Genpact Director Sold $93K In Company Stock

It was reported on November 14, that N. V. Tyagarajan, Director at Genpact G executed a significant insider sell, according to an SEC filing.

What Happened: Tyagarajan’s recent move involves selling 2,000 shares of Genpact. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value is $93,400.

Genpact‘s shares are actively trading at $45.1, experiencing a down of 0.0% during Friday’s morning session.

Unveiling the Story Behind Genpact

Genpact Ltd is a provider of business process management services. Clients are industry verticals and operate in banking and financial services, insurance, capital markets, consumer product goods, life sciences, infrastructure, manufacturing and services, healthcare, and high-tech. Genpact’s services include aftermarket, direct procurement, risk and compliance, human resources, IT, industrial solutions, collections, finance and accounting, and media services. Genpact’s end market by revenue is India. It is a General Electric spin-off, which is still a large source of revenue for Genpact.

Genpact: Delving into Financials

Revenue Growth: Over the 3 months period, Genpact showcased positive performance, achieving a revenue growth rate of 2.95% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Insights into Profitability:

-

Gross Margin: The company faces challenges with a low gross margin of 35.63%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 0.75, Genpact showcases strong earnings per share.

Debt Management: Genpact’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.77.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 12.39 is lower than the industry average, implying a discounted valuation for Genpact’s stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.75 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 11.16 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Deciphering Transaction Codes in Insider Filings

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Genpact’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Expedia Group Options Trading: A Deep Dive into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on Expedia Group.

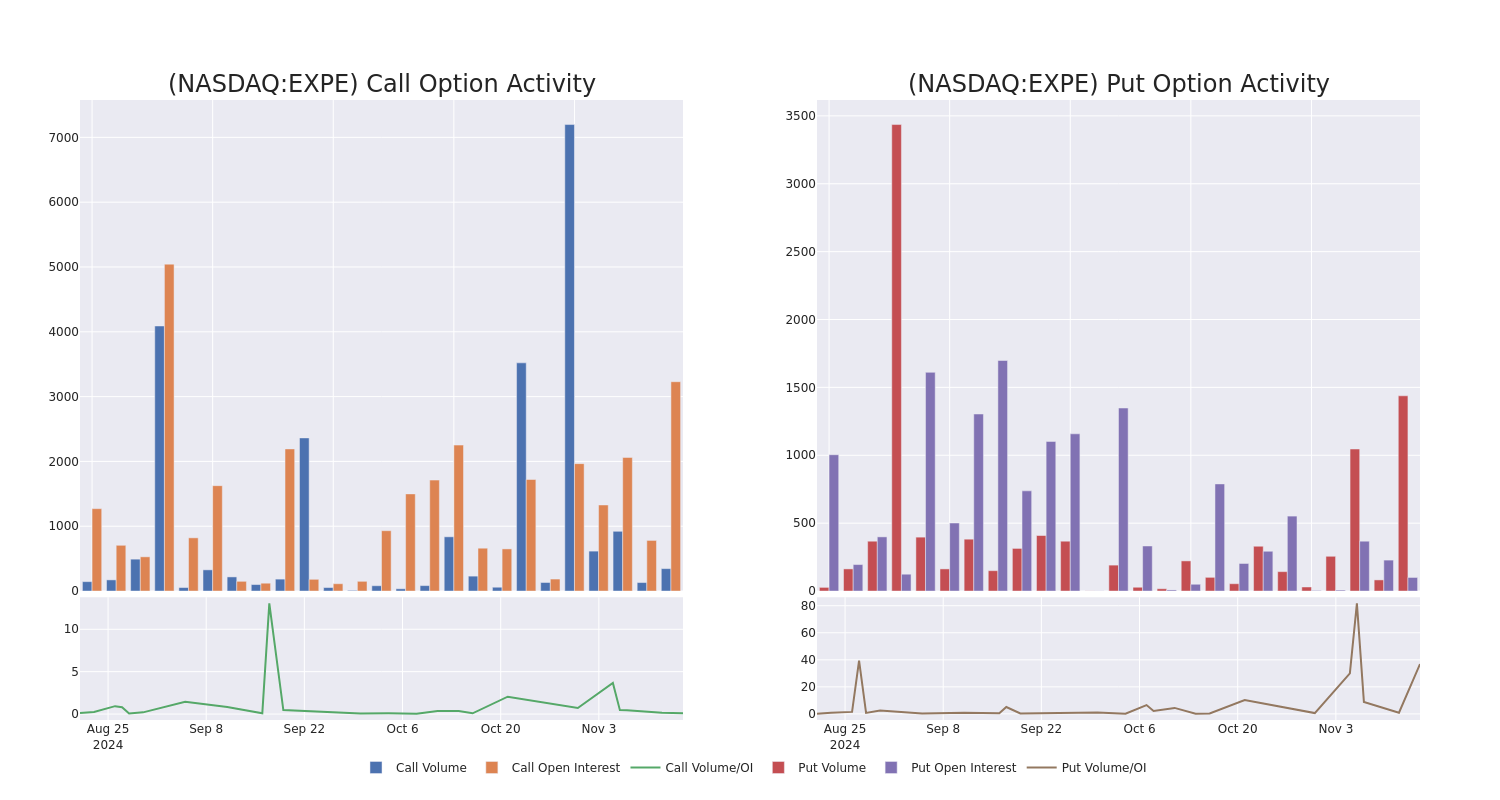

Looking at options history for Expedia Group EXPE we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 60% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $203,880 and 6, calls, for a total amount of $424,321.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $110.0 to $192.5 for Expedia Group over the recent three months.

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Expedia Group stands at 475.71, with a total volume reaching 1,784.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Expedia Group, situated within the strike price corridor from $110.0 to $192.5, throughout the last 30 days.

Expedia Group Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EXPE | CALL | SWEEP | BULLISH | 01/17/25 | $21.5 | $21.1 | $21.5 | $160.00 | $107.6K | 1.3K | 151 |

| EXPE | CALL | TRADE | BEARISH | 01/17/25 | $21.95 | $21.0 | $21.28 | $160.00 | $106.4K | 1.3K | 51 |

| EXPE | PUT | TRADE | BULLISH | 11/22/24 | $1.43 | $0.72 | $0.74 | $172.50 | $88.8K | 54 | 1.2K |

| EXPE | CALL | TRADE | BULLISH | 01/17/25 | $21.3 | $21.05 | $21.3 | $160.00 | $78.8K | 1.3K | 101 |

| EXPE | CALL | TRADE | BEARISH | 01/17/25 | $41.75 | $40.25 | $40.81 | $140.00 | $65.2K | 1.3K | 16 |

About Expedia Group

Expedia is the world’s second-largest online travel agency by bookings, offering services for lodging (80% of total 2023 sales), air tickets (3%), rental cars, cruises, in-destination, and other (11%), and advertising revenue (6%). Expedia operates a number of branded travel booking sites, but its three core online travel agency brands are Expedia, Hotels.com, and Vrbo. It also has a metasearch brand, Trivago. Transaction fees for online bookings account for the bulk of sales and profits.

Having examined the options trading patterns of Expedia Group, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Expedia Group

- With a volume of 719,408, the price of EXPE is down -1.06% at $180.33.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 83 days.

Expert Opinions on Expedia Group

In the last month, 5 experts released ratings on this stock with an average target price of $173.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Expedia Group, targeting a price of $210.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Neutral rating for Expedia Group, targeting a price of $166.

* An analyst from Jefferies persists with their Hold rating on Expedia Group, maintaining a target price of $160.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Expedia Group with a target price of $153.

* An analyst from Wedbush persists with their Neutral rating on Expedia Group, maintaining a target price of $180.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Expedia Group options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insights Ahead: Bitdeer Technologies's Quarterly Earnings

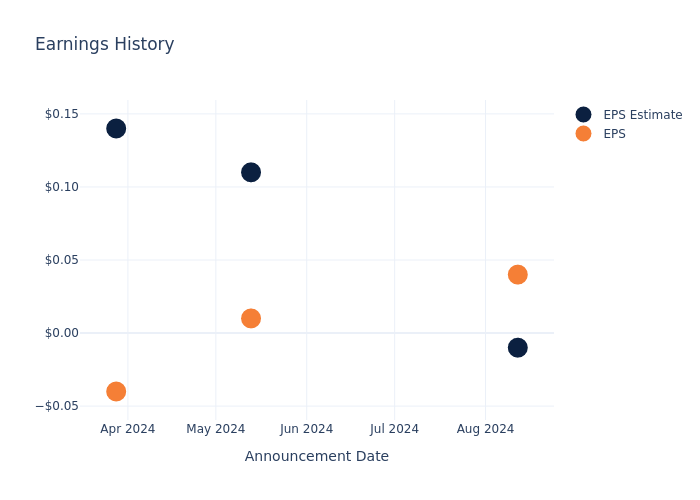

Bitdeer Technologies BTDR will release its quarterly earnings report on Monday, 2024-11-18. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Bitdeer Technologies to report an earnings per share (EPS) of $-0.07.

The market awaits Bitdeer Technologies’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Performance in Previous Earnings

The company’s EPS beat by $0.05 in the last quarter, leading to a 3.68% increase in the share price on the following day.

Here’s a look at Bitdeer Technologies’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.01 | 0.11 | 0.14 | -0.04 |

| EPS Actual | 0.04 | 0.01 | -0.04 | -0.02 |

| Price Change % | 4.0% | -1.0% | 1.0% | 33.0% |

Market Performance of Bitdeer Technologies’s Stock

Shares of Bitdeer Technologies were trading at $10.74 as of November 14. Over the last 52-week period, shares are up 128.99%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Bitdeer Technologies

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Bitdeer Technologies.

With 7 analyst ratings, Bitdeer Technologies has a consensus rating of Buy. The average one-year price target is $12.57, indicating a potential 17.04% upside.

Analyzing Analyst Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of LiveRamp Holdings, PagerDuty and Iris Energy, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- The prevailing sentiment among analysts is an Buy trajectory for LiveRamp Holdings, with an average 1-year price target of $39.5, implying a potential 267.78% upside.

- PagerDuty received a Neutral consensus from analysts, with an average 1-year price target of $21.0, implying a potential 95.53% upside.

- Iris Energy received a Buy consensus from analysts, with an average 1-year price target of $15.67, implying a potential 45.9% upside.

Overview of Peer Analysis

The peer analysis summary presents essential metrics for LiveRamp Holdings, PagerDuty and Iris Energy, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Bitdeer Technologies | Buy | 5.77% | $24.41M | -4.08% |

| LiveRamp Holdings | Buy | 16.02% | $134.25M | 0.18% |

| PagerDuty | Neutral | 7.73% | $95.86M | -7.82% |

| Iris Energy | Buy | 70.58% | $49.01M | -3.05% |

Key Takeaway:

Bitdeer Technologies ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit. However, it is at the top for Consensus rating and in the middle for Return on Equity.

Unveiling the Story Behind Bitdeer Technologies

Bitdeer Technologies Group is principally engaged in provision of digital asset mining services. Its majority business segments are: proprietary mining, cloud hash rate sharing and cloud hosting. The company operates five proprietary mining datacenters in the United States and Norway.

Unraveling the Financial Story of Bitdeer Technologies

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Bitdeer Technologies displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 5.77%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Bitdeer Technologies’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -17.88%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company’s ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -4.08%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Bitdeer Technologies’s ROA excels beyond industry benchmarks, reaching -2.34%. This signifies efficient management of assets and strong financial health.

Debt Management: Bitdeer Technologies’s debt-to-equity ratio is below the industry average. With a ratio of 0.24, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Bitdeer Technologies visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TransDigm Gr Unusual Options Activity

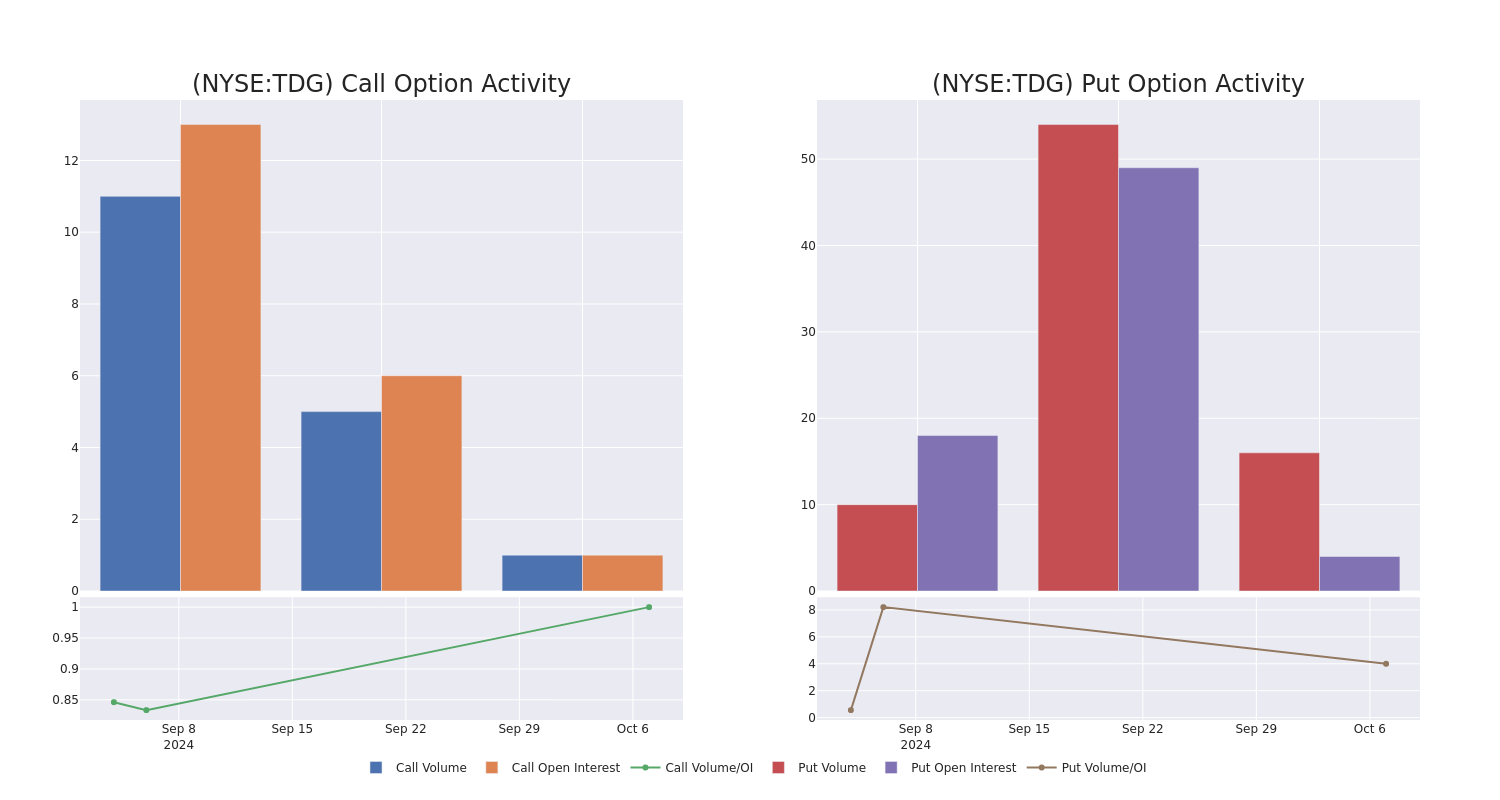

Investors with a lot of money to spend have taken a bearish stance on TransDigm Gr TDG.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with TDG, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 15 uncommon options trades for TransDigm Gr.

This isn’t normal.

The overall sentiment of these big-money traders is split between 26% bullish and 60%, bearish.

Out of all of the special options we uncovered, 12 are puts, for a total amount of $1,689,007, and 3 are calls, for a total amount of $122,970.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $765.0 and $1325.0 for TransDigm Gr, spanning the last three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for TransDigm Gr’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of TransDigm Gr’s whale trades within a strike price range from $765.0 to $1325.0 in the last 30 days.

TransDigm Gr Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TDG | PUT | SWEEP | BULLISH | 11/15/24 | $31.3 | $30.6 | $31.3 | $1305.00 | $356.8K | 121 | 114 |

| TDG | PUT | SWEEP | BEARISH | 01/17/25 | $54.2 | $52.0 | $53.5 | $1250.00 | $292.5K | 0 | 83 |

| TDG | PUT | SWEEP | BULLISH | 12/20/24 | $30.7 | $29.0 | $29.0 | $1200.00 | $287.1K | 4 | 205 |

| TDG | PUT | SWEEP | NEUTRAL | 12/20/24 | $26.8 | $22.4 | $26.0 | $1200.00 | $252.2K | 4 | 103 |

| TDG | PUT | SWEEP | BEARISH | 11/15/24 | $17.0 | $11.2 | $17.0 | $1265.00 | $170.0K | 34 | 102 |

About TransDigm Gr

TransDigm manufactures and services a diverse set of specialized parts for commercial and military aircraft. The firm organizes itself in three segments: power and control, airframes, and a small non-aviation segment, which serves mostly off-road vehicles and mining equipment. It operates as an acquisitive holding company that focuses its portfolio on firms that make proprietary aerospace products with substantial aftermarket demand. TransDigm regularly employs financial leverage to amplify its operating results.

Having examined the options trading patterns of TransDigm Gr, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of TransDigm Gr

- With a trading volume of 236,246, the price of TDG is up by 1.44%, reaching $1290.0.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 83 days from now.

Professional Analyst Ratings for TransDigm Gr

In the last month, 2 experts released ratings on this stock with an average target price of $1531.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on TransDigm Gr with a target price of $1500.

* An analyst from Citigroup has decided to maintain their Buy rating on TransDigm Gr, which currently sits at a price target of $1563.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest TransDigm Gr options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock Slide Deepens With Fed Cut Bets in Focus: Markets Wrap

(Bloomberg) — Stocks fell for a second day as Trump trades lost steam and investors bet the Federal Reserve will have to slow the pace of policy easing.

Most Read from Bloomberg

The S&P 500 traded near session lows, with tech stocks leading declines. Including losses on Friday, the benchmark has now ceded more than half of the trough-to-peak gains it notched after the US presidential election. Traders now see just over even odds of a quarter-point cut next month after a report on October retail sales included large upside revisions to the prior month.

As the initial euphoria about Trump’s pro-business agenda begins to fade, investors are coming to terms with the costs of his fiscal plans and their potential to reignite inflation.

“It will come at the expense of potentially larger budget deficits, potentially larger debt and there is also the inflation dimension,” said Charles-Henry Monchau, chief investment officer at Banque Syz & Co. “There’s been a realization that there is a price to pay for this.”

The S&P 500 fell 1.5% and the tech-heavy Nasdaq 100 dropped more than 2%. Shares of all “Magnificent Seven” megacaps declined except Elon Musk’s Tesla Inc., with Amazon.com Inc., Nvidia Corp. and Meta Platforms Inc. sliding more than 3%.

Traders priced just over a 50% chance the Fed will deliver a quarter-point reduction at its December meeting, down from 80% earlier this week. Bets on cuts were pared after Fed Chair Jerome Powell warned Thursday that the central bank may take its time easing policy. Boston Fed President Susan Collins said Friday a December cut remained on the table, emphasizing the central bank’s decision will be guided by incoming data.

“The market is expensive and I think Powell’s speech last night basically saying that Fed officials don’t need to rush to lower rates, that’s probably the main reason why we’re selling off specifically today,” said John Davi, CEO and CIO at Astoria Advisors, by phone. “The higher rates go, the more equity risk premiums tilt more in the favor of bonds.”

Meanwhile, drugmakers Moderna Inc. and Pfizer Inc. came under pressure in New York trading after Trump named a prominent vaccine skeptic Robert F. Kennedy Jr. to a top health-policy role.

The greenback eased off two-year highs but is on track for its seventh straight weekly gain. Another of the so-called Trump trades, Bitcoin, has given up some gains this week, trading below $90,000 on Friday after hitting a record level above $93,000 earlier this week on hopes of crypto-friendly policies from the new US administration.

Eyenovia Stock Sinks As Pivotal Trial Fails To Hit Primary Efficacy Goal, Analyst Downgrades Due To Limited Capital And Near Term Upside From Pipeline

On Friday, Eyenovia, Inc. EYEN stock is trading lower after an update from the Phase 3 CHAPERONE study evaluating its proprietary drug-device combination of low-dose atropine in the company’s Optejet dispensing platform pediatric progressive myopia.

Progressive myopia is a type of nearsightedness that worsens over time due to the eyeball growing too long.

The company said that an independent Data Review Committee (DRC) reviewed the CHAPERONE data and found that the trial is not meeting its primary endpoint of a less than 0.5 diopter progression in visual acuity over three years.

The DRC reviewed the safety and efficacy data from 252 evaluable patients. The DRC found that the rate of myopia progression was not significantly different between the two active treatment arms (0.01% and 0.1% atropine ophthalmic metered spray) and placebo.

In the safety analysis, all dosages and placebo appeared well-tolerated, with a mild and infrequent adverse event profile. Full study data has not yet been released to Eyenovia.

“We plan to terminate the study, review the data more thoroughly, and evaluate the next steps,” stated Michael Rowe, Eyenovia’s CEO.

In light of the results of this review, the company is considering strategic options, which may include a business combination, reverse merger, asset sales or a combination of those alternatives.

William Blair has downgraded Eyenovia to Market Perform.

The analyst says,” While the approval of Mydcombi provided important validation of Eyenovia’s Optejet device, and the subsequent approval of clobetasol propionate ophthalmic solution 0.05% added another promising product to the company’s commercial portfolio, we believe the negative results from the CHAPERONE study and limited capital to invest in the launch of clobetasol or further pipeline programs limits near-term upside.”

Price Action: EYEN stock is down 68.2% at $0.1083 at last check Friday.

Image via Unsplash

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

C21 Reports Q2 Revenue Up 14% QoQ, South Reno Cannabis Dispensary Sees 53% Sales Growth

Vertically integrated cannabis company C21 Investments Inc. CXXI CXXIF announced its interim unaudited financial statements and management discussion and analysis on Thursday for its second quarter ending Sept. 30, 2024.

“We are pleased with the strong performance and positive customer reception of our new dispensary during its first quarter of operations,” said Sonny Newman, CEO and president. “These results have exceeded our expectations and we continue to see robust sales growth into the new quarter.”

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Q2 Financial Highlights

The company said there is no equivalent time period to the second quarter report in the company’s historical results due to the previously reported change in fiscal year end from Jan. 31 to March 31.

- Revenue totaled $7.5 million, representing a 14% increase from the first quarter.

- Gross margin rose to 43.5%, up from 31% in the prior quarter, fueled by operational efficiencies and higher retail revenues.

- The South Reno dispensary ramped up sales by 53% within the quarter, reaching $416,000 in Sept. and continued to perform well post-quarter. The dispensary sales increased by 14% in Oct. reaching $475,000.

- Adjusted EBITDA came in positive at $1.3 million, up from $0.3 million in the previous period, reflecting better margins and retail growth.

- Free cash flow turned positive, reaching $0.8 million, compared to a negative $0.09 million in the first quarter.

- Net loss decreased to $845,132.

- Selling, general and administrative expenses increased by 3% increase due to the new dispensary’s lease and labor costs.

- Total assets grew to $58.6 million, while liabilities increased to $28.3 million. The South Reno dispensary sales increased by 14% in October, reaching $475,000.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Automotive Properties REIT Announces November 2024 Distribution

/NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES/

TORONTO, Nov. 15, 2024 /CNW/ – Automotive Properties Real Estate Investment Trust APR (the “REIT”) today announced a cash distribution of $0.067 per REIT unit for the month of November 2024, representing $0.80 per REIT unit on an annualized basis. Payment will be made on December 16, 2024 to unitholders of record as at November 29, 2024.

About Automotive Properties REIT

Automotive Properties REIT is an unincorporated, open-ended real estate investment trust focused on owning and acquiring primarily income-producing automotive dealership properties located in Canada. The REIT’s portfolio currently consists of 76 income-producing commercial properties, representing approximately 2.8 million square feet of gross leasable area, in metropolitan markets across British Columbia, Alberta, Saskatchewan, Manitoba, Ontario and Québec. Automotive Properties REIT is the only public vehicle in Canada focused on consolidating automotive dealership real estate properties. For more information, please visit: www.automotivepropertiesreit.ca.

SOURCE Automotive Properties Real Estate Investment Trust

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/15/c7400.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/15/c7400.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Matt Gaetz To Be Confirmed As Attorney General In A Trump Administration? Not So Fast, Polymarket Traders Say

Polymarket predictions reveal significant doubt over whether Matt Gaetz will be confirmed as Attorney General in a Trump administration, with current betting odds showing only a 28% chance of approval.

What Happened: The chances of confirmation have been oscillating between 25% and 30%, according to Polymarket traders.

The unconventional nomination has sparked widespread commentary, with former Speaker Kevin McCarthy (R-Calif.) casting doubts on Gaetz’s chances.

McCarthy, a long-time Trump ally, remarked in an interview with Bloomberg that “Gaetz won’t get confirmed. Everybody knows that,” suggesting that Gaetz lacks strong support among Senate Republicans due to his divisive history within the party.

McCarthy’s own relationship with Gaetz has been tumultuous, particularly after Gaetz led the charge to oust him as speaker of the House

Gaetz, known for his libertarian views and advocacy for cryptocurrency, has introduced radical proposals, including a bill to allow federal income taxes to be paid in Bitcoin.

His potential nomination as Attorney General is part of Trump’s promise to overhaul the Justice Department and address what he calls the “weaponization” of government institutions.

Trump publicly praised Gaetz on his Truth Social account, stating, “Matt will end Weaponized Government, Protect our Borders, dismantle Criminal Organizations, and restore Americans’ badly-shattered Faith and Confidence in the Justice Department.”

Also Read: Solana, Ripple, Litecoin ETFs May Be On The Table Under Trump Administration, Industry Experts Say

Gaetz’s path to confirmation is complicated by ongoing controversies. The House Ethics Committee is investigating him for allegations of sexual misconduct, drug use, and other claims, though Gaetz has consistently denied any wrongdoing.

The Department of Justice previously investigated him for sex trafficking but decided against pressing charges last year.

For many Senate Republicans, these unresolved issues could prove insurmountable during the confirmation process .

Adding to his profile, Gaetz has also pushed for legislation to dismantle the Federal Reserve and legalize marijuana.

His pro-crypto stance aligns with Trump’s campaign promise to make the U.S. the “Bitcoin superpower of the world,” a stance that has fueled excitement within the crypto community.

What’s Next: Gaetz’s involvement in crypto and his support for innovative financial policies make his nomination particularly relevant as investors await Benzinga’s Future of Digital Assets event on Nov. 19.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Genpact Insider Trades Send A Signal

It was reported on November 14, that Carol Lindstrom, Director at Genpact G executed a significant insider sell, according to an SEC filing.

What Happened: After conducting a thorough analysis, Lindstrom sold 3,218 shares of Genpact. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total transaction value is $149,875.

The latest market snapshot at Friday morning reveals Genpact shares down by 0.0%, trading at $45.1.

Get to Know Genpact Better

Genpact Ltd is a provider of business process management services. Clients are industry verticals and operate in banking and financial services, insurance, capital markets, consumer product goods, life sciences, infrastructure, manufacturing and services, healthcare, and high-tech. Genpact’s services include aftermarket, direct procurement, risk and compliance, human resources, IT, industrial solutions, collections, finance and accounting, and media services. Genpact’s end market by revenue is India. It is a General Electric spin-off, which is still a large source of revenue for Genpact.

Financial Insights: Genpact

Revenue Growth: Genpact displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 2.95%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 35.63%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Genpact’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 0.75.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.77.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 12.39 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The P/S ratio of 1.75 is lower than the industry average, implying a discounted valuation for Genpact’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 11.16 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Genpact’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.