Earnings Preview For i3 Verticals

i3 Verticals IIIV is gearing up to announce its quarterly earnings on Monday, 2024-11-18. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that i3 Verticals will report an earnings per share (EPS) of $0.20.

i3 Verticals bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

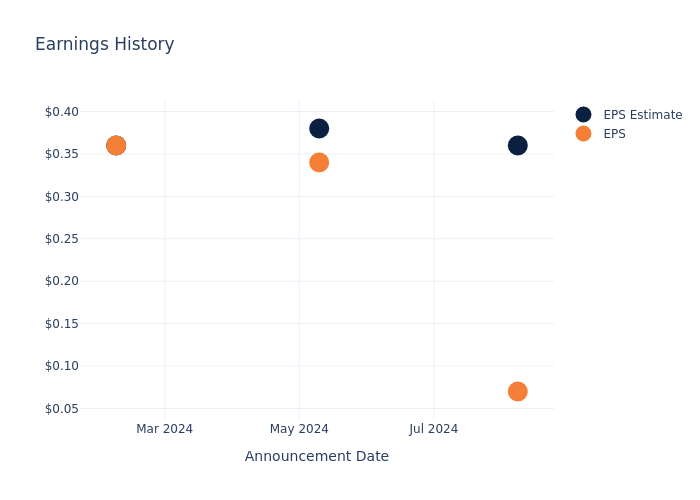

Earnings Track Record

During the last quarter, the company reported an EPS missed by $0.29, leading to a 7.47% drop in the share price on the subsequent day.

Here’s a look at i3 Verticals’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.36 | 0.38 | 0.36 | 0.4 |

| EPS Actual | 0.07 | 0.34 | 0.36 | 0.4 |

| Price Change % | -7.000000000000001% | -10.0% | -2.0% | 0.0% |

i3 Verticals Share Price Analysis

Shares of i3 Verticals were trading at $24.87 as of November 14. Over the last 52-week period, shares are up 19.95%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on i3 Verticals

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on i3 Verticals.

A total of 4 analyst ratings have been received for i3 Verticals, with the consensus rating being Buy. The average one-year price target stands at $29.5, suggesting a potential 18.62% upside.

Comparing Ratings with Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Cantaloupe, IntL Money Express and Repay Holdings, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Cantaloupe, with an average 1-year price target of $10.67, suggesting a potential 57.1% downside.

- Analysts currently favor an Buy trajectory for IntL Money Express, with an average 1-year price target of $27.5, suggesting a potential 10.57% upside.

- Repay Holdings is maintaining an Buy status according to analysts, with an average 1-year price target of $13.0, indicating a potential 47.73% downside.

Summary of Peers Analysis

Within the peer analysis summary, vital metrics for Cantaloupe, IntL Money Express and Repay Holdings are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| i3 Verticals | Buy | -2.14% | $51.31M | -3.02% |

| Cantaloupe | Outperform | 13.01% | $28.85M | 1.78% |

| IntL Money Express | Buy | -0.28% | $60.60M | 12.17% |

| Repay Holdings | Buy | 4.35% | $58.59M | -0.50% |

Key Takeaway:

i3 Verticals is at the bottom for Revenue Growth and Gross Profit, with negative values for both metrics. It is also at the bottom for Return on Equity. Overall, i3 Verticals is performing less favorably compared to its peers in terms of financial metrics.

Delving into i3 Verticals’s Background

i3 Verticals Inc offers integrated payment and software solutions to small and medium-sized businesses and organizations in strategic vertical markets. Its operating segment includes Merchant Services and Software and Services. The company generates maximum revenue from the Software and Services segment. The company’s strategic vertical market includes schools, the public sector, not-for-profit organizations, healthcare and others. It provides various solutions such as, gateway, payment processing, online payment, Document management, and ERP among others.

Financial Milestones: i3 Verticals’s Journey

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: i3 Verticals’s revenue growth over a period of 3 months has faced challenges. As of 30 June, 2024, the company experienced a revenue decline of approximately -2.14%. This indicates a decrease in the company’s top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of -13.46%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): i3 Verticals’s ROE excels beyond industry benchmarks, reaching -3.02%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): i3 Verticals’s ROA excels beyond industry benchmarks, reaching -0.87%. This signifies efficient management of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.54.

To track all earnings releases for i3 Verticals visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply