Chartwell Announces Strong Third Quarter 2024 Results, Provides an Update on Growth and Portfolio Optimization Activities and Launches At-the-Market Program

MISSISSAUGA, ON, Nov. 14, 2024 /CNW/ – Chartwell Retirement Residences (“Chartwell”) CSH announced today its results for the three and nine months ended September 30, 2024.

Q3 2024 Highlights

- Resident revenue increased by $34.6 million from Q3 2023.

- Net income was $23.6 million compared to $158.2 million in Q3 2023 that included the gain on sale of $178.9 million due to the sale of the Ontario Long Term Care platform (“OLTC Platform”)(4).

- Funds from Operations (“FFO”)(1) up 43.2% from Q3 2023.

- Same property adjusted net operating income (“NOI”)(1) up 17.1% from Q3 2023.

- Same property adjusted operating margin(1) up 200 basis points (“bps”) from Q3 2023.

- Weighted average same property occupancy up 610 bps from Q3 2023 and expected to grow to 90.2% by December 2024.

“Our teams delivered another quarter of strong operating and financial performance in Q3 2024. Importantly, we made great strides toward achieving our aspirational 2025 strategic objectives. Our 2024 Employee Engagement score of 57% highly engaged employees exceeded our 2025 target of 55%, our 2024 Resident Satisfaction score of 66% very satisfied residents was within one percentage point of our 2025 target, and with the forecasted December 2024 same property occupancy of 90.2%, we are well on the way to our 2025 target of 95%,” commented Vlad Volodarski, Chartwell’s CEO. “2024 is shaping up to be a record year of transactional activity for Chartwell. To date, we have announced transactions valued at over $1.2 billion, adding newer, well-located, high-quality properties to our portfolio and divesting older non-core assets. Our investment team continues their great work investigating many other growth and portfolio optimization opportunities to further our strategy of portfolio renewal and growth. I am proud of our recent successes and grateful to our teams for their dedication, exceptional work and focus on driving results in all aspects of our business.”

Results of Operations

The following table summarizes select financial and operating performance measures:

|

Three Months Ended |

Nine Months Ended |

||||||

|

($000s, except per unit amounts, number of units, and percentages) |

2024 |

2023 |

Change |

2024 |

2023 |

Change |

|

|

Resident revenue |

207,995 |

173,383 |

34,612 |

581,478 |

507,378 |

74,100 |

|

|

Direct property operating expense |

128,389 |

113,344 |

15,045 |

370,472 |

344,508 |

25,964 |

|

|

Net income |

23,603 |

158,156 |

(134,553) |

18,834 |

141,446 |

(122,612) |

|

|

FFO(1) |

|||||||

|

Continuing operations |

55,861 |

36,087 |

19,774 |

139,798 |

82,905 |

56,893 |

|

|

Total |

55,861 |

39,002 |

16,859 |

139,798 |

94,091 |

45,707 |

|

|

FFO per unit(1) |

|||||||

|

Continuing operations |

0.20 |

0.15 |

0.05 |

0.55 |

0.34 |

0.21 |

|

|

Total |

0.20 |

0.16 |

0.04 |

0.55 |

0.39 |

0.16 |

|

|

Weighted average number of units outstanding (000s)(2) |

274,318 |

242,258 |

32,060 |

254,956 |

241,157 |

13,799 |

|

|

Weighted average same property occupancy rate (3) |

88.5 % |

82.4 % |

6.1pp |

87.4 % |

81.1 % |

6.3pp |

|

|

Same property adjusted NOI(1) |

63,643 |

54,357 |

9,286 |

181,067 |

150,219 |

30,848 |

|

|

Same property adjusted operating margin(1) |

38.4 % |

36.4 % |

2.0pp |

37.3 % |

34.5 % |

2.8pp |

|

|

G&A expenses |

11,731 |

14,403 |

(2,672) |

39,126 |

46,995 |

(7,869) |

|

For Q3 2024, resident revenue increased $34.6 million or 20.0% and direct property operating expense increased $15.0 million or 13.3%.

For Q3 2024, net income was $23.6 million compared to $158.2 million in Q3 2023 that included the gain on sale of $178.9 million due to the sale of the OLTC Platform. The remaining differences are due to:

- deferred tax expense in Q3 2024 as compared to a deferred tax benefit in Q3 2023,

- higher direct property operating expense,

- higher negative changes in fair value of financial instruments, primarily due to increases in trading prices of our Trust Units,

- higher finance costs, and

- higher depreciation of property, plant and equipment (“PP&E”).

partially offset by:

- higher gain on disposal of assets,

- higher resident revenue,

- lower current income tax expense due to the sale of the OLTC Platform,

- lower general, administrative, and Trust (“G&A”) expenses, and

- higher net income from joint ventures.

For Q3 2024, FFO from continuing operations was $55.9 million or $0.20 per unit, compared to $36.1 million or $0.15 per unit for Q3 2023. The change in FFO from continuing operations was primarily due to:

- higher adjusted NOI from continuing operations of $20.7 million,

- lower G&A expenses of $2.7 million,

- one-time retroactive government funding related to the sale of the OLTC Platform of $1.4 million,

- higher interest income of $0.3 million, and

- lower depreciation of PP&E and amortization of intangibles assets used for administrative purposes of $0.1 million,

partially offset by:

- higher finance costs of $5.1 million, and

- lower management fees of $0.3 million.

For Q3 2024, FFO from continuing operations includes $0.2 million of Lease-up-Losses and Imputed Cost of Debt related to our development projects (Q2 2023 – $0.5 million). Total FFO for Q3 2023 includes results of discontinued operations from the OLTC Platform of $2.9 million or $0.01 per unit.

For 2024 YTD, resident revenue increased $74.1 million or 14.6%, and direct property operating expense increased $26.0 million or 7.5%.

For 2024 YTD, net income was $18.8 million compared to $141.4 million in 2023 YTD that included the gain on sale of $178.9 million due to the sale of the OLTC Platform. The remaining differences are due to:

- deferred tax expense in 2024 YTD as compared to a deferred tax benefit in 2023 YTD,

- higher direct property operating expense,

- higher negative changes in fair value of financial instruments, primarily due to increases in trading prices of our Trust Units,

- higher finance costs,

- higher transaction costs related to dispositions, and

- higher depreciation of PP&E.

partially offset by:

- higher resident revenue,

- higher gain on disposal of assets,

- lower current income tax expense due to the sale of the OLTC Platform,

- lower G&A expenses, and

- higher net income from joint ventures.

For 2024 YTD, FFO from continuing operations was $139.8 million or $0.55 per unit, compared to $82.9 million or $0.34 per unit for 2023 YTD. The change in FFO from continuing operations was primarily due to:

- higher adjusted NOI from continuing operations of $54.4 million,

- lower G&A expenses of $7.9 million,

- one-time retroactive government funding related to the sale of the OLTC Platform of $1.4 million,

- higher interest income of $1.1 million, and

- lower depreciation of PP&E and amortization of intangibles assets used for administrative purposes of $0.4 million,

partially offset by:

- higher finance costs of $7.8 million, and

- lower management fees of $0.5 million.

For 2024 YTD, FFO from continuing operations includes $0.9 million of Lease-up-Losses and Imputed Cost of Debt related to our development projects (2023 YTD – $1.6 million). Total FFO for 2023 YTD includes results of discontinued operations from the OLTC Platform of $11.2 million or $0.05 per unit.

Financial Position

As at September 30, 2024, liquidity(1) amounted to $385.3 million, which included $26.1 million of cash and cash equivalents and $359.2 million of available borrowing capacity on our credit facilities.

The interest coverage ratio(5) was 2.6 at September 30, 2024, compared to 2.3 at December 31, 2023. The net debt to adjusted EBITDA ratio(5) at September 30, 2024 was 8.3 compared to 10.2 at December 31, 2023.

2024 Outlook and Recent Developments

An updated discussion of our business outlook can be found in the “2024 Outlook” section of our Management’s Discussion and Analysis for the three and nine months ended September 30, 2024 (the “Q3 2024 MD&A”).

Operations

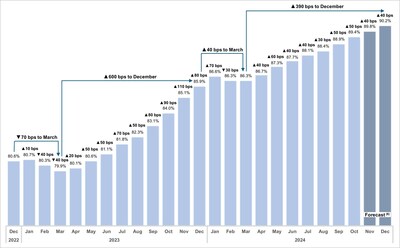

The chart included (Figure 1) provides an update in respect of our same property occupancy.

We continue to experience strong demand fundamentals having achieved occupancy growth through the historically weaker winter season. Our same property portfolio occupancy increased from December to March by 40 bps compared to a 70 bps decline for the same period last year. Initial contacts and personalized tour activity remains robust, we have experienced strong conversion rates to permanent move-ins and expect this positive momentum to continue through to the end of 2024. As such, we expect to reach 90.2% occupancy in our same property portfolio in December 2024, representing a 430 bps growth over the prior year. The growth in same property occupancy combined with our blended rental and service rate growth of 3.9%, resulted in an 11.0% increase in same property adjusted resident revenue in Q3 2024 compared to Q3 2023. 2024 YTD same property adjusted resident revenue grew 11.6% as compared to 2023 YTD from blended rental and service rate growth of 4.3% and 630 bps of occupancy growth.

Acquisition in Victoria, British Columbia

On November 14, 2024, we entered into a definitive agreement to acquire an upscale, 131-suite ISL retirement residence in Victoria, B.C. for a purchase price of $75.0 million. Constructed in 2021, all suites in the residence have full kitchens, in-suite laundry, and modern finishes, with many offering unobstructed views of Victoria’s harbour and major landmarks. Current occupancy is 28%. The acquisition will be our fourth property on Vancouver Island adding critical mass in the region and is expected to close in Q1 2025.

“We are pleased to add this modern, urban residence to our Western Canada platform below current replacement cost. This acquisition furthers our strategy to refresh and grow our portfolio with high quality assets. The quality of this residence and its location, combined with our operating expertise and branding strength will support successful lease up and multiyear occupancy and market rate growth,” added Jonathan Boulakia, Chief Investment Officer.

Growth and Portfolio Optimization Activities

We continue to execute on our portfolio strategies of enhancing our asset base to generate increased NOI, acquiring new strategic properties in core markets and selling non-core properties, including:

- On July 22, 2024, we completed the previously announced acquisition of a 100% ownership interest in a portfolio of five retirement residences (1,428 suites) located in Quebec. The purchase price was $297.0 million and, subject to normal working capital and other closing adjustments, was paid in cash. Acquisition related costs of $3.4 million have been capitalized.

- On July 31, 2024, we acquired the remaining 10% ownership interest in land located in Pickering, Ontario, which was previously accounted for as a joint operation. The purchase price of $1.2 million was paid in cash.

- On August 29, 2024, we entered into definitive agreements to acquire three modern retirement residences on Vancouver Island totalling 384 suites for an aggregate purchase price of $226.9 million and paid an $11.0 million deposit. Details of these acquisitions are as follows:

- On October 31, 2024, we acquired the 152-suite Vista Retirement Residence, located in Victoria. The purchase price was $103.9 million, subject to normal working capital and other closing adjustments and was paid in cash. The vendor provided us with a 24-month NOI guarantee, with $9.2 million of the purchase price held in escrow to support the vendor’s obligation.

- On October 31, 2024, we acquired the 77-suite Nanaimo Memory Care, located in Nanaimo. The purchase price was $20.3 million, subject to normal working capital and other closing adjustments and was paid in cash.

- The Edgewater Retirement Residence, located adjacent to Nanaimo Memory Care, is currently under construction and will be comprised of 155 suites. The purchase price is $102.7 million, subject to normal working capital and other closing adjustments, and is expected be paid in cash utilizing a combination of net proceeds from the sales of our non-core assets, cash on hand, and credit facilities. The vendor has agreed to provide us with a 36-month NOI guarantee, with $8.7 million of the purchase price to be held in escrow to support the vendor’s obligation. We will acquire the residence upon construction completion, which is expected in Q2 2025.

- On August 15, 2024, we completed the sale of one non-core property in Ontario for a sale price of $10.8 million, which was settled in cash.

- On August 30, 2024, we completed the sale of one non-core property in Ontario for a sale price of $4.6 million, which was settled in cash. In addition, we entered into a leaseback agreement for the land and building until the property is vacated.

- On September 18, 2024, we completed the sale of one non-core property in Ontario for a sale price of $79.5 million, which was settled in cash.

Liquidity and Financing

On July 22, 2024, we entered into a $150.0 million unsecured term loan agreement with a Canadian chartered bank. The terms of the loan include borrowings based on either the bank’s Prime rate or CORRA, with an initial term of six months and an optional extension for an additional six months. On October 31, 2024, we repaid $75.0 million.

On October 24, 2024, CMHC confirmed the termination of our Large Borrower Agreement (“LBA”) and the transition to a Large Borrower Risk Management Framework (the “LBRMF”). The LBRMF provides a more flexible financing environment and improved liquidity and removes previous financial covenant and cross collateralization requirements.

On October 28, 2024, we issued $150.0 million of 4.400% Series D senior unsecured debentures (the “Series D Debentures”) due on November 5, 2029. The net proceeds of the Series D Debentures was used to repay existing indebtedness, including indebtedness under our secured credit facility and term loan, and to partially finance certain previously announced acquisitions of retirement residences expected to close in the fourth quarter of 2024.

As at November 14, 2024, liquidity amounted to $401.3 million, which included $54.1 million of cash and cash equivalents and $347.2 million of available borrowing capacity on our Credit Facilities.

As of the date of this release, we have $98.8 million of mortgage debt maturing in 2024 with a weighted average interest rate of 7.08%. At November 14, 2024, 10-year CMHC-insured mortgage rates are estimated at approximately 4.08% and five-year conventional mortgage financing is available at 5.01%.

At-the-Market Equity Distribution Program

On November 14, 2024, Chartwell will file a prospectus supplement to establish an at-the-market equity distribution program (the “ATM Program”). The ATM Program will allow Chartwell to issue up to $250 million of trust units (“Trust Units”) from treasury to the public from time to time during the term of the ATM Program, at its discretion. The ATM Program is designed to provide Chartwell with additional financing flexibility, should it be required in the future. Chartwell intends to use the net proceeds from the ATM Program, if any, for future property acquisitions, development and redevelopment opportunities, repayment of indebtedness and for general trust purposes.

“We are very excited to launch our inaugural ATM Program today. The ATM Program, which may be used from time to time during favourable market conditions, provides Chartwell with a new cost-effective tool to raise equity to match our capital requirements as required, including to support our growth strategy,” commented Jeffrey Brown, Chief Financial Officer.

In connection with the establishment of the ATM Program, Chartwell has entered into an equity distribution agreement dated November 14, 2024 (the “Distribution Agreement”) with TD Securities Inc. and Scotia Capital Inc. (collectively, the “Agents”). Any Trust Units sold under the ATM Program will be distributed through the Toronto Stock Exchange or any other permitted marketplace at the market prices prevailing at the time of sale. The volume and timing of distributions under the ATM Program, if any, will be determined at Chartwell’s sole discretion. There is no certainty that any Trust Units will be offered or sold under the ATM Program. The ATM Program will terminate upon the earlier of (i) May 30, 2026, (ii) the issuance and sale of all of the Trust Units qualified for distribution under the ATM Program, and (iii) the termination of the Distribution Agreement (as set out in the Distribution Agreement).

Given that Trust Units sold in the ATM Program, if any, will be distributed at the market prices prevailing at the time of sale, prices may vary among purchasers during the period of the distribution. Distributions of Trust Units through the ATM Program, if any, will be made pursuant to the terms of the Distribution Agreement. In connection with the establishment of the ATM Program, Chartwell will file a prospectus supplement dated November 14, 2024 (the “Prospectus Supplement”) to the final base shelf prospectus dated April 30, 2024 (the “Base Shelf Prospectus”). The Prospectus Supplement, the Distribution Agreement and the Base Shelf Prospectus will be available on SEDAR+ at www.sedarplus.com under Chartwell’s profile. Alternatively, the Agents will send copies of the Prospectus Supplement, the Distribution Agreement and the Base Shelf Prospectus, as applicable, to investors upon request to TD Securities Inc. at 1625 Tech Avenue, Mississauga, Ontario L4W 5P5, attention: Symcor, NPM, by telephone at (289) 360-2009, or by email at sdcconfirms@td.com. and Scotia Capital Inc. at 40 Temperance Street, 6th Floor, Toronto, Ontario M5H 0B4, by telephone at (416) 863-7704 or by email at equityprospectus@scotiabank.com.

This press release does not constitute an offer to sell securities, nor is it a solicitation of an offer to buy securities, in any jurisdiction in which such offer or solicitation is unlawful. This press release is not an offer of securities for sale in the United States (“U.S.”). The securities being offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and accordingly are not being offered for sale and may not be offered, sold or delivered, directly or indirectly within the U.S., its possessions and other areas subject to its jurisdiction or to, or for the account or for the benefit of a U.S. person, except pursuant to an exemption from the registration requirements of that Act.

Quarterly Investor Materials and Conference Call

We invite you to review our Q3 2024 investor materials on our website at investors.chartwell.com

Q3 2024 Financial Statements

Q3 2024 MD&A

Q3 2024 Investor Presentation

A conference call hosted by Chartwell’s senior management will be held Friday, November 15, 2024, at 10:00 AM ET. The telephone numbers to participate in the conference call are: Local: (416) 340-2217 or Toll Free: 1-800-806-5484. The passcode for the conference call is: 5352093#. Please log on at least 15 minutes before the call commences to register for the Q&A. A slide presentation to accompany management’s comments during the conference call will be available on the website. A live webcast of the call will be available at https://events.q4inc.com/attendee/632664840. Joining via webcast is recommended for those who will not be participating in the Q&A.

The telephone numbers to listen to the call after it is completed (Instant Replay) are: Local (905) 694-9451 or Toll-Free: 1-800-408-3053. The Passcode for the Instant Replay is 5208327#. These numbers will be available for 30 days following the call. An audio file recording of the call, along with the accompanying slides, will also be archived on Chartwell’s website at investors.chartwell.com.

Footnotes

|

(1) |

FFO, FFO for continuing operations, Total FFO, including per unit amounts, adjusted resident revenue, adjusted direct property operating expense, adjusted NOI, adjusted operating margin, liquidity, interest coverage ratio, Lease-up Losses, Imputed Cost of Debt, and net debt to adjusted EBITDA ratio are non-GAAP measures. These measures do not have standardized meanings prescribed by GAAP and, therefore, may not be comparable to similar measures used by other issuers. These measures are used by management in evaluating operating and financial performance. Please refer to the heading “Non-GAAP Financial Measures” on page 8 of this press release. Certain information about non-GAAP financial measures, non-GAAP ratios, capital management measures, and supplementary measures found in Chartwell’s Q3 2024 MD&A, is incorporated by reference. Full definitions of FFO & FFO per unit can be found on page 16, same property adjusted NOI on page 17, adjusted NOI on page 17, adjusted operating margin on page 17, liquidity on page 24, interest coverage ratio on page 39, and net debt to adjusted EBITDA ratio on page 40 of the Q3 2024 MD&A available on Chartwell’s website, and under Chartwell’s profile on the System for Electronic Document and Analysis Retrieval (“SEDAR+”) website at sedarplus.com. The definition of these measures have been incorporated by reference. |

|

(2) |

Includes Trust Units, Class B Units of Chartwell Master Care LP, and Trust Units issued under Executive Unit Purchase Plan and Deferred Trust Unit Plan. |

|

(3) |

‘pp’ means percentage points. |

|

(4) |

Refer to the “Significant Events – Portfolio Optimization” section on page 12 of the Q3 2024 MD&A. |

|

(5) |

Non-GAAP; calculated in accordance with the Trust indentures for Chartwell’s 4.211% Series B senior unsecured debentures and 6.000% Series C senior unsecured debentures and may not be comparable to similar metrics used by other issuers or to any GAAP measures. |

|

(6) |

Forecast includes leases and notices as at October 31, 2024, and an estimate of mid-month move-ins of 10 bps for November and 50 bps for December, based on the preceding 12-month average of such activity. |

Forward-Looking Information

This press release contains forward-looking information that reflects the current expectations, estimates and projections of management about the future results, performance, achievements, prospects or opportunities for Chartwell and the seniors housing industry. Forward-looking statements are based upon a number of assumptions and are subject to a number of known and unknown risks and uncertainties, many of which are beyond our control, and that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking statements. Examples of forward-looking information in this document include, but are not limited to, statements regarding our business strategies, operational sales, marketing and portfolio optimization strategies including targets, and the expected results of such strategies, predictions and expectations with respect to industry trends including growth in the senior population, a deficit of long term care beds and the slow down of new construction starts, expectations with respect to taxes that are expected to be payable in the current and future years and statements regarding the tax classification of distributions, and occupancy rate forecasts. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those expected or estimated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. These factors are more fully described in the “Risks and Uncertainties and Forward-Looking Information” section in Chartwell’s Q3 2024 MD&A, and in materials filed with the securities regulatory authorities in Canada from time to time, including but not limited to our most recent Annual Information Form the (“AIF”). A copy of the Q3 2024 MD&A, the AIF, and Chartwell’s other publicly filed documents can be accessed under Chartwell’s profile on the SEDAR+ website at sedarplus.com. Except as required by law, Chartwell does not intend to update or revise any forward-looking statements, whether as a result of new information, future events, or for any other reason.

About Chartwell

Chartwell is in the business of serving and caring for Canada’s seniors, committed to its vision of Making People’s Lives BETTER and to providing a happier, healthier, and more fulfilling life experience for its residents. Chartwell is an unincorporated, open-ended real estate trust which indirectly owns and operates a complete range of seniors housing communities, from independent living through to assisted living and long term care. Chartwell is one of the largest operators in Canada, serving approximately 25,000 residents in four provinces across the country. For more information visit www.chartwell.com.

For more information, please contact:

Chartwell Retirement Residences

Jeffrey Brown, Chief Financial Officer

Tel: (905) 501-6777

Email: investorrelations@chartwell.com

Non-GAAP Financial Measures

Chartwell’s condensed consolidated interim financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”). Management uses certain financial measures to assess Chartwell’s operating and financial performance, which are measures not defined in generally accepted accounting principles (“GAAP”) under IFRS. The following measures: FFO, FFO per unit, same property adjusted NOI, adjusted NOI, adjusted operating margin, liquidity, interest coverage ratio and net debt to adjusted EBITDA ratio as well as other measures discussed elsewhere in this release, do not have a standardized definition prescribed by IFRS. They are presented because management believes these non-GAAP measures are relevant and meaningful measures of Chartwell’s performance and as computed may differ from similar computations as reported by other issuers and may not be comparable to similarly titled measures reported by such issuers. For a full definition of these measures, please refer to the Q3 2024 MD&A available on Chartwell’s website and on SEDAR+.

The following table reconciles resident revenue and direct property operating expense from our financial statements to adjusted resident revenue and adjusted direct property operating expense and NOI to Adjusted NOI from continuing operations and Adjusted NOI and identifies contributions from our same property portfolio, our growth portfolio, and our repositioning portfolio:

|

($000s, except occupancy rates) |

Q3 2024 |

Q3 2023 |

Change |

2024 YTD |

2023 YTD |

Change |

|

Resident revenue |

207,995 |

173,383 |

34,612 |

581,478 |

507,378 |

74,100 |

|

Add (Subtract): |

||||||

|

Share of resident revenue from joint ventures (1) |

35,071 |

32,103 |

2,968 |

102,945 |

93,605 |

9,340 |

|

Resident revenue from LTC Discontinued Operations (2) |

– |

45,521 |

(45,521) |

– |

167,068 |

(167,068) |

|

Share of resident revenue from non-controlling interest (3) |

(1,328) |

– |

(1,328) |

(1,328) |

– |

(1,328) |

|

Adjusted resident revenue |

241,738 |

251,007 |

(9,269) |

683,095 |

768,051 |

(84,956) |

|

Comprised of: |

||||||

|

Same property |

165,615 |

149,138 |

16,477 |

485,511 |

434,942 |

50,569 |

|

Growth |

42,459 |

22,870 |

19,589 |

95,582 |

66,567 |

29,015 |

|

Repositioning |

33,664 |

78,999 |

(45,335) |

102,002 |

266,542 |

(164,540) |

|

Adjusted resident revenue |

241,738 |

251,007 |

(9,269) |

683,095 |

768,051 |

(84,956) |

|

Direct property operating expense |

128,389 |

113,344 |

15,045 |

370,472 |

344,508 |

25,964 |

|

Add (Subtract): |

||||||

|

Share of direct property operating expense from joint ventures (1) |

22,187 |

21,036 |

1,151 |

67,040 |

64,655 |

2,385 |

|

Direct property operating expense from LTC Discontinued Operations (2) |

– |

41,330 |

(41,330) |

– |

151,266 |

(151,266) |

|

Share of direct property operating expense from non-controlling interest (3) |

(677) |

– |

(677) |

(677) |

– |

(677) |

|

Adjusted direct property operating expense |

149,899 |

175,710 |

(25,811) |

436,835 |

560,429 |

(123,594) |

|

Comprised of: |

||||||

|

Same property |

101,972 |

94,781 |

7,191 |

304,444 |

284,723 |

19,721 |

|

Growth |

23,554 |

14,599 |

8,955 |

56,377 |

44,131 |

12,246 |

|

Repositioning |

24,373 |

66,330 |

(41,957) |

76,014 |

231,575 |

(155,561) |

|

Adjusted direct property operating expense |

149,899 |

175,710 |

(25,811) |

436,835 |

560,429 |

(123,594) |

|

NOI |

79,606 |

60,039 |

19,567 |

211,006 |

162,870 |

48,136 |

|

Add (Subtract): |

||||||

|

Share of NOI from joint ventures |

12,884 |

11,067 |

1,817 |

35,905 |

28,950 |

6,955 |

|

Share of NOI from non-controlling interest |

(651) |

– |

(651) |

(651) |

– |

(651) |

|

Adjusted NOI from continuing operations |

91,839 |

71,106 |

20,733 |

246,260 |

191,820 |

54,440 |

|

Add (Subtract): |

||||||

|

NOI from LTC Discontinued Operations |

– |

4,191 |

(4,191) |

– |

15,802 |

(15,802) |

|

Adjusted NOI |

91,839 |

75,297 |

16,542 |

246,260 |

207,622 |

38,638 |

|

Comprised of: |

||||||

|

Same property |

63,643 |

54,357 |

9,286 |

181,067 |

150,219 |

30,848 |

|

Growth |

18,905 |

8,271 |

10,634 |

39,205 |

22,436 |

16,769 |

|

Repositioning |

9,291 |

12,669 |

(3,378) |

25,988 |

34,967 |

(8,979) |

|

Adjusted NOI |

91,839 |

75,297 |

16,542 |

246,260 |

207,622 |

38,638 |

|

Weighted average occupancy rate: |

||||||

|

Same property portfolio |

88.5 % |

82.4 % |

6.1pp |

87.4 % |

81.1 % |

6.3pp |

|

Growth portfolio |

88.4 % |

76.9 % |

11.5pp |

87.2 % |

75.1 % |

12.1pp |

|

Repositioning portfolio |

84.9 % |

85.2 % |

(0.3pp) |

84.3 % |

84.2 % |

0.1pp |

|

Total portfolio |

87.9 % |

82.5 % |

5.4pp |

86.9 % |

81.2 % |

5.7pp |

|

(1) |

Non-GAAP; represents Chartwell’s proportionate share of the resident revenue and direct property operating expense of our Equity-Accounted JVs, respectively. |

|

(2) |

Represents the resident revenue and direct property operating expense related to LTC Discontinued Operations, respectively. |

|

(3) |

Non-GAAP; represents Chartwell’s proportionate share of the resident revenue and direct property operating expense of our non-controlling interest, respectively. |

The following table provides a reconciliation of net income/(loss) to FFO for continuing operations:

|

($000s, except per unit amounts and number of units) |

Q3 2024 |

Q3 2023 |

Change |

2024 YTD |

2023 YTD |

Change |

|

|

Net income/(loss) |

23,603 |

(23,330) |

46,933 |

18,834 |

(48,183) |

67,017 |

|

|

Add (Subtract): |

|||||||

|

B |

Depreciation of PP&E |

43,009 |

38,027 |

4,982 |

117,146 |

115,050 |

2,096 |

|

D |

Amortization of limited life intangible assets |

521 |

566 |

(45) |

1,710 |

2,058 |

(348) |

|

B |

Depreciation of PP&E and amortization of intangible assets used for administrative purposes included in depreciation of PP&E and amortization of intangible assets above |

(974) |

(1,093) |

119 |

(2,968) |

(3,332) |

364 |

|

E |

Loss/(gain) on disposal of assets |

(55,850) |

(2,883) |

(52,967) |

(54,905) |

(6,304) |

(48,601) |

|

J |

Transaction costs arising on dispositions |

2,507 |

469 |

2,038 |

5,028 |

975 |

4,053 |

|

H |

Impairment losses |

– |

625 |

(625) |

– |

625 |

(625) |

|

F |

Tax on gains or losses on disposal of properties |

2,840 |

28,100 |

(25,260) |

2,489 |

28,100 |

(25,611) |

|

G |

Deferred income tax |

24,120 |

(11,274) |

35,394 |

27,586 |

(21,091) |

48,677 |

|

O |

Distributions on Class B Units recorded as interest expense |

231 |

234 |

(3) |

696 |

702 |

(6) |

|

M |

Changes in fair value of financial instruments |

14,998 |

5,622 |

9,376 |

21,535 |

11,212 |

10,323 |

|

Q |

FFO adjustments for Equity-Accounted JVs |

900 |

1,024 |

(124) |

2,691 |

3,093 |

(402) |

|

U |

Non-controlling interest |

(44) |

– |

(44) |

(44) |

– |

(44) |

|

FFO |

55,861 |

36,087 |

19,774 |

139,798 |

82,905 |

56,893 |

|

|

Weighted average number of units (000) |

274,318 |

242,258 |

32,060 |

254,956 |

241,157 |

13,799 |

|

|

FFOPU |

0.20 |

0.15 |

0.05 |

0.55 |

0.34 |

0.21 |

|

The following table provides a reconciliation of net income/(loss) to Total FFO for total operations:

|

($000s, except per unit amounts and number of units) |

Q3 2024 |

Q3 2023 |

Change |

2024 YTD |

2023 YTD |

Change |

|

|

Net income/(loss) |

23,603 |

158,156 |

(134,553) |

18,834 |

141,446 |

(122,612) |

|

|

Add (Subtract): |

|||||||

|

B |

Depreciation of PP&E |

43,009 |

38,027 |

4,982 |

117,146 |

115,050 |

2,096 |

|

D |

Amortization of limited life intangible assets |

521 |

566 |

(45) |

1,710 |

2,058 |

(348) |

|

B |

Depreciation of PP&E and amortization of intangible assets used for administrative purposes included in depreciation of PP&E and amortization of intangible assets above |

(974) |

(1,093) |

119 |

(2,968) |

(3,332) |

364 |

|

E |

Loss/(gain) on disposal of assets |

(55,850) |

(181,794) |

125,944 |

(54,905) |

(185,208) |

130,303 |

|

J |

Transaction costs arising on dispositions |

2,507 |

809 |

1,698 |

5,028 |

1,436 |

3,592 |

|

H |

Impairment losses |

– |

625 |

(625) |

– |

625 |

(625) |

|

F |

Tax on gains or losses on disposal of properties |

2,840 |

28,100 |

(25,260) |

2,489 |

28,100 |

(25,611) |

|

G |

Deferred income tax |

24,120 |

(11,274) |

35,394 |

27,586 |

(21,091) |

48,677 |

|

O |

Distributions on Class B Units recorded as interest expense |

231 |

234 |

(3) |

696 |

702 |

(6) |

|

M |

Changes in fair value of financial instruments |

14,998 |

5,622 |

9,376 |

21,535 |

11,212 |

10,323 |

|

Q |

FFO adjustments for Equity-Accounted JVs |

900 |

1,024 |

(124) |

2,691 |

3,093 |

(402) |

|

U |

Non-controlling interest |

(44) |

– |

(44) |

(44) |

– |

(44) |

|

FFO |

55,861 |

39,002 |

16,859 |

139,798 |

94,091 |

45,707 |

|

|

Weighted average number of units (000) |

274,318 |

242,258 |

32,060 |

254,956 |

241,157 |

13,799 |

|

|

FFOPU |

0.20 |

0.16 |

0.04 |

0.55 |

0.39 |

0.16 |

|

SOURCE Chartwell Retirement Residences (IR)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/14/c0403.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/14/c0403.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply