Elanco Animal Health Incorporated Investors: Please contact the Portnoy Law Firm to recover your losses. December 6, 2024 Deadline to file Lead Plaintiff Motion

Investors can contact the law firm at no cost to learn more about recovering their losses

LOS ANGELES, Nov. 14, 2024 (GLOBE NEWSWIRE) — The Portnoy Law Firm advises Elanco Animal Health Incorporated (“Elanco Animal” or the “Company”) ELAN investors of a class action representing investors that bought securities between November 7, 2023 and June 26, 2024, inclusive (the “Class Period”). Elanco Animal investors have until December 6, 2024 to file a lead plaintiff motion.

Investors are encouraged to contact attorney Lesley F. Portnoy, by phone 310-692-8883 or email: lesley@portnoylaw.com, to discuss their legal rights, or click here to join the case. The Portnoy Law Firm can provide a complimentary case evaluation and discuss investors’ options for pursuing claims to recover their losses.

Case Allegations:

Elanco Animal Health, a company focused on animal health products for pets and farm animals, is developing Zenrelia, a once-daily oral Janus kinase inhibitor for canine dermatology, and Credelio Quattro, a broad-spectrum parasiticide for dogs.

The class action lawsuit against Elanco Animal alleges that, during the class period, the company made false and/or misleading statements and failed to disclose crucial information regarding its products. Specifically, the lawsuit claims that: (i) Zenrelia was less safe than Elanco had represented to investors; and (ii) Elanco was unlikely to meet its previously stated timeline for the U.S. approval and commercial launch of both Zenrelia and Credelio Quattro.

The lawsuit further alleges that on June 27, 2024, Elanco revealed that it expected the U.S. label for Zenrelia to include a boxed warning on safety. This warning was based on the results of a trial involving unvaccinated dogs that were dosed at three times the labeled dose. As a result, Elanco anticipated that the product’s adoption in the U.S. would be slower than expected and that the number of treatment days (the number of days Zenrelia could safely be administered to vaccinated dogs) would be reduced by approximately 25%.

Additionally, Elanco disclosed that it now expected Zenrelia to receive FDA approval in the third quarter of 2024, with a potential commercial launch in the fourth quarter of 2024. The company also revised its expectations for Credelio Quattro, now forecasting FDA approval for the product in the fourth quarter of 2024.

Following these disclosures, Elanco’s stock price reportedly dropped by more than 20%, according to the lawsuit.

Please visit our website to review more information and submit your transaction information.

The Portnoy Law Firm represents investors in pursuing claims against caused by corporate wrongdoing. The Firm’s founding partner has recovered over $5.5 billion for aggrieved investors. Attorney advertising. Prior results do not guarantee similar outcomes.

Lesley F. Portnoy, Esq.

Admitted CA and NY Bar

lesley@portnoylaw.com

310-692-8883

www.portnoylaw.com

Attorney Advertising

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

/R E P E A T — CF Lime Ridge Marks the Final Stop of the 2024 Hamilton Santa Claus Parade with Festive Fun/

Parade-goers are invited to CF Lime Ridge to continue the celebration with festive activities, including cookie decorating, musical performances, and visits with Santa

HAMILTON, ON, Nov. 12, 2024 /CNW/ – CF Lime Ridge is pleased to announce its participation in the 2024 Hamilton Santa Claus Parade as the final stop of the parade route on Saturday, November 16th. This cherished annual event signals the start of the holidays in Hamilton, and as one of the leading destinations in the city, CF Lime Ridge is proud to invite parade-goers to continue the celebration with an exciting lineup of festive activities at the centre.

“We are truly proud to welcome our community during this special time of the year,” said Andy Traynor, General Manager of CF Lime Ridge. “The holidays are a celebration of love, laughter, and togetherness, when cherished memories are made with family and friends. It’s an honour to be part of this beloved annual tradition to share in the spirit of the season with everyone.”

2024 Hamilton Santa Claus Parade Details

|

Date: |

Saturday, November 16, 2024 |

|

Parade Timing: |

2:00pm – 3:30pm |

|

Parade Route: |

Starts at Upper Sherman Ave. & Acadia Rd. |

|

North on Upper Sherman to Limeridge Rd. E |

|

|

West on Limeridge Rd. to Lime Ridge Mall Rd. |

|

|

North on Lime Ridge Mall Rd to the NE corner of the parking lot. |

|

|

Final Stop: |

CF Lime Ridge, 999 Upper Wentworth St, Hamilton, ON |

Santa and Mrs. Claus continue the parade by foot through CF Lime Ridge, greeting guests before reaching the centre’s Rockefeller Tree where guests are invited to enjoy a magical tree lighting countdown. The shopping centre will be beautifully adorned with holiday decorations, creating an enchanting backdrop perfect for making memories and taking photos. Other parade day festivities include:

- Musical Performances: Guests can enjoy live musical performances while they shop.

- Cookie Decorating: Wildflour Fields Bakeshop will host an interactive cookie decorating workshop where kids can unleash their creativity.

- Hot Beverage Stations: Guests can enjoy complimentary hot beverages courtesy of Second Cup, David’s Tea, and Starbucks.

- Holiday Passport Scavenger Hunt: Guests of all ages can participate in a scavenger hunt for special retailer offers and a chance to win exciting prizes.

Experience Holiday Magic with CF Lime Ridge All Season Long

Visits with Santa

Santa makes his special appearance at CF Lime Ridge from November 15th to December 24th. Tickets are now available online at shops.cadillacfairview.com/holiday. Each ticket costs $15 and includes a visit with Santa and instant downloads of up to five digital photos. This season, Santa’s cabin will be located at Coles Court inside Entrance 3.

Giving Back to the Community

This holiday season, CF Lime Ridge is committed to giving back. Join the centre in supporting:

- Salvation Army Toy Drive – Beginning November 14th

Guests are invited to drop off toy donations in the Toy Shed located on the upper level beside the Centre Court elevator. Bounce Radio will be onsite broadcasting live all day for Toy Mountain on Thursday, November 28th. - Santa for a Senior – November 12th to December 10th

This year CF Lime Ridge is partnering with St. Joseph’s Home Care and Banyan Community Centre for its annual Santa to a Senior program. Guests are invited to pick a tag off of the Santa to a Senior Christmas Tree located next to Guest Services, purchase the wishlist item for a Hamilton senior and return the unwrapped gift to Guest Services by December 10th. - Hamilton Police Cram a Cruiser for Hamilton Food Share – November 22nd to 24th

Guests are invited to help the Hamilton Police Services fill a police cruiser with non-perishable food items in support of the Hamilton Food Share. - Corus Radio Toy Drive – December 7th

Benefiting The Children’s Fund and Hamilton Rotary Club December 7th, Corus Radio will be broadcasting live onsite from 10:00am to 6:00pm, and the community is invited to come by with a toy or monetary donation.

Become a CF Insider

Shoppers are invited to join the CF Insider e-newsletter to receive exclusive offers, insider news, and updates on this year’s curated CF Shop the Look – Gift Guide. Packed with the latest trends from CF retailers, the guide features inspiring gift ideas to help ensure that everyone finds, and receives, the perfect present.

Extended Holiday Hours

Starting November 25th, CF Lime Ridge will extend its shopping hours to make holiday shopping even easier:

- Monday – Friday: 10:00am – 9:30pm

- Saturday: 9:30am – 9:30pm

- Sunday 10:00am – 7:00pm

- Christmas Eve – 10:00am – 5:00pm

- Christmas Day – CLOSED

- Boxing Day – 8:00am – 8:00pm

- New Year’s Eve – 10:00am – 5:00pm

- New Year’s Day – CLOSED

For more information on holiday hours, activities, and event registration, please visit shops.cadillacfairview.com/holiday. For details on the 2024 Hamilton Santa Claus parade and route map, visit hamiltonsantaparade.com.

SOURCE Cadillac Fairview Corporation Limited

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/15/c3449.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/15/c3449.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lenovo Q2 Earnings: Cloud Momentum, AI PCs, And Smartphone Growth Drive Revenue Beat

On Thursday, Chinese PC company Lenovo Group Ltd (OTC: LNVGY) reported a fiscal second-quarter revenue growth of 24% year-on-year to $17.85 billion, beating the analyst consensus estimate of $16.34 billion.

The Solutions and Services Group (SSG) posted revenue growth of 13% Y/Y to $2.17 billion, with an operating margin of 20.4%, up by 40 bps Y/Y. The segment accounted for 32% of the total operating profit of the three business groups. Managed services and Project & Solution Services revenue experienced double-digit growth, attributed to a solid contract backlog.

Also Read: Disney Q4 Earnings: Revenue And Profit Beat, Best Film Studio Performance, 3-Year Outlook And More

The Infrastructure Solutions Group (ISG) revenue grew 65% Y/Y to $3.31 billion, driven by solid cloud momentum and strengthening enterprise business. High double-digit revenue growth for Storage came from aggressive cloud investment. Both the smartphone and tablet businesses delivered high double-digit revenue growth. The segment operating margin loss improved to (1.1)% versus (2.7)% Y/Y.

Intelligent Devices Group (IDG) increased 17% to $13.51 billion, driven by substantial market share gain in PC and smartphones and the rapid popularity of five feature AI PCs. The PC business expanded its market leadership to almost 24% market share. The segment operating margin stood flat at 7.3%.

The non-PC revenue mix during the quarter stood at 46%. Gross margin reached 15.7% versus 17.5% a year ago. The expenses-to-revenue ratio was 12.0% vs. 13.9% the prior year.

Net income grew by 48% Y/Y to $404 million. EPS per ADR rose to $0.0278 from $0.0199 a year ago.

As of September 30, 2024, cash and equivalents stood at $4.2 billion.

Dividend: Lenovo’s Board declared an interim dividend of 8.5 Hong Kong cents per share.

Outlook: Lenovo plans to focus on boosting net income margin in the medium term and capitalize on digital transformation for sustained growth. The company finds itself well-positioned to lead the Hybrid AI shift, offering comprehensive solutions from devices to edge and cloud. It expects ongoing growth momentum across all three business units, with plans to enhance profitability.

Recently, Lenovo Group has partnered with Meta Platforms and Nvidia Corp to boost its AI capabilities in markets beyond China.

At its Tech World event in Seattle, Lenovo launched “AI Now,” a personal AI assistant for PCs outside China. Built on Meta’s Llama 3.1 open-source large language model, the AI operates locally without internet access.

Lenovo also expanded its collaboration with Nvidia to roll out enterprise AI solutions. The Lenovo ThinkSystem SC777 V4 Neptune server now integrates Nvidia’s Blackwell GPUs alongside Lenovo’s water-cooling technology.

Facing risks from geopolitical tensions affecting supply chains, Lenovo employs its AI-driven Supply Chain Intelligence solution, which has already cut logistics and manufacturing costs by 20%.

Price Action: LNVGY stock closed higher by 1.14% at $24.78 on Thursday.

Photo by Robert Way via Shutterstock

Also Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

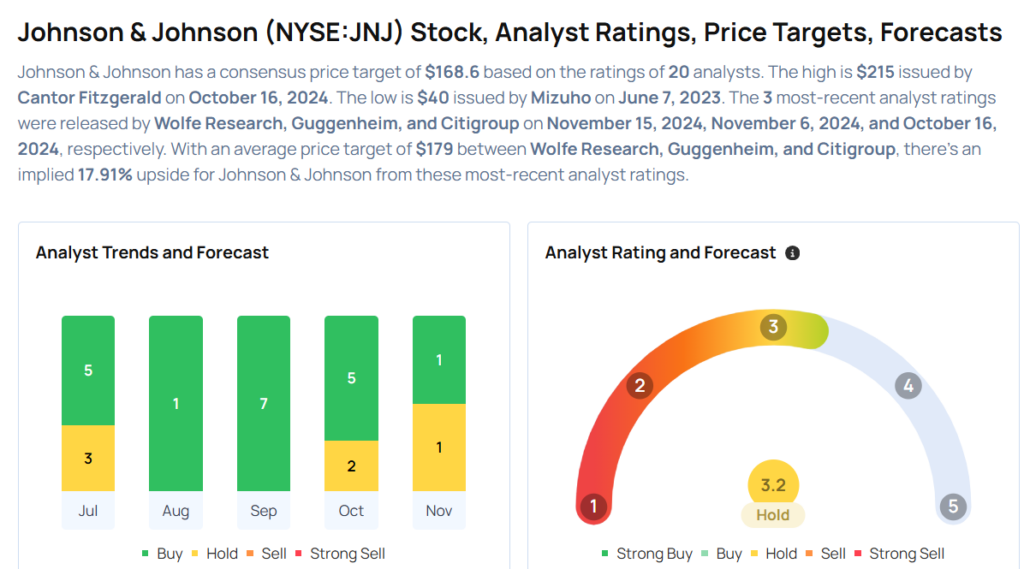

This Johnson & Johnson Analyst Begins Coverage On A Bullish Note; Here Are Top 5 Initiations For Friday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Goldman Sachs analyst David Roman initiated coverage on HealthEquity, Inc. HQY with a Neutral rating and announced a price target of $108. HealthEquity shares closed at $95.70 on Thursday. See how other analysts view this stock.

- Wolfe Research analyst Alexandria Hammond initiated coverage on Pfizer Inc. PFE with an Underperform rating and announced a price target of $25. Pfizer shares closed at $26.02 on Thursday. See how other analysts view this stock.

- Stifel analyst Brian Brophy initiated coverage on EMCOR Group, Inc. EME with a Buy rating and announced a price target of $600. EMCOR shares closed at $498.11 on Thursday. See how other analysts view this stock.

- Redburn Atlantic analyst Harry Read initiated coverage on Insight Enterprises, Inc. NSIT with a Buy rating and announced a price target of $220. Insight Enterprises shares closed at $152.63 on Thursday. See how other analysts view this stock.

- Wolfe Research analyst Alexandria Hammond initiated coverage on Johnson & Johnson JNJ with an Outperform rating and announced a price target of $190. Johnson & Johnson shares closed at $151.87 on Thursday. See how other analysts view this stock.

Considering buying JNJ stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Autonomous Trucks Market worth $179.9 billion by 2035, Globally, at a CAGR of 14.4%, says MarketsandMarkets™

Delray Beach, FL, Nov. 15, 2024 (GLOBE NEWSWIRE) — Autonomous Trucks Market size is projected to grow from USD 40.7 Billion in 2024 to USD 179.9 Billion by 2035, at a CAGR of 14.4% over the forecast period, as per the recent study by MarketsandMarkets™. The increasing demand for electric and autonomous vehicle and government regulation regarding safety is expected to increase the demand for autonomous trucks. Additionally, continuous innovation in advance driving technologies and components will boost the demand for autonomous trucks.

Browse in-depth TOC on “Autonomous Trucks Market”

326 – Tables

86 – Figures

346 – Pages

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=87328844

List of Key Players in Autonomous Trucks Market:

- Daimler Truck AG (Germany)

- AB Volvo (Sweden)

- Iveco S.p.A. (Netherlands)

- NVIDIA Corporation (US)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

Drivers, Opportunities and Challenges in Autonomous Trucks Market:

- Driver: Rising adoption of automation technology

- Restraint: Lack of infrastructure in developing countries

- Opportunity: Surge in demand for truck platooning s

- Challenge: Regulatory hurdles

Key Findings of the Study:

- LiDAR segment is estimated to exhibit the fastest growth in autonomous trucks market

- Last-mile Delivery Truck segment is expected to have significant growth in Autonomous trucks market during the forecast period

- L2 and L3 segment is expected to see largest growth in Autonomous trucks market during the forecast period

- The Europe Autonomous trucks market is projected to become fastest by 2035

Get Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=87328844

Electric segment is expected to be the fastest in the Autonomous trucks market

The electric segment is expected to be the fastest one during the forecast period. The rising demand for passenger safety and efficient bus transit operations would boost the demand for the electric segment for the advanced autonomous bus market during the forecast period. Favorable government regulations for better road safety would positively impact the autonomous bus market. Features such as AEB and BSD are expected to be compulsory for all vehicles, including buses. In December 2023, Davao Metro Shuttle Corporation (Philippines) launched a self-driving shuttle and its first electric bus, which includes AEB and ACC features.

Shuttle segment is estimated to exhibit the fastest growth in Autonomous trucks market

The shuttles segment is expected to be the fastest market in the autonomous trucks market, as they are commercialized. Navya (US), Easilmile (France), and Local Motors (US) have developed self-driving shuttles. Successful pilot programs of autonomous shuttles worldwide indicate that shuttles could be a practical solution to the gaps in traditional public transport. In January 2023, EasyMile(France) partnered with Keolis (France) on an autonomous shuttle project underway at France’s National Sports Shooting. Such partnerships highlight the growth of the shuttles segment in the market.

US to lead the Autonomous trucks market in North America

The US is expected to have the largest market share in terms of value in the North American autonomous trucks market due to strict safety regulations imposed by the NHTSA that have compelled OEMs to provide safety features. Road safety is very critical for efficient transportation. Autonomous trucks can help to improve safety, which, in turn, would boost the market in the region. Major OEMs in the region are forming supply contracts for products like sensors, LiDAR that would further enhance their vehicles performance. For instance, in January 2024, Daimler Truck AG (Germany) and TORC Robotics (US) selected Aeva Technologies (US) to Supply advanced 4D LiDAR technology for series-production of autonomous trucks.

Inquiry Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=87328844

Recent Developments:

- In March 2024, MAN Truck & Bus SE partnered with TRATON GROUP, Scania, Navistar International Inc., and PlusAI, Inc. for autonomous driving for trucks.

- In February 2024, MAN Truck & Bus SE expanded its logistics center in Salzgitter, Germany, strengthening its global service parts network.

- In January 2024, Daimler Truck AG partnered with Aeva Inc. and Torc Robotics to commercialize self-driving vehicle technology to equip its series-produced autonomous trucks with Aeva Inc.’s advanced 4D LiDAR sensors.

Related Reports:

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MDA SPACE REPORTS THIRD QUARTER 2024 RESULTS

- Q3 2024 Highlights

- Significant backlog of $4.6 billion at quarter-end, up 49% YoY

- Strong top line growth with revenues of $282.4 million, up 38% YoY

- Solid profitability with adjusted EBITDA1 of $55.5 million, up 30% YoY, and adjusted EBITDA margin1 of 19.7%

- Solid adjusted net income1 of $34.7 million, up 60% YoY, and adjusted diluted earnings per share1 of $0.28, up 56% YoY

- Strong operating cash flow of $258.8 million

- Net debt to adjusted EBITDA1 ratio of 0.8x at quarter-end

- Updated 2024 full-year financial outlook

- Raised revenue guidance, narrowed adjusted EBITDA guidance and reaffirmed capital expenditures guidance

- Reaffirmed positive free cash flow in 2024

BRAMPTON, ON, Nov. 15, 2024 /PRNewswire/ – MDA Space Ltd. MDA, a trusted space mission partner to the rapidly expanding global space industry, today announced its financial results for the third quarter ended September 30, 2024.

“In Q3, the MDA Space team delivered another strong quarter with double digit growth in our top and bottom lines as we continued to execute and convert our backlog,” said Mike Greenley, Chief Executive Officer of MDA Space.

“The team continued to execute on our major programs, successfully conducting the preliminary design review for the Canadarm3 program, a critical milestone for the program. We also made significant progress on MDA CHORUS™, our next generation Earth Observation constellation, completing the spacecraft assembly and commencing spacecraft integration and testing. And in our Satellite Systems business, the team made solid progress advancing the engineering work for the Telesat Lightspeed program. In Q3, we also broke ground on our Satellite Systems facility expansion in Quebec which will add 185,000 square feet of advanced manufacturing capacity,” continued Mr. Greenley.

“I am also pleased to welcome Guillaume Lavoie to the MDA Space Team as Chief Financial Officer. Guillaume brings a wealth of financial leadership experience and will be instrumental in supporting our long-term growth plans and helping us deliver successfully for our customers and shareholders.”

Q3 2024 HIGHLIGHTS

- Backlog of $4.6 billion at quarter-end provides good revenue visibility for 2025 and beyond and was up 49% compared to Q3 2023. The year-over-year increase in backlog is driven by new order bookings including the $1 billion award for Phases C/D of the Canadarm3 program announced in Q2 2024.

- Revenues of $282.4 million in Q3 2024 were up 38.0% year-over-year driven by higher work volumes across the business with strong contributions from the Satellite Systems and Robotics & Space Operations businesses.

- Adjusted EBITDA of $55.5 million in Q3 2024 compared to $42.8 million in Q3 2023, representing an increase of $12.7 million (or 29.7%) year-over-year. Adjusted EBITDA margin of 19.7% in Q3 2024 is consistent with the Company’s full year margin guidance of 19-20% and compares to adjusted EBITDA margin of 20.9% reported in the third quarter of 2023.

- Adjusted net income for Q3 2024 was $34.7 million compared to $21.7 million in Q3 2023, representing an increase of $13.0 million (or 59.9%) year-over-year driven by higher operating income. Adjusted diluted earnings per share of $0.28 in Q3 2024 compared to $0.18 in Q3 2023, representing an increase of 55.6% year-over-year.

- Operating cash flow was $258.8 million in Q3 2024 compared to $(30.0) million in Q3 2023. The year-over-year increase in operating cash flow was driven by positive working capital contributions primarily related to the Telesat Lightspeed program.

- At quarter-end, net debt to adjusted EBITDA ratio was 0.8x compared to 2.4x as of December 2023 (2.0x as of June 30, 2024) as the Company utilized its strong operating cash flow in Q3 2024 to make repayments to its revolving credit facility and deleverage the balance sheet while continuing to invest in its growth initiatives.

|

_______________________ |

|

1 As defined in the “Non-IFRS Financial Measures” section |

2024 FINANCIAL OUTLOOK

As a trusted mission partner and leading global space technology provider, we are leveraging our capabilities and expertise to execute on targeted growth strategies across our end markets and business areas. Our strategic initiatives, which span across our three businesses, include investing in next generation space technology and services, expanding our presence in high growth markets and geographies, scaling and expanding skills, talent and operations to meet current and future market demand and leveraging strategic M&A to complement organic growth. We continue to make good progress against our long-term strategic plan.

MDA Space is well positioned to capitalize on strong customer demand and robust market activity given our diverse and proven technology offerings. Our growth pipeline is significant and underpinned by existing and new programs and our book of business is healthy. We see activities ramping up in line with our expectations and are encouraged by the team’s solid execution.

For fiscal 2024, we are raising our full year revenue guidance to $1,045 – $1,065 million from $1,020 – $1,060 million previously, representing robust year-over-year growth of approximately 30% at the mid-point of guidance compared to 2023 levels. We are narrowing our full year adjusted EBITDA range to $205 – $210 million from $200 – $210 million previously, representing approximately 19% – 20% adjusted EBITDA margin. We reaffirm our expectations that capital expenditures will be $200 – $220 million, comprising primarily growth investments to support CHORUS and the previously outlined growth initiatives across our three business areas. We continue to expect favourable working capital contributions related to the Telesat Lightspeed program to result in positive free cash flow in 2024 allowing us to continue to deleverage our balance sheet

FINANCIAL OVERVIEW

KEY INDICATORS SUMMARY

|

Third Quarters Ended |

Nine Months Ended |

|||||||

|

(in millions of Canadian dollars, except per share data) |

Sept. 30, 2024 |

Sept. 30, 2023 |

Sept. 30, 2024 |

Sept. 30, 2023 |

||||

|

Revenues |

$ |

282.4 |

$ |

204.7 |

$ |

733.5 |

$ |

602.6 |

|

Gross profit |

$ |

75.7 |

$ |

57.7 |

$ |

199.8 |

$ |

186.2 |

|

Gross margin |

26.8 % |

28.2 % |

27.2 % |

30.9 % |

||||

|

Adjusted EBITDA2 |

$ |

55.5 |

$ |

42.8 |

$ |

146.2 |

$ |

132.1 |

|

Adjusted EBITDA margin2 |

19.7 % |

20.9 % |

19.9 % |

21.9 % |

||||

|

Adjusted Net Income2 |

$ 34.7 |

$ 21.7 |

$ 76.0 |

$ 70.1 |

||||

|

Adjusted Diluted EPS2 |

$ 0.28 |

$ 0.18 |

$ 0.61 |

$ 0.58 |

||||

|

As at |

||||

|

(in millions of Canadian dollars, except for ratios) |

September 30, 2024 |

December 31, 2023 |

||

|

Backlog |

$ |

4,578.1 |

$ |

3,097.0 |

|

Net debt2 to Adjusted TTM3 EBITDA ratio |

0.8x |

2.4x |

||

REVENUES BY BUSINESS AREA

|

Third Quarters Ended |

Nine Months Ended |

|||||||

|

(in millions of Canadian dollars) |

Sept. 30, 2024 |

Sept. 30, 2023 |

Sept. 30, 2024 |

Sept. 30, 2023 |

||||

|

Geointelligence |

$ |

48.3 |

$ |

48.4 |

$ |

154.7 |

$ |

147.6 |

|

Robotics & Space Operations |

66.5 |

61.9 |

215.1 |

183.5 |

||||

|

Satellite Systems |

167.6 |

94.4 |

363.7 |

271.5 |

||||

|

Consolidated revenues |

$ |

282.4 |

$ |

204.7 |

$ |

733.5 |

$ |

602.6 |

Revenues

Consolidated revenues for the third quarter of 2024 were $282.4 million, representing an increase of $77.7 million (or 38.0%) from the third quarter of 2023. The year-over-year increase in revenues was driven by higher work volumes across our business, with strong contributions from our Satellite Systems and Robotics & Space Operations businesses.

By business area, revenues in Geointelligence for the third quarter of 2024 were $48.3 million, which represents a decrease of $0.1 million (or 0.2%) from the same period in 2023 reflecting steady work volumes. Revenues in Robotics & Space Operations for the third quarter of 2024 were $66.5 million, which represents an increase of $4.6 million (or 7.4%) from the same period in 2023. The year-over-year increase is primarily driven by higher volume of work performed on the Canadarm3 program. Revenues in Satellite Systems for the third quarter of 2024 were $167.6 million, which represents an increase of $73.2 million (or 77.5%) from the same period in 2023 driven by higher contributions in the latest quarter from new programs including Telesat Lightspeed and the authorization to proceed (ATP) for an undisclosed customer for a NGSO satellite constellation (announced in Q4 2023).

Consolidated revenues for the nine months ended September 30, 2024 were $733.5 million, representing an increase of $130.9 million (or 21.7%) from the same period of 2023. The year-over-year increase in revenues was primarily driven by increased work volume from our Satellite Systems and Robotics & Space Operations businesses.

By business area, revenues in Geointelligence for the first nine months of 2024 were $154.7 million, which represents an increase of $7.1 million (or 4.8%) from the same period in 2023 reflecting higher work volume on CSC and other new programs in 2024. Revenues in Robotics & Space Operations for the first nine months of 2024 were $215.1 million, which represents an increase of $31.6 million (or 17.2%) from the same period in 2023. The year-over-year increase is primarily driven by the higher volume of work performed on the Canadarm3 program. Revenues in Satellite Systems for the first nine months of 2024 were $363.7 million, which represents an increase of $92.2 million (or 34.0%) from the same period in 2023 driven by higher contributions from new programs including the Telesat Lightspeed program and the ATP for an undisclosed customer for a NGSO satellite constellation.

|

________________________ |

|

2 As defined in the “Non-IFRS Financial Measures” section |

Gross Profit and Gross Margin

Gross profit reflects our revenues less cost of revenues. Q3 2024 gross profit of $75.7 million represents a $18.0 million (or 31.2%) increase over Q3 2023 driven by higher work volume in the current quarter. Gross margin in Q3 2024 was 26.8%, which is in line with the Company’s expectations and compares to gross margin of 28.2% in Q3 2023. The year- over-year change in gross margin is driven by evolving program mix and higher depreciation expense as new assets come into service.

For the nine months ended September 30, 2024, gross profit of $199.8 million represents a $13.6 million (or 7.3%) increase over 2023 levels. Gross margin for the nine months ended September 30, 2024 was 27.2% which is in line with the Company’s expectations and compares to 30.9% for the same period in 2023. The year-over-year change in gross profit and gross margin metrics is driven by evolving program mix and higher depreciation expense as new assets come into service.

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA for the third quarter of 2024 was $55.5 million compared with $42.8 million for the third quarter of 2023, representing an increase of $12.7 million (or 29.7%) year-over-year driven by higher volume of work and steady operating expenses. Adjusted EBITDA margin of 19.7% for the third quarter of 2024 is consistent with the Company’s full year margin guidance of 19-20% and compares to adjusted EBITDA margin of 20.9% reported in the third quarter of 2023.

Adjusted EBITDA for the nine months ended September 30, 2024 was $146.2 million compared with $132.1 million for the same period in 2023, representing an increase of $14.1 million (or 10.7%) year-over-year. The improvement was driven by higher volumes of work performed year-over-year somewhat offset by program mix. Adjusted EBITDA margin was 19.9% for the nine months ended September 30, 2024 compared with 21.9% for the same period in 2023.

Adjusted Net Income

Adjusted net income for the third quarter of 2024 was $34.7 million compared with $21.7 million for the third quarter of 2023, representing an increase of $13.0 million (or 59.9%) year-over-year driven by higher operating income in the latest quarter.

Adjusted net income for the nine months ended September 30, 2024 was $76.0 million compared with $70.1 million for the same period in 2023, representing a increase of $5.9 million (or 8.4%) year-over-year driven by the aforementioned gross profit variance.

Backlog

Backlog is comprised of our remaining performance obligations which represent the transaction price of firm orders less inception to date revenue recognized and excludes unexercised contract options and indefinite delivery or indefinite quantity contracts. Backlog as at September 30, 2024 was $4,578.1 million, an increase of $1,509.4 million compared with the backlog at September 30, 2023 driven by new order bookings, partially offset by continued conversion of our backlog into revenue. The following table shows the build up of backlog for Q3 2024 as compared with the same period in 2023.

|

Third Quarters Ended |

Nine Months Ended |

|||||||

|

(in millions of Canadian dollars) |

Sept. 30, 2024 |

Sept. 30, 2023 |

Sept. 30, 2024 |

Sept. 30, 2023 |

||||

|

Opening Backlog |

$ |

4,596.0 |

$ |

1,098.3 |

$ |

3,097.0 |

$ |

1,378.2 |

|

Less: Revenue recognized |

(282.4) |

(204.7) |

(733.5) |

(602.6) |

||||

|

Add: Order Bookings |

264.5 |

2,175.1 |

2,214.6 |

2,293.1 |

||||

|

Ending Backlog |

$ |

4,578.1 |

$ |

3,068.7 |

$ |

4,578.1 |

$ |

3,068.7 |

CONFERENCE CALL AND WEBCAST

MDA Space will host a conference call and webcast to discuss these financial results on Friday, November 15, 2024 at 8:30 a.m. ET. Interested parties can join the call by dialing 416-764-8609 (Toronto area) or 1-888-390-0605 (toll-free North America) or +44-800-652-2435 (toll-free United Kingdom) and entering the conference ID 94799731. A live webcast of the conference call and an accompanying slide presentation will be available at https://mda-en.investorroom.com/events-presentations.

A replay of the conference will be archived on the MDA Space website following the call. Parties may also access a recording of the call which will be available until November 22, 2024, by dialing 1-888-390-0541 and entering the passcode 799731 #.

NON-IFRS FINANCIAL MEASURES

This press release refers to certain non-IFRS measures. These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective. Accordingly, the measures should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS. We use non-IFRS measures, including EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted Earnings per Share, Order Bookings, Net Debt and Free Cash Flow, to provide investors with supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. We define EBITDA as net income (loss) before: i) depreciation and amortization expenses, ii) provision for (recovery of) income taxes, and iii) finance costs. Adjusted EBITDA is calculated by adding to and deducting from EBITDA, as applicable, certain expenses, costs, charges or benefits incurred in such period which in management’s view are either not indicative of underlying business performance or impact the ability to assess the operating performance of our business, including i) unrealized foreign exchange gain or loss ii) unrealized gain or loss on financial instruments and iii) share-based compensation expenses, and iv) other items that may arise from time to time. Adjusted EBITDA margin represents Adjusted EBITDA divided by revenue. Order Bookings is the dollar sum of contract values of firm customer contracts. Adjusted Net Income is calculated by adding to and deducting from net income, as applicable, certain expenses, costs, charges or benefits incurred in such period which in management’s view are either not indicative of underlying business performance or impact the ability to assess the operating performance of our business, including i) amortization of intangible assets related to business combinations, ii) unrealized foreign exchange gain or loss, iii) unrealized gain or loss on financial instruments, and iv) share-based compensation expenses, and iv) other items that may arise from time to time. Adjusted Earnings per Share represents Adjusted Net Income divided by the weighted average number of shares outstanding. Order Bookings is indicative of firm future revenues; however, it does not provide a guarantee of future net income and provides no information about the timing of future revenue. Net Debt is the total carrying amount of long-term debt including current portions, as presented in the Q2 2024 Financial Statements, less cash (or plus bank indebtedness) and excluding any lease liabilities. Net Debt is a liquidity metric used to determine how well the Company can pay all of its debts if they were due immediately. Free Cash Flow is a supplemental measure used to monitor the availability of discretionary cash generated, and available to the Company to repay debt, make strategic investments, and meet other payment obligations. We define Free Cash Flow as operating cash flows less net capital expenditures.

FORWARD-LOOKING STATEMENTS

This press release may contain forward‐looking information within the meaning of applicable securities legislation, which reflects the Company’s current expectations regarding future events. Forward‐looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward‐looking information. Such risks and uncertainties include, but are not limited to the factors discussed under “Risk Factors” in the Company’s Annual Information Form (AIF) dated February 28, 2024 and available on SEDAR+ at www.sedarplus.com. MDA Space does not undertake any obligation to update such forward‐looking information, whether as a result of new information, future events or otherwise, except as expressly required by applicable law.

ABOUT MDA SPACE

Building the space between proven and possible, MDA Space MDA is a trusted mission partner to the global space industry. A robotics, satellite systems and geointelligence pioneer with a 55-year+ story of world firsts and more than 450 missions, MDA Space is a global leader in communications satellites, Earth and space observation, and space exploration and infrastructure. The MDA Space team of more than 3,000 space experts in Canada, the US and the UK has the knowledge and know-how to turn an audacious customer vision into an achievable mission – bringing to bear a one-of-a-kind mix of experience, engineering excellence and wide-eyed wonder that’s been in our DNA since day one. For those who dream big and push boundaries on the ground and in the stars to change the world for the better, we’ll take you there. For more information, visit www.mda.space.

MDA Space Ltd.

Unaudited Interim Condensed Statement of Comprehensive Income

For the three and nine months ended September 30, 2024 and 2023

(In millions of Canadian dollars except per share figures)

|

Three months |

Three months |

Nine months |

Nine months |

|||||||||

|

Revenue |

$ |

282.4 |

$ |

204.7 |

$ |

733.5 |

$ |

602.6 |

||||

|

Cost of revenue |

||||||||||||

|

Materials, labour and subcontractors |

(197.0) |

(138.2) |

(502.6) |

(394.0) |

||||||||

|

Depreciation and amortization of assets |

(9.7) |

(8.8) |

(31.1) |

(22.4) |

||||||||

|

Gross profit |

75.7 |

57.7 |

199.8 |

186.2 |

||||||||

|

Operating expenses |

||||||||||||

|

Selling, general and administration |

(18.4) |

(17.8) |

(57.9) |

(52.2) |

||||||||

|

Research and development, net |

(7.2) |

(10.4) |

(25.0) |

(30.8) |

||||||||

|

Amortization of intangible assets |

(11.6) |

(11.0) |

(35.5) |

(34.8) |

||||||||

|

Share-based compensation |

(3.0) |

(2.8) |

(8.6) |

(6.9) |

||||||||

|

Operating income |

35.5 |

15.7 |

72.8 |

61.5 |

||||||||

|

Other income (expenses) |

||||||||||||

|

Unrealized gain (loss) on financial instruments |

— |

1.0 |

1.2 |

(0.1) |

||||||||

|

Foreign exchange gain (loss) |

7.2 |

0.6 |

8.7 |

(0.8) |

||||||||

|

Finance income |

2.3 |

0.3 |

3.7 |

0.3 |

||||||||

|

Finance costs |

(4.4) |

(2.7) |

(18.4) |

(7.0) |

||||||||

|

Other income |

— |

— |

6.6 |

— |

||||||||

|

Income before income taxes |

40.6 |

14.9 |

74.6 |

53.9 |

||||||||

|

Income tax expense |

(11.1) |

(5.6) |

(20.3) |

(18.6) |

||||||||

|

Net income |

29.5 |

9.3 |

54.3 |

35.5 |

||||||||

|

Other comprehensive income |

||||||||||||

|

Gain (loss) on translation of foreign operations |

(0.8) |

0.3 |

(1.0) |

— |

||||||||

|

Gain (loss) on cash flow hedges |

(5.1) |

2.2 |

(3.2) |

4.1 |

||||||||

|

Remeasurement gain on defined benefit plans |

12.7 |

4.7 |

12.1 |

6.4 |

||||||||

|

Total comprehensive income |

$ |

36.3 |

$ |

16.5 |

$ |

62.2 |

$ |

45.8 |

||||

|

Earnings per share: |

||||||||||||

|

Basic |

$ |

0.25 |

$ |

0.08 |

$ |

0.45 |

$ |

0.30 |

||||

|

Diluted |

0.24 |

0.08 |

0.44 |

0.29 |

||||||||

|

Weighted-average common shares outstanding: |

||||||||||||

|

Basic |

120,107,965 |

119,329,839 |

119,874,946 |

119,191,837 |

||||||||

|

Diluted |

124,286,353 |

121,912,874 |

123,610,686 |

120,546,321 |

||||||||

MDA Space Ltd.

Unaudited Interim Condensed Statement of Financial Position

September 30, 2024

(In millions of Canadian dollars)

|

As at |

September 30, 2024 |

December 31, 2023 |

|||||

|

Assets |

|||||||

|

Current assets: |

|||||||

|

Cash |

$ |

139.2 |

$ |

22.5 |

|||

|

Trade and other receivables |

143.7 |

169.5 |

|||||

|

Unbilled receivables |

266.5 |

183.1 |

|||||

|

Inventories |

10.1 |

9.9 |

|||||

|

Income taxes receivable |

44.7 |

47.3 |

|||||

|

Other current assets |

78.9 |

24.3 |

|||||

|

683.1 |

456.6 |

||||||

|

Non-current assets: |

|||||||

|

Property, plant and equipment |

448.8 |

369.1 |

|||||

|

Right-of-use assets |

87.2 |

71.8 |

|||||

|

Intangible assets |

580.5 |

582.5 |

|||||

|

Goodwill |

441.0 |

439.8 |

|||||

|

Deferred income tax assets |

14.2 |

14.9 |

|||||

|

Other non-current assets |

315.0 |

227.0 |

|||||

|

1,886.7 |

1,705.1 |

||||||

|

Total assets |

$ |

2,569.8 |

$ |

2,161.7 |

|||

|

Liabilities and shareholders’ equity |

|||||||

|

Current liabilities: |

|||||||

|

Accounts payable and accrued liabilities |

$ |

235.2 |

$ |

219.1 |

|||

|

Income taxes payable |

3.1 |

4.4 |

|||||

|

Contract liabilities |

523.1 |

76.9 |

|||||

|

Current portion of net employee benefit payable |

48.7 |

57.4 |

|||||

|

Current portion of lease liabilities |

13.6 |

10.9 |

|||||

|

Other current liabilities |

1.7 |

4.5 |

|||||

|

825.4 |

373.2 |

||||||

|

Non-current liabilities: |

|||||||

|

Net employee defined benefit payable |

23.2 |

22.8 |

|||||

|

Lease liabilities |

90.9 |

75.2 |

|||||

|

Long-term debt |

293.8 |

438.9 |

|||||

|

Deferred income tax liabilities |

190.0 |

180.8 |

|||||

|

Other non-current liabilities |

6.6 |

6.1 |

|||||

|

604.5 |

723.8 |

||||||

|

Total liabilities |

1,429.9 |

1,097.0 |

|||||

|

Shareholders’ equity |

|||||||

|

Common shares |

963.6 |

956.1 |

|||||

|

Contributed surplus |

36.8 |

31.3 |

|||||

|

Accumulated other comprehensive income |

26.5 |

18.6 |

|||||

|

Retained earnings |

113.0 |

58.7 |

|||||

|

Total equity |

1,139.9 |

1,064.7 |

|||||

|

Total liabilities and equity |

$ |

2,569.8 |

$ |

2,161.7 |

|||

MDA Space Ltd.

Unaudited Interim Condensed Consolidated Statement of Cash Flows

For the three and nine months ended September 30, 2024 and 2023

(In millions of Canadian dollars)

|

Three months |

Three months |

Nine months |

Nine months |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||

|

Cash flows from operating activities |

||||||||||||

|

Net income |

$ |

29.5 |

$ |

9.3 |

$ |

54.3 |

$ |

35.3 |

||||

|

Items not affecting cash: |

||||||||||||

|

Income tax expense |

11.1 |

5.6 |

20.3 |

18.6 |

||||||||

|

Depreciation of property, plant and equipment |

4.1 |

3.5 |

14.2 |

9.4 |

||||||||

|

Depreciation of right-of-use assets |

2.4 |

2.5 |

8.1 |

6.8 |

||||||||

|

Amortization of intangible assets |

14.8 |

13.8 |

44.3 |

41.0 |

||||||||

|

Gain on disposal of assets |

— |

— |

(5.8) |

— |

||||||||

|

Write-down of assets |

— |

4.8 |

— |

4.8 |

||||||||

|

Share-based compensation expense |

2.2 |

2.8 |

7.7 |

6.9 |

||||||||

|

Investment tax credits accrued |

(10.5) |

(6.0) |

(29.7) |

(18.7) |

||||||||

|

Finance costs, net |

2.1 |

2.4 |

14.7 |

6.7 |

||||||||

|

Unrealized (gain) loss on financial instruments |

— |

(1.0) |

(1.2) |

0.1 |

||||||||

|

Changes in operating assets and liabilities |

200.7 |

(59.9) |

315.4 |

(38.8) |

||||||||

|

256.4 |

(22.2) |

442.3 |

72.1 |

|||||||||

|

Interest paid |

(6.9) |

(4.9) |

(19.4) |

(12.9) |

||||||||

|

Income tax received (paid) |

9.3 |

(2.9) |

9.6 |

(4.5) |

||||||||

|

Net cash from operating activities |

258.8 |

(30.0) |

432.5 |

54.7 |

||||||||

|

Cash flows from investing activities |

||||||||||||

|

Purchases of property and equipment |

(36.8) |

(37.1) |

(86.4) |

(100.7) |

||||||||

|

Purchase/development of intangible assets |

(16.6) |

(12.3) |

(46.1) |

(34.9) |

||||||||

|

Proceeds from disposal of assets |

— |

— |

7.4 |

— |

||||||||

|

Investment in equity securities |

— |

— |

(9.2) |

— |

||||||||

|

Acquisition of subsidiary, net of cash |

(4.0) |

— |

(27.3) |

— |

||||||||

|

Net cash used in investing activities |

(57.4) |

(49.4) |

(161.6) |

(135.6) |

||||||||

|

Cash flows from financing activities |

||||||||||||

|

Borrowings from senior credit facility |

— |

55.0 |

110.0 |

90.0 |

||||||||

|

Repayments to senior credit facility |

(105.0) |

— |

(255.0) |

(30.0) |

||||||||

|

Payment of lease liability (principal portion) |

(1.6) |

(1.7) |

(6.1) |

(5.6) |

||||||||

|

Proceeds from stock options exercised |

2.2 |

0.2 |

3.0 |

0.6 |

||||||||

|

Net cash provided by financing activities |

(104.4) |

53.5 |

(148.1) |

55.0 |

||||||||

|

Net decrease in cash |

97.0 |

(25.9) |

122.8 |

(25.9) |

||||||||

|

Net foreign exchange differences on cash |

(4.2) |

0.3 |

(6.1) |

— |

||||||||

|

Cash, beginning of period |

46.4 |

39.0 |

22.5 |

39.3 |

||||||||

|

Cash, end of period |

$ |

139.2 |

$ |

13.4 |

$ |

139.2 |

$ |

13.4 |

||||

RECONCILIATION OF NON-IFRS MEASURES

The following tables provide a reconciliation of net income to EBITDA, adjusted EBITDA, and adjusted net income:

|

Third Quarters Ended |

Nine Months Ended |

|||||||||||||||||||||||

|

(in millions of Canadian dollars) |

Sept. 30, 2024 |

Sept. 30, 2023 |

Sept. 30, 2024 |

Sept. 30 2023 |

||||||||||||||||||||

|

Net income |

$ |

29.5 |

$ |

9.3 |

$ |

54.3 |

$ |

35.3 |

||||||||||||||||

|

Depreciation and amortization of assets |

9.7 |

8.8 |

31.1 |

22.4 |

||||||||||||||||||||

|

Amortization of intangible assets related to business combination |

11.6 |

11.0 |

35.5 |

34.8 |

||||||||||||||||||||

|

Income tax expense |

11.1 |

5.6 |

20.3 |

18.6 |

||||||||||||||||||||

|

Finance income |

(2.3) |

(0.3) |

(3.7) |

(0.3) |

||||||||||||||||||||

|

Finance costs |

4.4 |

2.7 |

18.4 |

7.0 |

||||||||||||||||||||

|

EBITDA |

$ |

64.0 |

$ |

37.1 |

$ |

155.9 |

$ |

117.8 |

||||||||||||||||

|

Unrealized foreign exchange loss (gain) |

(10.7) |

(0.9) |

(10.4) |

2.5 |

||||||||||||||||||||

|

Unrealized (gain) loss on financial instruments |

— |

(1.0) |

(1.2) |

0.1 |

||||||||||||||||||||

|

Impairment of long-lived assets |

— |

4.8 |

— |

4.8 |

||||||||||||||||||||

|

Gain on disposal of assets |

— |

— |

(5.8) |

— |

||||||||||||||||||||

|

Share-based compensation |

2.2 |

2.8 |

7.7 |

6.9 |

||||||||||||||||||||

|

Adjusted EBITDA |

$ |

55.5 |

$ |

42.8 |

$ |

146.2 |

$ |

132.1 |

||||||||||||||||

|

Third Quarters Ended |

Nine Months Ended |

|||||||||||||||||||||||

|

(in millions of Canadian dollars) |

Sept. 30, 2024 |

Sept. 30, 2023 |

Sept. 30, 2024 |

Sept. 30, 2023 |

||||||||||||||||||||

|

Net Income |

$ 29.5 |

$ 9.3 |

$ 54.3 |

$ 35.3 |

||||||||||||||||||||

|

Amortization of intangible assets related to business combination |

11.6 |

11.0 |

35.5 |

34.8 |

||||||||||||||||||||

|

Impairment of long-lived assets |

— |

4.8 |

— |

4.8 |

||||||||||||||||||||

|

Gain on disposal of assets |

— |

— |

(5.8) |

— |

||||||||||||||||||||

|

Unrealized (gain) loss on financial instruments |

— |

(1.0) |

(1.2) |

0.1 |

||||||||||||||||||||

|

Net foreign exchange (gain) loss |

(7.2) |

(0.6) |

(8.7) |

0.8 |

||||||||||||||||||||

|

Embedded derivative effects |

0.5 |

— |

2.2 |

— |

||||||||||||||||||||

|

Share-based compensation |

2.2 |

2.8 |

7.7 |

6.9 |

||||||||||||||||||||

|

Income taxes related to the above items3 |

(1.9) |

(4.6) |

(8.0) |

(12.6) |

||||||||||||||||||||

|

Adjusted Net income |

$ 34.7 |

$ 21.7 |

$ 76.0 |

$ 70.1 |

||||||||||||||||||||

|

Weighted average number of shares outstanding – diluted |

124,286,353 |

121,912,874 |

123,610,686 |

120,546,321 |

||||||||||||||||||||

|

Adjusted EPS – diluted |

$ 0.28 |

$ 0.18 |

$ 0.61 |

$ 0.58 |

||||||||||||||||||||

|

3 Standard income tax rate of 26.5% applied |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/mda-space-reports-third-quarter-2024-results-302306490.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/mda-space-reports-third-quarter-2024-results-302306490.html

SOURCE MDA Space

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SIGMA LITHIUM ANNOUNCES 3Q24 RESULTS: PRODUCTION BEATS GUIDANCE, MAINTAINED LOW COSTS AT TARGET, GENERATED ROBUST $ 34 MILLION OPERATING CASH FLOW

HIGHLIGHTS

- Sigma Lithium achieved strong operational performance at its Greentech industrial plant.

- Produced 60,237t of Quintuple Zero Lithium Concentrate in 3Q24, higher than the 60,000t guidance

- Further increased shipping cadence to quasi monthly volumes sold of 22,000t

- Sales volumes totaled 57,483t in 3Q24, increasing 9% q-on-q

- Successfully executed Plant 1 efficiency capex revamp implementation

- Expects 4Q24 production and sales volumes of at least 60,000t

- Maintained one of the lowest cash unit operating costs in the industry, with CIF China averaging US$ 513/t, down from US$ 515/t in 2Q24.

- Commercial strategy adapted to capitalize on seasonal restocking trends, weather seasonality more effectively, and outperform market price benchmarks

- Average CIF sales price for the third quarter of US$ 820/t

- Robust operating cash flow generation of US$ 34 million in the third quarter enabled the Company to maintain a healthy cash position of US$ 66 million at quarter-end while reducing debt by $40 million

- Signed final development loan agreement with the BNDES, fully financing its plant 2 expansion, further de-risking construction

- Term: 16 years with 18 months amortization grace period

- Sub-Treasury Interest Rate: BRL 7.53%, or USD 2.5% at prevailing swap rates

- Continued to advance Plant 2 construction with earthworks and engineering

Conference Call Information

The Company will conduct a conference call to discuss its financial results for the third quarter at 8:00 a.m. EST on Friday, November 15, 2024. Participating in the call will be Co-Chairperson and Chief Executive Officer, Ana Cabral, Chief Financial Officer, Rogerio Marchini, and Executive Vice President for Corporate Affairs and Strategic Development, Matthew DeYoe. To register for the call, please proceed through the following link Register here. For access to the webcast, please Click here.

SÃO PAULO, Nov. 15, 2024 /PRNewswire/ — Sigma Lithium Corporation SGML BVMF: S2GM34,SGML, a leading global lithium producer dedicated to powering the next generation of electric vehicles with carbon neutral, socially and environmentally sustainable lithium concentrate, announces its results for the third quarter ended September 30, 2024.

Ana Cabral, Co-Chairperson and CEO said: “This quarter we achieved our production and low industry cost targets, generating robust free cash flow and demonstrating our operational resilience to lithium cycles. We also benefited from our shifted commercial strategy to navigate industry seasonality, enabling us to secure higher average realized prices compared to benchmarks.

“Over the last year we are proud to have transformed Sigma from an emerging producer into an industry leader, demonstrating the operational and financial resilience of a mature producer, with dependability and consistency. Meanwhile we have delivered on all of our climate goals, reaching Net Zero one year in advance of our target and 27 years ahead of the industry, with our Quintuple Zero Green Lithium. We are confident that over the lithium cycles, our capabilities to execute to strategy will deliver long-term value for Sigma and all of its stakeholders“, Ms. Cabral concluded.

Key Performance Metrics for Quarter Ended September 30, 2024 (US$)

|

Unit |

3Q24 |

2Q24 |

|

|

Sales Revenue for Shipents in Quarter |

$ 000s |

44,210 |

54,418 |

|

Provisional Price Adjustment |

$ 000s |

(23,316) |

(8,498) |

|

Total Sales Revenue |

$ 000s |

20,894 |

45,920 |

|

Concentrate Sold |

tonnes |

57,483 |

52,572 |

|

Concentrate Grade Sold |

% |

5.2 % |

5.5 % |

|

Average Reported Selling Price CIF (1) |

$/t |

820 |

1,056 |

|

Average Revenue per Tonne CIF (2) |

$/t |

415 |

894 |

|

Unit Operating Cost CIF (3) |

$/t |

513 |

515 |

|

Cash and Cash Equivalents |

$ 000s |

65,594 |

75,330 |

Revenues in the third quarter totaled US$44.2 million or US$20.9 million net of provisional price adjustments.

The Company has undergone a significant evolution in its commercial relationship with trading companies, strengthening commercial conditions. As a result of this change in strategy the Company concluded the final settlement of provisional sales invoices from previous quarters conducted through our traders, generating an accounting adjustment of US$(23.3) million. Importantly, these are primarily non-cash accounting closing settlements and do not have an effect on the future earnings potential of the Company.

In 3Q, Sigma Lithium maintained one of the lowest cash unit operating costs in the industry, with CIF China averaging US$ 513/t, down from US$ 515/t in 2Q24, in line with target levels.

- Cash unit operating costs(3) for lithium concentrate produced at the Company’s Grota do Cirilo operations in the third quarter averaged US$ 395/t (including a temporary US$25/t for mobile crushers).

- On an FOB Vitoria(3) basis (which includes transportation and port charges) costs averaged US$449/t.

- On a CIF China basis(3) (includes ocean freight, insurance and royalties) costs averaged US$513/t.

Robust operating cash flow generation of US$ 34 million in the third quarter enabled the Company to maintain a healthy cash position of US$ 66 million, ultimately reflecting the non-cash nature of the accounting adjustments to the quarter.

- The Company delivered third quarter cash adjusted EBITDA(4) of US$(10.6) million. Reported EBITDA for the third quarter totaled US$(12.8) million.

- The cash adjusted EBITDA number excludes US$0.8 million of non-recurring expenditures, primarily related to capital markets and cost initiatives, and US$1.4 million in non-cash stock-based compensation expenses.

Net income in the quarter totaled US$(25.1) million or US$(0.23) per diluted share outstanding. These reported results were affected by the aforementioned US$(23.3) million in accounting adjustments.

Operational Update

Sigma Lithium achieved strong operational performance at its Greentech industrial plant in the third quarter. Production of Sigma Lithium’s Quintuple Zero Lithium Concentrate totaled 60,237t, up 22% from 2Q24 and ahead of the 60,000t guidance. This includes numerous daily production records and periods of sustained operations above 860t per day. The Company expects 4Q24 production of lithium concentrate to reach at least 60,000 tonne.

Commercial Strategy Update

Sigma Lithium sold 57,483 tonnes of its Quintuple Zero Green Lithium concentrate in the third quarter, when its operational performance enabled it to further increase shipping cadence to quasi monthly volumes sold of 22,000t. As a result, the Company made two full 22,000t shipments during the quarter and supplemented these volumes with 13,483t sold at the Port customs warehouse.

Operational reliability and a consistent shipment pattern lowered the Company’s export credit risk, increasing the availability and lowering the interest rate of its trade finance lines. This generated direct benefits for Sigma’s commercial strategy, enabling the Company to further geographically diversify its accounts receivables, shipping to three distributors across the world: Glencore AG (Europe), Mitsubishi Corporation RtM International Pte. Ltd (Japan/ Singapore), and International Resources Holdings (UAE/Abu Dhabi).

The interest rate cost of the Company’s trade finance export credit lines decreased substantially over the year from nearly 15.5% in 4Q23 to 9.0% in 3Q24. In parallel, the amount of available export trade lines exceeded US$ 100 million in the year.

The increased financial flexibility enabled the Company to strengthen its commercial strategy and change its distribution relationship with trading companies from “traders as principals” to “traders as distributors”. This strategy shift allows Sigma to capitalize on annual restocking trends of chemical refiners, weather seasonality more effectively and outperform market price benchmarks, achieving average CIF sales price for the third quarter of US$ 820/t.

While Sigma Lithium ships and sells monthly to its trading partners, its goal is to build maximum flexibility in the final re-sale to clients to benefit from the established seasonality of refiners’ restocking periods. When combined with its superior metallurgical properties and the associated value-in-use driven cost savings to customers, Sigma believes it has positioned itself to drive superior price realizations over time.

This commercial strategy of “trader as a distributor” was not yet in place during Company’s second through seventh shipments, when trading partners served as the principals to the transaction. The accounting provisional price adjustment booked in this quarter was mainly a result of the booking of final invoice settlement and closing of these trades.

Phase 2 Expansion

Recall, on April 1, 2024, the Board of Directors announced a Final Investment Decision for the Company’s Phase 2 Greentech Plant expansion. The project is expected to add 250,000 tonnes of production capacity to the current Phase 1 operation. Importantly, the Company has already received all relevant licenses to build and operate this second Greentech Plant.

In 3Q, Sigma Lithium initiated earthworks by completing clearing of the terrain for arid and semi-arid vegetation suppression (including fauna capture and classification) for the entire industrial project, including future phase 3 construction of production plant. Total building and commissioning are expected to occur over a 12-month period, with budgeted capex for Phase 2 of BRL492 million (approximately US$90mm at current exchange rates).

On August 29, the National Brazilian Bank for Economic and Social Development (BNDES) delivered a binding commitment to Sigma for a BRL 487mm development loan to finance this expansion.

On October 10, Sigma and the BNDES signed the final binding loan agreement, concluding the closing of the loan package. The first disbursement of the development loan is pending the Company posting bank guarantees with BNDES. This disbursement shall reimburse the capex already disbursed by the Company since first approval of the development bank loan.

The key terms and conditions of the development loan are:

- Amount: BRL 487 million

- Term: 192 months (16 years)

- Interest Rate: BRL 7.53% per year (US$ at approximately 2.5% at prevailing swap rates).

- Amortization Grace Period: 18 months – Calendarized Amortization: 174 months

- Assets in Collateral: Not required. Development Loan shall be secured by letter of credit (“fianca bancaria”) issued by a BNDES registered financial institution.

Balance Sheet & Liquidity

Robust operating cash flow generation of US$ 34 million during the third quarter enabled the Company to maintain a healthy cash position. Sigma Lithium ended the third quarter with US$65.6 million in cash and cash equivalents.

Free cash flow in the quarter totaled US$32 million primarily related to a reduction in working capital associated with the collection of accounts receivable.

Cash generation in the third quarter enabled the Company to repay certain export credit debt, reducing outstanding trade line balances. At the end of the quarter, the Company had US$181 million in short-term and long-term debt. This included US$59 million in drawn and available, but unutilized, additional liquidity through trade finance lines.

Capital expenditures during the third quarter totaled US$2.5 million (C$3.1 million) directed towards maintenance, mining, Phase 2 expansion work, and incremental investments in the Greentech Plant.

ABOUT SIGMA LITHIUM

Sigma Lithium SGMLSGML BVMF: S2GM34)) is a leading global lithium producer dedicated to powering the next generation of electric vehicle batteries with carbon neutral, socially and environmentally sustainable chemical-grade lithium concentrate.

Sigma Lithium is one of the world’s largest lithium producers. The Company operates at the forefront of environmental and social sustainability in the EV battery materials supply chain at its Grota do Cirilo Operation in Brazil. Here, Sigma produces Quintuple Zero Green Lithium at its state-of-the-art Greentech lithium beneficiation plant that delivers net zero carbon lithium, produced with zero dirty power, zero potable water, zero toxic chemicals and zero tailings’ dams.

Phase 1 of the Company’s operations entered commercial production in the second quarter of 2023. The Company has issued a Final Investment Decision, formally approving construction to double capacity to 520,000 tonnes of concentrate through the addition of a Phase 2 expansion of its Greentech Plant.

Please refer to the Company’s National Instrument 43-101 technical report titled “Grota do Cirilo Lithium Project Araçuaí and Itinga Regions, Minas Gerais, Brazil, Amended and Restated Technical Report” issued March 19, 2024, which was prepared for Sigma Lithium by Homero Delboni Jr., MAusIMM, Promon Engenharia; Marc-Antoine Laporte, P.Geo, SGS Canada Inc; Jarrett Quinn, P.Eng., Primero Group Americas; Porfirio Cabaleiro Rodriguez, (MEng), FAIG, GE21 Consultoria Mineral; and William van Breugel, P.Eng (the “Updated Technical Report”). The Updated Technical Report is filed on SEDAR and is also available on the Company’s website.

For more information about Sigma Lithium, visit our website

Sigma Lithium

LinkedIn: Sigma Lithium

Instagram: @sigmalithium

X: @SigmaLithium

FORWARD-LOOKING STATEMENTS

This news release includes certain “forward-looking information” under applicable Canadian and U.S. securities legislation, including but not limited to statements relating to timing and costs related to the general business and operational outlook of the Company, the environmental footprint of tailings and positive ecosystem impact relating thereto, donation and upcycling of tailings, timing and quantities relating to tailings and Green Lithium, achievements and projections relating to the Zero Tailings strategy, achievement of ramp-up volumes, production estimates and the operational status of the Grota do Cirilo Project, and other forward-looking information. All statements that address future plans, activities, events, estimates, expectations or developments that the Company believes, expects or anticipates will or may occur is forward-looking information, including statements regarding the potential development of mineral resources and mineral reserves which may or may not occur. Forward-looking information contained herein is based on certain assumptions regarding, among other things: general economic and political conditions; the stable and supportive legislative, regulatory and community environment in Brazil; demand for lithium, including that such demand is supported by growth in the electric vehicle market; the Company’s market position and future financial and operating performance; the Company’s estimates of mineral resources and mineral reserves, including whether mineral resources will ever be developed into mineral reserves; and the Company’s ability to operate its mineral projects including that the Company will not experience any materials or equipment shortages, any labour or service provider outages or delays or any technical issues. Although management believes that the assumptions and expectations reflected in the forward-looking information are reasonable, there can be no assurance that these assumptions and expectations will prove to be correct. Forward-looking information inherently involves and is subject to risks and uncertainties, including but not limited to that the market prices for lithium may not remain at current levels; and the market for electric vehicles and other large format batteries currently has limited market share and no assurances can be given for the rate at which this market will develop, if at all, which could affect the success of the Company and its ability to develop lithium operations. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, except as required by law. For more information on the risks, uncertainties and assumptions that could cause our actual results to differ from current expectations, please refer to the current annual information form of the Company and other public filings available under the Company’s profile at www.sedarplus.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Financial Tables

The Company’s independent auditor has not performed a review of the unaudited interim consolidated financial statements for the three-month period ended March 31, 2024, the six-month period ended June 30, 2024, or the interim consolidated financial statements for the nine months ended September 30, 2024 in accordance with standards established by the Canadian Institute of Chartered Accountants for a review of interim financial statements by the entity’s auditor.

Figure 1: Unaudited Income Statement Summary

|

Income Statement – Unaudited |

Three Months Ended |

Three Months Ended |

|

|

($000) |

CAD |

USD |

|

|

Sales Revenues |

59,887 |

44,210 |

|

|

Provisional price adjustments |

(31,612) |

(23,316) |

|

|

Revenue |

28,275 |

20,894 |

|

|

Cost of goods sold & distribution |

(39,733) |

(29,232) |

|

|

Gross profit |

(11,458) |

(8,338) |

|

|

Sales expense |

(535) |

(392) |

|

|

G&A expense |

(7,163) |

(5,252) |

|

|

Stock-based compensation |

(1,871) |

(1,369) |

|

|

ESG and other operating expenses |

(416) |

(304) |

|

|

EBIT |

(21,444) |

(15,655) |

|

|

Financial income and (expenses), net |

(11,277) |

(8,267) |

|

|

Non-cash FX & other income (expenses), net |

(278) |

(163) |

|

|

Income (loss) before taxes |

(32,998) |

(24,085) |

|

|

Income taxes and social contribution |

(1,247) |

(1,013) |

|

|

Net Income (loss) for the period |

(34,246) |

(25,098) |

|

|

Weighted avg diluted shares outstanding |

110,822 |

110,822 |

|

|

Earnings per share |

($0.31) |

($0.23) |

Figure 2: Unaudited Balance Sheet Summary

|

Balance Sheet – Unaudited |

Three Months Ended |

Three Months Ended |

|

|

($000) |

CAD |

USD |

|

|

Assets |

|||

|

Cash and cash equivalents |

88,645 |

65,594 |

|

|

Trade accounts receivable |

20,122 |

14,889 |

|

|

Inventories |

22,394 |

16,571 |

|

|

Other current assets |

24,883 |

18,413 |

|

|

Total current assets |

156,044 |

115,467 |

|

|

Property, plant and equipment |

224,945 |

166,451 |

|

|

Other non-current assets |

117,459 |

86,915 |

|

|

Total Assets |

498,447 |

368,833 |

|

|

Liabilities & Shareholder Equity |

|||

|

Financing and export prepayment |

94,573 |

69,980 |

|

|

Suppliers & accounts payable |

57,596 |

42,619 |

|

|

Other current liabilities |

33,082 |

24,480 |

|

|

Total current liabilities |

185,251 |

137,080 |

|

|

Financing and export prepayment |

150,274 |

111,197 |

|

|

Other non-current liabilities |

15,029 |

11,121 |

|

|

Total non-current liabilities |

165,303 |

122,318 |

|

|

Total shareholders’ equity |

147,893 |

109,435 |

|

|

Total Liabilities & Shareholders’ Equity |

498,447 |

368,833 |

Figure 3: Unaudited Cash Flow Statement Summary

|

Cash Flow Statement – Unaudited |

Nine Months Ended |

Nine Months Ended |

|

|

($000) |

CAD |

USD |

|

|

Operating Activities |

|||

|

Net income (loss) for the period |

(58,302) |

(42,855) |

|

|

Adjustments, including FX movements |

51,351 |

37,346 |

|