What the Options Market Tells Us About Tenet Healthcare

Whales with a lot of money to spend have taken a noticeably bearish stance on Tenet Healthcare.

Looking at options history for Tenet Healthcare THC we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $225,654 and 5, calls, for a total amount of $627,150.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $80.0 and $175.0 for Tenet Healthcare, spanning the last three months.

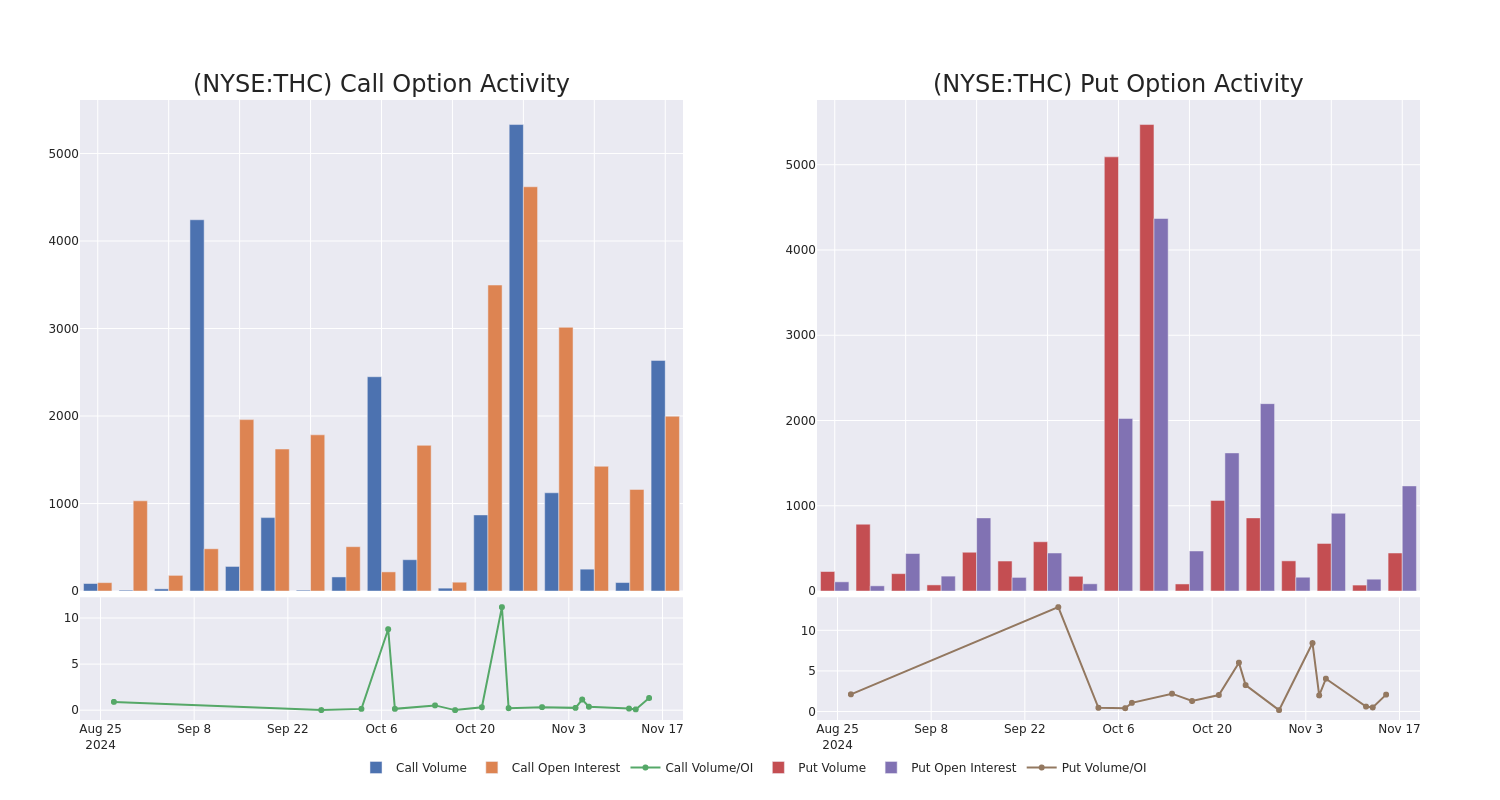

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Tenet Healthcare stands at 538.5, with a total volume reaching 3,082.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Tenet Healthcare, situated within the strike price corridor from $80.0 to $175.0, throughout the last 30 days.

Tenet Healthcare Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| THC | CALL | TRADE | BULLISH | 12/20/24 | $78.0 | $73.6 | $76.53 | $80.00 | $382.6K | 95 | 50 |

| THC | CALL | SWEEP | BEARISH | 01/17/25 | $3.1 | $3.0 | $3.0 | $175.00 | $109.8K | 1.9K | 0 |

| THC | CALL | SWEEP | BEARISH | 01/17/25 | $3.2 | $3.0 | $3.0 | $175.00 | $66.0K | 1.9K | 743 |

| THC | PUT | SWEEP | NEUTRAL | 12/20/24 | $6.8 | $6.3 | $6.55 | $155.00 | $44.8K | 99 | 20 |

| THC | CALL | SWEEP | BEARISH | 01/17/25 | $3.1 | $2.85 | $3.0 | $175.00 | $36.9K | 1.9K | 994 |

About Tenet Healthcare

Tenet Healthcare is a Dallas-based healthcare services organization. It operates a collection of hospitals (about 50 as of July 2024) and over 500 ambulatory surgery centers and other outpatient facilities across the U.S., primarily in the South. Through its Conifer segment, Tenet also provides revenue cycle management solutions.

Following our analysis of the options activities associated with Tenet Healthcare, we pivot to a closer look at the company’s own performance.

Where Is Tenet Healthcare Standing Right Now?

- With a volume of 793,505, the price of THC is down -5.36% at $153.93.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 83 days.

Professional Analyst Ratings for Tenet Healthcare

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $189.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Wells Fargo persists with their Overweight rating on Tenet Healthcare, maintaining a target price of $195.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Tenet Healthcare with a target price of $196.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Tenet Healthcare, targeting a price of $190.

* An analyst from Truist Securities downgraded its action to Buy with a price target of $190.

* Maintaining their stance, an analyst from Cantor Fitzgerald continues to hold a Overweight rating for Tenet Healthcare, targeting a price of $177.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Tenet Healthcare, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply