Alibaba, Applied Materials And 3 Stocks To Watch Heading Into Friday

With U.S. stock futures trading lower this morning on Friday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Alibaba Group Holding Limited BABA to report quarterly earnings at $2.1 per share on revenue of $33.95 billion before the opening bell, according to data from Benzinga Pro. Alibaba shares rose 0.1% to $90.70 in after-hours trading.

- Applied Materials, Inc. AMAT reported better-than-expected earnings for its fourth quarter. For the first quarter of fiscal 2025, Applied said it expects net revenue to be approximately $7.15 billion, plus or minus $400 million. Non-GAAP diluted EPS is expected to be approximately $2.29, plus or minus 18 cents. Applied Materials shares fell 6% to $174.90 in the after-hours trading session.

- Analysts are expecting Spectrum Brands Holdings, Inc. SPB to post quarterly earnings at $1.02 per share on revenue of $746.54 million. The company will release earnings before the markets open. Spectrum Brands shares gained 1.8% to $95.50 in after-hours trading.

Check out our premarket coverage here

- Despegar.com, Corp. DESP reported better-than-expected third-quarter earnings and sales results on Thursday. The company said it sees FY24 revenue of at least $760 million and adjusted EBITDA of at least $170 million. Despegar.com shares jumped 13.4% to $16.85 in the after-hours trading session.

- Analysts expect RLX Technology Inc. RLX to report quarterly earnings at 3 cents per share on revenue of $105.08 million before the opening bell. RLX Technology shares gained 0.6% to $1.64 in after-hours trading.

Check This Out:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top Wall Street Forecasters Revamp Nexxen International Price Expectations Ahead Of Q3 Earnings

Nexxen International Ltd. NEXN will release earnings results for its third quarter, before the opening bell on Friday, Nov. 15.

Analysts expect the Tel Aviv-Yafo, Israel-based bank to report quarterly earnings at 13 cents per share, down from 18 cents per share in the year-ago period. Nexxen projects to report revenue of $88.65 million for the recent quarter, compared to $80.09 million a year earlier, according to data from Benzinga Pro.

On Aug. 22, Nexxen International posted better-than-expected sales for the second quarter.

Nexxen shares gained 1.9% to close at $7.67 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

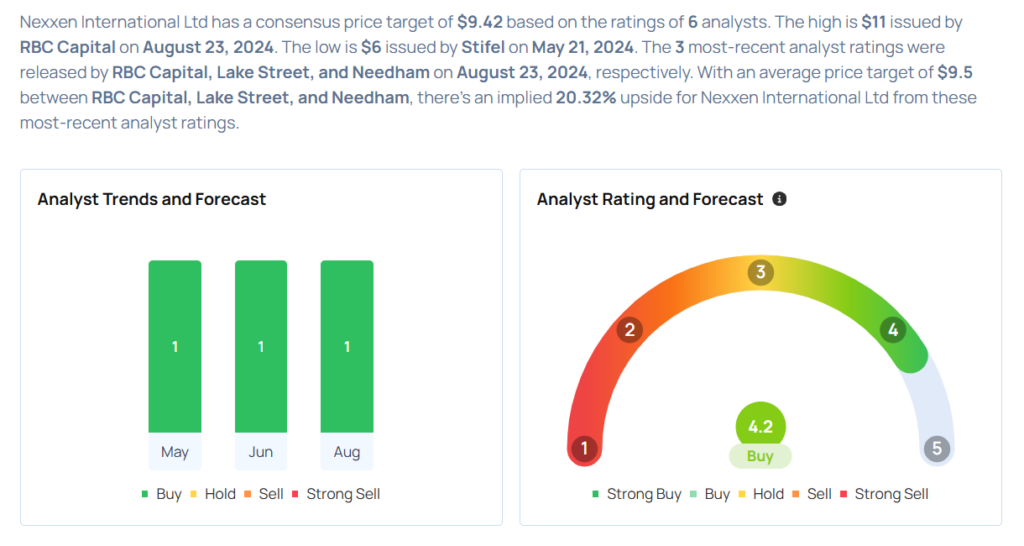

- RBC Capital analyst Matthew Swanson maintained an Outperform rating and raised the price target from $9 to $11 on Aug. 23. This analyst has an accuracy rate of 62%.

- Needham analyst Laura Martin maintained a Buy rating and raised the price target from $6.5 to $8.5 on Aug. 23. This analyst has an accuracy rate of 74%.

- JMP Securities analyst Andrew Boone reiterated a Market Outperform rating with a price target of $11 on June 14. This analyst has an accuracy rate of 61%.

- Stifel analyst Mark Kelley maintained a Hold rating and raised the price target from $5.5 to $6 on May 21. This analyst has an accuracy rate of 88%.

Considering buying NEXN stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pro-Bitcoin Argentina President Javier Milei Becomes First Foreign Leader To Meet Trump: 'Winds Of Freedom Are Blowing Much Stronger'

President-elect Donald Trump met Argentina President Javier Milei at his Mar-a-Lago resort Thursday. This was his first meeting with a world leader since winning the elections last week.

What Happened: Milei congratulated Trump on his election victory, lending support to the shared ideas of liberty and economic prosperity, Bloomberg reported.

“Today, the winds of freedom are blowing much stronger,” he said in Spanish at the America First Policy Institute event. “I am exhilarated to be able to share with the new U.S. administration the same level of freedom, and I’m convinced that together we will restore it to the place it deserves.

Milei, who assumed office a year ago, also praised tech mogul Elon Musk, who was in the audience, for promoting free speech through X.

Trump, in turn, acknowledged Milei’s speech, stating, “Your speech was beautiful, but the job you’ve done is incredible.”

Why It Matters: Milei has earned praise from Trump for his economic policies. During an interview with Musk In August, the president-elect highlighted Argentina’s prosperity under Milei’s leadership, drawing parallels to his own “Make America Great Again” policy.

There has been significant bonhomie between Musk and Milei as well. The two met warmly in September on the sidelines of Argentina’s national speech to the United Nations General Assembly.

Prior to that, Musk expressed his admiration for Milei’s efforts in restoring Argentina’s stature.

Milei secured victory in the November elections after promising large cuts in public spending to address Argentina’s fiscal deficit and increasing inflation. His libertarian stance is also reflected in his support for Bitcoin BTC/USD, making him one of the very few heads of state to openly endorse the asset.

However, the president has also faced criticism for his austerity measures, with many taking to the streets to oppose his attempts to halt the increase in pension spending.

resident of the Republic of Armenia via Wikimedia Commons

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Asian Stocks Gain on China Recovery, Weaker Dollar: Markets Wrap

(Bloomberg) — Asian equities climbed, aided by some encouraging signs in China’s economy and a retreat in the dollar.

Most Read from Bloomberg

The MSCI Asia Pacific Index rose 0.4%, its first gain this week, following data that showed China’s retail sales expanded at the strongest pace in eight months and property prices fell at a slower pace. Japanese benchmarks advanced about 0.8%, supported by weakness in the yen. US contracts slipped.

A gauge of the dollar halted a five-day gain that was helped by Federal Reserve Chair Jerome Powell’s comments that the central bank will be in no rush to cut interest rates. Friday’s action gives a welcome respite to emerging market assets after they were sold off for most of the week on US President-elect Donald Trump’s cabinet picks and uncertainties over China’s recovery.

“The strength of the dollar has obviously taken away some of the returns from emerging markets local currency bonds, but we think the more attractive opportunity at this point is in the hard currency aspect of emerging markets,” Salman Niaz, head of global fixed income for APAC ex-Japan at Goldman Sachs Asset Management, said on Bloomberg Television, referring to dollar-denominated debt. “We think a December rate cut is in the cards and we think there will be at least two cuts next year.”

US two-year yields were little changed after surging in the previous session as traders pared back their expectations for an interest-rate cut in December. More clarity on the Fed’s path can emerge as the US releases retail sales data and a host of Fed officials are set to speak.

A gauge of emerging markets equities was on pace for its worst week since June 2022, while a separate index of emerging markets currencies came close to erasing its gains for the year.

Among key earnings in Asia, Alibaba Group Holding Ltd. reports later Friday after another Chinese consumption bellwether JD.com Inc posted a moderate expansion in revenue.

China’s retail sales were “pretty good,” and a result of the central bank’s stimulus policy in late September, according to Jason Chan, senior investment strategist for Bank of East Asia. ““Fiscal stimulus is on the way, probably more details would be announced in December.”

In commodities, oil headed for a weekly drop, weighed down by the impact of a stronger dollar and concerns the global market will flip to a glut next year. Gold held near a two-month low.

Americans Want to Recycle but Worry About Getting It Right

Stamford, CT, Nov. 14, 2024 (GLOBE NEWSWIRE) — Americans overwhelmingly support recycling (87%), but inconsistent rules and limited infrastructure are leaving many—especially Gen Zs and Millennials—confused and overwhelmed about doing it correctly. That’s according to a new survey conducted by The Harris Poll on behalf of Keep America Beautiful® for America Recycles Day 2024.*

The uncertainty is contributing to significant levels of recycling tension and anxiety, which impacts all age groups, but is most prominent among younger Americans. One in three Americans say they feel anxious when trying to determine which items are recyclable, driven by Gen Zs and Millennials (both 42%), with one in five reporting that the topic has caused arguments in their household.

“In these divisive times, it’s heartening to see Americans united in their commitment to reducing waste and protecting the environment for future generations,” said Keep America Beautiful President and CEO Jennifer Lawson. “While 87% say recycling is important, the national recycling rate remains stuck at around 32%—a gap driven by confusion and concern about how to recycle correctly. If we want recycling levels to increase, we must make it more accessible and provide better guidance, so people feel confident in their efforts.”

Among other key survey findings:

- Americans believe in recycling: Regardless of demographics like where they live or their political affiliations, a strong majority of Americans say recycling is important to them, and 80% believe individual efforts in recycling can make a difference in the environment.

- But recycling anxiety is real: One in 3 Americans gets anxious when trying to recycle, with anxiety levels among Gen Zs (42%) and Millennials (42%) significantly higher compared with Gen Xers (27%) and Boomers (26%). Over two in five Americans (41%) acknowledge placing items in the trash to avoid the risk of recycling incorrectly. This concern is most prevalent among Gen Zs (58%) and Millennials (50%), compared with Gen Xers (37%) and Boomers (27%).

- A source of household tension: For some, recycling has become a point of contention, with one in five Americans saying the topic has caused arguments in their household (Gen Z – 37%; Millennials – 32%; Gen X – 17%; Boomers – 6%) and a similar number reporting tension in their marriage or personal relationships – (Gen Z – 37%; Millennials – 29%; Gen X – 14%; Boomers – 3%).

- Motivations for recycling varies: Those who recycle are primarily motivated by a desire to reduce the amount of trash going to landfills (61%), reduce their carbon footprint (59%), contribute positively to society (48%), and ensure a better future for their children or future generations (46%)

- Americans want to do better but feel they fall short: A notable 61% of Americans admit to feeling guilty when they see their trash bin fill up with items that could have been recycled, reflecting a desire to improve but uncertainty about how to do so correctly.

- The U.S. should recycle more: Most Americans don’t think the country does a good job of recycling, with 63% grading it a “C” or lower, with 22% rating America’s performance as a “D” or “F.”

- More recycling infrastructure is needed in public spaces: Only half of Americans (51%) report regularly recycling in public areas such as parks, shopping centers, or streets, underscoring the need for more accessible recycling options.

In celebration of America Recycles Day and to raise awareness about recycling initiatives like the Greatest American Cleanup®, Lawson rang the opening bell at the Nasdaq stock market on November 13, spotlighting the organization’s commitment to improving recycling habits and infrastructure nationwide.

The Nasdaq event was made possible thanks to the support of Keep America Beautiful’s America Recycles Day partners: Altria, Anheuser-Busch, Cirba Solutions, IBWA, Kimberly-Clark, Santa Fe Natural Tobacco Company, and Veggie Wash.

Recycling is also a key component of the Greatest American Cleanup, an ambitious campaign to pick up 25 billion pieces of litter and beautify 25,000 communities in celebration of America’s 250th birthday. The Greatest American Cleanup is supported by Hilton, iHeart Media, Northrop Grumman, The Coca-Cola Company, Carol Cone on Purpose, Recycled Materials Association (REMA), and The Harris Poll.

For more information on America Recycles Day or to learn how to recycle effectively, visit kab.org.

* This survey was conducted online within the United States by The Harris Poll on behalf of Keep America Beautiful from October 3-7, 2024, among 2,075 adults ages 18 and older. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within ±2.5 percentage points using a 95% confidence level. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact McCall Vrydaghs (mvrydaghs@kab.org).

###

McCall Vrydaghs Keep America Beautiful 8458635621 mvrydaghs@kab.org

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.