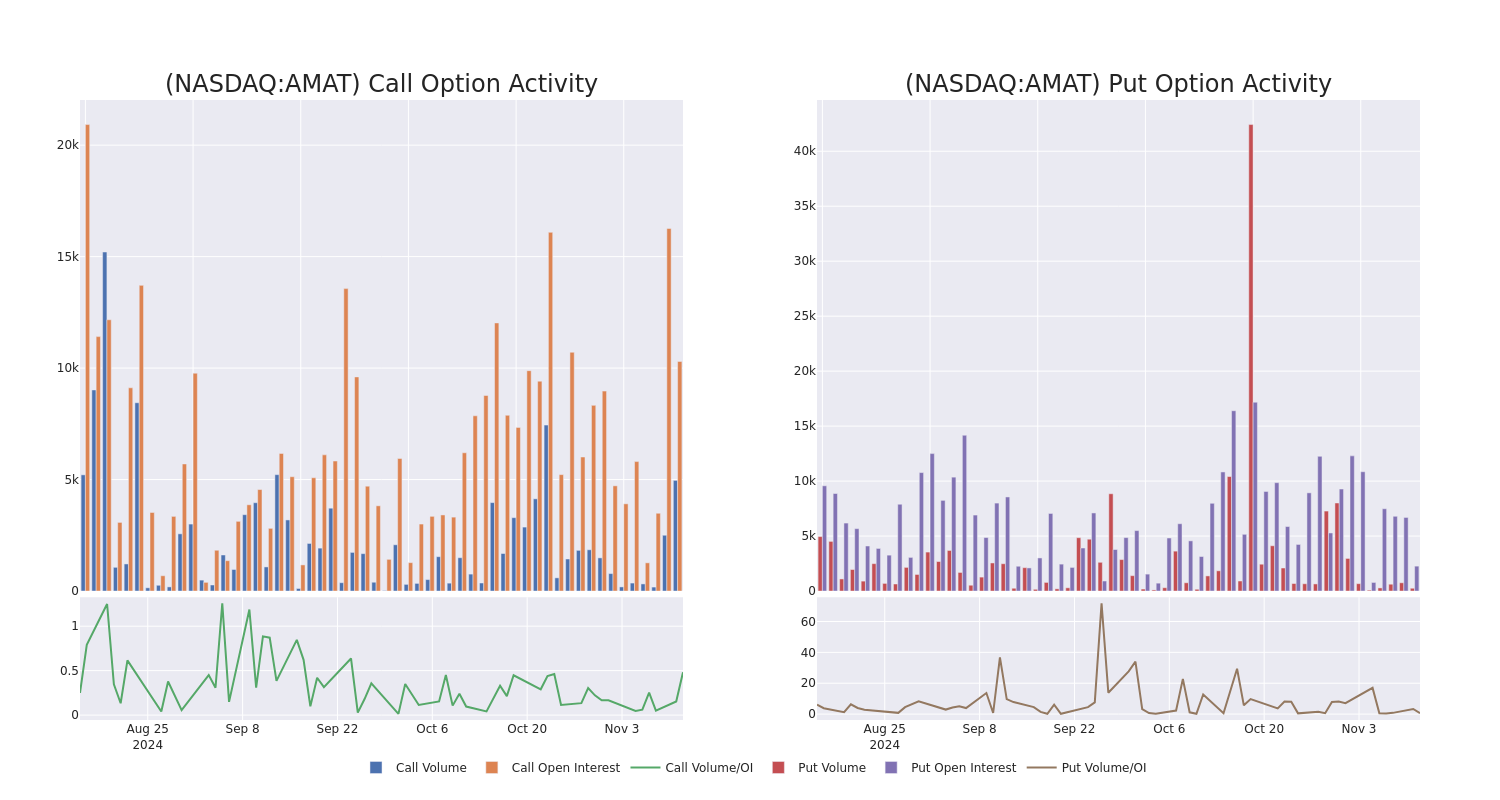

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Applied Mat’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Applied Mat’s whale trades within a strike price range from $150.0 to $210.0 in the last 30 days.

Applied Mat Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | CALL | SWEEP | BEARISH | 11/15/24 | $4.05 | $3.9 | $3.9 | $190.00 | $69.8K | 3.9K | 1.1K |

| AMAT | CALL | TRADE | BEARISH | 11/15/24 | $4.8 | $4.7 | $4.7 | $190.00 | $47.0K | 3.9K | 196 |

| AMAT | CALL | SWEEP | BEARISH | 01/17/25 | $4.65 | $4.55 | $4.55 | $210.00 | $45.5K | 1.8K | 128 |

| AMAT | CALL | TRADE | BULLISH | 11/15/24 | $2.5 | $2.29 | $2.5 | $197.50 | $45.0K | 609 | 236 |

| AMAT | CALL | TRADE | BEARISH | 01/17/25 | $8.5 | $8.3 | $8.38 | $200.00 | $41.9K | 2.4K | 88 |

About Applied Mat

Applied Materials is the largest semiconductor wafer fabrication equipment, or WFE, manufacturer in the world. Applied Materials has a broad portfolio spanning nearly every corner of the WFE ecosystem. Specifically, Applied Materials holds a market share leadership position in deposition, which entails the layering of new materials on semiconductor wafers. It is more exposed to general-purpose logic chips made at integrated device manufacturers and foundries. It counts the largest chipmakers in the world as customers, including TSMC, Intel, and Samsung.

Having examined the options trading patterns of Applied Mat, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Applied Mat’s Current Market Status

- Currently trading with a volume of 3,243,432, the AMAT’s price is down by -0.9%, now at $186.87.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 2 days.

What Analysts Are Saying About Applied Mat

2 market experts have recently issued ratings for this stock, with a consensus target price of $210.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Susquehanna has decided to maintain their Neutral rating on Applied Mat, which currently sits at a price target of $170.

* An analyst from Stifel has decided to maintain their Buy rating on Applied Mat, which currently sits at a price target of $250.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Applied Mat with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply