RH Unusual Options Activity For November 15

Investors with a lot of money to spend have taken a bearish stance on RH RH.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with RH, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for RH.

This isn’t normal.

The overall sentiment of these big-money traders is split between 10% bullish and 80%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $106,519, and 8 are calls, for a total amount of $298,502.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $310.0 to $500.0 for RH over the last 3 months.

Analyzing Volume & Open Interest

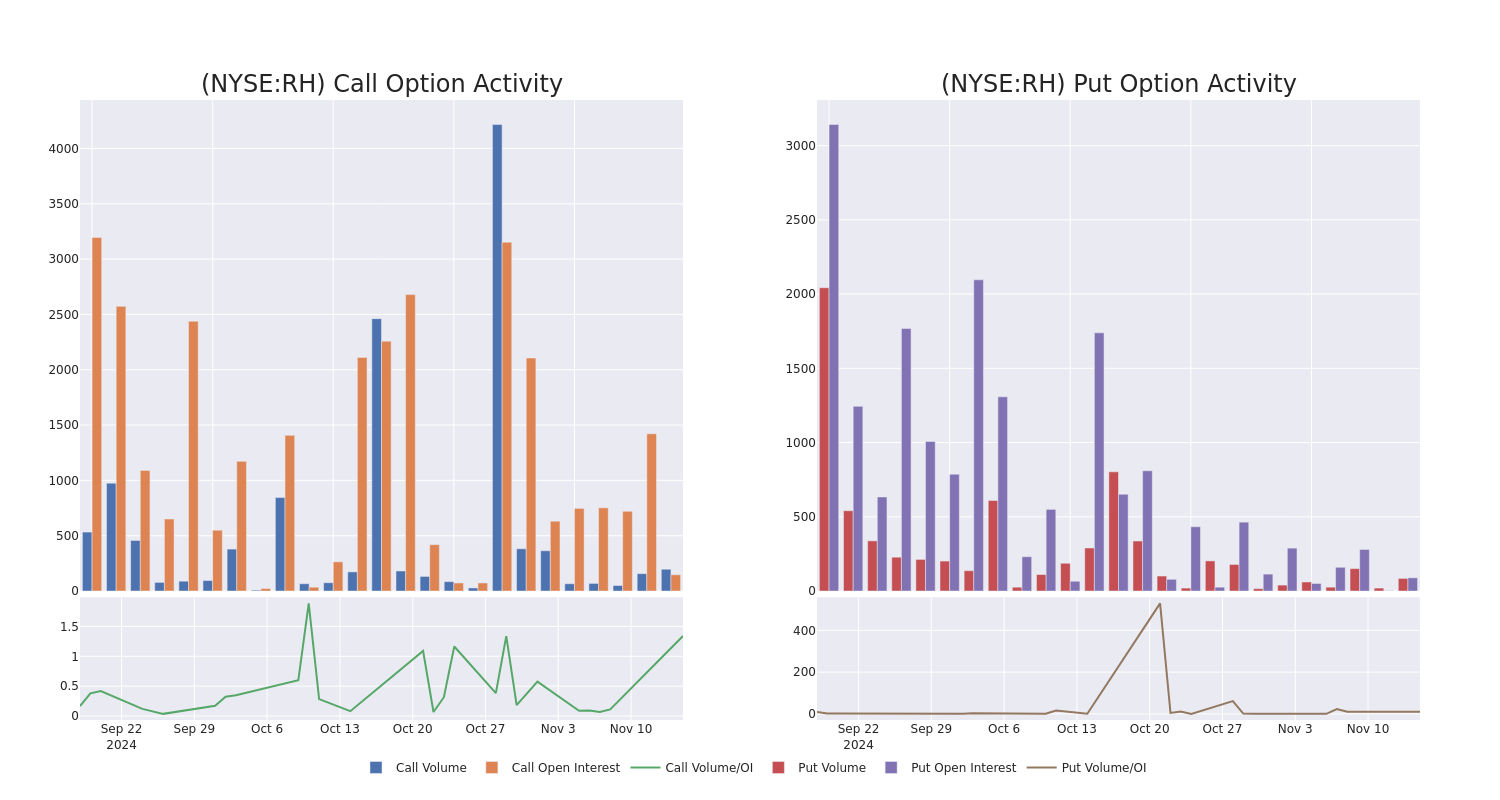

In today’s trading context, the average open interest for options of RH stands at 59.0, with a total volume reaching 242.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in RH, situated within the strike price corridor from $310.0 to $500.0, throughout the last 30 days.

RH Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RH | CALL | SWEEP | BEARISH | 12/13/24 | $25.4 | $23.9 | $23.69 | $320.00 | $73.0K | 0 | 38 |

| RH | PUT | SWEEP | BEARISH | 11/29/24 | $16.2 | $11.5 | $16.2 | $322.50 | $72.9K | 85 | 45 |

| RH | CALL | TRADE | BEARISH | 01/16/26 | $25.9 | $25.0 | $25.0 | $500.00 | $50.0K | 147 | 54 |

| RH | CALL | TRADE | BEARISH | 01/16/26 | $28.8 | $25.2 | $25.3 | $500.00 | $35.4K | 147 | 54 |

| RH | CALL | TRADE | BEARISH | 09/19/25 | $70.5 | $70.0 | $70.0 | $310.00 | $35.0K | 0 | 5 |

About RH

RH is a luxury furniture and lifestyle retailer operating in the $134 billion domestic furniture and home furnishing industry. The firm offers merchandise across many categories including furniture, lighting, textiles, bath, decor, and children and is growing the presence of its hospitality business with 18 restaurant locations. RH innovates, curates, and integrates products, categories, services, and businesses across channels and brand extensions (RH Modern and Waterworks, for example). RH is fully integrated across channels and is positioned to broaden its addressable market over the next decade by expanding abroad, with its World of RH digital platform (highlighting offerings outside of home furnishings), and with offerings in color, bespoke furniture, architecture, media, and more.

Where Is RH Standing Right Now?

- With a trading volume of 199,342, the price of RH is down by -2.24%, reaching $315.58.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 20 days from now.

What Analysts Are Saying About RH

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $430.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Wedbush has elevated its stance to Outperform, setting a new price target at $430.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for RH with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply