Mobileye Global Options Trading: A Deep Dive into Market Sentiment

Deep-pocketed investors have adopted a bearish approach towards Mobileye Global MBLY, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MBLY usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for Mobileye Global. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 22% leaning bullish and 33% bearish. Among these notable options, 5 are puts, totaling $421,273, and 4 are calls, amounting to $694,236.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $12.0 to $21.0 for Mobileye Global over the last 3 months.

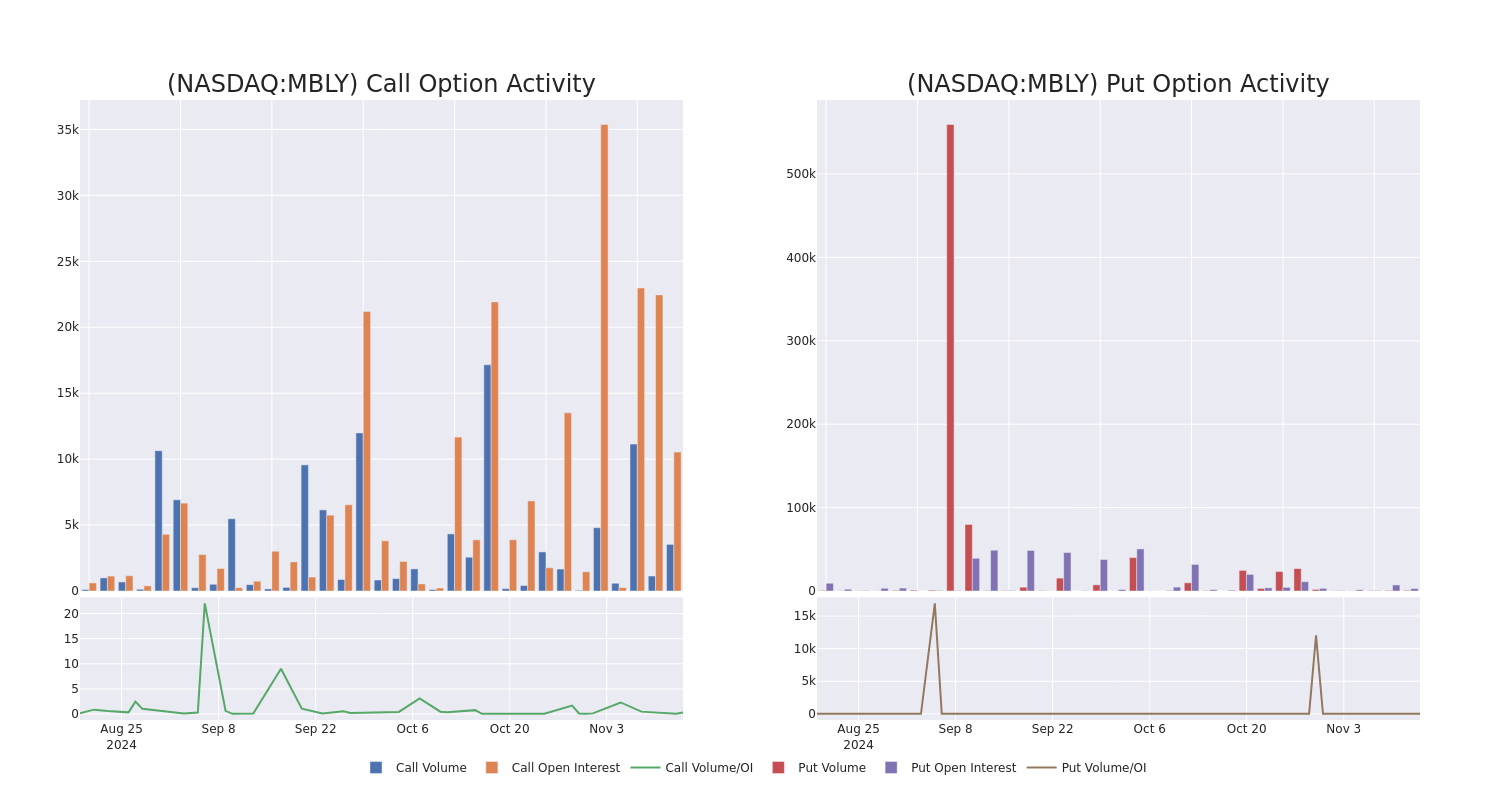

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Mobileye Global’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Mobileye Global’s whale trades within a strike price range from $12.0 to $21.0 in the last 30 days.

Mobileye Global Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MBLY | CALL | TRADE | BEARISH | 11/22/24 | $2.6 | $2.35 | $2.37 | $14.00 | $592.5K | 1.1K | 2.5K |

| MBLY | PUT | SWEEP | NEUTRAL | 01/15/27 | $5.5 | $5.3 | $5.4 | $15.00 | $99.5K | 152 | 225 |

| MBLY | PUT | SWEEP | BULLISH | 01/17/25 | $5.4 | $5.2 | $5.2 | $21.00 | $94.6K | 831 | 185 |

| MBLY | PUT | SWEEP | NEUTRAL | 01/15/27 | $5.5 | $5.3 | $5.4 | $15.00 | $94.2K | 152 | 408 |

| MBLY | PUT | SWEEP | NEUTRAL | 01/15/27 | $3.8 | $3.6 | $3.7 | $12.00 | $68.2K | 1.9K | 225 |

About Mobileye Global

Mobileye Global Inc engages in the development and deployment of ADAS and autonomous driving technologies and solutions. It is building a portfolio of end-to-end ADAS and autonomous driving solutions to provide the capabilities needed for the future of autonomous driving, leveraging a comprehensive suite of purpose-built software and hardware technologies. Mobileye is the Company’s only reportable operating segment. Its solutions comprise Driver Assist, Cloud-Enhanced Driver Assist, Mobileye SuperVision Lite, Mobileye SuperVision, Mobileye Chauffeur, Mobileye Drive, Self-Driving System & Vehicles. It also provides data services to Expedite Maintenance Operations with AI-Powered Road Survey Technology.

After a thorough review of the options trading surrounding Mobileye Global, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Mobileye Global Standing Right Now?

- With a trading volume of 5,576,962, the price of MBLY is down by -7.89%, reaching $15.95.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 70 days from now.

Expert Opinions on Mobileye Global

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $20.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Mobileye Global with a target price of $19.

* An analyst from Barclays has decided to maintain their Overweight rating on Mobileye Global, which currently sits at a price target of $18.

* Reflecting concerns, an analyst from Loop Capital lowers its rating to Buy with a new price target of $20.

* Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on Mobileye Global with a target price of $25.

* An analyst from Needham persists with their Buy rating on Mobileye Global, maintaining a target price of $20.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Mobileye Global options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply