Wall Street's Most Accurate Analysts Spotlight On 3 Utilities Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilites sector.

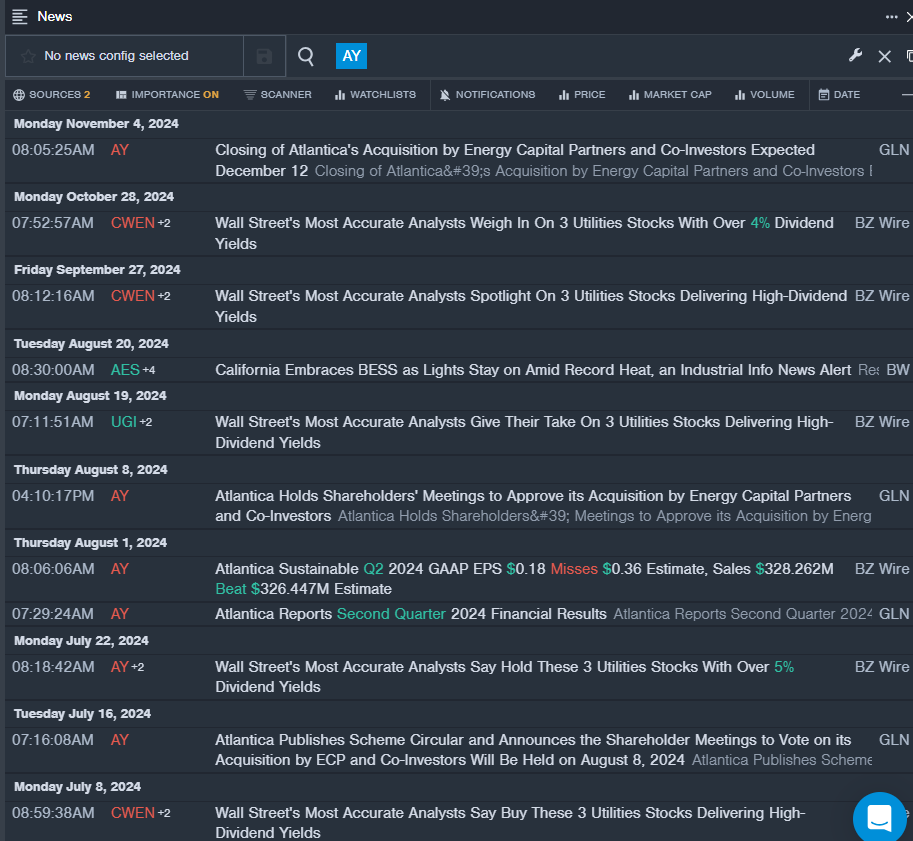

Atlantica Sustainable Infrastructure plc AY

- Dividend Yield: 8.05%

- Seaport Global analyst Angie Storozynski downgraded the stock from Buy to Neutral on May 29. This analyst has an accuracy rate of 76%.

- BMO Capital analyst James Thalacker maintained a Market Perform rating and raised the price target from $20 to $23 on May 10. This analyst has an accuracy rate of 74%.

- Recent News: On Aug. 1, Atlantica Sustainable posted better-than-expected quarterly sales.

- Benzinga Pro’s real-time newsfeed alerted to latest AY news

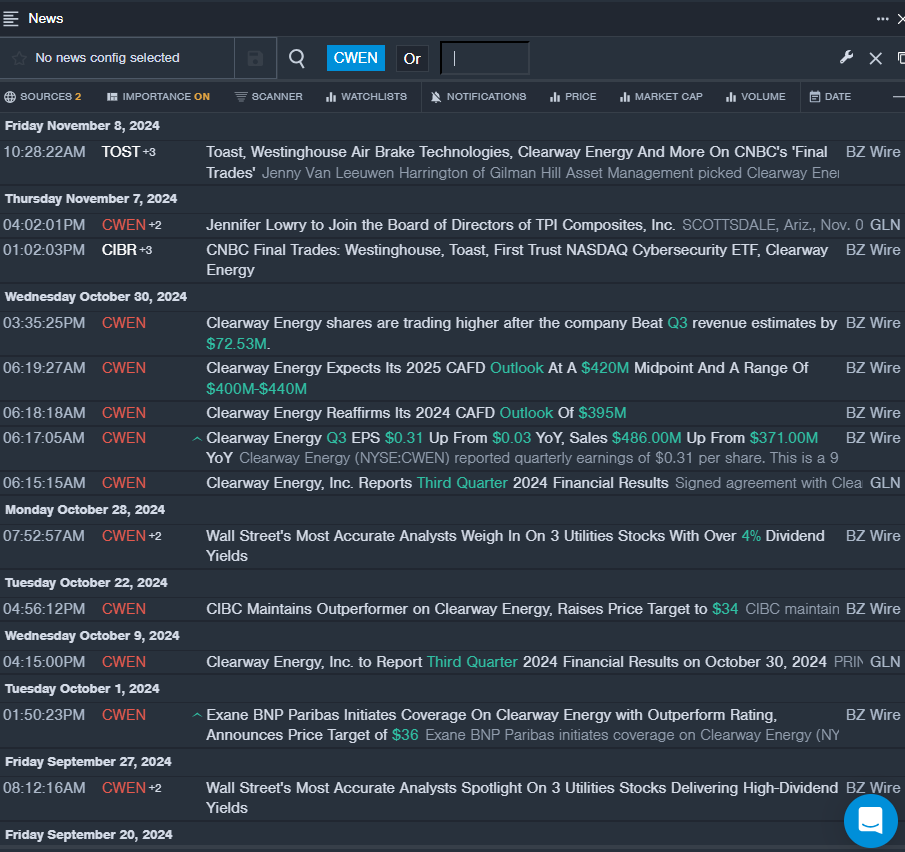

Clearway Energy, Inc. CWEN

- Dividend Yield: 6.37%

- Jefferies analyst Julien Dumoulin-Smith initiated coverage on the stock with a Buy rating and a price target of $35 on Sept. 20. This analyst has an accuracy rate of 68%.

- Morgan Stanley analyst Robert Kad upgraded the stock from Equal-Weight to Overweight and raised the price target from $25 to $36 on July 31. This analyst has an accuracy rate of 77%.

- Recent News: On Oct. 30, Clearway Energy beat third-quarter revenue estimates by $72.53 million.

- Benzinga Pro’s real-time newsfeed alerted to latest CWEN news.

Avista Corporation AVA

- Dividend Yield: 5.04%

- B of A Securities analyst Ross Fowler reinstated an Underperform rating and a price target of $37 on Sept. 12. This analyst has an accuracy rate of 63%.

- Mizuho analyst Anthony Crowdell upgraded the stock from Underperform to Neutral and raised the price target from $32 to $36 on May 3. This analyst has an accuracy rate of 63%.

- Recent News: On Nov. 6, Avista posted better-than-expected quarterly earnings, while sales missed estimates.

- Benzinga Pro’s charting tool helped identify the trend in AVA stock.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Previous Post

LEEF Brands Cannabis Co. Reports Revenue Growth, Higher Operating Expenses In Q3

Next Post

Leave a Reply