Bitwise Seeks to Convert $1.3B Crypto Index to ETP

Bitwise Asset Management has announced that NYSE Arca has filed a Form 19b-4 to uplist the $1.3 billion Bitwise 10 Crypto Index Fund (BITW) as an ETP, joining a growing trend of crypto asset managers seeking to convert investment vehicles into exchange-traded structures.

“Bitwise believes that ETPs are among the most efficient, convenient, and useful vehicles for providing crypto exposure,” Bitwise CEO Hunter Horsley said in the announcement. “We remain committed to converting BITW to an ETP.”

BITW, which launched in November 2017 as the world’s first crypto index fund, provides investors exposure to diversified portfolio of digital assets, with shares currently quoted on the OTCQX Best Market, according to the release.

The current fund holds 10 of the largest cryptocurrencies, with bitcoin comprising 74.8% of the portfolio, followed by Ethereum at 16.2%, and Solana at 4.4%, according to its fund page. The remaining allocations are spread across smaller cryptocurrencies including XRP, Cardano, and Avalanche.

The conversion effort aims to enhance the fund’s efficiency and regulatory protections, according to the announcement. An ETP structure would accept subscriptions and redemptions at net asset value, creating an arbitrage mechanism that could help the fund trade more closely to its underlying value.

The fund currently trades at $52 while having a net asset value of $62, highlighting the premium/discount issues that a conversion is intended to address.

The filing follows Grayscale’s recent move to convert its Digital Large Cap Fund into an ETF structure. Grayscale has already successfully converted its bitcoin and Ethereum trusts into ETFs earlier this year.

Read More: Grayscale Seeks SEC Nod for Multi-Crypto ETF Conversion

BITW currently charges a 2.5% expense ratio and has generated returns of 50.2% over the past month and 108.9% year-to-date in secondary market trading, compared to 30% and 81.8%, respectively, for its underlying crypto index, according to the fund page.

If successful, the conversion would represent another milestone in Bitwise’s efforts to broaden access to cryptocurrency investments through regulated vehicles. The company first registered BITW as a Securities and Exchange Commission reporting company in April 2021, providing additional transparency for investors, the release noted.

T-Mobile hacked in massive Chinese breach of telecom networks, WSJ reports

(Reuters) -T-Mobile’s network was among the systems hacked in a damaging Chinese cyber-espionage operation that gained entry into multiple U.S. and international telecommunications companies, The Wall Street Journal reported on Friday citing people familiar with the matter.

Hackers linked to a Chinese intelligence agency were able to breach T-Mobile as part of a monthslong campaign to spy on the cellphone communications of high-value intelligence targets, the Journal added, without saying when the attack took place.

“T-Mobile is closely monitoring this industry-wide attack, and at this time, T-Mobile systems and data have not been impacted in any significant way, and we have no evidence of impacts to customer information,” a company spokesperson told WSJ.

It was unclear what information, if any, was taken about T-Mobile customers’ calls and communications records, according to the report.

T-Mobile did not immediately respond to a Reuters’ request for comment.

On Wednesday, The Federal Bureau of Investigation (FBI) and the U.S. cyber watchdog agency CISA said China-linked hackers have intercepted surveillance data intended for American law enforcement agencies after breaking into an unspecified number of telecom companies.

(Reporting by Urvi Dugar; Editing by Sandra Maler and Stephen Coates)

Supermicro Stock Surges on Reports of Plan To Avoid Delisting

Annabelle Chih / Bloomberg / Getty Images

Super Micro Computer CEO Charles Liang at the Computex conference in Taipei, Taiwan, on June 5, 2024

Super Micro Computer (SMCI) shares soared over 18% in extended trading Friday following reports the company is expected to file a plan for its delayed annual report by Monday that could help it avoid delisting.

Supermicro said it received a letter from the Nasdaq on Sept. 17 warning it would be delisted if it does not file the delinquent report or submit a plan within 60 days, or by Nov. 16, with the weekend deadline making Monday the effective date for the submission.

Earlier this week, the company said it would not be able to submit its annual report on time, and that it could delay its first-quarter report as well, requiring more time to prepare the statements and hire a new auditor after EY resigned from the job.

Shares of Supermicro have taken a hit in recent months on regulatory concerns following allegations of accounting manipulation and other issues. They were down over 34% for the year through Friday’s close.

TradingView

Stock market today: Indexes tumble after Fed comments dent December rate-cut odds

-

Stock indexes retreated as investors digested Thursday commentary from Fed Chair Jerome Powell.

-

The odds of a 25-basis-point rate cut in December fell sharply after Powell’s address.

-

Bond yields also climbed on the comments, and amid signs of economic strength.

US equities slumped Friday morning as Wall Street pulled back rate-cut expectations for December.

The scaling-back started on Thursday afternoon after Federal Reserve Chair Jerome Powell indicated that central bank will take its time in easing policy, citing ongoing US economic strength.

“The economy is not sending any signals that we need to be in a hurry to lower rates,” he said.

The odds of a 25-basis-point rate cut fell to less than 60% shortly after Powell’s comments, down from 80%, as calculated by the CME FedWatch Tool. The probability remained lower, around 58%, on Friday morning.

Also impacting rate-cut expectations is a streak of encouraging economic data. New figures on Friday showed US retail sales advanced in October, boosted by a jump in autos purchases.

While the three major indexes headed for their first losing week since the election, bond yields climbed. The 2-year yield — most sensitive to near-term rate forecasts — has risen 7 basis points in the last two days.

Here’s where US indexes stood shortly after the 9:30 a.m. opening bell on Friday:

Here’s what else is going on:

In commodities, bonds, and crypto:

-

Oil markets were down. West Texas Intermediate crude slid 0.96% to $68.04 a barrel. Brent crude, the international benchmark, fell 0.94% to $71.88 a barrel.

-

Gold stayed essentially flat at $2,572 an ounce.

-

The 10-year Treasury climbed 4 basis points to 4.459%.

-

Bitcoin jumped 2.28% to $90,053.

Read the original article on Business Insider

Investor Notice: Robbins LLP Informs Stockholders of the Class Action Lawsuit Filed Against ASML Holding N.V.

SAN DIEGO, Nov. 15, 2024 (GLOBE NEWSWIRE) — Robbins LLP announces that a shareholder filed a class action on behalf of all investors that purchased or otherwise acquired ASML Holding N.V. ASML ordinary shares between January 24, 2024 and October 15, 2024. ASML is a leading supplier to the semiconductor industry, providing chipmakers with hardware, software, and services to mass produce integrated circuits (i.e., microchips).

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that ASML Holding N.V. (ASML) Misled Investors About How Issues in the Semiconductor Industry Would Impact the Company

According to the complaint, during the class period, defendants failed to disclose that: (1) the issues being faced by suppliers, like ASML, in the semiconductor industry were much more severe than defendants had indicated to investors; (2) the pace of recovery of sales in the semiconductor industry was much slower than defendants had publicly acknowledged; (3) defendants had created the false impression that they possessed reliable information pertaining to customer demand and anticipated growth, while also downplaying risk from macroeconomic and industry fluctuations, as well as stronger regulations restricting the export of semiconductor technology, including the products that ASML sells; and (4) as a result, defendants’ statements about the Company’s business, operations, and prospects lacked a reasonable basis. As a result of these acts, ASML stock has declined significantly, harming investors.

What Now: You may be eligible to participate in the class action against ASML Holding N.V. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by January 13, 2025. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against ASML Holding N.V. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/4a5fd11c-859b-4575-b6f4-862a0506d704

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

First Capital REIT Announces November 2024 Distribution

TORONTO, Nov. 15, 2024 /CNW/ – First Capital REIT (“First Capital”) FCR announced today that it will make a cash distribution of $0.072 per REIT unit for the month of November, representing approximately $0.86 per REIT unit on an annualized basis. The distribution will be paid on December 16, 2024 to unitholders of record as at November 29, 2024.

About First Capital REIT FCR

First Capital owns, operates and develops grocery-anchored, open-air centres in neighbourhoods with the strongest demographics in Canada.

SOURCE First Capital Real Estate Investment Trust

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/15/c8188.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/15/c8188.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BioNTech's Options: A Look at What the Big Money is Thinking

Whales with a lot of money to spend have taken a noticeably bearish stance on BioNTech.

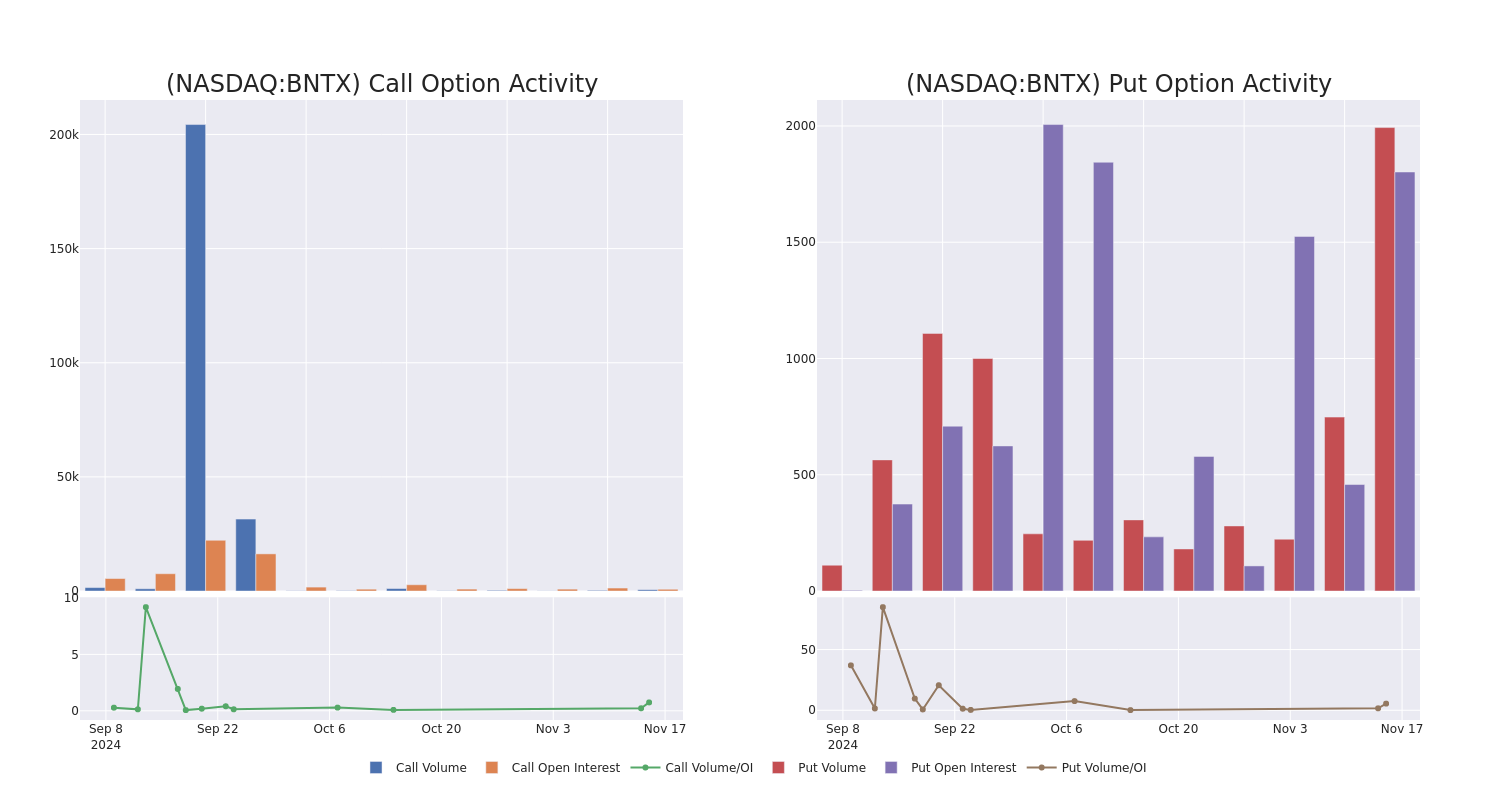

Looking at options history for BioNTech BNTX we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 54% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $442,050 and 4, calls, for a total amount of $353,063.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $92.5 and $120.0 for BioNTech, spanning the last three months.

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of BioNTech stands at 369.29, with a total volume reaching 2,574.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in BioNTech, situated within the strike price corridor from $92.5 to $120.0, throughout the last 30 days.

BioNTech Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BNTX | CALL | TRADE | BULLISH | 01/15/27 | $23.6 | $19.7 | $23.6 | $115.00 | $160.4K | 140 | 129 |

| BNTX | CALL | SWEEP | BEARISH | 03/21/25 | $4.5 | $4.1 | $4.1 | $120.00 | $105.9K | 108 | 261 |

| BNTX | PUT | SWEEP | BULLISH | 11/15/24 | $6.6 | $6.1 | $6.1 | $105.00 | $88.4K | 818 | 429 |

| BNTX | PUT | SWEEP | BEARISH | 11/15/24 | $12.3 | $11.5 | $12.3 | $110.00 | $67.6K | 921 | 55 |

| BNTX | PUT | SWEEP | BEARISH | 11/15/24 | $11.6 | $11.3 | $11.6 | $110.00 | $64.9K | 921 | 489 |

About BioNTech

BioNTech is a Germany-based biotechnology company that focuses on developing cancer therapeutics, including individualized immunotherapy, as well as vaccines for infectious diseases, including covid. The company’s oncology pipeline contains several classes of drugs, including mRNA-based drugs to encode antigens, neoantigens, cytokines, and antibodies; cell therapies; bispecific antibodies; and antibody-drug conjugates, or ADCs. BioNTech is partnered with several large pharmaceutical companies, including Roche, Eli Lilly, Pfizer, Sanofi, and Genmab. Covid vaccine Comirnaty is its first commercialized product.

Current Position of BioNTech

- With a volume of 2,881,741, the price of BNTX is down -3.1% at $100.35.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 124 days.

Expert Opinions on BioNTech

5 market experts have recently issued ratings for this stock, with a consensus target price of $135.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from JP Morgan persists with their Neutral rating on BioNTech, maintaining a target price of $124.

* An analyst from Goldman Sachs has elevated its stance to Buy, setting a new price target at $137.

* An analyst from TD Cowen persists with their Hold rating on BioNTech, maintaining a target price of $122.

* Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on BioNTech with a target price of $171.

* Maintaining their stance, an analyst from TD Cowen continues to hold a Hold rating for BioNTech, targeting a price of $122.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest BioNTech options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump-Appointed Doug Collins To Lead VA: What's Next For Cannabis and Psychedelics In Veterans' Healthcare?

President-elect Donald Trump has chosen former Representative Doug Collins (R-GA) to lead the U.S. Department of Veterans Affairs (VA).

The decision has sparked discussions about how the agency might handle medical cannabis issues, given his inconsistent track record on the issue, as reported Marijuana Moment.

Collins’ Record On Cannabis

During his time in Congress, Collins opposed efforts to expand access to medical cannabis for veterans. Between 2014 and 2016, he voted against three proposals that would have allowed VA doctors to recommend cannabis to their patients.

See Also: Trump’s Cabinet Choices: Will His Administration Support Or Restrict Cannabis?

Collins’ views began to shift in 2019. He supported the STATES Act, which would protect state marijuana programs from federal interference, and co-signed a letter with Rep. Matt Gaetz (R-FL), urging Congress to take action on cannabis policy.

“We believe this Committee and this Congress must act to clarify the rights and responsibilities, relative to cannabis, of individuals, physicians, businesses, medical patients, and law enforcement officials,” they wrote.

Later that year, Collins backed a bipartisan bill to protect banks that serve marijuana businesses in states where it is legal. However, he did not take part in a 2020 vote on federal cannabis legalization.

Collins’ Stance On Psychedelics

When it comes to psychedelics, there isn’t much known about Collins’s stance. However, his shifting views on cannabis policy hint that he could be open to exploring different approaches.

Cannabis At The VA

VA policy has long prohibited its doctors from recommending cannabis, citing marijuana’s classification as a Schedule I controlled substance under federal law. This stance has remained consistent across both Republican and Democratic administrations, despite growing support for change in Congress.

Recent efforts to address this issue include a Senate Appropriations Committee request for the VA to explore cannabis as an alternative to opioids. Lawmakers have also introduced measures that would allow VA doctors to recommend cannabis in states where it is legal. These efforts have gained bipartisan support, but none have yet become law.

Veterans service organizations have pushed for further reforms, including expanded research into the potential benefits of cannabis. Last year, a Senate committee approved a bill to study cannabis for veterans with certain medical conditions, but it failed to advance to a floor vote.

Read Next:

Cover image made with AI.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

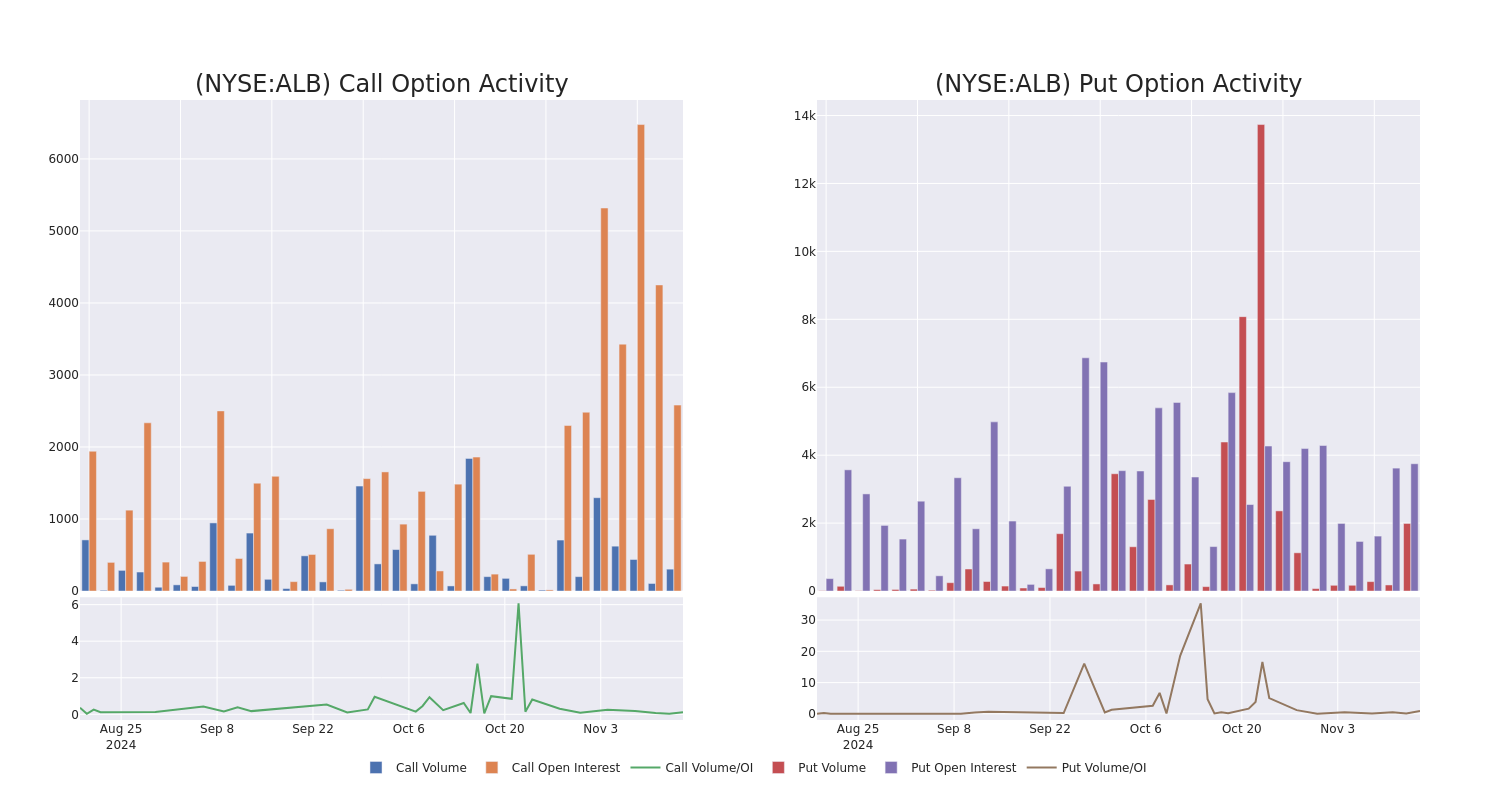

Unpacking the Latest Options Trading Trends in Albemarle

Investors with a lot of money to spend have taken a bearish stance on Albemarle ALB.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ALB, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 12 uncommon options trades for Albemarle.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 58%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $645,810, and 3 are calls, for a total amount of $127,222.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $110.0 for Albemarle during the past quarter.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Albemarle options trades today is 1266.0 with a total volume of 2,294.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Albemarle’s big money trades within a strike price range of $95.0 to $110.0 over the last 30 days.

Albemarle Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALB | PUT | TRADE | BULLISH | 06/20/25 | $11.85 | $11.6 | $11.65 | $95.00 | $291.2K | 790 | 250 |

| ALB | PUT | SWEEP | BULLISH | 01/17/25 | $12.95 | $12.9 | $12.9 | $110.00 | $101.9K | 2.9K | 341 |

| ALB | CALL | SWEEP | BEARISH | 12/20/24 | $7.75 | $7.6 | $7.62 | $100.00 | $57.1K | 1.4K | 219 |

| ALB | PUT | TRADE | NEUTRAL | 01/17/25 | $13.0 | $12.7 | $12.85 | $110.00 | $43.6K | 2.9K | 407 |

| ALB | PUT | SWEEP | BEARISH | 01/17/25 | $13.65 | $13.55 | $13.65 | $110.00 | $42.3K | 2.9K | 81 |

About Albemarle

Albemarle is one of the world’s largest lithium producers. In the lithium industry, the majority of demand comes from batteries, where lithium is used as the energy storage material, particularly in electric vehicles. Albemarle is a fully integrated lithium producer. Its upstream resources include salt brine deposits in Chile and the US and two hard rock mines in Australia, both of which are joint ventures. The company operates lithium refining plants in Chile, the US, Australia, and China. Albemarle is a global leader in the production of bromine, used in flame retardants. It is also a major producer of oil refining catalysts.

Following our analysis of the options activities associated with Albemarle, we pivot to a closer look at the company’s own performance.

Where Is Albemarle Standing Right Now?

- With a volume of 1,232,520, the price of ALB is down -0.61% at $101.48.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 89 days.

What The Experts Say On Albemarle

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $127.25.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Albemarle with a target price of $170.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Albemarle with a target price of $127.

* Maintaining their stance, an analyst from Baird continues to hold a Neutral rating for Albemarle, targeting a price of $79.

* An analyst from RBC Capital has decided to maintain their Outperform rating on Albemarle, which currently sits at a price target of $133.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Albemarle options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500 Gains and Losses Today: Palantir Stock Jumps as Listing Heads to Nasdaq

David Paul Morris / Bloomberg / Getty Images

-

The S&P 500 fell 1.3% on Friday, Nov. 15, after the Fed chair struck a cautious tone on additional rate cuts and a report showed strong retail sales in October.

-

Semiconductor equipment maker Applied Materials issued soft current-quarter sales guidance, citing weakness in China, and its shares tumbled.

-

Palantir Technologies shares surged after the analytics software provider said it will transfer its stock listing to the Nasdaq.

Major U.S. equities indexes dropped to close out the trading week after Federal Reserve Chair Jerome Powell suggested that the central bank has leeway to ease off on its rate-cutting campaign if needed.

Meanwhile, retail sales data from October came in stronger than expected, with consumer spending remaining robust despite uncertainty around the election and the impact of several major storms. While the strong retail sales figures are a signal of economic resilience, this could provide the Fed with more flexibility as it considers the urgency of additional interest-rate reductions.

The S&P 500 fell 1.3%, while the Dow slipped 0.7%. Underperformance in the tech sector pressured the Nasdaq, which dropped 2.2%.

Applied Materials (AMAT) exceeded top- and bottom-line estimates for the recently completed quarter, but the semiconductor equipment provider offered lower-than-expected sales guidance for the current quarter. Applied Materials shares tumbled 9.2% on Friday, losing the most of any S&P 500 stock.

Shares of marketing and corporate communications firm Omnicom Group (OMC) dropped 7.8%. In its most recent earnings report, released a month ago, Omnicom topped sales and profit expectations, benefitting from its acquisition of digital commerce platform Flywheel Digital, which closed at the beginning of this year. However, analysts indicate that Omnicom faces challenges related to managing costs as well economic uncertainties and possible technological disruptions.

Moderna (MRNA) shares lost 7.3% following reports that President-elect Donald Trump intends to nominate Robert F. Kennedy Jr., who has openly expressed his skepticism about vaccines, as the leader of the Department of Health and Human Services. Kennedy has indicated that he will push for significant changes to the Food and Drug Administration (FDA). Shares of fellow vaccine maker Pfizer (PFE) slid 4.7%.

Palantir Technologies (PLTR) shares logged the top performance of any S&P 500 constituent on Friday, surging 11.1%. The analytics software firm announced that it would move its stock listing to the Nasdaq from the New York Stock Exchange. Palantir’s Class A shares are set to begin trading on the Nasdaq Global Select Market, maintaining the “PLTR” ticker, the company said.