Earnings Preview For i3 Verticals

i3 Verticals IIIV is gearing up to announce its quarterly earnings on Monday, 2024-11-18. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that i3 Verticals will report an earnings per share (EPS) of $0.20.

i3 Verticals bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

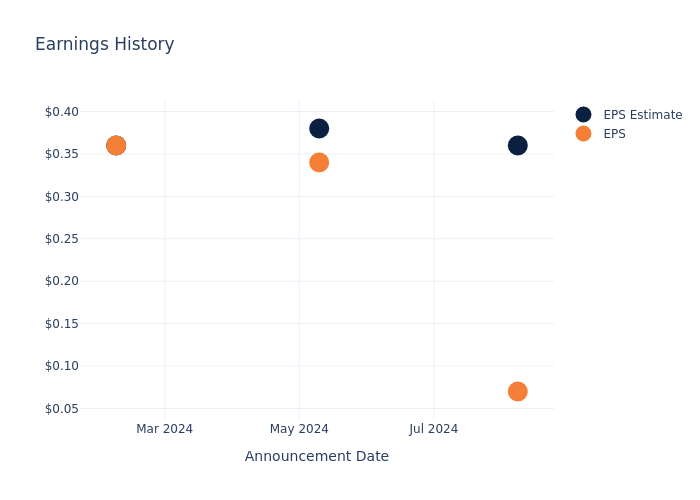

Earnings Track Record

During the last quarter, the company reported an EPS missed by $0.29, leading to a 7.47% drop in the share price on the subsequent day.

Here’s a look at i3 Verticals’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.36 | 0.38 | 0.36 | 0.4 |

| EPS Actual | 0.07 | 0.34 | 0.36 | 0.4 |

| Price Change % | -7.000000000000001% | -10.0% | -2.0% | 0.0% |

i3 Verticals Share Price Analysis

Shares of i3 Verticals were trading at $24.87 as of November 14. Over the last 52-week period, shares are up 19.95%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on i3 Verticals

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on i3 Verticals.

A total of 4 analyst ratings have been received for i3 Verticals, with the consensus rating being Buy. The average one-year price target stands at $29.5, suggesting a potential 18.62% upside.

Comparing Ratings with Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Cantaloupe, IntL Money Express and Repay Holdings, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Cantaloupe, with an average 1-year price target of $10.67, suggesting a potential 57.1% downside.

- Analysts currently favor an Buy trajectory for IntL Money Express, with an average 1-year price target of $27.5, suggesting a potential 10.57% upside.

- Repay Holdings is maintaining an Buy status according to analysts, with an average 1-year price target of $13.0, indicating a potential 47.73% downside.

Summary of Peers Analysis

Within the peer analysis summary, vital metrics for Cantaloupe, IntL Money Express and Repay Holdings are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| i3 Verticals | Buy | -2.14% | $51.31M | -3.02% |

| Cantaloupe | Outperform | 13.01% | $28.85M | 1.78% |

| IntL Money Express | Buy | -0.28% | $60.60M | 12.17% |

| Repay Holdings | Buy | 4.35% | $58.59M | -0.50% |

Key Takeaway:

i3 Verticals is at the bottom for Revenue Growth and Gross Profit, with negative values for both metrics. It is also at the bottom for Return on Equity. Overall, i3 Verticals is performing less favorably compared to its peers in terms of financial metrics.

Delving into i3 Verticals’s Background

i3 Verticals Inc offers integrated payment and software solutions to small and medium-sized businesses and organizations in strategic vertical markets. Its operating segment includes Merchant Services and Software and Services. The company generates maximum revenue from the Software and Services segment. The company’s strategic vertical market includes schools, the public sector, not-for-profit organizations, healthcare and others. It provides various solutions such as, gateway, payment processing, online payment, Document management, and ERP among others.

Financial Milestones: i3 Verticals’s Journey

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: i3 Verticals’s revenue growth over a period of 3 months has faced challenges. As of 30 June, 2024, the company experienced a revenue decline of approximately -2.14%. This indicates a decrease in the company’s top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of -13.46%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): i3 Verticals’s ROE excels beyond industry benchmarks, reaching -3.02%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): i3 Verticals’s ROA excels beyond industry benchmarks, reaching -0.87%. This signifies efficient management of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.54.

To track all earnings releases for i3 Verticals visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Bloom Energy Stock Rocketed 48% on Friday

Bloom Energy (NYSE: BE) investors are having a terrific Friday, as shares of the renewable energy company surged 47.8% through 10:30 a.m. ET.

Last night, Bloom Energy announced a deal to supply up to 1 gigawatt’s-worth of fuel cells to electric utility American Electric Power (NASDAQ: AEP).

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Last night’s announcement comes on the heels of a miserable earnings report from Bloom last week — a report that was redeemed by Bloom’s announcement of a deal to set up an 80-megawatt fuel cell system for South Korea’s SK Eternix. There’s 1,000 megawatts in a gigawatt, though.

So today’s news is 12.5 times bigger than that one, which explains the size of the reaction investors are having to it.

As Bloom explained, AEP intends to buy Bloom’s fuel cell systems to deploy them at the location of some of its customers’ AI data centers. (Yes, you read that right. Bloom Energy is an artificial intelligence stock now.) Rollout will begin with an initial order of 100 MW worth of fuel cells (so already more than last week’s announcement), with more fuel cells to be ordered in 2025, and being “rapidly deployed.”

In total, the AEP deal promises to roll out roughly 77% of the volume of fuel cells Bloom has already deployed (1.3 GW) over its entire 23 years of existence. While Bloom didn’t say how big the AEP deal will be in terms of revenue, if you compare historical data on Bloom’s revenues since 2014, which is as far back as the historical data goes on S&P Global Market Intelligence, this implies the AEP deal could eventually yield revenues well in excess of $7 billion for Bloom.

Moreover, Bloom has already reached a point at which this revenue is gross-profitable, generating gross profit margins of nearly 24% in Q3, and while profitable operating and net margins are finally looking achievable.

This deal could be the one that puts Bloom over the top, and finally turns the company profitable.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

S&P 500 Down Over 1%; US Retail Sales Top Expectations

U.S. stocks traded lower midway through trading, with the S&P 500 falling by over 1% on Friday.

The Dow traded down 0.90% to 43,356.00 while the NASDAQ fell 2.26% to 18,676.22. The S&P 500 also fell, dropping, 1.42% to 5,864.40.

Check This Out: Top 4 Utilities Stocks That May Keep You Up At Night This Quarter

Leading and Lagging Sectors

Energy shares rose by 0.4% on Friday.

In trading on Friday, information technology shares fell by 1.9%.

Top Headline

U.S. retail sales rose 0.4% month-over-month in October compared to a revised 0.8% increase in September, and toping market estimates of 0.3%.

Equities Trading UP

- The Arena Group Holdings, Inc. AREN shares shot up 232% to $1.89 after it announced its first ever profitable quarter.

- Shares of Bloom Energy Corporation BE got a boost, surging 49% to $19.80. Bloom Energy announced a 1 GW fuel cell deal with AEP, providing clean power for AI Data Centers.

- Simpple Ltd. SPPL shares were also up, gaining 90% to $1.6601 after the company announced a $400,000 contract to supply autonomous cleaning robots at Singapore’s International Airport Terminal.

Equities Trading DOWN

- TFF Pharmaceuticals, Inc. TFFP shares dropped 78% to $0.3581 after the company announced it will wind down its operations.

- Shares of Eyenovia, Inc. EYEN were down 73% to $0.0932 after the company announced that its CHAPERONE trial is not meeting its primary endpoint, prompting the discontinuation of the study and a review of the full data set to evaluate next steps for the program.

- Ryvyl Inc. RVYL was down, falling 33% to $1.1724 after the company reported worse-than-expected third-quarter financial results and cut its FY24 sales guidance.

Commodities

In commodity news, oil traded down 0.5% to $68.35 while gold traded up 0.2% at $2,579.20.

Silver traded up 0.7% to $30.79 on Friday, while copper rose 0.8% to $4.1220.

Euro zone

European shares were mostly lower today. The eurozone’s STOXX 600 fell 0.58%, Germany’s DAX fell 0.16% and France’s CAC 40 fell 0.26%. Spain’s IBEX 35 Index gained 0.82%, while London’s FTSE 100 fell 0.06%.

The annual inflation rate in Italy increased to 0.9% in October versus 0.7% in the prior month, while France’s annual inflation rate rose to 1.2% in October. The GDP in the UK grew by 1% year-over-year during the third quarter.

Asia Pacific Markets

Asian markets closed lower on Friday, with Japan’s Nikkei 225 gaining 0.28%, Hong Kong’s Hang Seng Index falling 0.05% and China’s Shanghai Composite Index dipping 1.45%.

Hong Kong’s economy expanded by 1.8% year-over-year in the third quarter compared to a 3.2% increase in the previous period. China’s retail sales rose by 4.8% year-over-year in October, while industrial production rose by 5.3% year-over-year in October.

Economics

- The NY Empire State Manufacturing Index surged to 31.2 in November versus -11.9 in the previous month and topping market estimates of -0.7.

- U.S. export prices increased by 0.8% in October, while import prices rose by 0.3% month-over-month in October.

- U.S. retail sales rose 0.4% month-over-month in October compared to a revised 0.8% increase in September, and toping market estimates of 0.3%.

- U.S. industrial production declined by 0.3% in October compared to a revised 0.5% declined in September.

- U.S. business inventories rose 0.1% month-over-month in September compared to a 0.3% gain in August and versus market estimates of 0.2%.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Motorola Solns Recent Insider Activity

A substantial insider sell was reported on November 14, by Gregory Q Brown, Chairman and CEO at Motorola Solns MSI, based on the recent SEC filing.

What Happened: Brown’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Thursday unveiled the sale of 120,000 shares of Motorola Solns. The total transaction value is $59,532,058.

As of Friday morning, Motorola Solns shares are down by 0.51%, currently priced at $491.2.

Discovering Motorola Solns: A Closer Look

Motorola Solutions is a leading provider of communications and analytics, primarily serving public safety departments as well as schools, hospitals, and businesses. The bulk of the firm’s revenue comes from sales of land mobile radios and radio network infrastructure, but the firm also sells surveillance equipment and dispatch software. Most of Motorola’s revenue comes from government agencies, while roughly 25% comes from schools and private businesses. Motorola has customers in over 100 countries and in every state in the United States.

Financial Insights: Motorola Solns

Revenue Growth: Motorola Solns displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 9.15%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Navigating Financial Profits:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 51.36%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Motorola Solns’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 3.36.

Debt Management: With a high debt-to-equity ratio of 4.96, Motorola Solns faces challenges in effectively managing its debt levels, indicating potential financial strain.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: Motorola Solns’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 54.07.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 7.92 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 34.92 positions the company as being more valued compared to industry benchmarks.

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Cracking Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Motorola Solns’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Canadian Cannabis Producer Rubicon Reports Record Q3 Revenue Of $13.5M, 34% YoY Growth

Cannabis producer Rubicon Organics Inc. ROMJ ROMJF reported its third quarter financial results for the three months ended Sept. 30, 2024.

The British Columbia-based company achieved a record net revenue of CA$13.5 million ($9.6 million) for the quarter, representing a 34% increase year-over-year.

“Rubicon Organics continues to innovate and expand our product offerings, solidifying a strong market share in premium flower, pre-rolls, edibles, and more,” said CFO Janis Risbin. “I’m particularly proud of the success of our 2024 vape launch, which has already achieved 55% distribution in just six months. Looking ahead, we expect to drive further growth in Canada and beyond, as we intend for new market entry in 2025.”

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Q3 2024 Financial Highlights

- Net revenue totaled CA$13.5 million, representing a 34% increase year-over-year.

- Gross profit before fair value adjustments was CA$4.4 million, representing a 35% year-over-year increase.

- Adjusted EBITDA came in positive at CA$2 million, up from CA$1.1 million in the prior year’s period.

- Positive operating cash flow was CA$0.9 million.

Product And Brand Highlights

- Wildflower is one of Canada’s leading cannabis wellness brands, with a 27.8% market share in topicals.

- The company’s premium edibles held a 28.5% market share in the third quarter of 2024.

- Rubicon launched 1964 Supply Co vape products, with strong growth and distribution already at 55% in six months.

ROMJF Price Action

Rubicon’s shares traded 2.5263% lower at $0.2778 per share at the time of writing on Friday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Rescheduling Cannabis Could Allow For Hemp Tobacco Cigarettes, But Not Weed And Tobacco Mixtures: No Spliff For You!

This article was originally published on Cannabis.net and appears here with permission.

Marijuana rescheduling could permit CBD from hemp in tobacco, but not weed!

A recent report from the Congressional Research Service (CRS) has ignited discussions about the potential for incorporating hemp-derived cannabidiol (CBD) into tobacco products, contingent upon the anticipated rescheduling of marijuana. As public perceptions of cannabis evolve and regulatory frameworks shift, this development could have profound implications for both the cannabis and tobacco industries, as well as for public health initiatives aimed at reducing smoking-related harm.

Understanding The Context Of Marijuana Rescheduling

Historically, marijuana has been classified as a Schedule I substance under the Controlled Substances Act (CSA), indicating that it is viewed as having no accepted medical use and a high potential for abuse. However, with growing evidence supporting the medicinal benefits of cannabis and changing public perceptions, there has been increasing momentum toward rescheduling marijuana. In August 2023, the Department of Health and Human Services (HHS) recommended that marijuana be reclassified to Schedule III, which would acknowledge its medical applications and significantly alter the regulatory landscape surrounding cannabis.

Implications Of Rescheduling

If marijuana is rescheduled to Schedule III, it would not only ease restrictions on research and development but also open new avenues for product innovation. According to the CRS report, while marijuana itself would still be prohibited in food, dietary supplements, or cosmetics, hemp-derived CBD could be used as an additive in tobacco products without violating federal law. This distinction is crucial because it allows manufacturers to explore new formulations that combine the non-psychoactive properties of CBD with traditional tobacco.

The Rise Of CBD And Its Potential Benefits

CBD, or cannabidiol, is one of over 100 cannabinoids found in the cannabis plant. Unlike THC (tetrahydrocannabinol), which is responsible for the psychoactive effects commonly associated with marijuana, CBD does not produce a high. Instead, it has gained immense popularity due to its purported health benefits, including anxiety reduction, pain relief, anti-inflammatory properties, and potential neuroprotective effects.

As consumers become more health-conscious and seek alternatives to traditional pharmaceuticals, CBD has emerged as a viable option for many individuals looking to manage various health conditions. Its non-psychoactive nature makes it particularly appealing to those who wish to avoid the intoxicating effects of THC while still benefiting from the therapeutic properties of cannabis.

Potential Health Benefits Of CBD In Tobacco Products

- Reduction in Cravings: By potentially inhibiting nicotine metabolism, CBD may help reduce cravings among smokers trying to quit or cut back on their tobacco use.

- Anxiety Relief: Many smokers use cigarettes as a way to cope with stress or anxiety. Incorporating CBD into tobacco products could provide an alternative method for managing these feelings without resorting solely to nicotine.

- Anti-inflammatory Properties: Research suggests that CBD may have anti-inflammatory effects that could counteract some of the harmful consequences of smoking.

- Harm Reduction: The addition of CBD may make tobacco products less harmful by providing therapeutic benefits that could offset some negative health impacts associated with nicotine consumption.

Regulatory Considerations

Despite these promising developments, any products containing CBD would still require marketing authorization from the Food and Drug Administration (FDA) before they can be legally sold. The FDA’s role in regulating hemp-derived products is crucial to ensuring consumer safety and product efficacy.

Public Health Implications

The potential introduction of CBD into tobacco products raises important public health considerations. While incorporating CBD may reduce some harmful effects associated with traditional smoking, it is crucial to assess whether this combination could inadvertently encourage smoking behavior among new users or young people.

Public health advocates will need to monitor these developments closely to ensure that any new products do not undermine efforts to reduce smoking rates or promote healthier alternatives. Additionally, ongoing research will be necessary to evaluate the long-term effects of using CBD in conjunction with nicotine.

Current Regulatory Landscape

As it stands, hemp-derived CBD is legal at the federal level due to the 2018 Farm Bill, which legalized hemp cultivation and removed hemp-derived products containing less than 0.3% THC from Schedule I classification. However, this legalization does not automatically grant approval for all hemp-derived products; they must still comply with FDA regulations regarding safety and labeling.

The FDA has expressed concerns ove” unregulated CBD products flooding the market without proper testing or oversight. As such, manufacturers seeking to incorporate CBD into tobacco products will need to navigate a complex regulatory landscape while ensuring compliance with all applicable laws.

Potential Challenges Ahead

While the prospect of combining CBD with tobacco presents exciting opportunities, several challenges remain:

-

Regulatory Hurdles: The FDA’s approval process can be lengthy and complex. Manufacturers will need to demonstrate that their products meet safety standards and provide adequate labeling information.

-

Consumer Education: As CBD-infused tobacco products enter the market, educating consumers about their benefits and potential risks will be essential. Misunderstandings about CBD may lead to skepticism or misuse.

-

Market Competition: The tobacco industry is highly competitive; introducing new products requires significant investment in marketing and distribution channels.

-

Quality Control: Ensuring consistent quality across different batches of CBD-infused tobacco products will be critical for maintaining consumer trust and safety.

-

Public Health Concerns: While integrating CBD into tobacco may offer some benefits, there are concerns that it could inadvertently encourage smoking behavior among new users or young people who might view these products as safer alternatives.

Conclusion

The report from the Congressional Research Service highlights a significant shift in how we might view the intersection between cannabis and tobacco industries if marijuana is rescheduled from Schedule I status under federal law. Such changes could pave pathways toward innovative product development incorporating hemp-derived ingredients like cannabidiol (CBD) within traditional smoking contexts—ultimately reshaping consumer choices while addressing pressing public health concerns related directly tied back towards smoking-related harms.

As stakeholders navigate this evolving landscape—collaboration between regulators researchers manufacturers—and public health officials will prove vital moving forward towards creating safe effective options available across diverse populations seeking healthier alternatives amidst ongoing challenges presented by both industries’ histories intertwined within broader societal contexts surrounding drug policy reform overall! By prioritizing safety efficacy through rigorous research transparent communication consumers, this new frontier product development holds promise leading healthier lifestyles across America’s diverse population seeking better choices today.

This article is from an external unpaid contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spectrum Brands Stock Falls After Q4 Earnings Miss On Lower Investment Income: Details

Spectrum Brands Holdings, Inc. SPB shares are trading lower on Friday.

The company reported fourth-quarter adjusted earnings per share of 97 cents, missing the street view of $1.07. Quarterly revenues were $773.7 million (+4.5%), beating the analyst consensus of $747.51 million.

Gross profit surged 17.8% to $288 million. Gross profit and margin increased due to productivity improvements, operational efficiencies, and inventory actions in the prior year, partially offset by ocean freight inflation.

Adjusted EBITDA decreased $42.6 million, driven by $32.5 million of lower investment income and $25.9 million of increased brand-focused investments, offset by gross profit improvements.

As of the fiscal year-end, the company reported a cash balance of $369 million and total liquidity of $860 million, including undrawn capacity on its cash flow revolver.

It had $578 million in outstanding debt, consisting of $496 million in senior unsecured notes and around $82 million in finance lease obligations, resulting in a net debt of approximately $209 million.

Outlook: Spectrum Brands expects low single-digit growth in reported net sales in fiscal 2025 and adjusted EBITDA to increase by mid to high single-digits. Adjusted free cash flow is expected to be approximately 50% of adjusted EBITDA.

The company continues to target a long-term net leverage ratio of 2.0 – 2.5 times.

“I am excited about the upcoming year. Our focus during fiscal 2025 will be to continue the momentum we built in fiscal 2024 by investing in our brands to drive long-term growth, in innovation to expand core and adjacent categories, and in our operations to drive further cost improvement, quality and safety,” said David Maura, Chairman and Chief Executive Officer of Spectrum Brands.

Price Action: SPB shares are trading lower by 4.78% to $89.38 at last check Friday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: Judy C Lewent Offloads $3.29M Worth Of Motorola Solns Stock

Disclosed on November 14, Judy C Lewent, Director at Motorola Solns MSI, executed a substantial insider sell as per the latest SEC filing.

What Happened: After conducting a thorough analysis, Lewent sold 6,642 shares of Motorola Solns. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total transaction value is $3,294,301.

As of Friday morning, Motorola Solns shares are down by 0.51%, currently priced at $491.2.

All You Need to Know About Motorola Solns

Motorola Solutions is a leading provider of communications and analytics, primarily serving public safety departments as well as schools, hospitals, and businesses. The bulk of the firm’s revenue comes from sales of land mobile radios and radio network infrastructure, but the firm also sells surveillance equipment and dispatch software. Most of Motorola’s revenue comes from government agencies, while roughly 25% comes from schools and private businesses. Motorola has customers in over 100 countries and in every state in the United States.

Key Indicators: Motorola Solns’s Financial Health

Revenue Growth: Motorola Solns displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 9.15%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Insights into Profitability:

-

Gross Margin: The company faces challenges with a low gross margin of 51.36%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Motorola Solns’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 3.36.

Debt Management: Motorola Solns’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 4.96, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 54.07 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 7.92 is above industry norms, reflecting an elevated valuation for Motorola Solns’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 34.92 reflects market recognition of Motorola Solns’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Navigating the World of Insider Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Motorola Solns’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Powell Speaks The Truth – Market Does Not Like It, Consternation About Kennedy, Gaetz, And Hegseth

To gain an edge, this is what you need to know today.

Powell Speaks The Truth

Please click here for an enlarged chart of SPDR S&P 500 ETF Trust SPY which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- It is worth a reminder that The Arora Report is politically agnostic. Our sole job is to help our members extract the maximum amount of money out of the markets with the least possible risk.

- The price action on the chart shows that the rip roaring Trump rally is taking a breather.

- The chart shows that the stock market is still above the breakout line.

- RSI on the chart shows that the stock market has pulled back, reflecting a loss of momentum. The stock market is still overbought.

- The chart shows that the volume remains low. This indicates that institutional investors are not rushing to buy stocks.

- Yesterday, Powell spoke that truth – the market did not like it. Powell said, “The economy is not sending any signals that we need to be in a hurry to lower rates.” Powell elaborated, “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

- Powell’s remarks brought some selling into stocks and bonds.

- This morning, in the early trade, selling continues.

- The reason for some selling is that the prevailing wisdom on Wall Street has been that another rate cut in December was a sure thing. The Arora Report has been questioning Wall Street’s wisdom and sharing with you that the data does not support another rate cut.

- Some conservative commentators are upset believing that the reason Powell started rate cuts with a 50 bps cut was to help Kamala Harris get elected. Now that Trump has been elected, Powell is in no hurry to cut rates.

- In The Arora Report analysis, even though the data does not support a rate cut in December, Powell is going to feel pressure from Trump and Republicans to cut rates. There is also a significant amount of data between now and the December Fed meeting.

- In The Arora Report analysis, based on a 360 degree view, including the political pressure and the pressure from Wall Street to cut rates, the probability of a rate cut in December is now about 60%.

- There is consternation about several Trump picks. Impacting the market most are Trump’s picks of RKF Jr, Matt Gaetz, and Pete Hegseth. These picks are bringing selling in vaccine makers such as Moderna Inc MRNA, BioNTech SE ADR BNTX, Novavax Inc NVAX, Merck & Co Inc MRK, and Pfizer Inc PFE. There is also selling in other healthcare stocks, including weight loss drug companies Eli Lilly And Co LLY and Novo Nordisk A/S NVO, and packaged food stocks such as The Kraft Heinz Co KHC. There is also selling in defense stocks such as Boeing Co BA, Lockheed Martin Corp LMT, Northrop Grumman Corp NOC, and Rtx Corp RTX. There is also selling in big tech stocks.

- The latest economic data is strong. The U.S. economy is about 70% consumer based. For this reason, prudent investors pay attention to retail sales. Here are the details of the just released data:

- Retail sales came at 0.4% vs. 0.3% consensus.

- Retail sales ex-auto came at 0.1% vs. 0.2% consensus.

- There are hundreds of indicators. At The Arora Report, the system has been refined through decades of research to share with you only those indicators that matter. Normally, we do not mention the NY Fed Empire State Manufacturing Index. Today, we are mentioning it due to its exceptional strength. The index came at 31.2 vs. 3.3 consensus. This indicates that manufacturing in the New York area has picked up steam. If similar strength is happening in the rest of the country, that would argue against further cutting interest rates. The problem for investors is that stock valuations are so high that to sustain them, rate cuts are needed.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Tesla Inc TSLA.

In the early trade, money flows are negative in Apple Inc AAPL, Amazon.com, Inc. AMZN, Alphabet Inc Class C GOOG, Meta Platforms Inc META, Microsoft Corp MSFT, and NVIDIA Corp NVDA.

In the early trade, money flows are negative in S&P 500 ETF (SPY) and Invesco QQQ Trust Series 1 QQQ.

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Even the slightest dips in Bitcoin BTC/USD are being bought.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror. The proprietary protection band from The Arora Report is very popular. The protection band puts all of the data, all of the indicators, all of the news, all of the crosscurrents, all of the models, and all of the analysis in an analytical framework that is easily actionable by investors.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Musk expands lawsuit against OpenAI, adding Microsoft and antitrust claims

By Mike Scarcella

(Reuters) -Billionaire entrepreneur Elon Musk expanded his lawsuit against ChatGPT maker OpenAI, adding federal antitrust and other claims and adding OpenAI’s largest financial backer Microsoft as a defendant.

Musk’s amended lawsuit, filed on Thursday night in federal court in Oakland, California, said Microsoft and OpenAI illegally sought to monopolize the market for generative artificial intelligence and sideline competitors.

Like Musk’s original August complaint, it accused OpenAI and its chief executive, Samuel Altman, of violating contract provisions by putting profits ahead of the public good in the push to advance AI.

“Never before has a corporation gone from tax-exempt charity to a $157 billion for-profit, market-paralyzing gorgon — and in just eight years,” the complaint said. It seeks to void OpenAI’s license with Microsoft and force them to divest “ill-gotten” gains.

OpenAI in a statement said the latest lawsuit “is even more baseless and overreaching than the previous ones.” Microsoft declined to comment.

“Microsoft’s anticompetitive practices have escalated,” Musk’s attorney Marc Toberoff said in a statement. “Sunlight is the best disinfectant.”

Musk has a long-simmering opposition to OpenAI, a startup he co-founded and that has since become the face of generative AI through billions of dollars in funding from Microsoft.

Musk has gained new prominence as a key force in U.S. President-elect Donald Trump’s incoming administration. Trump named Musk to a new role designed to cut government waste, after he donated millions of dollars to Trump’s Republican campaign.

The expanded lawsuit said OpenAI and Microsoft violated antitrust law by conditioning investment opportunities on agreements not to deal with the companies’ rivals. It said the companies’ exclusive licensing agreement amounted to a merger lacking regulatory approvals.

In a court filing last month, OpenAI accused Musk of pursuing the lawsuit as part of an “increasingly blusterous campaign to harass OpenAI for his own competitive advantage.”

(Reporting by Mike Scarcella; editing by David Bario and Jonathan Oatis)