S&P 500 Moves Lower; US Crude Oil Inventories Increase

U.S. stocks traded lower toward the end of trading, with the Dow Jones index falling by more than 150 points on Thursday.

The Dow traded down 0.38% to 43,790.84 while the NASDAQ fell 0.34% to 19,166.29. The S&P 500 also fell, dropping, 0.37% to 5,963.37.

Check This Out: Jim Cramer Recommends Microsoft, Praises American Water Works For Being ‘Consistent’

Leading and Lagging Sectors

Information technology shares rose by 0.2% on Thursday.

In trading on Thursday, industrials shares fell by 1.4%.

Top Headline

U.S. crude oil inventories increased by 2.089 million barrels in the week ended Nov. 8, compared to market estimates of a 1.85 million gain.

Equities Trading UP

- AgEagle Aerial Systems, Inc. UAVS shares shot up 129% to $3.68 after the company announced 17 new purchase orders for its eBee TAC drones from U.S. defense and security customers.

- Shares of DLocal Limited DLO got a boost, surging 16% to $10.48 after the company reported better-than-expected third-quarter revenue results.

- AC Immune SA ACIU shares were also up, gaining 20% to $3.7503 after the company announced interim safety and immunogenicity data from the Phase 2 VacSYn clinical trial evaluating ACI-7104.056 for the treatment of patients with early Parkinson’s disease.

Equities Trading DOWN

- Nuvectis Pharma, Inc. NVCT shares dropped 40% to $6.35 after the company reported data from its Phase 1b study evaluating NXP800.

- Shares of Sow Good Inc. SOWG were down 58% to $4.1099 after the company reported worse-than-expected quarterly financial results.

- Vislink Technologies, Inc. VISL was down, falling 32% to $4.4535 after the company reported worse-than-expected third-quarter financial results.

Commodities

In commodity news, oil traded down 0.1% to $68.41 while gold traded down 0.4% at $2,575.60.

Silver traded down 0.4% to $30.555 on Thursday, while copper fell 0.2% to $4.0750.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 gained 1.08%, Germany’s DAX climbed 1.37% and France’s CAC 40 gained 1.32%. Spain’s IBEX 35 Index gained 1.29%, while London’s FTSE 100 rose 0.51%.

Asia Pacific Markets

Asian markets closed lower on Thursday, with Japan’s Nikkei 225 falling 0.48%, Hong Kong’s Hang Seng Index falling 1.96%, China’s Shanghai Composite Index dipping 1.73% and India’s BSE Sensex falling 0.14%.

Economics

- U.S. initial jobless claims declined by 4,000 from the previous week to 217,000 in the week ending Nov. 9, compared to market estimates of 223,000.

- U.S. producer prices rose 0.2% month-over-month in October compared to a revised 0.1% gain in September and in-line with market expectations.

- U.S. crude oil inventories increased by 2.089 million barrels in the week ended Nov. 8, compared to market estimates of a 1.85 million gain.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Rally Fades As Investors Await Powell's Remarks, Bitcoin Drops Below $90,000: What's Driving Markets Thursday?

Signs of a waning Trump-led rally emerged Thursday as investors assessed the economic outlook and awaited potential signals on the interest-rate path from the upcoming Fed Chair Jerome Powell‘s speech in Dallas at 3 p.m. ET.

Inflation data from the past two days provided mixed signals: consumer prices met expectations, while producer prices slightly exceeded forecasts, with both indicators showing a year-over-year uptick in October.

Despite this inflation data, markets remain confident the Fed will continue easing, pricing in an 80% likelihood of a December rate cut.

Wall Street’s major indices were in the red by midday, with the S&P 500 down 0.3% and small-cap stocks lagging behind large-caps.

The U.S. dollar index ticked up 0.1%, even as Treasury yields declined. Bonds outperformed equities, with the iShares 20+ Year Treasury Bond ETF TLT climbing 1.2%.

Gold edged 0.2% lower, while oil rose 0.2%. Meanwhile, Bitcoin BTC/USD saw its rally stall, dropping 1.8%.

Thursday’s Performance In Major US Indices, ETFs

| Major Indices | Price | Chg % (1 day) |

| Dow Jones | 43,884.60 | -0.2% |

| Nasdaq 100 | 20,986.66 | -0.2% |

| S&P 500 | 5,969.78 | -0.3% |

| Russell 2000 | 2,345.60 | -1.0% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY fell 0.3% to $595.18.

- The SPDR Dow Jones Industrial Average DIA eased 0.2% to $438.76.

- The tech-heavy Invesco QQQ Trust Series QQQ slipped 0.4% to $510.28.

- The iShares Russell 2000 ETF IWM tumbled 1% to $232.71.

- The Consumer Staples Select Sector SPDR Fund XLP outperformed, rising 0.2%. The Industrials Select Sector SPDR Fund XLI lagged, down 1.5%.

Thursday’s Stock Movers

- Walt Disney Co. DIS rose 7% after reporting better-than-expected quarterly results.

Other stocks reacting to earnings reports included:

- Cisco Systems Inc. CSCO, down over 2%,

- Brookfield Corp. BN, up 0.9%,

- Talen Energy Corp. TLN, up 0.9%,

- Nu Holdings Ltd. NU, down 7.5%,

- Tetra Tech Inc. TTEK, down over 10%,

- StandardAero Inc. SARO, down 5.5%.

Companies slated to report their earnings after Thursday’s close include Applied Materials Inc. AMAT, Globant S.A. GLOB, AST SpaceMobile Inc. ASTS, Post Holdings Inc. POST.

Read now:

Image:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

D-Wave Quantum Stock Is Moving Higher Following Q3 Earnings: What You Need To Know

D-Wave Quantum Inc. QBTS shares are trading higher Thursday. The company released its third-quarter financial results before the market open. Here’s what you need to know.

What To Know: Quantum computing company D-Wave reported a third-quarter loss of 11 cents per share, versus estimates for a loss of 10 cents per share. The company also reported revenue of $1.87 million, missing estimates of $2.53 million, according to Benzinga Pro.

Revenue was down 27% year-over-year, primarily due to lower professional services revenue. QCaaS (Quantum Computing as a Service) revenue increased by 41% to $1.6 million, but overall bookings fell 22%.

The company reaffirmed guidance for improved 2024 adjusted EBITDA losses, versus last year’s loss of $54.3 million. D-Wave also said it anticipates a quarter-over-quarter increase in revenue and bookings in the fourth quarter.

Related Link: IonQ Stock Is Trading Higher Today: What’s Going On?

Highlights from the quarter include plans to work with Japan’s largest mobile phone operator to improve network performance, a collaboration with Japan Tobacco on drug discovery using quantum and AI and the completed calibration of a 4,400 qubit Advantage2 processor.

“Annealing quantum computing is continuing to drive the commercial adoption of quantum technology,” said Alan Baratz, CEO of D-Wave.

“Organizations around the world – from Vinci Energies in Europe to NTT DOCOMO in Japan – are recognizing the value our technology can bring right now in fueling new discoveries, facilitating operational excellence and driving measurable outcomes.”

QBTS Price Action: D-Wave Quantum shares initially fell when earnings were released, but the stock was up 12.7% at $2.01 at the time of writing, according to Benzinga Pro.

Read Next:

Image Via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump's Red Wave Pushes Emerging Market Stocks To 2-Month Lows: Volatility 'Expected To Remain Elevated'

Emerging market stocks have dropped to levels last seen in mid-September, with the downturn exacerbated by Donald Trump‘s victory and a Republican sweep of the U.S. Congress.

The iShares MSCI Emerging Markets ETF EEM has slumped 7% over the past month, with the iShares MSCI China ETF MCHI and the iShares Mexico ETF EWW underperforming — down 10.1% and 7.8%, respectively.

Trump’s win and full Republican control of Washington, D.C. raise critical questions for emerging markets (EM). What does a more protectionist U.S. policy and potential fiscal loosening mean for emerging economies, currencies and credit conditions?

Trump’s election has sparked concerns over possible shifts in U.S. fiscal and trade policies that could have a ripple effect on global markets.

“The prospects of looser fiscal policy and more trade protectionism have increased short- and long-term U.S. interest rates, putting upward pressure on borrowing costs in EMs,” according to Elijah Oliveros-Rosen, chief emerging markets economist at S&P Global Ratings.

Higher U.S. interest rates tend to strengthen the dollar, making it more expensive for emerging markets to service dollar-denominated debt. This tighter financial environment has already started affecting emerging market currencies, which have weakened across the board against the dollar.

Following Trump’s win, most EM currencies — especially in Central and Eastern Europe and Latin America — have depreciated significantly against the U.S. dollar.

Investors worry the Federal Reserve may delay rate cuts in response to Trump’s policies, which could include new tariffs or stricter immigration rules. A stronger dollar and potential trade barriers pose serious risks for EM economies reliant on exports and foreign investment.

The Mexican peso, in particular, has been hit hard by Trump’s election, as uncertainty over trade and immigration policies toward Mexico has made investors skittish.

Private fixed investment in Mexico, which has been strong over the last two years due to nearshoring, could lose momentum until there’s more clarity on U.S. policy.

“During the Trump 2016-2020 administration (excluding the pandemic), private fixed investment in Mexico declined 4.5%,” S&P Global wrote in a report.

The rise in U.S. interest rates is tightening financial conditions for EMs, which rely heavily on affordable credit to finance growth.

With borrowing costs rising, fiscal vulnerabilities in these markets could become more pronounced, potentially limiting governments’ ability to stimulate their economies.

“Volatility in emerging market assets is expected to remain elevated for some time due to uncertainties surrounding U.S. policy details including trade, fiscal, and regulatory environment,” said Oliveros-Rosen.

Investors are likely to remain on edge until the new administration clarifies its approach, particularly toward trade.

The tightening financial environment is already impacting EM credit ratings.

While the number of issuers rated ‘CCC+’ and below has decreased slightly, indicating some deleveraging, many EM companies are still struggling with high debt levels. Riskier credits have been able to refinance for the first time since November 2021, but this could come at the cost of reduced capital expenditures in 2025-2026.

Corporate bond spreads in EMs remain tight, supporting robust market activity for speculative-grade issuers. With two months left in 2024, all EM regions — except for Asia — have already surpassed their average bond issuance volumes from the last seven years. Both benchmark and corporate yields have edged up amid the uncertainty, reflecting a more cautious investor sentiment.

Looking ahead, EMs face a mixed outlook. In the near term, “volatility in emerging market assets is expected to remain elevated for some time due to uncertainties surrounding U.S. policy details including, trade, fiscal, and regulatory environment,” S&P Global wrote.

Yet, demographics, technology, and the global energy transition could provide structural growth tailwinds over the next decade, potentially offsetting some of the risks posed by a protectionist U.S. stance.

Supply-chain shifts and nearshoring trends, particularly in regions like Latin America, may also help some EMs attract investment.

As Oliveros-Rosen stated, “The specific policies announced by the next U.S. administration could either further amplify or reverse the recent tightening in financial conditions, with implications for EM growth and credit conditions.”

In other words, the ball is in Washington’s court. Whether EMs face a full-blown crisis or simply a period of adjustment will depend largely on Trump’s policy choices in 2025.

Read Next:

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Inseego's Turnaround Gains Traction: New Products And Partnerships to Fuel Future Growth, Says Analyst

Roth MKM analyst Scott W. Searle upgraded Inseego Corp. INSG from Neutral to Buy, raising the price forecast from $13 to $15.

Searle highlights the company’s successful balance sheet recapitalization and reducing net debt. The analyst also notes strong growth in core products, up 25%, and emphasizes the experienced management team.

Looking ahead, Searle sees new products, evolving sales channels, and potential acquisitions to boost the company’s outlook for 2025 and 2026.

In the third quarter, the company’s results and fourth-quarter guidance were affected by the sale of its Telematics business, which is now classified as discontinued. This made comparisons tricky, showing only 5% growth, compared to around 25% organic growth, the analyst writes. The sale of Telematics is expected to reduce annual EBITDA by $8-10 million.

Also Read: Disney Q4 Earnings: Revenue And Profit Beat, Best Film Studio Performance, 3-Year Outlook And More

However, core product growth is strong, with hotspots returning to growth (20% in 2024 and 45% in 2H24).

Searle sees new products and better carrier partnerships to drive continued growth in Mobile Solutions (hotspots) through 2025 and 2026, with projected growth rates of 8% and 20%+ respectively.

The analyst noted that the company is expected to drive continued growth through more focused product development and strategic go-to-market approaches.

Searle adds that with an improved balance sheet, inorganic growth opportunities, such as mergers and acquisitions, are also becoming a more viable option.

For FY24, the analyst projects earnings of 2 cents per share, followed by 38 cents per share in FY25 and 70 cents per share in FY26.

Price Action: INSG shares are trading higher by 11.9% to $12.12 at last check Thursday.

Photo by Ground Picture on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Transaction: Charles F. Willis IV Sells $10.10M Worth Of Willis Lease Finance Shares

Charles F. Willis IV, Executive Chairman at Willis Lease Finance WLFC, reported an insider sell on November 13, according to a new SEC filing.

What Happened: IV’s recent move involves selling 50,000 shares of Willis Lease Finance. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value is $10,103,233.

As of Thursday morning, Willis Lease Finance shares are up by 5.06%, currently priced at $210.0.

All You Need to Know About Willis Lease Finance

Willis Lease Finance Corp with its subsidiaries is a lessor and servicer of commercial aircraft and aircraft engines. The company has two reportable business segments namely Leasing and Related Operations which involves acquiring and leasing, pursuant to operating leases, commercial aircraft, aircraft engines and other aircraft equipment and the selective purchase and resale of commercial aircraft engines and other aircraft equipment and other related businesses and Spare Parts Sales segment involves the purchase and resale of after-market engine parts, whole engines, engine modules and portable aircraft components. The company generates the majority of its revenue from leasing and related operations.

Willis Lease Finance: Delving into Financials

Revenue Growth: Willis Lease Finance’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 38.28%. This signifies a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Key Insights into Profitability Metrics:

-

Gross Margin: With a high gross margin of 73.39%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Willis Lease Finance’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 3.51.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 3.84, caution is advised due to increased financial risk.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 14.18 is lower than the industry average, implying a discounted valuation for Willis Lease Finance’s stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 2.52 is above industry norms, reflecting an elevated valuation for Willis Lease Finance’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 9.95, Willis Lease Finance presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

A Closer Look at Important Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Willis Lease Finance’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Director At Plexus Sells $399K Of Stock

It was reported on November 13, that J. Joel Quadracci, Director at Plexus PLXS executed a significant insider sell, according to an SEC filing.

What Happened: Quadracci’s recent move involves selling 2,450 shares of Plexus. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value is $399,539.

As of Thursday morning, Plexus shares are down by 0.0%, currently priced at $155.88.

Get to Know Plexus Better

Plexus Corp is a U.S based Electronic Manufacturing Services company that provides a range of services, from conceptualization and design to fulfilling orders and providing sustaining solutions, such as replenishment and refurbishment. The company’s segments comprise AMER, APAC,ge and EMEA.

Plexus’s Financial Performance

Revenue Growth: Plexus displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 9.35%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Key Insights into Profitability Metrics:

-

Gross Margin: With a low gross margin of 10.27%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Plexus’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 1.52.

Debt Management: Plexus’s debt-to-equity ratio is below the industry average at 0.21, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: Plexus’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 38.87.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.1 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 26.38, Plexus demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Plexus’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tower Semiconductor Analyst Raises Forecast On 'Aggressive AI-Levered Demand'

Tower Semiconductor Ltd TSEM tanked in trading on Thursday, after the company reported upbeat third-quarter results.

The company reported strong results and announced higher-than-expected guidance on “aggressive AI-levered demand,” according to Benchmark.

Analyst Cody Acree reiterated a Buy rating on Tower Semiconductor while raising the price target from $55 to $60.

The Tower Semiconductor Thesis: The company reported sales of $371 million and earnings of 57 cents per share, higher than consensus of $370 million and 53 cents per share, respectively, Acree said in the note.

Check out other analyst stock ratings.

Tower Semiconductor announced its December quarter revenues about $9 million higher than consensus on robust demand from “its broader RF (Radio Frequency) business, which includes both RF Mobile, RF SOI switches for the smartphone market, and RF Infrastructure demand for Data Center connectivity applications,” the analyst stated.

“With solid customer demand increasing for its SiGe and SiPho products for optical transceivers servicing AI Data Center applications, Tower is undertaking a new $350 million capacity expansion initiative, where it is planning to invest in multiple existing factories to significantly increase its ability to meet rapidly increasing customer forecasts,” he further wrote.

TSEM Price Action: Shares of Tower Semiconductor had declined by 4.81% to $46.09 at the time of publication on Thursday.

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Decoding Block's Options Activity: What's the Big Picture?

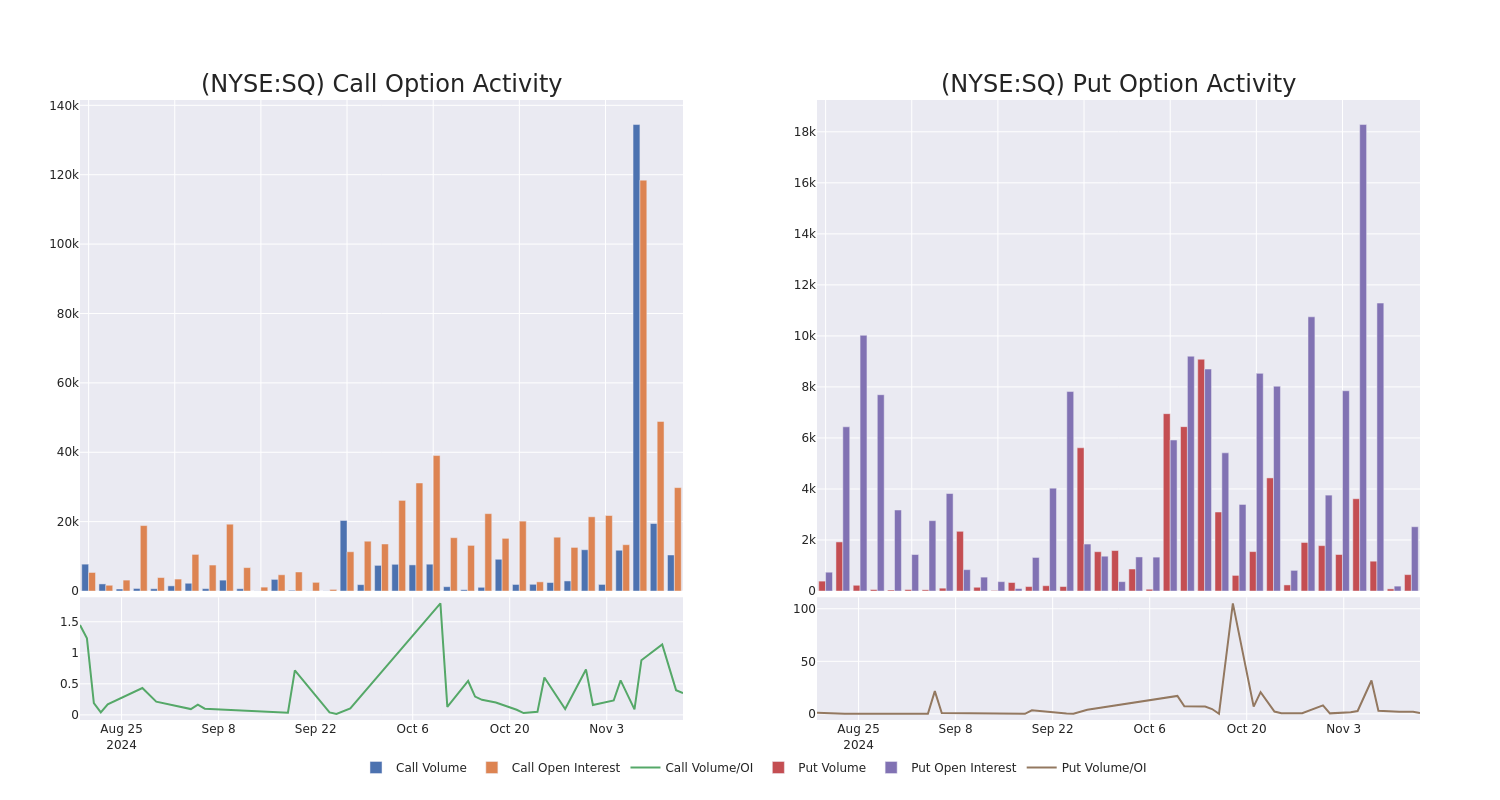

Financial giants have made a conspicuous bearish move on Block. Our analysis of options history for Block SQ revealed 15 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $92,180, and 12 were calls, valued at $1,227,460.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $125.0 for Block over the last 3 months.

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Block’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Block’s substantial trades, within a strike price spectrum from $70.0 to $125.0 over the preceding 30 days.

Block Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | CALL | TRADE | BEARISH | 01/17/25 | $13.65 | $13.45 | $13.45 | $72.50 | $402.1K | 2.3K | 306 |

| SQ | CALL | SWEEP | BEARISH | 12/20/24 | $2.36 | $2.25 | $2.36 | $90.00 | $202.4K | 3.7K | 1.1K |

| SQ | CALL | TRADE | NEUTRAL | 11/22/24 | $0.27 | $0.23 | $0.25 | $93.00 | $160.6K | 7.3K | 6.7K |

| SQ | CALL | SWEEP | BULLISH | 01/15/27 | $13.55 | $13.45 | $13.55 | $125.00 | $135.5K | 341 | 111 |

| SQ | CALL | SWEEP | BEARISH | 12/20/24 | $15.5 | $15.25 | $15.35 | $70.00 | $75.1K | 2.7K | 51 |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square’s payment volume was a little over $200 million.

In light of the recent options history for Block, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Block’s Current Market Status

- Currently trading with a volume of 5,295,109, the SQ’s price is down by -2.13%, now at $83.99.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 98 days.

Professional Analyst Ratings for Block

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $92.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Block with a target price of $90.

* An analyst from RBC Capital downgraded its action to Outperform with a price target of $88.

* Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Block, targeting a price of $120.

* In a cautious move, an analyst from Piper Sandler downgraded its rating to Overweight, setting a price target of $83.

* An analyst from Keefe, Bruyette & Woods has decided to maintain their Market Perform rating on Block, which currently sits at a price target of $80.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Block with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Inter&Co Inc. Reports Another Record Net Income of R$260M, And Remains On Track On Its Long-Term Plan

MIAMI, Nov. 14, 2024 (GLOBE NEWSWIRE) — Inter&Co Inc. INTR B3: INBR32)), the leading financial super app providing financial and digital commerce services to over 34.9 million customers, today reported financial results for the third quarter of 2024.

Highlights:

- Record Net Income of R$ 260 million ($52 million USD).

- Total Payment Volume (TPV) of R$ 320 million ($64 million USD), up 46% YoY, a R$ 1.2 trillion Run Rate.

- Total Net Revenue of R$ 1.7 billion ($340 million USD), up 32% YoY.

- Net Interest Margin of 9.6%, up from 9.2% last quarter.

- ROE of 11.9%, up 6.2 p.p. YoY.

- 34.9 million clients, with 1.1 million net new active clients, totaling 19.5 million active clients.

Figures in USD have been converted with the USD BRL rate of 1 USD = 5.00 BRL as of Tuesday, November 12 at 9:00 am ET. Exchange rates can fluctuate.

João Vitor Menin, Global CEO of Inter&Co, commented:

“We had a solid third quarter, reporting increased profitability and growth in both fee and interest income. Our focus on executing the 60/30/30 plan by increasing market share and product penetration, while we maintain efficiency gains is paying off.”

“We are constantly innovating, enhancing our super app with new features and hyper-personalizing the client experience. And our clients are rewarding us with more deposits and increased engagement, boosting our revenues. In addition to that, our sound capital allocation strategy has ensured that as our deposits have grown, so has our net interest margin.”

He added, “We are building an increasingly diversified and resilient business, and I’m confident in our ability to continue delivering value to our clients and shareholders in the years to come.”

Conference Call

Inter&Co will discuss its 3Q2024 financial results on November 14th, 2024, at 01 p.m. ET. The webcast details, along with the earnings materials can be accessed on the company’s Investor Relations website at https://investors.inter.co/en/.

About Inter&Co

Inter&Co INTR, the company that controls Banco Inter in Brazil and the subsidiary Inter&Co Payments, is the pioneering financial super app serving over 35 million customers across the Americas. The Inter ecosystem offers a broad array of services, including banking, investments, mortgages, credit, insurance, and cross-border payments. The financial super app also boasts a dynamic marketplace, linking consumers with shopping discounts, cashback rewards, and exclusive access to marquee events across the globe. Focused on innovation and captivating member experiences, Inter&Co delivers comprehensive financial and lifestyle solutions to meet the evolving needs of modern consumers.

Investor Relations:

Rafaela de Oliveira Vitória

ir@inter.co

Media Relations:

Kaio Philipe

kaio.philipe@inter.co

Chemistry Agency

interco@chemistryagency.com

Disclaimer

This report may contain forward-looking statements regarding Inter, anticipated synergies, growth plans, projected results and future strategies. While these forward-looking statements reflect our Management’s good faith beliefs, they involve known and unknown risks and uncertainties that could cause the company’s results or accrued results to differ materially from those anticipated and discussed herein. These statements are not guarantees of future performance. These risks and uncertainties include, but are not limited to, our ability to realize the number of projected synergies and the projected schedule, in addition to economic, competitive, governmental and technological factors affecting Inter, the markets, products and prices and other factors. In addition, this presentation contains managerial figures that may differ from those presented in our financial statements. The calculation methodology for these managerial numbers is presented in Inter’s quarterly earnings release. Statements contained in this report that are not facts or historical information may be forward looking statements under the terms of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may, among other things, beliefs related to the creation of value and any other statements regarding Inter. In some cases, terms such as “estimate”, “project”, “predict”, “plan”, “believe”, “can”, “expectation”, “anticipate”, “intend”, “aimed”, “potential”, “may”, “will/shall” and similar terms, or the negative of these expressions, may identify forward looking statements.

These forward-looking statements are based on Inter’s expectations and beliefs about future events and involve risks and uncertainties that could cause actual results to differ materially from current ones. Any forward-looking statement made by us in this document is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether because of new information, future developments or otherwise. The definition of each such operational metric is included in the earnings release available on our Investor Relations website.

For additional information that about factors that may lead to results that are different from our estimates, please refer to sections “Cautionary Statement Concerning Forward Looking Statements” and “Risk Factors” of Inter&Co Annual Report on Form 20-F. The numbers for our key metrics (Unit Economics), which include, among other, active clients and average revenue per active client (ARPAC), are calculated using Inter’s internal data. Although we believe these metrics are based on reasonable estimates, there are challenges inherent in measuring the use of our business. In addition, we continually seek to improve our estimates, which may change due to improvements or changes in methodology, in processes for calculating these metrics and, from time to time, we may discover inaccuracies and adjust to improve accuracy, including adjustments that may result in recalculating our historical metrics.

About Non-IFRS Financial Measures

To supplement the financial measures presented in this press release and related conference call, presentation, or webcast in accordance with IFRS, Inter&Co also presents non-IFRS measures of financial performance, as highlighted throughout the documents. The non-IFRS Financial Measures include, among others: Adjusted Net Income, Cost of Funding, Efficiency Ratio, Cost of Risk, Cards+PIX TPV, Gross ARPAC, Global Clients, Total Gross Revenues, and Return on average equity (ROE).

A “non-IFRS financial measure” refers to a numerical measure of Inter&Co’s historical or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS in Inter&Co’s financial statements. Inter&Co provides certain non-IFRS measures as additional information relating to its operating results as a complement to results provided in accordance with IFRS. The non-IFRS financial information presented herein should be considered together with, and not as a substitute for or superior to, the financial information presented in accordance with IFRS. There are significant limitations associated with the use of non-IFRS financial measures. Further, these measures may differ from the non-IFRS information, even where similarly titled, used by other companies and therefore should not be used to compare Inter&Co’s performance to that of other companies.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.