What the Options Market Tells Us About Walmart

Deep-pocketed investors have adopted a bullish approach towards Walmart WMT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WMT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 23 extraordinary options activities for Walmart. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 60% leaning bullish and 26% bearish. Among these notable options, 3 are puts, totaling $153,872, and 20 are calls, amounting to $2,986,061.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $86.67 for Walmart over the recent three months.

Volume & Open Interest Development

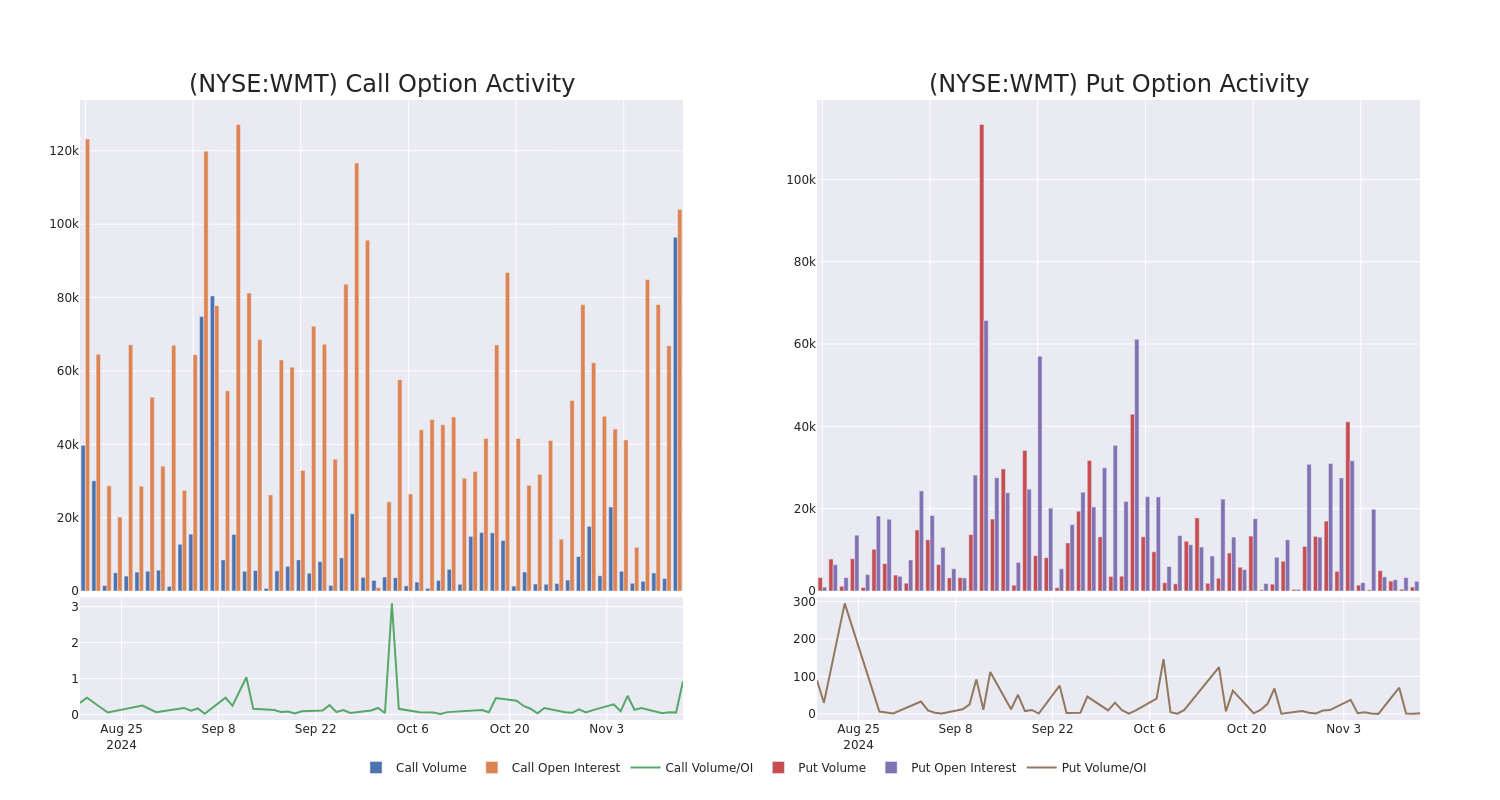

In today’s trading context, the average open interest for options of Walmart stands at 10636.8, with a total volume reaching 97,378.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Walmart, situated within the strike price corridor from $60.0 to $86.67, throughout the last 30 days.

Walmart Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $2.57 | $2.54 | $2.57 | $86.67 | $476.0K | 10.0K | 3.6K |

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $2.59 | $2.55 | $2.58 | $86.67 | $464.9K | 10.0K | 6.6K |

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $2.57 | $2.55 | $2.58 | $86.67 | $398.6K | 10.0K | 1.6K |

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $2.58 | $2.55 | $2.58 | $86.67 | $231.9K | 10.0K | 4.6K |

| WMT | CALL | SWEEP | BULLISH | 12/20/24 | $2.59 | $2.55 | $2.58 | $86.67 | $206.6K | 10.0K | 7.5K |

About Walmart

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam’s Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam’s Club contributing another $86 billion to the company’s top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

Walmart’s Current Market Status

- With a trading volume of 2,967,114, the price of WMT is up by 0.04%, reaching $85.53.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 5 days from now.

What Analysts Are Saying About Walmart

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $89.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Walmart, targeting a price of $89.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Walmart with a target price of $87.

* Maintaining their stance, an analyst from Telsey Advisory Group continues to hold a Outperform rating for Walmart, targeting a price of $92.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Walmart, which currently sits at a price target of $90.

* An analyst from Keybanc persists with their Overweight rating on Walmart, maintaining a target price of $88.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walmart options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply