Stocks Tumble As Traders Rethink Fed's Action, VIX Spikes 17%, Nasdaq Erases Post-Trump Gains: What's Driving Markets Friday?

Risk aversion dominated Wall Street in the final session of the week, driving sharp losses across major indices.

Investors grappled with growing uncertainties surrounding the economic impacts of Donald Trump‘s policies and the Federal Reserve’s next moves.

Fed Chair Jerome Powell‘s remarks from the previous day weighed heavily on risk assets. Powell signaled no need to lower rates, citing the economy’s resilience and emphasizing the importance of fully finishing the inflation jobs.

Boston Fed President Susan Collins added to the uncertainty on Friday, stating she needs to see additional data before deciding on further rate cuts at the Federal Reserve’s upcoming policy meeting.

Expectations for a 25-basis-point rate cut in December were significantly scaled back, with odds falling to 59%, down from 82% just a day earlier.

U.S. indices are poised to end the week in negative territory, as optimism fueled by Trump’s win fizzled. Tech stocks were hit hardest, with the Nasdaq 100 plunging 2.5%, wiping out its post-election gains.

Chipmakers tumbled across the board, with the iShares Semiconductor ETF SOXX reaching a 2-month low, as Applied Materials Inc. AMAT released a disappointing outlook.

The surge in rate-cut uncertainty and broader economic concerns pushed the CBOE Volatility Index (VIX) up by more than 17%, reflecting heightened market fear.

Treasury yields edged lower, indicating a flight to safe-haven bonds. The drop in yields supported the Japanese yen, which ended a four-day losing streak.

The U.S. dollar eased but remains on track for its seventh consecutive week of gains, marking its longest winning streak since September 2023.

Gold prices remained flat despite falling yields and a softer dollar, failing to act as a hedge in a turbulent session. Meanwhile, Bitcoin BTC/USD defied the risk-off sentiment, rising 2.5% to $89,600 in a surprising show of strength.

Friday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day %chg |

| Dow Jones | 43,416.20 | -0.8% |

| S&P 500 | 5,869.72 | -1.3% |

| Russell 2000 | 2,302.85 | -1.5% |

| Nasdaq 100 | 20,391.40 | -2.4% |

| CBOE VIX | 16.79 | 17.3% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY fell 1.4% to $585.28.

- The SPDR Dow Jones Industrial Average DIA fell 0.8% to $434.08.

- The tech-heavy Invesco QQQ Trust Series QQQ fell 2.5% to $496.12.

- The iShares Russell 2000 ETF IWM tumbled 1.4% to $228.75.

- The Utilities Select Sector SPDR Fund XLU outperformed, rising 0.8%. The Technology Select Sector SPDR Fund XLY lagged, down 2.7%.

Friday’s Stock Movers

- Palantir Technologies Inc. PLTR skyrocketed 8.4%, on news that the AI-champion will be included in the Nasdaq 100 index.

- Walt Disney Co. DIS rose over 4%, fueling stock momentum after the 6.2% gain on Thursday amid stronger than expected earnings.

- Alcoa Corp. AA rallied over 8% after China announced to end its export-tax rebate for aluminum from Dec. 1.

Stocks reacting on earnings reports were:

- Globant S.A. GLOB, down 11%.

- AST SpaceMobile Inc. ASTS, down 13.8%,

- Post Holdings Inc. POST, down 2.8%.

Now Read:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PCS Edventures! Reports Unaudited Results for the Second Quarter of Fiscal Year 2025

BOISE, Idaho, Nov. 15, 2024 (GLOBE NEWSWIRE) — PCS Edventures!, Inc. (“PCSV”), a leading provider of K-12 Science, Technology, Engineering and Mathematics (“STEM”) education programs, today announced unaudited results of operations for its second quarter of Fiscal Year 2025, which ended on September 30, 2024.

Revenue was $2.27 million compared to $3.77 million in revenue for the same period last year. Net income before income tax provisions was $0.55 million, compared to net income before income tax provisions of $1.81 million for the same period last year. The Company ended the quarter with $4.01 million in cash.

Mike Bledsoe, President, commented, “Last year, we had a record quarter in the second quarter of the fiscal year, due in large part to $2.08 million in orders from two large customers for our Discover Drones product. This year during the second quarter of the fiscal year, we generated $0.45 million in revenue from these two customers. Excluding the revenue from these customers from both periods would show a comparison of $1.69 million in revenue in last year’s second quarter of the fiscal year versus $1.82 million for this fiscal year’s second quarter. We believe that this comparison more accurately reflects the growth we are experiencing as a company, albeit with lumpiness at times like we just experienced.”

Todd Hackett, CEO, stated, “We have been investing significantly to expand our capacity with the expectation of higher sales volumes in the future. We believe that we have many years of growth ahead of us and are positioning the Company to take advantage of our opportunities.”

For more information about PCS Edventures!, Inc., visit our website.

Company financial information and reports can be found at https://www.sec.gov

About PCS Edventures!, Inc.

PCS Edventures!, Inc. (“OTCPK: PCSV”) is a Boise, Idaho, company that designs and delivers technology-rich products and services for the K-12 market that develop 21st-century skills. PCS programs emphasize experiential learning in Science, Technology, Engineering, and Math (“STEM”). https://edventures.com/.

Forward-Looking Statements.

This Press Release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this Press Release. This Press Release should be considered in light of the disclosures contained in the filings of PCS and its “forward-looking statements” in such filings that are contained in the United States Securities and Exchange Commission (the “SEC”) Edgar Archives at https://www.sec.gov.

Contact.

Investor Contact: Michael Bledsoe 1.800.429.3110, mikeb@edventures.com

Investor Relations Web Site: https://investors.edventures.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

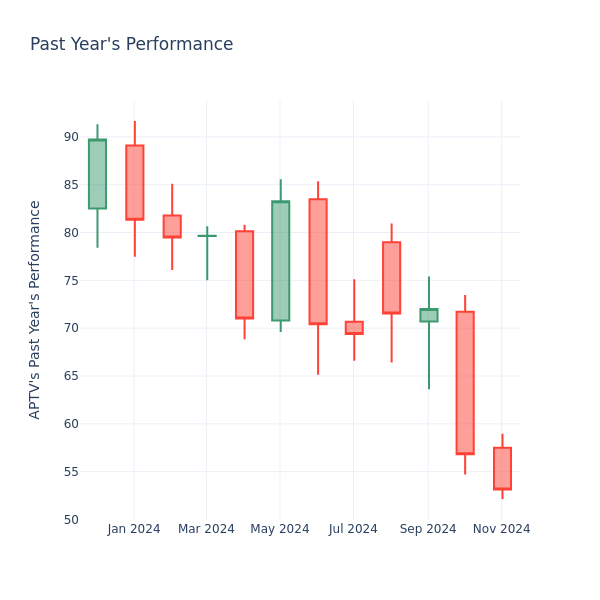

Price Over Earnings Overview: Aptiv

In the current session, Aptiv Inc. APTV is trading at $53.09, after a 1.73% decrease. Over the past month, the stock decreased by 25.95%, and in the past year, by 34.77%. With performance like this, long-term shareholders are more likely to start looking into the company’s price-to-earnings ratio.

Comparing Aptiv P/E Against Its Peers

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Aptiv has a lower P/E than the aggregate P/E of 28.77 of the Automobile Components industry. Ideally, one might believe that the stock might perform worse than its peers, but it’s also probable that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump's Win, Economic Challenges Lead to Tougher Outlook for Renewable Energy Stocks: Morgan Stanley

The recent U.S. presidential election results, including a Republican sweep, have raised questions about the future of renewable energy under President-elect Donald Trump’s leadership.

Morgan Stanley’s report evaluates the economic impact on renewables under various policy scenarios and its effects on earnings.

The analyst has adjusted its view on the clean tech industry to “In-Line” from “Attractive.”

Also Read: Solar, Renewables Stocks Crash After Trump Win: Should You Buy Now At Cheap Valuations?

While long-term demand for renewables is likely stronger than current market perceptions, near-term growth prospects have become less clear due to new uncertainties.

It’s important to remember that these new uncertainties add to the already difficult environment facing the clean energy sector, dealing with issues such as permitting and interconnection delays, funding challenges, and intense competition that have hurt profitability.

Uncertainty about the Inflation Reduction Act (IRA), tariffs, and interest rates has significantly impacted clean fuel valuations.

Morgan Stanley writes that clear guidance on the IRA is essential for clean tech valuations to rebound. However, this may take time since it will likely be linked to discussions about the Tax Cuts and Job Act (TCJA), which is set to expire at the end of 2025.

Morgan Stanley recommends investing in stocks with high-quality and durable growth/ margins, with a clear catalyst path and/or strong balance sheet to weather any near-term volatility in growth and/or profitability.

-

The analyst maintains an Overweight rating on GE Vernova Inc. (NYSE:GEV), First Solar Inc. (NASDAQ:FSLR), and Bloom Energy Corporation (NYSE:BE).

However, the analyst has downgraded three cleantech stocks from Equal-weight to Underweight, including:

-

SolarEdge Technologies, Inc. (NASDAQ:SEDG): The analyst reduced the price target from $23 to $9, citing slower profitability due to decreased European demand and tough competition from cheaper Chinese manufacturers. As a result, the company is not expected to break even on EBITDA until after 2026. At last check Friday, the stock was trading 13.2% lower at $11.13.

-

Maxeon Solar Technologies (NASDAQ:MAXN): Morgan Stanley anticipates a slow recovery to profitability due to increasing competition in Europe’s utility-scale solar market, which will likely keep pushing prices down. The analyst maintains the price target of $4. Additionally, recent customer losses in the U.S. residential market could make maintaining market share and premium pricing harder. Stock is trading 10.08% lower at $10.08 at last check Friday.

-

TPI Composites, Inc. (NASDAQ:TPIC): The analyst notes an uncertainty about how quickly the U.S. wind market will recover, mainly due to challenges in securing financing and recent issues with design and inspections as the industry shifts to larger blade sizes. Morgan Stanley has cut the price target from $4 to $2. Stock is down 8.82% at $2.16 at the last check Friday.

Brian E Mueller Takes Money Off The Table, Sells $1.32M In Grand Canyon Education Stock

A substantial insider sell was reported on November 14, by Brian E Mueller, CEO at Grand Canyon Education LOPE, based on the recent SEC filing.

What Happened: Mueller opted to sell 7,700 shares of Grand Canyon Education, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The transaction’s total worth stands at $1,318,702.

Grand Canyon Education‘s shares are actively trading at $162.95, experiencing a down of 1.17% during Friday’s morning session.

Discovering Grand Canyon Education: A Closer Look

Grand Canyon Education Inc is a publicly traded education services company dedicated to serving colleges and universities. GCE’s university partner is Grand Canyon University, an Arizona non-profit corporation that operates a comprehensive regionally accredited university that offers graduate and undergraduate degree programs, emphases and certificates across nine colleges both online, on ground at its campus in Phoenix, Arizona and at four off-site classroom and laboratory sites. The Company generates all of its revenue through services agreements with its university partners.

Grand Canyon Education’s Economic Impact: An Analysis

Revenue Growth: Grand Canyon Education’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 7.38%. This signifies a substantial increase in the company’s top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Insights into Profitability:

-

Gross Margin: The company maintains a high gross margin of 50.01%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Grand Canyon Education’s EPS is below the industry average. The company faced challenges with a current EPS of 1.43. This suggests a potential decline in earnings.

Debt Management: Grand Canyon Education’s debt-to-equity ratio is below the industry average. With a ratio of 0.14, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Grand Canyon Education’s P/E ratio of 21.67 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 4.77 is above industry norms, reflecting an elevated valuation for Grand Canyon Education’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 14.36, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Grand Canyon Education’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Netflix Streams Mike Tyson Vs. Jake Paul: The Fight Everyone's Talking About

Netflix Inc NFLX is leveraging tonight’s boxing match between Mike Tyson and Jake Paul to bolster its live offerings.

The streaming service, which has been pushing into live sports content, currently boasts more than 282 million global paid subscribers. Its ad-supported plan recently hit 70 million subscribers.

So far, Netflix has aired live comedy stand-ups, award shows, roasts and other special events. This is its inaugural boxing event.

Taking place at AT&T Stadium in Dallas, the fight features a dramatic age gap. Tyson, 58, is a boxing legend known for his fierce power. His career record is 50 wins and six losses. Paul, 27, is a social media personality turned boxer beginning in 2020. He holds a 10-1 record with seven knockouts in his career. His lone loss came via a split decision to Tommy Fury in February 2023.

Read Also: Mike Tyson On Psychedelics: ‘The Toad Showed Me God, And It Changed My Life’

Tyson’s last professional fight was in 2005, although he participated in a high-profile exhibition match in 2020 against Roy Jones Jr., which ended in a split draw.

The buildup took an ugly turn when, during the weigh-in, Tyson slapped Paul.

This real, officially sanctioned fight will be a significant test for both fighters, adding excitement to the streaming giant’s growing sports portfolio.

Astronomical Cost To Attend: The celebrity fight promises huge profits. Per a report by USA Today, with 80,000 seats and VIP packages ranging from $5,000 to $25,000, the event is set to generate millions.

The exclusive MVP Owner’s Experience is valued at $2 million, and the fight will also stream live on Netflix, which will benefit from a significant audience.

Tyson is estimated to earn $20 million, while Paul aims for $40 million.

Betting Big: Per a report by the NY Post, Paul has taken his confidence to the extreme, betting his entire $40 million purse on himself for his upcoming fight against Tyson.

During a pre-fight exchange, Paul accepted a challenge from Irish boxer Katie Taylor to wager his earnings, with Tyson favored to win.

While unlikely to see the bet come to fruition, Taylor, set to earn $6.1 million for her own fight against Amanda Serrano, stands at +650 odds for Tyson’s victory.

In a bold move, Paul offered Tyson $5 million if he can last beyond four rounds. However, if Tyson fails, he must get a tattoo reading “I love Jake Paul.”

Tyson responded with his own counteroffer, demanding $20 million to agree to the challenge. This bet adds to the spectacle, further heightening the tension between the two fighters. It also fuels interest in the already highly anticipated event, blending high stakes with controversy.

Read Also:

Image: Netflix

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Morguard Real Estate Investment Trust Declares November 2024 Distribution of 2 Cents per Unit

MISSISSAUGA, ON, Nov. 15, 2024 /CNW/ – Morguard Real Estate Investment Trust (the “Trust”) MRT today announced that it has declared a distribution of 2 cents per unit for the month of November 2024. The distribution will be payable on December 16, 2024 to unitholders of record as at November 29, 2024.

About Morguard Real Estate Investment Trust

The Trust is a closed-end real estate investment trust, which owns a diversified portfolio of 45 high quality retail, office and industrial income producing properties in Canada consisting of approximately 8.1 million square feet of leasable space.

For more information, please visit Morguard.com.

SOURCE Morguard Real Estate Investment Trust

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/15/c8032.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/15/c8032.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

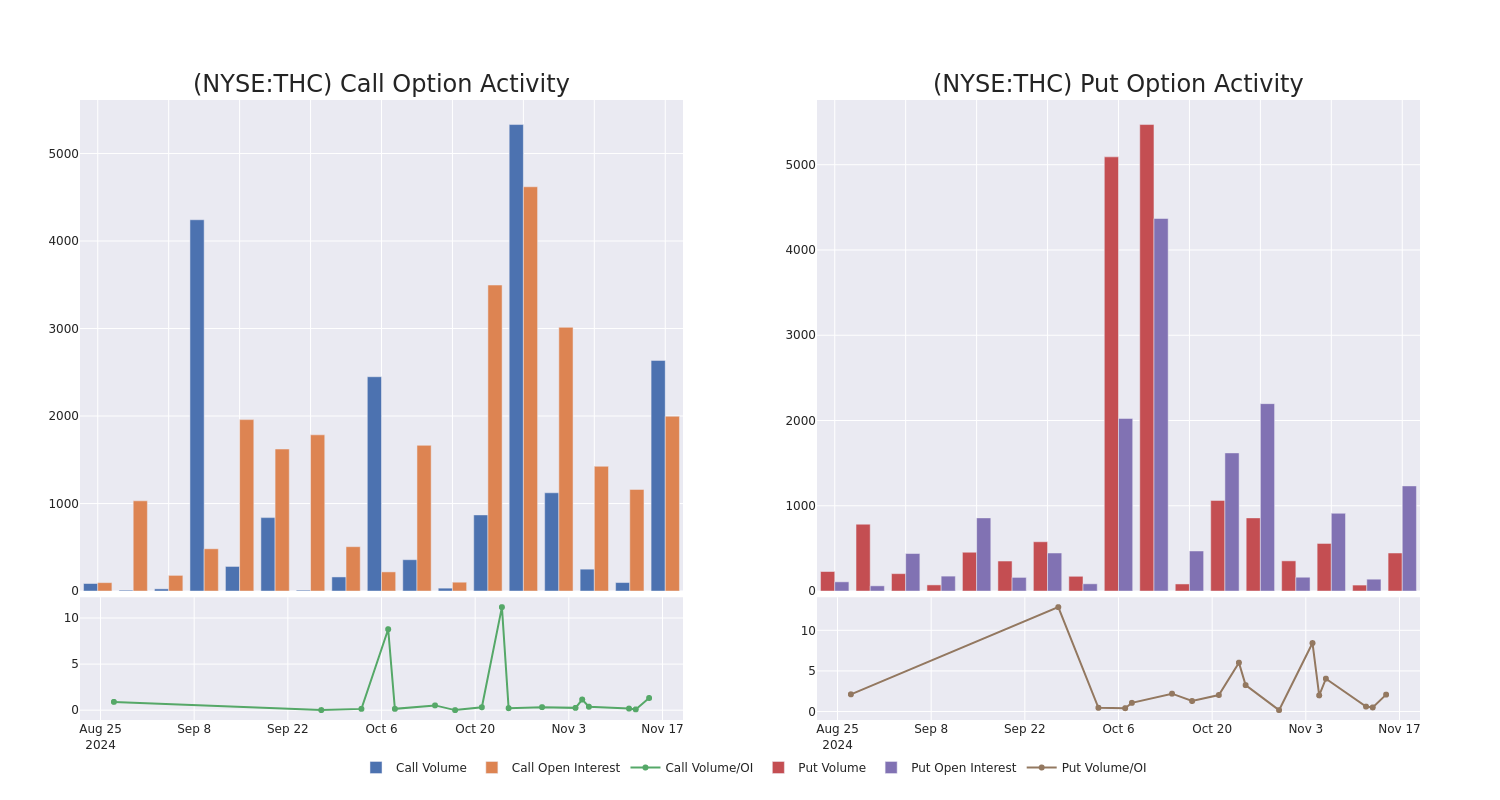

What the Options Market Tells Us About Tenet Healthcare

Whales with a lot of money to spend have taken a noticeably bearish stance on Tenet Healthcare.

Looking at options history for Tenet Healthcare THC we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $225,654 and 5, calls, for a total amount of $627,150.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $80.0 and $175.0 for Tenet Healthcare, spanning the last three months.

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Tenet Healthcare stands at 538.5, with a total volume reaching 3,082.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Tenet Healthcare, situated within the strike price corridor from $80.0 to $175.0, throughout the last 30 days.

Tenet Healthcare Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| THC | CALL | TRADE | BULLISH | 12/20/24 | $78.0 | $73.6 | $76.53 | $80.00 | $382.6K | 95 | 50 |

| THC | CALL | SWEEP | BEARISH | 01/17/25 | $3.1 | $3.0 | $3.0 | $175.00 | $109.8K | 1.9K | 0 |

| THC | CALL | SWEEP | BEARISH | 01/17/25 | $3.2 | $3.0 | $3.0 | $175.00 | $66.0K | 1.9K | 743 |

| THC | PUT | SWEEP | NEUTRAL | 12/20/24 | $6.8 | $6.3 | $6.55 | $155.00 | $44.8K | 99 | 20 |

| THC | CALL | SWEEP | BEARISH | 01/17/25 | $3.1 | $2.85 | $3.0 | $175.00 | $36.9K | 1.9K | 994 |

About Tenet Healthcare

Tenet Healthcare is a Dallas-based healthcare services organization. It operates a collection of hospitals (about 50 as of July 2024) and over 500 ambulatory surgery centers and other outpatient facilities across the U.S., primarily in the South. Through its Conifer segment, Tenet also provides revenue cycle management solutions.

Following our analysis of the options activities associated with Tenet Healthcare, we pivot to a closer look at the company’s own performance.

Where Is Tenet Healthcare Standing Right Now?

- With a volume of 793,505, the price of THC is down -5.36% at $153.93.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 83 days.

Professional Analyst Ratings for Tenet Healthcare

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $189.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Wells Fargo persists with their Overweight rating on Tenet Healthcare, maintaining a target price of $195.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Tenet Healthcare with a target price of $196.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Tenet Healthcare, targeting a price of $190.

* An analyst from Truist Securities downgraded its action to Buy with a price target of $190.

* Maintaining their stance, an analyst from Cantor Fitzgerald continues to hold a Overweight rating for Tenet Healthcare, targeting a price of $177.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Tenet Healthcare, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Tumble As Traders Rethink Fed's Action, VIX Spikes 17%, Nasdaq Erases Back Post-Trump Gains: What's Driving Markets Friday?

Risk aversion dominated Wall Street in the final session of the week, driving sharp losses across major indices.

Investors grappled with growing uncertainties surrounding the economic impacts of Donald Trump‘s policies and the Federal Reserve’s next moves.

Fed Chair Jerome Powell‘s remarks from the previous day weighed heavily on risk assets. Powell signaled no need to lower rates, citing the economy’s resilience and emphasizing the importance of fully finishing the inflation jobs.

Boston Fed President Susan Collins added to the uncertainty on Friday, stating she needs to see additional data before deciding on further rate cuts at the Federal Reserve’s upcoming policy meeting.

Expectations for a 25-basis-point rate cut in December were significantly scaled back, with odds falling to 59%, down from 82% just a day earlier.

U.S. indices are poised to end the week in negative territory, as optimism fueled by Trump’s win fizzled. Tech stocks were hit hardest, with the Nasdaq 100 plunging 2.5%, wiping out its post-election gains.

Chipmakers tumbled across the board, with the iShares Semiconductor ETF SOXX reaching a 2-month low, as Applied Materials Inc. AMAT released a disappointing outlook.

The surge in rate-cut uncertainty and broader economic concerns pushed the CBOE Volatility Index (VIX) up by more than 17%, reflecting heightened market fear.

Treasury yields edged lower, indicating a flight to safe-haven bonds. The drop in yields supported the Japanese yen, which ended a four-day losing streak.

The U.S. dollar eased but remains on track for its seventh consecutive week of gains, marking its longest winning streak since September 2023.

Gold prices remained flat despite falling yields and a softer dollar, failing to act as a hedge in a turbulent session. Meanwhile, Bitcoin BTC/USD defied the risk-off sentiment, rising 2.5% to $89,600 in a surprising show of strength.

Friday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day %chg |

| Dow Jones | 43,416.20 | -0.8% |

| S&P 500 | 5,869.72 | -1.3% |

| Russell 2000 | 2,302.85 | -1.5% |

| Nasdaq 100 | 20,391.40 | -2.4% |

| CBOE VIX | 16.79 | 17.3% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY fell 1.4% to $585.28.

- The SPDR Dow Jones Industrial Average DIA fell 0.8% to $434.08.

- The tech-heavy Invesco QQQ Trust Series QQQ fell 2.5% to $496.12.

- The iShares Russell 2000 ETF IWM tumbled 1.4% to $228.75.

- The Utilities Select Sector SPDR Fund XLU outperformed, rising 0.8%. The Technology Select Sector SPDR Fund XLY lagged, down 2.7%.

Friday’s Stock Movers

- Palantir Technologies Inc. PLTR skyrocketed 8.4%, on news that the AI-champion will be included in the Nasdaq 100 index.

- Walt Disney Co. DIS rose over 4%, fueling stock momentum after the 6.2% gain on Thursday amid stronger than expected earnings.

- Alcoa Corp. AA rallied over 8% after China announced to end its export-tax rebate for aluminum from Dec. 1.

Stocks reacting on earnings reports were:

- Globant S.A. GLOB, down 11%.

- AST SpaceMobile Inc. ASTS, down 13.8%,

- Post Holdings Inc. POST, down 2.8%.

Now Read:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JP Morgan Downgrades Gene Therapy Focused Bluebird Bio, Cites Limited Funding Options

On Thursday, Bluebird Bio Inc. BLUE reported a third-quarter EPS loss of 31 cents, compared to a loss of 80 cents a year ago, beating the consensus loss of 36 cents.

The gene therapy company reported sales of $10.6 million, down from $12.39 million, missing the consensus of $18.1 million.

The company’s cash, cash equivalents, and restricted cash balance were approximately $118.7 million, which is expected to provide a cash runway into the first quarter of 2025.

Also Read: Worries Mount Over Cancer Risks in Bluebird Bio’s Gene Therapy

The company anticipates quarterly cash flow break-even in the second half of 2025, assuming it scales to approximately 40 drug product deliveries per quarter and obtains additional cash resources to extend its runway.

JP Morgan downgraded Bluebird after the third-quarter results. The analyst notes a reduced cash runway to “into 1Q25” from “into 2Q25.”

JP Morgan highlights that Bluebird did achieve the milestone of its first Lyfgenia infusion during the quarter (and revenue recognition) and continues to increase the pace of patient starts (cell collections) across its portfolio but is doing so against a backdrop of continued negative gross margins.

- 57 patient starts completed to date in 2024 (35 Zynteglo, 17 Lyfgenia, 5 Skysona).

- Seventeen additional starts are scheduled through the remainder of 2024.

“Altogether presenting few avenues to emerge from remaining a going concern,” the analyst says. JP Morgan has downgraded from Neutral to Underweight.

The analyst writes that the proxy vote did not gather enough support to approve a reverse stock split and increase the number of shares available for issuance. This outcome effectively eliminates equity financing as an option for raising capital.

In September, Bluebird bio implemented a restructuring to optimize its cost structure and enable quarterly cash flow break-even in the second half of 2025.

Price Action: BLUE stock is down 11.2% at $0.32 at last check Friday.

Photo by Ground Picture on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.