Expedia Group Options Trading: A Deep Dive into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on Expedia Group.

Looking at options history for Expedia Group EXPE we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 60% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $203,880 and 6, calls, for a total amount of $424,321.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $110.0 to $192.5 for Expedia Group over the recent three months.

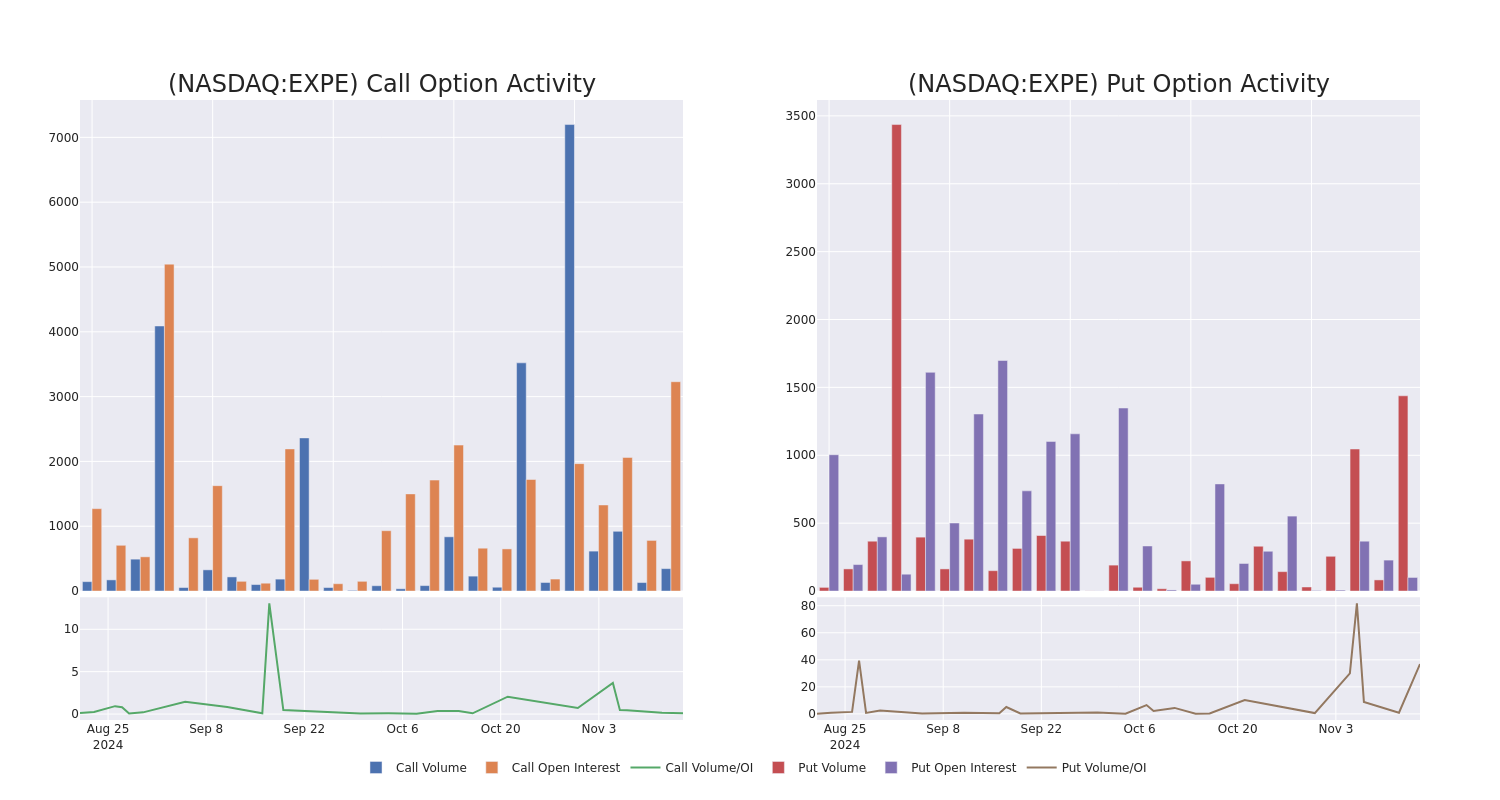

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Expedia Group stands at 475.71, with a total volume reaching 1,784.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Expedia Group, situated within the strike price corridor from $110.0 to $192.5, throughout the last 30 days.

Expedia Group Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EXPE | CALL | SWEEP | BULLISH | 01/17/25 | $21.5 | $21.1 | $21.5 | $160.00 | $107.6K | 1.3K | 151 |

| EXPE | CALL | TRADE | BEARISH | 01/17/25 | $21.95 | $21.0 | $21.28 | $160.00 | $106.4K | 1.3K | 51 |

| EXPE | PUT | TRADE | BULLISH | 11/22/24 | $1.43 | $0.72 | $0.74 | $172.50 | $88.8K | 54 | 1.2K |

| EXPE | CALL | TRADE | BULLISH | 01/17/25 | $21.3 | $21.05 | $21.3 | $160.00 | $78.8K | 1.3K | 101 |

| EXPE | CALL | TRADE | BEARISH | 01/17/25 | $41.75 | $40.25 | $40.81 | $140.00 | $65.2K | 1.3K | 16 |

About Expedia Group

Expedia is the world’s second-largest online travel agency by bookings, offering services for lodging (80% of total 2023 sales), air tickets (3%), rental cars, cruises, in-destination, and other (11%), and advertising revenue (6%). Expedia operates a number of branded travel booking sites, but its three core online travel agency brands are Expedia, Hotels.com, and Vrbo. It also has a metasearch brand, Trivago. Transaction fees for online bookings account for the bulk of sales and profits.

Having examined the options trading patterns of Expedia Group, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Expedia Group

- With a volume of 719,408, the price of EXPE is down -1.06% at $180.33.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 83 days.

Expert Opinions on Expedia Group

In the last month, 5 experts released ratings on this stock with an average target price of $173.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Expedia Group, targeting a price of $210.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Neutral rating for Expedia Group, targeting a price of $166.

* An analyst from Jefferies persists with their Hold rating on Expedia Group, maintaining a target price of $160.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Expedia Group with a target price of $153.

* An analyst from Wedbush persists with their Neutral rating on Expedia Group, maintaining a target price of $180.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Expedia Group options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply