Applied Materials Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Applied Materials, Inc. AMAT will release earnings results for its fourth quarter, after the closing bell on Thursday, Nov. 14.

Analysts expect the Santa Clara, California-based bank to report quarterly earnings at $2.19 per share, up from $2.12 per share in the year-ago period. Applied Materials projects to report revenue of $6.97 billion for the recent quarter, compared to $6.72 billion a year earlier, according to data from Benzinga Pro.

On Sept. 12, Applied Materials’ board approved a quarterly cash dividend of 40 cents per share payable on the company’s common stock.

Applied Materials shares fell 2.1% to close at $182.79 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

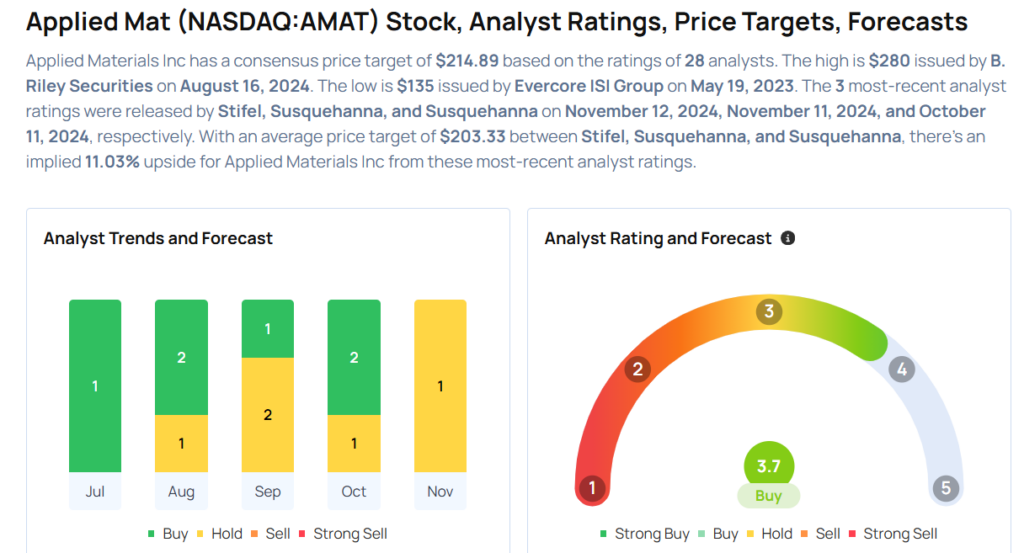

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Stifel analyst Brian Chin maintained a Buy rating and cut the price target from $270 to $250 on Nov. 12. This analyst has an accuracy rate of 71%.

- Cantor Fitzgerald analyst C J Muse reiterated an Overweight rating with a price target of $250 on Oct. 8. This analyst has an accuracy rate of 72%.

- Wells Fargo analyst Joseph Quatrochi maintained an Overweight rating and slashed the price target from $260 to $235 on Oct. 3. This analyst has an accuracy rate of 75%.

- Mizuho analyst Vijay Rakesh maintained an Outperform rating and cut the price target from $245 to $225 on Sept. 20. This analyst has an accuracy rate of 77%.

- Citigroup analyst Atif Malik maintained a Buy rating and cut the price target from $240 to $217 on Sept. 16. This analyst has an accuracy rate of 78%.

Considering buying AMAT stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply